Emotional Risk Management in Trading: How to Stop Letting Fear and Greed Destroy Your Profits

Nov, 14 2025

Nov, 14 2025

Emotional Risk Assessment Tool

Emotional Risk Assessment

Answer these questions honestly to understand your emotional risk level in trading. Each question represents a common emotional trap.

Your Emotional Risk Assessment

Why Your Trading Plan Fails Even When You Know the Rules

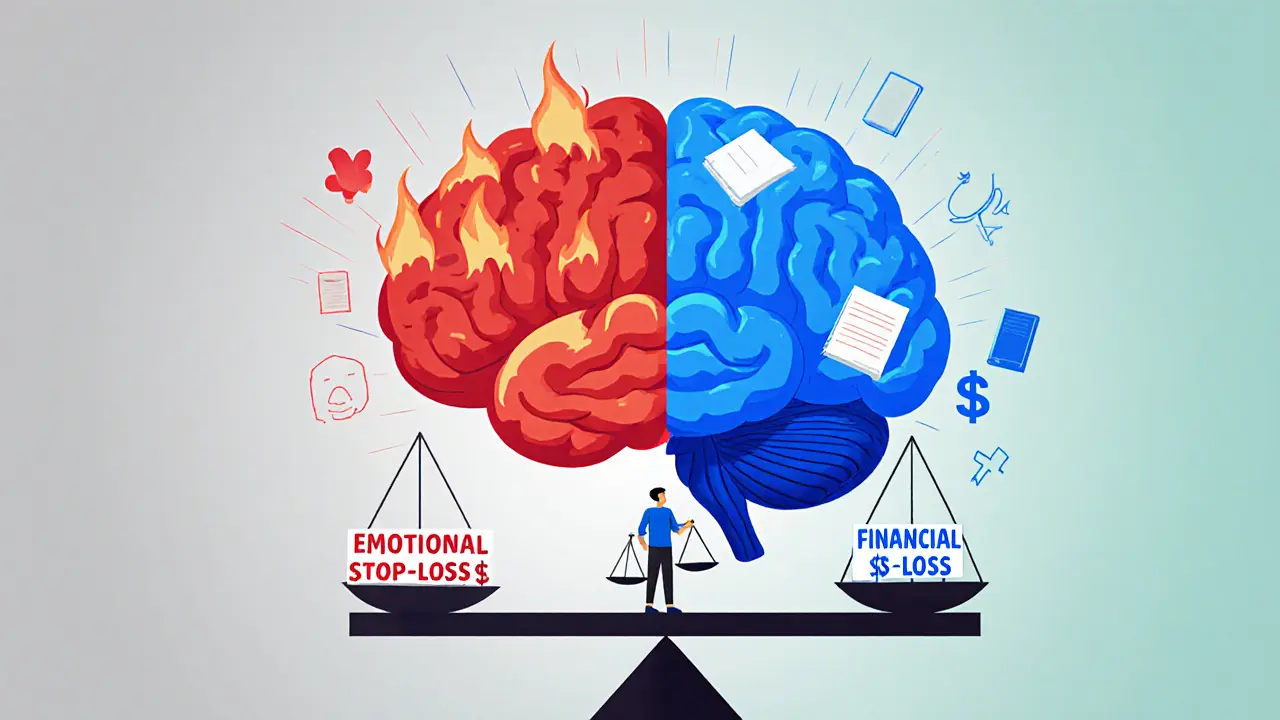

You’ve read the books. You’ve studied the charts. You know exactly where to place your stop-loss and how much to risk per trade. So why do you still lose money? The problem isn’t your strategy. It’s your emotions.

Eighty to ninety percent of retail traders fail-not because they don’t understand technical analysis, but because they can’t control fear, greed, and revenge. You see a trade going against you, and instead of sticking to your plan, you move your stop-loss. You watch a coin pump and jump in late, terrified of missing out. After a loss, you double down to "get it back." These aren’t mistakes. They’re emotional reactions-and they’re killing your account.

Emotional risk management isn’t about becoming a robot. It’s about building systems that protect you from yourself. It’s the difference between surviving the market and being crushed by it.

What Emotional Risk Management Actually Means

Traditional risk management tells you to risk no more than 1% of your capital per trade. That’s smart. But it doesn’t stop you from ignoring that rule when you’re scared or overconfident. Emotional risk management adds the human layer: it’s the set of practices that keep you aligned with your plan even when your brain is screaming to do the opposite.

This isn’t new. Dr. Brett Steenbarger started researching this in the 1990s. He found that traders who could regulate their emotions outperformed those who were technically better but emotionally reactive. By 2010, as algorithmic trading made markets more volatile, the term "emotional risk management" became official. Today, 78% of professional trading firms have formal protocols for it.

It’s not about suppressing emotions. It’s about recognizing them before they control you. Your amygdala-the part of your brain that triggers fear-can override your prefrontal cortex (the part that makes rational decisions) in under half a second. That’s why you act before you think. Emotional risk management gives you tools to slow that down.

The Four Most Dangerous Emotions in Trading

- Fear: You see a trade moving against you, and instead of trusting your setup, you exit early. You’re afraid of losing more, so you lock in a small loss-but you also miss the rebound. This is called "fear of giving back profits." NinjaTrader found 54% of traders do this regularly.

- Greed: You’re in a winning trade and watch it climb. You think, "I’ll just hold a little longer." Then it reverses. You didn’t take profits because you wanted more. Greed makes you ignore your profit targets.

- FOMO (Fear of Missing Out): You see a crypto pump on Twitter. Everyone’s talking about it. You jump in without a plan, chasing the move. You’re not trading your strategy-you’re chasing hype. NinjaTrader’s survey found 68% of traders cite FOMO as their biggest emotional weakness.

- Revenge Trading: You lose a trade. Instead of stepping away, you double down. You think, "I’ll win this one back." You trade bigger, faster, and without logic. Edgewonk found traders who use emotional risk management reduce revenge trading by 81%.

These aren’t personality flaws. They’re biological responses. Your brain treats financial loss like physical threat. That’s why emotional risk management isn’t optional-it’s survival.

Proven Techniques to Take Control

Here’s what works-based on real data from thousands of traders.

1. The One Percent Rule (With a Psychological Twist)

Don’t risk more than 1% of your account on any single trade. This isn’t just about math-it’s about psychology. If you lose 1%, it stings, but it doesn’t break you. If you lose 10%, your brain goes into panic mode. You start making desperate moves. The 1% rule keeps your emotions in check because the pain stays manageable.

2. Emotional Stop-Loss = Financial Stop-Loss

Many traders set a stop-loss at $500, but when the price hits $490, they think, "It’s just $10 away from recovery." They move it. That’s emotional interference. The "Rule of Alignment" says your emotional stop must match your financial stop. No exceptions. If your system says exit at $500, you exit at $500. No arguing. No second-guessing. Traders who follow this reduce emotional errors by 63%.

3. The Stopwatch Technique

When you feel the urge to exit a trade early-or add to a losing position-set a 90-second timer. Do nothing. Breathe. Watch the chart. Most urges pass in under a minute. NinjaTrader tracked traders who used this for 30 days: their average trade holding time increased by 47%, and profits rose 22%.

4. Daily Mindfulness Practice

Just 10-15 minutes a day of focused breathing or meditation rewires your brain. Studies show this increases activity in your prefrontal cortex (rational thinking) by 16% and reduces amygdala activation (fear response) by 27% after eight weeks. You don’t need to sit cross-legged. Just sit quietly, focus on your breath, and let thoughts pass without reacting. Blueberry Markets found traders who did this consistently had 37% smaller drawdowns.

5. Trade Journaling with Emotional Notes

Don’t just log entries and exits. Write down how you felt before, during, and after each trade. "I felt anxious when the price dropped below support." "I got greedy and held past my target." This creates awareness. Edgewonk analyzed 15,000 trader journals and found those who journal emotions had 29% more consistent win rates.

What Happens When You Ignore Emotional Risk Management

One Reddit user, "DayTradeDisaster," lost 78% of his $25,000 account in eight months. He knew the rules. He had a plan. But after a loss, he traded bigger. After another loss, he traded recklessly. He called it "emotional revenge." He wasn’t trading the market-he was fighting his own frustration.

On the flip side, "QuantTrader87" reduced emotional errors from 62% to 17% in six months by combining journaling, meditation, and the stopwatch technique. His returns jumped 29%.

The difference? One person treated emotions as noise. The other treated them as data.

Why Even Professionals Can’t Escape Emotions

Even the best traders aren’t immune. During the March 2020 market crash, when volatility spiked past 45 on the VIX index, even traders with perfect emotional systems made 28% more emotional decisions. Why? Because extreme fear triggers a biological fight-or-flight response. Your brain shuts down rational thinking.

That’s why emotional risk management works best in volatile but predictable markets (VIX 15-35). In black swan events, no system is foolproof. But in normal conditions, it’s your armor.

And here’s the brutal truth: traders who think they’re "immune" to emotions are the most vulnerable. Dr. Ari Kiev found that overconfident traders-those who rated their emotional control above 8 out of 10-had 41% bigger drawdowns than those who admitted they struggled.

How to Start Today (No Fluff, Just Action)

You don’t need a PhD in psychology. You need structure.

- Week 1-2: Identify your triggers. Write down every time you broke your plan. What were you feeling? Write it in your journal.

- Week 3-4: Implement the stopwatch technique. Every time you feel the urge to deviate, set a timer. Wait 90 seconds. Then decide.

- Week 5-6: Add 10 minutes of daily breathing. Sit quietly. Focus on your breath. No phone. No distractions.

- Week 7+: Lock your emotional stop-loss to your financial stop-loss. No exceptions. Ever.

Most traders quit after three losses. Don’t be one of them. If you hit a losing streak, activate your "circuit breaker": stop trading for 24 hours after a 5% weekly drawdown. Beacon Investing found this cuts emotional mistakes during slumps by 76%.

The Future of Emotional Risk Management

Companies are now using biometrics to detect trader stress in real time. Heart rate variability (HRV) monitors are being tested to alert traders when their stress spikes. Some are even experimenting with EEG headbands that give feedback when the brain enters a panic state.

But the real breakthrough isn’t technology. It’s mindset. The most successful traders don’t see emotional risk management as a fix. They see it as a daily practice-like brushing your teeth. You don’t do it because you’re broken. You do it because you’re serious about staying healthy.

Final Thought: The Real Edge Isn’t in the Chart

The market doesn’t care if you’re right. It only cares if you’re consistent. And consistency comes from control-not prediction.

Jack Schwager interviewed over 100 of the most successful traders in history. Every single one had a system for managing emotions. Not because they were smarter. But because they understood the truth: amateurs focus on returns. Professionals focus on risk.

Your next trade won’t make you rich. Your next 100 disciplined trades will.

What’s the difference between traditional risk management and emotional risk management?

Traditional risk management focuses on numbers: position size, stop-loss levels, risk-reward ratios. Emotional risk management focuses on behavior: how you react when you’re scared, greedy, or frustrated. You can have perfect math but still lose money if your emotions override your plan. Emotional risk management ensures your actions match your strategy-even when your feelings tell you otherwise.

Can I use emotional risk management in crypto trading?

Yes, and it’s even more critical in crypto. Cryptocurrencies are far more volatile than stocks, with wild swings happening in minutes. That amplifies fear and FOMO. The same techniques-stopwatch, mindfulness, emotional stop-loss alignment-work better here because the emotional triggers are stronger. Most crypto traders fail not because they don’t understand blockchain, but because they can’t handle the emotional rollercoaster.

How long does it take to see results from emotional risk management?

You’ll start noticing small changes in 14 days-like pausing before acting on impulse. But real change takes 45-60 days of consistent practice. That’s how long it takes your brain to form new neural pathways. Don’t expect overnight results. Expect gradual control. After two months, traders typically report fewer impulsive trades, better sleep, and less stress.

Do I need to meditate to manage emotions in trading?

No, but it’s one of the most effective tools. If meditation isn’t your thing, try journaling your emotions before trading, or take a 5-minute walk before opening a position. The goal isn’t to meditate-it’s to create space between stimulus and response. Any practice that slows you down helps. The key is consistency, not the method.

What if I lose money even after using emotional risk management?

Losing trades are part of trading. Emotional risk management doesn’t guarantee wins-it prevents you from turning losses into disasters. If you follow your plan and still lose, that’s a normal loss. If you break your plan and lose, that’s an emotional loss. The goal is to make only the first kind. Over time, disciplined losses lead to profitability. Undisciplined losses lead to ruin.