How Identity Verification Stops Sybil Attacks in Blockchain

May, 26 2025

May, 26 2025

Verification Method Selector

Select Your Project Requirements

Answer these questions to find the best identity verification method for your project.

Recommended Verification Methods

Verification Method Comparison

| Method | Privacy Impact | Implementation Cost | Scalability | Use Cases |

|---|---|---|---|---|

| Phone / SMS OTP | Medium | Low | High | Token airdrops, simple DAO voting |

| KYC (government ID) | High | Medium | Medium | Regulated DeFi, fiat on-ramps |

| Decentralized DID | Low | High | High | Enterprise supply-chain, privacy-focused DAOs |

| Web-of-trust / referral | Low | Low | Low | Early-stage testnets, niche communities |

When a malicious actor floods a network with fake personas, the whole system can crumble. In the world of Sybil attack a security breach where one entity creates many false identities to gain disproportionate influence, the damage looks exactly like that. The good news? identity verification gives you a practical way to block those fake accounts before they can vote, stake, or steal consensus.

Why Sybil Attacks Matter for Blockchain

Public blockchains thrive on permissionless entry - anyone can spin up a node, submit a transaction, or join a DAO. That openness is a double‑edged sword. As Chainlink Labs explained in 2023, "All Sybil attacks depend on semi‑permissionless and pseudo‑anonymous access to a network." When an attacker creates dozens or thousands of identities, they can sway voting, drain token airdrops, or even manipulate proof‑of‑stake economics.

Traditional cryptoeconomic defenses like Proof of Work a consensus method that requires computational puzzles to be solved or Proof of Stake a method where validators lock up tokens to earn the right to propose blocks raise the cost of an attack but don’t eliminate it. A well‑funded bot farm can still rent cloud instances or spoof phone numbers, breaking the cost barrier. That’s why many projects now layer an identity verification processes that bind a digital address to a real‑world person or device step on top of the cryptoeconomic shield.

Core Types of Identity Verification for Sybil Defense

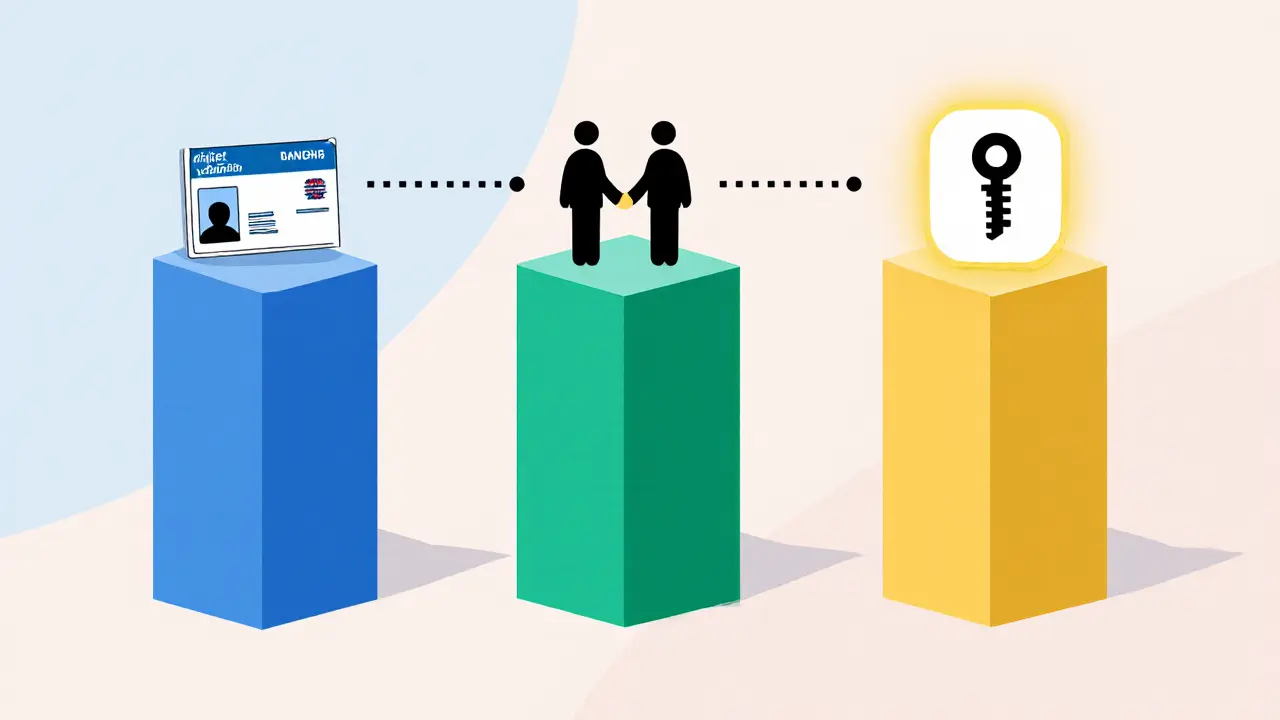

Verification methods fall into three buckets: direct, indirect, and decentralized.

- Direct validation - a central authority checks a government ID, credit card, or phone number in real time. This is the classic KYC approach used by exchanges.

- Indirect validation - existing trusted users vouch for newcomers. Reputation‑based systems like web‑of‑trust fall here.

- Decentralized identity (DID) - standards such as Verifiable Credentials cryptographically signed attestations that prove a claim without revealing the underlying data let users prove uniqueness via zero‑knowledge proofs while keeping personal data off‑chain.

Each option balances privacy, cost, and scalability differently. The table below gives a quick side‑by‑side view.

| Method | Privacy Impact | Implementation Cost | Scalability | Typical Use Cases |

|---|---|---|---|---|

| Phone / SMS OTP | Moderate - phone number linked to user | Low - third‑party API fees | High - millions of messages per day possible | Token airdrops, simple DAO voting |

| KYC (government ID) | High - personal ID stored | Medium - compliance tooling | Medium - manual review bottlenecks | Regulated DeFi, fiat on‑ramps |

| Decentralized DID (e.g., Microsoft ION) | Low - zero‑knowledge proofs, no PII on‑chain | High - smart‑contract development | High - on‑chain verification fast | Enterprise supply‑chain, privacy‑focused DAOs |

| Web‑of‑trust / referral | Low - no personal data required | Low - community driven | Low - growth limited by trust circles | Early‑stage testnets, niche communities |

How to Deploy Identity Verification in a Blockchain Project

Below is a step‑by‑step checklist that works for both permissioned networks (like Hyperledger Fabric) and semi‑permissioned public chains (e.g., Optimism).

- Define the threat model - are you protecting a token distribution, DAO voting, or critical enterprise data?

- Select a verification method that matches the privacy‑vs‑security trade‑off defined in step 1.

- Choose a provider or protocol. Popular options include:

- Civic a platform offering KYC‑as‑a‑service with API integration

- Microsoft ION a decentralized identifier network built on Bitcoin

- Formo a token‑gated verification engine that processes ~12 k checks per day

- Integrate the verification flow into your smart contracts or off‑chain gateway. For DIDs, follow the W3C Verifiable Credentials Data Model 2.0 (2024) and use zero‑knowledge proof libraries like zk‑SNARKs.

- Implement rate‑limiting and anti‑scraping measures - bots can still flood verification endpoints.

- Test across jurisdictions. Remember the 73 % compliance headache highlighted in the 2023 Blockchain Association report.

- Deploy to mainnet and monitor metrics: verification success rate, avg. completion time, false‑positive rate.

For most teams, a basic KYC API takes 2-3 weeks to wire up, while a full DID stack may need 6-8 weeks of development and security audits.

Pros and Cons: Identity Verification vs. Pure Crypto‑Economic Security

Identity verification gives immediate Sybil resistance - you know each participant is unique. The trade‑off is reduced anonymity and the risk of storing personal data.

Pure cryptoeconomic approaches (PoW, PoS) keep anonymity intact but demand either massive energy consumption or large capital holdings. As Gartner’s 2023 report points out, the highest‑rated verification solution scored 4.2/5 for enterprises but only 2.1/5 for public chains, underscoring the context‑dependence.

Hybrid models are gaining traction. A DAO might require a lightweight phone‑OTP for basic voting, then elevate to DID‑based proofs for high‑value proposals. This layered approach mirrors Vitalik Buterin’s 2023 recommendation to combine partial verification with economic stakes.

Real‑World Examples

• Optimism airdrop (2023) - Users spent an average of 17.3 minutes completing a KYC flow. 82 % said the friction was worth preventing bot farms.

• Formo’s token‑gated system - Processes 12 k verifications daily with 98.7 % accuracy, according to Q3 2023 data.

• Enterprise Hyperledger Fabric networks - 91 % of surveyed firms reported a sharp drop in Sybil incidents after deploying certificate‑based identity management.

These cases show verification works, but the user experience and privacy concerns differ sharply across domains.

Future Outlook: Privacy‑Preserving Verification

The next wave focuses on proving “one‑person‑one‑vote” without ever revealing who that person is. Zero‑knowledge proof‑based DIDs, such as those built on Microsoft ION or the upcoming Ethereum EIP‑735, promise 89 % Sybil mitigation while keeping data off‑chain.

Forrester predicts that by 2026, 60 % of enterprise blockchains will embed some verification layer, and public chains will adopt hybrid models. The trilemma-security, privacy, permissionlessness-remains unsolved, but the rapid standardization of Verifiable Credentials suggests a viable path forward.

Key Takeaways

- Sybil attacks thrive on anonymous, permissionless entry; identity verification cuts the attack surface.

- Choose a method that matches your privacy requirements: KYC for regulated finance, DIDs for privacy‑centric DAOs.

- Implementation time varies: 2‑3 weeks for simple KYC APIs, up to 12 weeks for custom DID solutions.

- Hybrid approaches can give the best of both worlds-immediate uniqueness plus economic deterrence.

- Watch emerging zero‑knowledge DID standards for the next big leap in Sybil resistance.

What exactly is a Sybil attack in blockchain?

A Sybil attack occurs when a single adversary creates many fake identities (or nodes) to gain disproportionate influence over consensus, voting, or token distribution in a blockchain network.

Why can’t proof‑of‑work alone stop Sybil attacks?

Proof‑of‑work raises the cost of creating new identities, but attackers can still rent cloud resources or use cheap hardware. It mitigates but does not eliminate the ability to spin up many nodes.

How does decentralized identity differ from traditional KYC?

Decentralized identity (DID) uses cryptographic proofs-often zero‑knowledge-to prove uniqueness without storing personal data on‑chain, whereas KYC collects and verifies government‑issued documents that are later retained by a central service.

What are the biggest privacy concerns with identity verification?

Storing personally identifiable information (PII) creates a honeypot for breaches. If the verification provider is compromised, attackers could obtain ID numbers, phone numbers, or facial data tied to blockchain addresses.

Can I combine identity verification with proof‑of‑stake?

Yes. Many DeFi platforms require users to stake tokens *and* pass a KYC or DID check. This layered defense forces an attacker to both acquire stake and prove a unique identity, dramatically raising the attack cost.

Clarice Coelho Marlière Arruda

October 25, 2025 AT 20:59so like... why do we even need to know who you are to vote on a DAO? it's supposed to be anonymous??

Will Barnwell

October 26, 2025 AT 11:22lol this whole post reads like a consulting deck. KYC on blockchain? that's not innovation, that's just Wall Street with a blockchain sticker.

Lawrence rajini

October 26, 2025 AT 22:34hybrid models are the future 🚀 one person one vote + staking = unstoppable. no more bot farms, no more griefing. this is how we scale trust.

Ron Murphy

October 27, 2025 AT 22:28the real issue isn't sybil attacks-it's that we're trying to solve a social coordination problem with cryptographic tools. you can't verify humanity with a government ID or a phone number. that's just replacing one central authority with another.

Henry Gómez Lascarro

October 27, 2025 AT 23:52everyone's so obsessed with 'identity verification' like it's some magic bullet, but let's be real-any system that requires personal data is just a honeypot for regulators and hackers. and don't get me started on 'zero-knowledge proofs'-those are just fancy math tricks that don't solve the core problem: if you can fake a passport, you can fake a ZKP. the whole thing is theater. real decentralization means no identity at all. period.

Dr. Monica Ellis-Blied

October 28, 2025 AT 17:49While I appreciate the comprehensive breakdown of verification methods, I must emphasize that the fundamental flaw in all these models lies in their assumption that identity can be meaningfully bound to a digital address without compromising autonomy. The very act of verification introduces a hierarchical structure that contradicts the ethos of permissionless systems. Furthermore, the reliance on third-party providers-Civic, Formo, even Microsoft ION-creates single points of failure that are antithetical to blockchain's original promise. We are not merely solving a Sybil problem; we are re-architecting trust itself, and if we do so by outsourcing it to corporate entities, we have already lost.

The notion that KYC is 'acceptable' for regulated DeFi ignores the chilling precedent it sets: that financial participation requires state-sanctioned identity. This is not innovation-it is regulatory capture dressed in smart contract clothing. And while decentralized identifiers sound elegant on paper, their implementation is riddled with interoperability nightmares and user experience friction that excludes non-technical populations-precisely the people who need decentralized systems most.

Moreover, the table comparing methods fails to address the ethical dimension: who owns the data? Who audits the auditors? And what happens when a government mandates that all DIDs be tied to national ID systems? The answer is already written in China’s social credit system. We must ask not just 'can we?' but 'should we?'-and if the answer is yes, then we are no longer building a blockchain, but a digital panopticon with better UX.

True Sybil resistance lies not in verification, but in incentive alignment. If a single entity gains disproportionate influence, the economic cost of that influence must exceed its potential reward. That is the genius of PoS-when properly designed. We don't need to know who you are; we need to make it prohibitively expensive to pretend to be many.

Kirsten McCallum

October 29, 2025 AT 09:23you're all missing the point. identity verification = surrender.

Jean Manel

October 29, 2025 AT 15:24Of course the 'hybrid model' works-because it's just KYC with a side of blockchain branding. The 82% who said the 17-minute KYC was 'worth it' are the same people who willingly handed their face to Clearview AI. This isn't security-it's behavioral conditioning. People don't care about privacy until their data gets sold. Then they scream. Meanwhile, the real Sybil threat isn't bot farms-it's venture capitalists using shell wallets to manipulate governance. You think a phone number stops that? LOL.

Matt Zara

October 29, 2025 AT 18:10man i get why people are skeptical but honestly, the airdrop example is pretty convincing. i spent 20 mins doing the Optimism KYC and yeah, it sucked-but i didn’t get airdropped 1000 tokens from a bot farm. that’s real value. maybe we don’t need full anonymity, just enough to protect the little guy.

jummy santh

October 29, 2025 AT 23:30As a Nigerian who has seen how mobile money fraud destroys lives, I must say: identity verification is not the enemy-it is the shield. In Lagos, we do not have government IDs for everyone, yet we use mobile phone verification to prevent duplicate claims on social aid. The same principle applies here. Yes, privacy matters-but so does fairness. If a single person can claim 500 airdrops, who suffers? The honest participant. We must not let the ideal of absolute anonymity blind us to the reality of exploitation.

Decentralized identity is the path forward, yes-but it must be built with the Global South in mind. Not just Silicon Valley engineers with their ZK-proofs, but people with broken phones, unstable internet, and no bank accounts. The technology must serve them, not exclude them.

Cory Munoz

October 30, 2025 AT 11:24just want to say… i’ve been in crypto since 2017 and i’ve seen every flavor of this debate. i get the fear of KYC. i really do. but i also remember when the first wave of airdrops got wiped out by bots and real people got nothing. it broke my heart. maybe there’s a middle ground-something lightweight, opt-in, and privacy-first. not perfect, but better than chaos.

Jasmine Neo

October 31, 2025 AT 08:33Let’s be brutally honest: the only reason we’re having this conversation is because VCs can’t pump and dump if they can’t control 80% of the votes. Identity verification isn’t about ‘Sybil resistance’-it’s about centralizing governance under the guise of security. The ‘hybrid model’ is just a Trojan horse for compliance-driven oligarchy. If you’re okay with KYC on a DAO, you’re not a blockchain believer-you’re a corporate rent-seeker with a wallet.

Prateek Kumar Mondal

October 31, 2025 AT 09:53no need for all this complexity. if you want to stop sybil attacks just require a small stake. simple. clean. no data collection. no bureaucracy. just economics.

Brian Collett

November 1, 2025 AT 06:34wait-so if I use a DID, does that mean I can prove I'm one person without giving up my phone number or ID? that sounds like the holy grail. anyone have a working example i can test?

Nick Cooney

November 2, 2025 AT 02:04you know what’s funny? the entire post cites Gartner, Forrester, and Chainlink like they’re gospel… but none of them are blockchain-native. they’re consultants paid by enterprises to sell ‘solutions.’ the real innovation isn’t in KYC or DIDs-it’s in proof-of-humanity protocols like Worldcoin or BrightID. those actually try to verify *biological uniqueness*. the rest? just rebranding surveillance.

Allison Andrews

November 2, 2025 AT 18:58the deeper question isn’t how to stop Sybil attacks-it’s whether we should even try. if a system requires identity to function, is it truly decentralized? or just a permissioned network with a fancy name? the trilemma exists for a reason. we can’t have all three. and if we choose identity, we’ve already chosen control over freedom.