ApeX Omni Crypto Exchange Review: The Future of Decentralized Trading

Feb, 12 2026

Feb, 12 2026

Most crypto traders know the trade-off: centralized exchanges like Binance or Bybit are fast and easy, but you don’t own your keys. Decentralized exchanges give you full control, but they’re slow, confusing, and fragmented across chains. ApeX Omni is trying to change that. Launched in June 2024 by ApeX Protocol, it’s not just another DEX-it’s a full rewrite of what decentralized trading can be. No more bridging tokens. No more gas fees. No more juggling five wallets. Just one clean interface that feels like your favorite CEX, but with true self-custody.

How ApeX Omni Works: No Account, Just Your Wallet

You don’t sign up for ApeX Omni. You don’t give them your email or ID. You don’t even create a password. All you do is connect your wallet-MetaMask, Trust Wallet, or any EVM-compatible one-and you’re in. That’s it. Your funds never leave your control. Every trade, every withdrawal, every vault you create happens directly from your wallet. No middleman. No delays. No risk of exchange hacks.

This isn’t a gimmick. It’s the core of what makes ApeX Omni different. Traditional DEXs like Uniswap or dYdX force you to jump through hoops: approve tokens, pay gas on Ethereum, wait for confirmations, switch chains, bridge assets. ApeX Omni removes all that. It uses a tech called zk-link to pull liquidity from Bitcoin, Ethereum, Solana, Arbitrum, Optimism, and more-without needing cross-chain bridges. That means you trade BTC/USDT, ETH/USDC, or SOL/USDT directly, with native tokens on their own chains, but all inside one interface. No wrapped tokens. No slippage from liquidity fragmentation.

Speed, Fees, and Leverage That Beats Centralized Exchanges

ApeX Omni claims 10,000 transactions per second. That’s not marketing fluff. It’s backed by zero-knowledge rollups that batch thousands of trades into a single proof, verified on-chain without slowing down. In practice, that means your limit orders fill instantly, your stop-losses trigger without lag, and your leveraged positions stay alive even during market spikes.

Fees? Zero for makers. Just 2.5 basis points (0.025%) for takers. Compare that to Binance’s 0.1% taker fee or Bybit’s 0.05%. On ApeX Omni, if you’re buying or selling small amounts, you pay almost nothing. And because there are no gas fees on the platform itself, you don’t need to hold ETH or MATIC just to trade. Your wallet’s native chain token covers any on-chain costs, and even that’s minimized by the zk-link efficiency.

Leverage is where ApeX Omni really shocks people. You can go up to 100x on Bitcoin and Ethereum perpetuals. That’s higher than most centralized exchanges offer. For altcoins, you get up to 50x. And unlike CEXs, there’s no liquidation queue. Your position either stays open or closes instantly based on your risk settings. No delays. No surprise margin calls.

Omni Vaults: Turn Your Trading Skills Into Passive Income

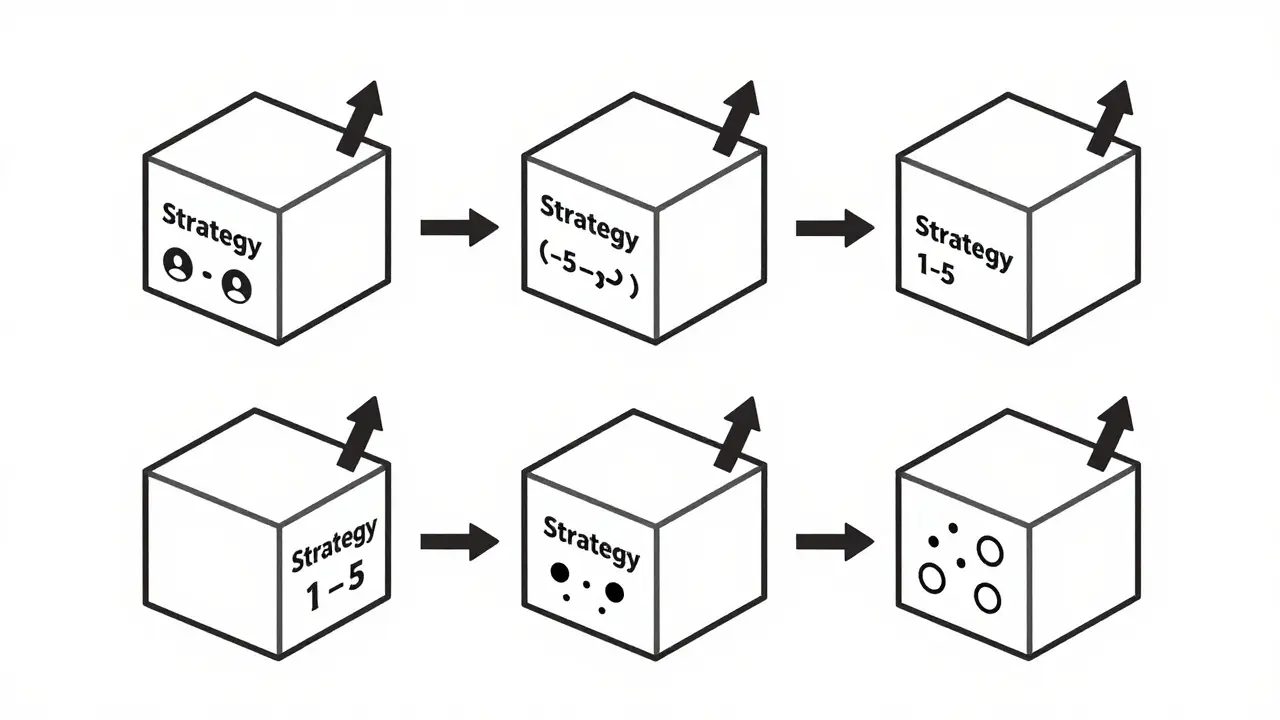

One of the most underrated features of ApeX Omni is its vault system. If you’ve got a solid trading strategy, you can create an Omni Vault. Minimum deposit: 100 USDT. Maximum capital you can raise from investors: $100,000. You set the rules-what pairs you trade, your risk level, your leverage. Then, other users can invest in your vault.

Here’s the split: you get 10% of all profits generated by the vault. Investors get 90%. That means if your vault makes $10,000 in a month, you earn $1,000 just for running the strategy. No need to be a hedge fund. Just need consistent results. You can run up to five vaults at once. So if you’ve got three strategies that work, you can turn them all into income streams.

And here’s the kicker: withdrawals are instant. No 24-hour hold. No approval process. Investors can pull their money out anytime, and your vault keeps running. It’s like a decentralized version of CopyTrading, but with full transparency and zero platform interference.

What’s Missing? The Roadmap and Real-World Proof

ApeX Omni is still young. It launched in mid-2024. So far, it supports 10 trading pairs-mostly BTC, ETH, SOL, and major stablecoins. Spot trading is coming soon, along with pre-market asset access (think new tokens before they hit major DEXs). There’s also ApeX Social, a community feature that lets users follow top vault creators and copy their trades manually.

But here’s the catch: there’s no public data on user numbers, trading volume, or daily active wallets. You won’t find reviews on CoinMarketCap or CoinGecko yet. No Reddit threads with thousands of upvotes. No YouTube breakdowns from big crypto influencers. That doesn’t mean it’s a scam-it means it’s early. The technology is solid. The architecture is proven. But adoption is still building.

Compare it to Uniswap V3 at its launch. No one knew what it was. No one reviewed it. But the tech was better. And once liquidity started flowing, it became the dominant DEX. ApeX Omni could be on a similar path.

ApeX Omni vs. ApeX Pro: Why Version 2.0 Matters

If you’ve used ApeX Pro (the original DEX from ApeX Protocol), you’ll notice the upgrade instantly. ApeX Pro was good-it offered low fees and decent leverage. But it was limited. It ran only on Ethereum and Arbitrum. No Solana. No Bitcoin. No multichain liquidity. Leverage capped at 25x. No vaults. No social features.

ApeX Omni is the full upgrade. It’s not just an update-it’s a new product line. The modular design means new features can be added fast. Spot trading? Coming next quarter. Options? In development. Futures on more chains? Already planned. ApeX Pro was a start. ApeX Omni is the vision.

Who Is ApeX Omni For?

It’s not for everyone. If you’re a beginner who just bought your first Bitcoin and doesn’t know what a wallet is, this isn’t your platform. You need to understand self-custody. You need to know how to send ETH or SOL from your wallet. You need to be comfortable with DeFi basics.

But if you’re an active trader who hates paying gas fees, hates waiting for bridges, hates limited leverage on DEXs, and wants to earn passive income from your trading skills-this is the platform you’ve been waiting for. It’s the first DEX that doesn’t make you choose between control and convenience. You get both.

Security: Zero-Knowledge Proofs, Not Just Marketing

ApeX Omni doesn’t just say it’s secure. It proves it. Every trade is verified using zero-knowledge proofs (ZKPs). That means the system confirms your trade is valid without ever seeing your private keys, wallet balance, or trade history. Your data stays private. Your funds stay yours. Even if the ApeX Omni servers go down, your assets are safe in your wallet. There’s no central database to hack.

This isn’t theoretical. ZKPs are used by top-tier protocols like zkSync and StarkNet. ApeX Omni is built on the same foundation. It’s not just a layer-2 solution-it’s a layer-0 architecture for trading. That’s why they can offer 10,000 TPS without compromising security.

Final Verdict: A Game-Changer in the Making

ApeX Omni isn’t perfect. It’s still growing. It doesn’t have the user base of Uniswap or the brand recognition of Bybit. But it solves real problems that have plagued DeFi for years. No more bridging. No more gas wars. No more sacrificing speed for decentralization.

If you’re serious about decentralized trading and tired of the compromises, ApeX Omni is worth testing. Connect your wallet. Try a small trade. Set up a vault. See how fast it is. See how little you pay. See how much control you really have.

This isn’t just another DEX. It’s the closest thing we’ve seen to a decentralized exchange that actually feels like a centralized one-without giving up any of the benefits of decentralization.