ASIC Manufacturer Comparison 2025: Bitmain, MicroBT, Canaan, ElphaPex, and Bitdeer Explained

Dec, 19 2025

Dec, 19 2025

Why ASIC Manufacturers Matter More Than Ever in 2025

If you're mining Bitcoin or other SHA-256 coins in 2025, the chip inside your miner matters more than the brand name on the box. ASICs aren’t just machines-they’re precision tools built to squeeze every last bit of hash power out of each joule of electricity. And with electricity making up 70-85% of mining costs, choosing the wrong manufacturer can cost you thousands per year.

The market isn’t what it was in 2021. Back then, a dozen companies were throwing ASICs at the wall. Now, just five dominate: Bitmain, A Chinese company founded in 2013, the largest ASIC manufacturer in the world with 55% market share and the industry’s most efficient mining hardware, MicroBT, A Shenzhen-based rival that won over mid-tier miners with stable firmware and aggressive pricing, Canaan, The budget-friendly option with Nasdaq listing and low entry cost but weaker support and efficiency, ElphaPex, A 2022 startup carving out a niche in Scrypt mining with innovative but unproven hardware, and Bitdeer, A Bitmain spin-off that only sells to institutional clients and integrates hardware with its own mining farms.

It’s not about who’s biggest. It’s about who fits your budget, your electricity rate, and your technical comfort level.

Bitmain: The Efficiency Leader (But Not the Cheapest)

Bitmain’s Antminer S21 XP Hyd is the king of raw efficiency in late 2024. At 12 J/TH and 473 TH/s, it pulls ahead of every other model on the market. That means for every terahash of computing power, it uses less electricity than anything else. In practical terms: if you’re paying $0.06/kWh, this miner makes about $11.20 per day after power costs.

But here’s the catch-it costs $14,474. That’s double the price of a MicroBT M66S Immersion, which only hits 19.9 J/TH. For small-scale miners, that price tag is a hard sell. Many report being priced out, with scalpers flipping units for 300% over MSRP.

Bitmain’s S21 Pro (234 TH/s, 15 J/TH) is more realistic for most. It still leads in efficiency among widely available models and has near-perfect uptime. Reddit users like u/MiningMaster42 report 99.7% reliability over eight months. But setup? It’s complex. New users spend 8-12 hours just getting it online. Firmware updates are frequent, and you need to know what you’re doing.

Bitmain doesn’t just sell hardware. They sell trust. Sixty-seven percent of mining farms larger than 100 PH/s use Bitmain equipment. That’s not luck-it’s results. But if you’re not running a commercial operation, the cost and complexity might not be worth it.

MicroBT: The Smart Choice for Most Miners

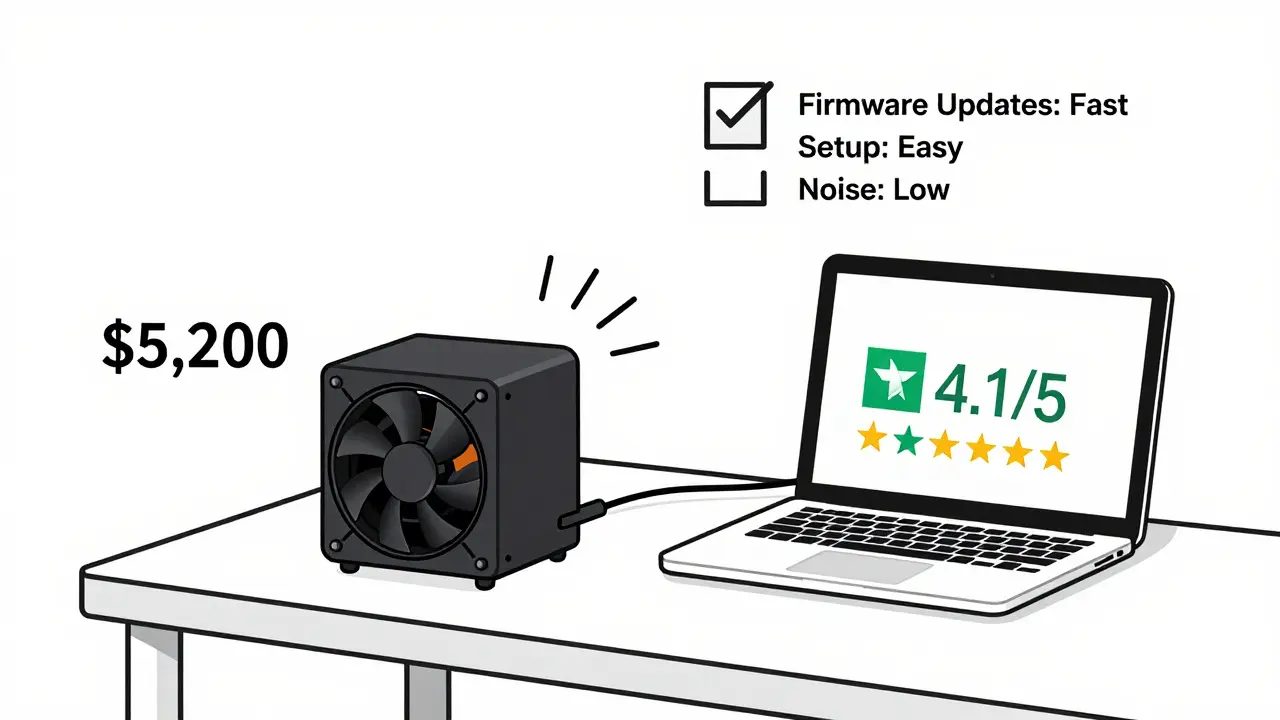

If you’re not a billionaire and you’re not running a 100-machine farm, MicroBT is probably your best bet. Their WhatsMiner M60S (186 TH/s, 17.5 J/TH) hits the sweet spot: solid efficiency, stable firmware, and a price around $5,200. That’s less than half the cost of Bitmain’s top model, but still delivers 90% of the daily profit at $0.06/kWh.

MicroBT leads in the 1-10 unit retail segment with 42% market share. Why? Because they listen. Their setup guide is 87 pages long-covering everything from airflow to voltage tuning. They respond to firmware bugs fast. When the M60S had a reboot issue in January 2025, they patched it within two weeks.

For miners with electricity between $0.05-$0.08/kWh, the M60S is the most profitable option according to SazMining’s November 2024 model. The newer M66S Immersion (247 TH/s, 19.9 J/TH) is powerful, but immersion cooling adds $800-$1,200 per unit in setup cost. Only worth it if you’re serious about scaling.

MicroBT’s Trustpilot rating? 4.1/5. That’s higher than Bitmain’s 3.8/5. Users don’t love them because they’re the fastest. They love them because they just work.

Canaan: The Budget Option (With Major Trade-Offs)

The Avalon A1566 is the cheapest ASIC on the market at $1,800. If you’re in Nigeria, Venezuela, or any region with unstable power and cheap electricity under $0.04/kWh, this might make sense. It’s 150 TH/s at 21.5 J/TH-slower and thirstier than the rest.

But here’s the problem: efficiency drops fast when electricity rises above $0.05/kWh. Koinly’s September 2025 analysis shows this miner breaks even only at $0.039/kWh. At $0.06/kWh, you’re losing money.

And support? Terrible. Average response time to technical questions is 72 hours. No custom firmware options. The stock software locks you into default settings. John Matze from Bitcoin Magazine found users lose 5-8% in potential profits because they can’t tweak performance.

Plus, noise. The Avalon runs at 95 dB-loud enough to wake a house. One user spent $200 per unit on soundproofing. If you’re mining at home, this isn’t just a nuisance-it’s a dealbreaker.

Canaan’s biggest strength? Price. Their biggest weakness? everything else.

ElphaPex: The Wildcard in Scrypt Mining

Most ASICs mine Bitcoin. ElphaPex mines Dogecoin and Litecoin. Their DG Hydro 1 delivers 20 GH/s for Scrypt algorithms-three times faster than Fluminer’s L1 Pro. If you’re focused on altcoins, this is the only serious option.

But it’s power-hungry: 6,200W. That’s 33% more than the L1 Pro. At $0.08/kWh, your daily profit is razor-thin. Only viable if you’ve got access to near-free power or you’re mining as a hobby.

What they lack in efficiency, they make up for in community. Their Discord server has 12,500 members. Responses to questions come in under 15 minutes. That’s unheard of in this industry.

But supply chain? A mess. One user waited 11 weeks for delivery. Another said their unit arrived with a cracked hashboard. ElphaPex is innovative-their modular design could be the future-but they’re still a startup. MiningNow’s CTO David Kwon says: "We need 12+ months of field data before recommending them for large deployments."

For the solo miner chasing Dogecoin? Worth a try. For anyone serious about ROI? Wait until they prove longevity.

Bitdeer: The Institutional Player You Can’t Buy

Bitdeer doesn’t want your money. They want your farm. After spinning off from Bitmain in 2021, they shifted entirely to vertical integration. Their SealMiner A2 Pro Hyd (7,450W, hydro-cooled) is only available to their own mining operations. No retail sales. No third-party access.

That’s not a bug-it’s the business model. Bitdeer designs hardware to work perfectly with their own cooling systems, power grids, and software. The result? Higher uptime and lower operational costs. But if you’re not part of their network, you can’t buy it.

Bitdeer’s strategy is bold: control the entire stack. But it’s also exclusionary. Reddit user u/BitdeerWannabe summed it up: "Sealminer A2 is only available to institutional buyers-no way for small miners to access."

They’re growing fast-planning to hit 2.4 EH/s by end of 2025. But for most people reading this, Bitdeer might as well be a ghost company.

Cooling Tech: The Hidden Game-Changer

It’s not just about the chip anymore. It’s about how you cool it.

Three years ago, air cooling was standard. Now, 35% of new deployments in Q4 2024 used immersion or hydro-cooling. By end of 2025, that’ll be 55%, according to SazMining.

Immersion cooling means submerging the ASIC in dielectric fluid. It’s silent. It’s 40-50% more efficient at removing heat. And it allows for higher density mining-more rigs in less space.

But it’s expensive. Setup adds $500-$1,200 per unit. You need tanks, pumps, filters. It’s not plug-and-play. Only Bitmain, MicroBT, and Bitdeer offer these models-and only for serious operators.

For home miners? Stick with air cooling. For commercial farms? Immersion isn’t optional anymore. It’s survival.

Who Should Buy What?

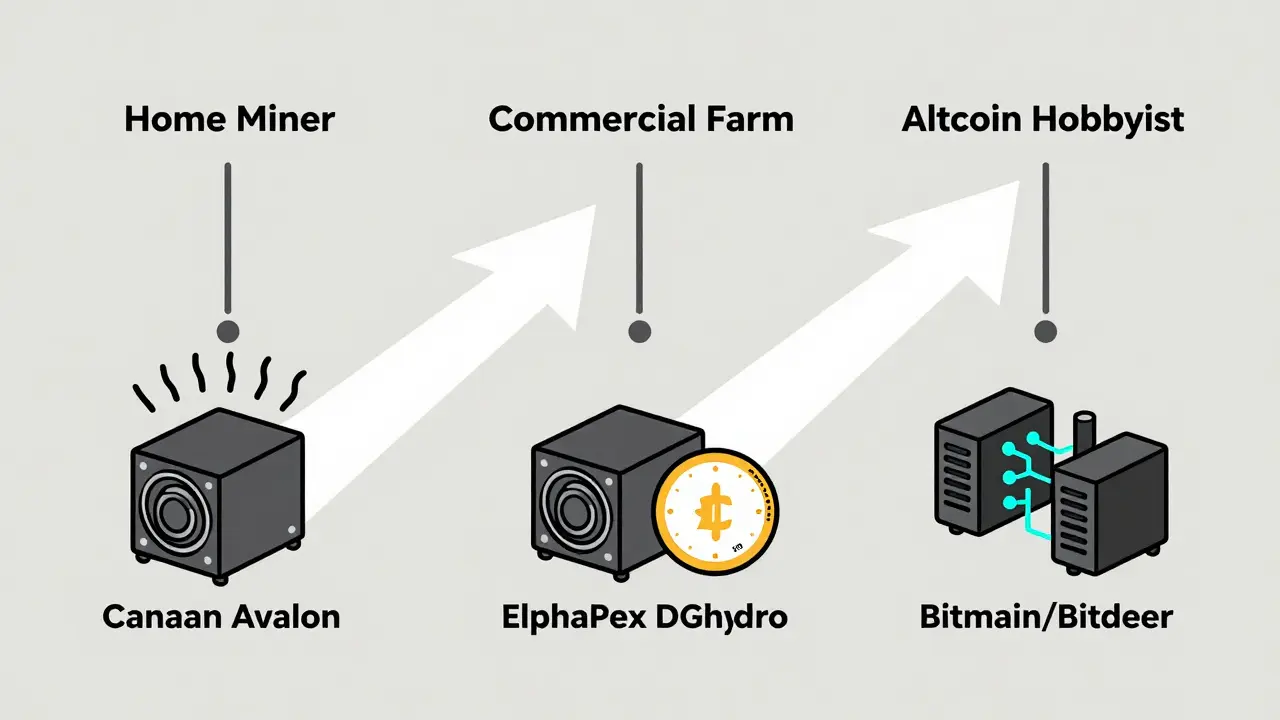

Let’s cut through the noise. Here’s who wins in 2025:

- Professional miners with $10k+ budget and low electricity: Go Bitmain S21 XP Hyd. You want the highest efficiency. You can afford the cost and complexity.

- Small to mid-sized operators ($5k-$10k budget): MicroBT M60S. Best balance of price, efficiency, and reliability. The most proven choice.

- Miners in regions with electricity under $0.04/kWh: Canaan Avalon A1566. Only if you’re desperate for low upfront cost.

- Dogecoin or Litecoin miners: ElphaPex DG Hydro 1. No real competition. But expect delays and higher power bills.

- Anyone wanting to buy an ASIC for personal use: Avoid Bitdeer. They don’t sell to you.

And one last rule: never buy an ASIC without running the numbers first. Plug your electricity cost, current BTC price, and difficulty into Koinly’s calculator. If it doesn’t break even in 12 months, walk away.

What’s Next? The Future of ASICs in 2025-2026

Bitmain’s S22 series, launching Q3 2025, targets 10 J/TH. That’s a 17% jump over today’s best. MicroBT’s M70 series aims for 14 J/TH. Canaan’s A16 is delayed due to chip yield issues. ElphaPex plans to enter SHA-256 mining by Q4 2025. Bitdeer is doubling its capacity.

Regulation is tightening. The EU now requires all new ASICs to be under 15 J/TH. Older models are being banned. That’s killing off cheap, inefficient units from China.

And margins? They’re thinning. In 2023, ASIC makers made 30% profit. In 2025, it’s 8-12%. That’s why analysts predict 2-3 manufacturers will exit by 2026. Only the ones with deep pockets and real R&D will survive.

The winners? The ones who keep pushing efficiency. The ones who fix firmware fast. The ones who don’t just sell hardware-they build ecosystems.

Which ASIC manufacturer is the most reliable in 2025?

Bitmain leads in reliability, with users reporting 99.7% uptime on S21 Pro models over 8+ months. MicroBT follows closely with strong firmware stability and fast bug fixes. Canaan has more hardware failures and poor support. ElphaPex and Bitdeer are unproven at scale for retail users.

Is Bitmain worth the high price?

Only if you’re running a commercial operation with low electricity costs (under $0.06/kWh) and can afford the $14,000+ upfront cost. For small miners, the extra efficiency doesn’t justify the price. MicroBT offers 90% of the profit at half the cost.

Can I mine Dogecoin with a Bitcoin ASIC?

No. Bitcoin ASICs only mine SHA-256 coins. Dogecoin and Litecoin use Scrypt, which requires different hardware. ElphaPex is currently the only manufacturer producing dedicated Scrypt ASICs at scale.

Should I buy a used ASIC?

Avoid it. Most used ASICs are worn out, underperforming, or have damaged components. A new MicroBT M60S costs $5,200 and lasts 3-4 years. A used one at $3,000 might die in 6 months. The risk isn’t worth the savings.

What’s the best ASIC for home mining in 2025?

The MicroBT M60S. It’s quiet enough for a garage, efficient enough to be profitable at $0.06-$0.08/kWh, and has the best support and firmware updates. Avoid Canaan (too loud) and Bitmain (too expensive and complex). ElphaPex is only for altcoin hobbyists.

Do I need immersion cooling?

Only if you’re running more than 20 machines in a single location. For 1-5 units, air cooling is fine. Immersion cooling adds $800-$1,200 per unit and requires special infrastructure. It’s for professional farms, not home miners.

Are ASICs still profitable in 2025?

Yes-but only if you have cheap electricity (under $0.08/kWh), buy new hardware, and avoid overpriced models. Profitability dropped 30% since 2023 due to higher difficulty and lower BTC prices. The best miners now break even in 10-14 months. Anything slower is a losing bet.

Which manufacturer has the best customer support?

ElphaPex has the best community support with a 12,500-member Discord and 15-minute response times. For official support, MicroBT leads with fast firmware updates and detailed documentation. Canaan’s support takes 72+ hours on average. Bitmain’s is adequate but expensive to access.