Crypto Exchange Licensing in Brazil by Central Bank: Rules, Limits, and What You Need to Know

Dec, 14 2025

Dec, 14 2025

When you trade crypto in Brazil, you’re not just using an app-you’re operating inside a tightly controlled financial system. The Central Bank of Brazil (BCB) doesn’t issue a standalone "crypto license." Instead, any platform offering crypto services must register as a Virtual Asset Service Provider (VASP) and follow strict rules under Law No. 14.478/2022, which became active on June 20, 2023. This law brought crypto exchanges under the same roof as banks, payment processors, and money transmitters. If you’re running or using a crypto exchange in Brazil, this is the framework you’re stuck with.

Who Regulates Crypto in Brazil?

The Central Bank of Brazil holds the main authority over crypto exchanges. It’s the only entity that can approve or reject VASP registrations. But there’s a second layer: the Securities and Exchange Commission of Brazil (CVM). The CVM steps in when a digital asset is classified as a security-like a token that promises profits based on a project’s success. In those cases, the CVM treats it like a stock or bond and enforces disclosure, registration, and investor protection rules. So if you’re listing tokens on a Brazilian exchange, you need to know which regulator is watching you.There’s no gray area here. Unlike some countries where crypto operates in legal limbo, Brazil made it clear: if you’re handling crypto for others, you’re a financial institution. That means background checks, anti-money laundering systems, and audits. No exceptions.

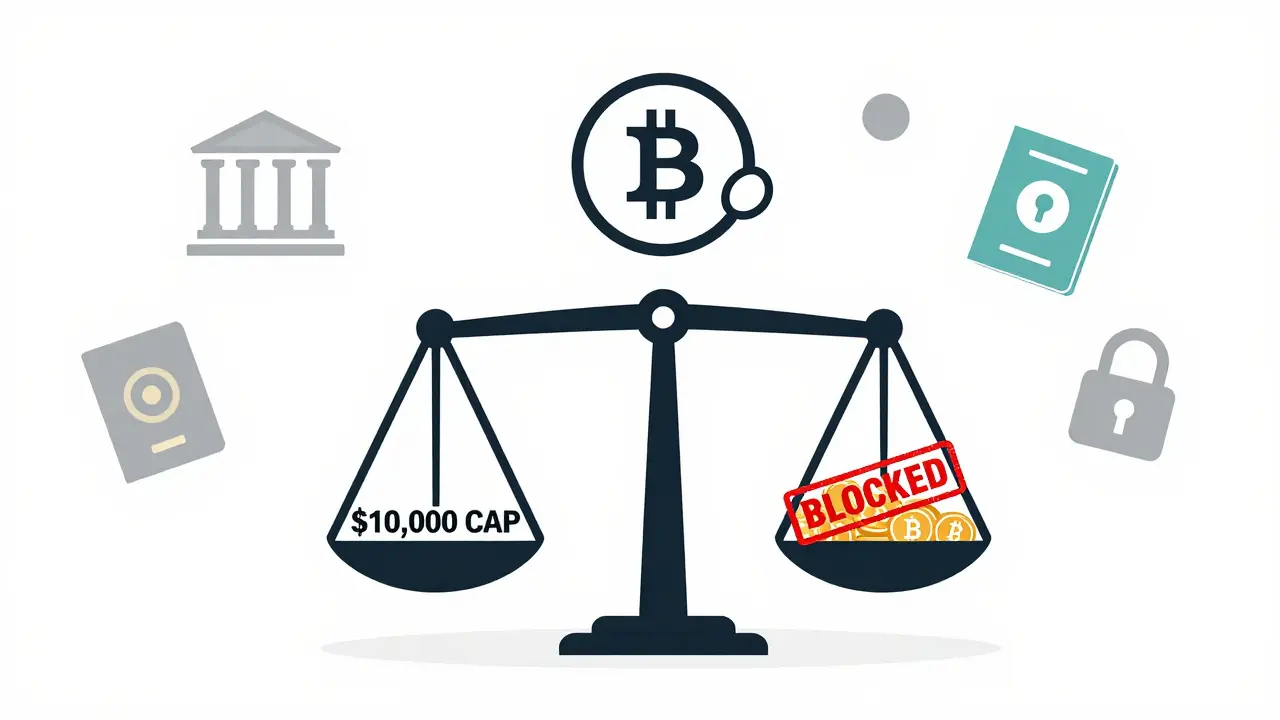

The $10,000 Rule That Changed Everything

In September 2024, the Central Bank dropped a bombshell: proposed new rules for electronic foreign exchange platforms. On the surface, it looked like it was only about forex trading. But here’s the catch-crypto exchanges that let users convert Bitcoin to USD or withdraw BRL to a foreign bank account? They fall under these same rules.The key restriction? Individuals can’t send or receive more than $10,000 per transaction. That cap applies to every single transfer, no matter how many times you try to split it. If you’re a trader moving $50,000 in Bitcoin to a foreign wallet, you’d need to break it into five separate transfers. Each one would require full documentation and approval. And that’s just the start.

Exchanges must now:

- Display every fee, tax, and conversion cost upfront-no hidden charges allowed

- Only allow deposits and withdrawals through government-approved financial channels

- Send detailed transaction data to the Central Bank in real time

- Verify the identity of both the sender and receiver for every cross-border transfer

This isn’t about stopping crypto. It’s about controlling the flow. The Central Bank wants to see every peso that moves in or out of the country. And if you’re a global exchange like Binance or Coinbase serving Brazilian users, you either comply-or risk blocking access to your platform for half your customer base.

What Happens If You Don’t Comply?

The penalties aren’t light. Operating without BCB registration can lead to fines, account freezes, and even criminal charges for company executives. The Central Bank doesn’t warn twice. In 2023, two unregistered Brazilian crypto platforms were shut down within weeks of being reported. Their founders faced investigations for money laundering and unlicensed financial activity.Even if you’re based overseas, if you’re serving Brazilian customers, you’re subject to Brazilian law. The Central Bank doesn’t care if your servers are in Singapore or New York. If a Brazilian user can access your platform and make a trade, you’re in their jurisdiction. That’s why some global exchanges now geo-block Brazilian IPs unless they meet local compliance standards.

How Do You Get Licensed?

There’s no official checklist published yet. But based on what’s required under Law No. 14.478/2022 and the new forex rules, here’s what you need to prepare:- Register as a VASP with the Central Bank’s online portal

- Submit detailed corporate documents: articles of incorporation, ownership structure, KYC policies

- Implement a full AML/CFT system aligned with FATF guidelines

- Set up a real-time reporting system to send transaction data to the BCB

- Partner with licensed Brazilian banks or payment processors for on/off ramps

- Build a system that blocks any transaction over $10,000 unless split and approved

- Display all fees clearly before the user confirms any trade

There’s no application fee listed, but legal and compliance costs can run over $100,000 for a mid-sized exchange. Smaller platforms are struggling. Some have shut down because they can’t afford the infrastructure. Others are merging with bigger players just to survive.

Who’s Affected the Most?

The $10,000 cap hits three groups hardest:- High-frequency traders who move large sums daily to arbitrage price differences between exchanges

- Institutional investors who want to allocate crypto into portfolios without breaking up transactions

- Remittance users who send crypto to family abroad as a cheaper alternative to Western Union

For retail users making small trades under $500, life hasn’t changed much. But if you’re doing serious trading, you’re now dealing with a system designed for banks, not blockchain.

What’s Next?

The public consultation for the forex rules ended in November 2024. The Central Bank hasn’t announced when the final rules will take effect. But industry insiders expect them to go live in early 2026. Once they do, there’s no turning back.Brazil is building a financial firewall around crypto-not to ban it, but to control it. The goal is to make crypto transactions as traceable and regulated as wire transfers. That means less anonymity, more paperwork, and slower trades. But it also means more legitimacy. Brazilian crypto exchanges are now seen as part of the formal economy, not rogue platforms.

For users, it’s a trade-off: less freedom, but more protection. Your funds are safer because the exchange is audited. Your transactions are slower because they’re monitored. And if something goes wrong, you have a regulator to turn to-not just a customer service chatbot.

How This Compares to Other Countries

Brazil’s approach is unique in Latin America. In Argentina, crypto is mostly unregulated. In Colombia, exchanges register but face no transaction limits. In Chile, crypto is treated as a commodity, not a financial service.Brazil is the only country in the region that treats crypto as a core part of its financial infrastructure-and then applies banking-level controls to it. It’s more like the EU’s MiCA regulation than the U.S.’s patchwork of state rules.

That’s why global crypto firms are watching Brazil closely. If they can make compliance work here, they can use the same system in other countries pushing for similar controls.

What Should You Do Now?

If you’re a Brazilian user:- Stick to BCB-registered exchanges

- Avoid platforms that don’t show full fees upfront

- Don’t try to bypass the $10,000 limit-your account could be frozen

- Keep records of all transactions for tax purposes

If you’re running a crypto business:

- Start the VASP registration process now-even if the rules aren’t final

- Build your compliance system around the $10,000 cap and real-time reporting

- Partner with a Brazilian bank or payment provider before applying

- Prepare for higher operational costs and slower user onboarding

The era of unregulated crypto trading in Brazil is over. The Central Bank isn’t waiting for you to catch up. You’re either in the system-or out of the market.

Is it legal to trade crypto in Brazil?

Yes, trading crypto is fully legal in Brazil. But only if you use a platform registered with the Central Bank of Brazil (BCB) as a Virtual Asset Service Provider (VASP). Unregistered exchanges operate illegally and can be shut down at any time.

Do I need a license to buy crypto as a regular user?

No, individual users don’t need a license. You just need to use a licensed exchange. The rules apply to the platforms you trade on, not to you as a customer. But if you’re running a business that exchanges crypto for others, you must register with the Central Bank.

Can I send more than $10,000 in crypto from Brazil?

Not through a single transaction. The Central Bank’s proposed rules cap individual transfers at $10,000. If you try to send more, your exchange will block it. Splitting the amount into multiple transfers may trigger suspicion and lead to account review or freeze.

Are global exchanges like Binance allowed in Brazil?

Binance and other global platforms are not registered with the BCB. While they still operate in Brazil, they face restrictions. Many now block Brazilian users from depositing or withdrawing funds unless they comply with local rules. Some users access them via VPN, but that violates terms of service and risks account closure.

What happens if my crypto exchange gets shut down?

If your exchange is unregistered and gets shut down, you may lose access to your funds. Registered exchanges are required to keep client assets separate from company funds and are subject to audits. If a licensed exchange fails, you have legal recourse through the Central Bank and financial ombudsman services.

Do I pay taxes on crypto in Brazil?

Yes. The Brazilian Revenue Service (Receita Federal) requires you to report crypto transactions over R$35,000 in a month. You pay capital gains tax on profits from sales, trades, or conversions. Even if you trade one crypto for another, it’s considered a taxable event. Exchanges registered with the BCB report transaction data to tax authorities automatically.