Crypto Exchange Regulations in Japan by FSA: What You Need to Know in 2025

Dec, 1 2025

Dec, 1 2025

Japan Crypto Tax Calculator

Japan's crypto tax system is unique and changing. Currently, crypto profits are taxed at up to 55%, while stocks are taxed at 20%. The FSA has proposed aligning crypto taxes with stocks (20%) which is expected to pass in early 2026. This calculator shows how these rates affect your investment.

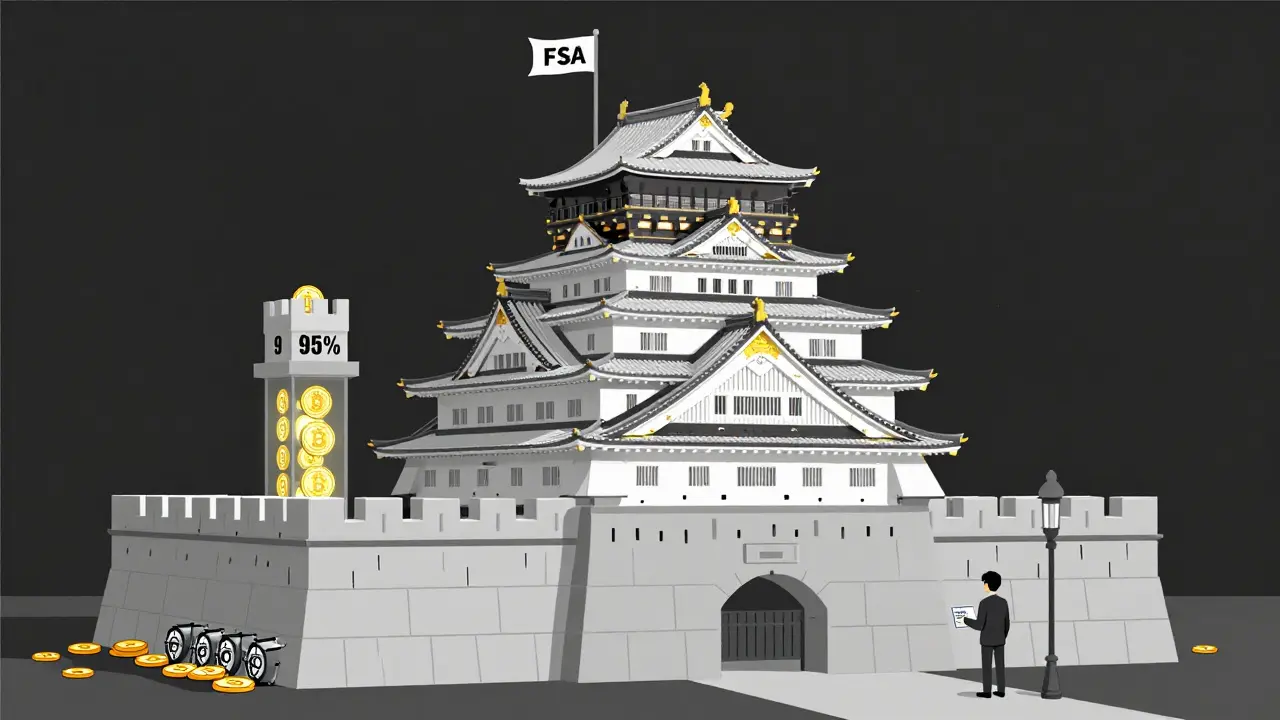

Japan doesn’t just allow crypto exchanges - it controls them. If you want to run a crypto exchange in Japan, you don’t apply for a permit. You build a legal, financial, and technical fortress that meets the Financial Services Agency’s (FSA) exacting standards. And if you don’t? You’re breaking the law.

Why Japan’s Rules Are Different

Most countries treat crypto like a wild west - some rules here, some rules there, and a lot of gray areas. Japan is not like that. Since the Mt. Gox collapse in 2014, the FSA has been rebuilding trust from the ground up. The result? One of the strictest, most detailed crypto regulatory systems on the planet. It’s not about stopping innovation. It’s about making sure when you lose money in crypto, it’s because the market moved - not because the exchange vanished with your coins. The core of Japan’s system is the Payment Services Act (PSA) is Japan’s primary law governing crypto exchanges, requiring licensing, cold storage, and fund segregation. But in June 2025, the FSA announced a major shift: certain crypto assets are now being moved under the Financial Instruments and Exchange Act (FIEA) is Japan’s securities law, now applying to tokens with investment or governance features. This isn’t a tweak. It’s a reclassification. Tokens that act like stocks - offering profit-sharing, voting rights, or passive income - are now treated like securities. That means full disclosure rules, insider trading bans, and legal paths for regulated crypto ETFs, including spot Bitcoin products.The Licensing Gauntlet

You can’t just register online. To get licensed by the FSA, you need:- A Kabushiki Kaisha a Japanese joint-stock company structure required for crypto exchange licensing - meaning you must incorporate in Japan as a formal corporation

- At least 10 million yen (about $65,000 USD) in capital - and often much more depending on your business model

- A physical office in Japan - no virtual addresses, no offshore management

- A Japanese bank account - no foreign banking allowed for customer deposits

- Appointed compliance officers who live in Japan and answer directly to the FSA

- A full AML/CFT system that tracks every transaction, every user, every deposit and withdrawal

The Cold Wallet Mandate: 95% Offline

This is where Japan sets itself apart from every other country. By law, at least 95% of customer crypto must be stored in cold wallets offline, air-gapped storage systems that prevent remote hacking. That means no internet connection. No remote access. No shortcuts. The other 5% can be in hot wallets - but here’s the catch: for every yen you keep online, you must back it with your own money. If a hacker steals $1 million from your hot wallet, you pay the customers back - out of your pocket. No other country enforces this. Not the U.S. Not the EU. Not Singapore. Japan says: If you want to trade crypto, you take the risk - not your users. This isn’t just a security rule. It’s a trust signal. Exchanges that pass this test - like BitFlyer, Coincheck, and Zaif - are seen as the gold standard in Asia. Investors trust them because they know their coins aren’t sitting on a server vulnerable to a single click.

What Happens If You Don’t Comply?

Operating without an FSA license is not a fine. It’s a criminal offense. In 2024, the FSA shut down three unregistered platforms that were offering leveraged trading to retail users. One of them had over 50,000 Japanese customers. The FSA didn’t warn them. They didn’t give them time to fix things. They froze their assets, blocked their domains, and referred the operators to prosecutors. Even foreign exchanges that don’t have a physical presence in Japan are not safe. The FSA works with international regulators and payment processors. If you accept Japanese customers without a license, your bank accounts get frozen, your payment gateways get cut off, and your domain gets blacklisted.Taxation: The Hidden Cost

Japan’s tax system is brutal for crypto investors. Profits from selling crypto are taxed as “miscellaneous income,” with rates up to 55% - higher than the top income tax rate in many countries. Compare that to stocks, which are taxed at a flat 20%. The FSA knows this is a problem. In late 2025, they proposed aligning crypto taxes with traditional financial assets. If passed in early 2026, the new law would cap crypto gains at 20%, making Japan far more attractive to long-term holders. Until then, traders are stuck paying steep taxes - and many are moving their trading to offshore platforms. But here’s the irony: those offshore platforms aren’t legal in Japan. So users are breaking the law to avoid taxes, while the FSA pushes for compliance.

DeFi and the Future

Japan isn’t just regulating exchanges. It’s preparing for the next wave: decentralized finance. The FSA launched a DeFi Study Group a formal working group of regulators, industry, and academics exploring DeFi regulation in Japan in 2024. It meets every two months. They’ve tested smart contract audits, looked at how to apply AML rules to non-custodial wallets, and even debated whether DAOs can be held legally responsible. They’re not trying to kill DeFi. They’re trying to make it safe. Their goal: find a way to protect users without crushing innovation. That’s why they’re studying how other countries handle it - and why they’re likely to be the first to issue formal DeFi guidelines.Market Impact: Growth Amid Strict Rules

Despite all the rules, Japan’s crypto market is growing. In 2025, the market is expected to hit $2.0 billion in revenue, with 18.69 million users - a 14.7% adoption rate. By 2026, that number will rise to 15.26%. Why? Because trust matters. Japanese investors aren’t chasing hype. They’re looking for safety. They want exchanges that have passed the FSA’s tests. That’s why BitFlyer, which has been licensed since 2017, still leads the market. It’s not the cheapest. It’s not the flashiest. But it’s the most trusted. Large Japanese corporations are also getting involved. Companies like Metaplanet have bought billions of dollars in Bitcoin. The government hasn’t disclosed its own holdings, but public companies are treating crypto like a legitimate asset class - because the FSA says it’s safe to do so.Is Japan’s Model the Future?

Yes - and no. Other countries are watching. The EU’s MiCA regulation, Singapore’s MAS framework, and even the U.S. SEC’s recent moves all echo Japan’s emphasis on custody, transparency, and investor protection. But few are willing to go as far as Japan. The cost of compliance is high. The time to market is long. The penalties are severe. That’s why new crypto startups avoid Japan. But for serious players - institutional investors, banks, and established exchanges - Japan is the most predictable, safest market in Asia. The FSA doesn’t want to be the biggest crypto hub. It wants to be the most trustworthy one. And in a world full of exchange collapses and rug pulls, that’s worth more than any trading volume.Can a foreign company run a crypto exchange in Japan without a local office?

No. The FSA requires all crypto exchange operators to establish a legal entity in Japan - specifically a Kabushiki Kaisha (joint-stock company) - with a physical office, Japanese bank account, and local compliance staff. Remote operations or offshore management are not permitted under any circumstances.

What happens if a Japanese crypto exchange gets hacked?

If the hack targets cold wallets (which are required to hold 95% of assets), the exchange is not liable - because those wallets are offline and technically unhackable by remote means. But if the breach occurs in the 5% hot wallet portion, the exchange must compensate users using its own funds. The FSA requires exchanges to maintain reserve capital specifically for this scenario.

Are Bitcoin and Ethereum treated differently under Japanese law?

As of 2025, Bitcoin and Ethereum are still classified as crypto-assets under the Payment Services Act. However, tokens built on Ethereum that offer investment returns, governance rights, or profit-sharing - like staking tokens or DeFi yield tokens - are now being reclassified under the Financial Instruments and Exchange Act as securities. This means those specific tokens face stricter disclosure and reporting rules.

How long does it take to get an FSA crypto license?

The process typically takes 8 to 14 months. It’s not a form you fill out - it’s a full organizational overhaul. You must hire compliance officers, build audit trails, set up cold storage infrastructure, and undergo multiple rounds of FSA inspections. Many applicants fail on their first attempt due to incomplete documentation or weak internal controls.

Is crypto trading taxed differently than stock trading in Japan?

Currently, yes. Crypto profits are taxed as miscellaneous income, with rates up to 55%. Stock gains are taxed at a flat 20%. The FSA proposed aligning crypto taxes with stocks in late 2025, and the law is expected to pass in early 2026. Until then, crypto traders pay significantly more than stock investors.

Can I use a foreign crypto exchange like Binance in Japan?

Technically, no. Binance is not FSA-licensed, and the agency actively blocks access to unregistered platforms. Japanese banks and payment providers are required to cut off services to users transacting with unlicensed exchanges. While some users still access them via VPNs, doing so is legally risky and violates Japanese financial law.

What’s the difference between PSA and FIEA in crypto regulation?

The Payment Services Act (PSA) governs crypto as a payment tool - it’s about exchanges, custody, and AML. The Financial Instruments and Exchange Act (FIEA) governs crypto as a financial asset - it’s about securities, disclosures, insider trading, and market manipulation. As of mid-2025, tokens with investment features are moving from PSA to FIEA, meaning they’re now treated like stocks or bonds under the law.