Curve Finance Crypto Exchange Review: Stablecoin Trading on a Leading DeFi Platform

Feb, 19 2026

Feb, 19 2026

Curve Finance isn't a typical crypto exchange. You won't find Bitcoin or Solana trading pairs here like you would on Binance or Coinbase. Instead, it's a specialized decentralized exchange built for one thing: swapping stablecoins and other low-volatility assets with near-zero slippage. If you're trading USDT, USDC, DAI, or even newly launched stablecoins like crvUSD, Curve is one of the most efficient platforms out there. But if you're looking for a simple way to buy Ethereum or swap altcoins, this isn't the place.

What Curve Finance Actually Does

Launched in 2020, Curve Finance operates as an automated market maker (AMM) - but not like Uniswap or SushiSwap. Those platforms use a constant product formula that works okay for volatile assets, but falls apart when trading assets that are supposed to be worth the same - like USDC and DAI. Curve’s secret sauce? A custom bonding curve designed specifically for stable assets. This means when you swap $1,000 worth of USDC for DAI, you get almost exactly $1,000 back. No 1% slippage. No 2% price impact. Just smooth, predictable trades.

This isn’t just theory. In 2025, Curve processed over $120 billion in stablecoin volume across all its chains. That’s more than most centralized exchanges handle for stable assets. Why? Because liquidity providers and traders know Curve delivers the lowest cost and fastest execution for these trades. It’s the go-to hub for DeFi protocols that need to move between stablecoins without losing value.

How Curve Makes Money - And How You Can Too

Curve doesn’t charge traditional fees. Instead, it uses a dynamic fee model. Swap fees are typically just 0.04%. Deposit and withdrawal fees only kick in if a pool becomes unbalanced - and even then, they’re only 0.02%. Most of the time? Zero fees. That’s why traders love it.

But the real money is in liquidity provision. If you deposit stablecoins into a Curve pool - say, 50% USDC and 50% DAI - you earn trading fees from everyone swapping between those two. In 2025, the Liquidity USD (lUSD) pool paid out around 0.47% APY. The Synthetic USD (sUSD) pool? Around 3.06%. And if you stake your CRV tokens in governance gauges, you can earn even more - sometimes over 10% APY depending on the pool and demand.

Here’s the catch: you need to understand impermanent loss. If one of your deposited assets changes value significantly, you could lose money compared to just holding. But with stablecoins? That risk is minimal. Most Curve users treat liquidity provision as a low-risk yield strategy, not speculation.

The crvUSD Stablecoin and Why It Matters

In mid-2024, Curve launched its own native stablecoin: crvUSD. Unlike USDC or DAI, crvUSD is over-collateralized and backed by a mix of crypto assets - not just cash reserves. It’s managed by a system called PegKeepers, which automatically adjusts collateral ratios to maintain its $1 peg. By early 2026, crvUSD had over $120 million in circulation and was integrated into dozens of DeFi protocols, including lending platforms and yield aggregators.

This wasn’t just a token launch. It was a strategic move to make Curve the central clearinghouse for DeFi liquidity. Now, instead of borrowing USDC from Aave and depositing it into Curve, you can borrow crvUSD directly and use it in Curve pools - reducing reliance on external stablecoins and deepening the ecosystem.

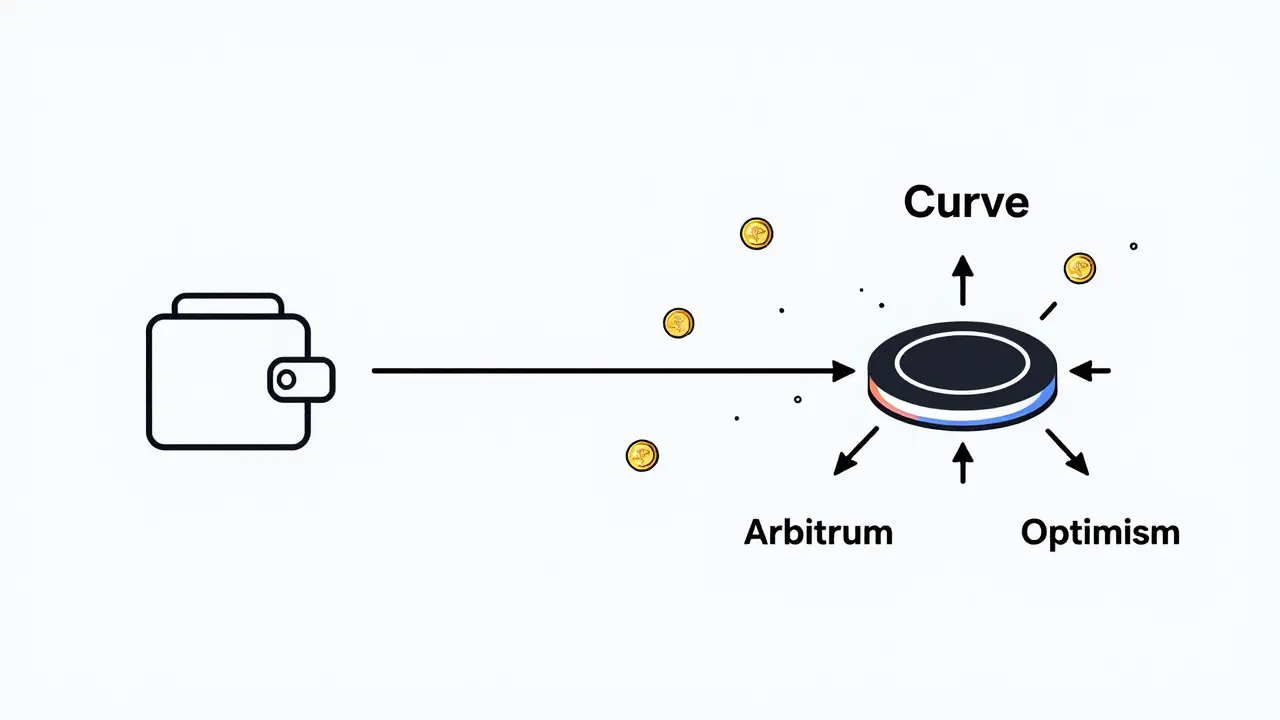

Multi-Chain Presence: It’s Not Just Ethereum Anymore

When Curve started, you had to pay Ethereum gas fees - often $10-$50 per trade. That scared off most users. But by 2025, Curve had expanded to Arbitrum, Optimism, Polygon, Fantom, and Avalanche. Each chain has its own version of the platform with identical pools and mechanics. You can deposit on Ethereum, withdraw on Polygon, and trade on Arbitrum - all using the same wallet.

These deployments aren’t afterthoughts. They’re core to Curve’s survival. Gas fees on Ethereum are still high, but on Polygon? A swap costs less than a penny. That’s why over 70% of Curve’s daily volume now happens on Layer 2 chains. The platform even uses bridges like LayerZero and Wormhole to move liquidity between chains without needing users to manually bridge assets.

Who Uses Curve - And Who Should Avoid It

Curve isn’t for beginners. If you’ve never connected a wallet, heard of APR vs APY, or don’t know what a governance token is, this isn’t your starting point. The interface is clean, but the underlying mechanics - gauges, veCRV, liquidity mining, pool weights - are complex. You need to understand how incentives work to avoid missing out or getting stuck with low-yield pools.

But if you’re already in DeFi? Curve is essential. It’s used by:

- Yield farmers who need to rebalance between stablecoins without slippage

- Lending protocols that use Curve pools as collateral sources

- DAO treasuries managing large stablecoin reserves

- Traders arbitraging price differences between centralized and decentralized exchanges

And if you’re holding CRV? Voting on governance proposals lets you influence which pools get the most incentives - and therefore, which ones earn you the most rewards. That’s power.

Security and Non-Custodial Control

Curve is non-custodial. That means your funds never leave your wallet. There’s no KYC. No withdrawal limits. No bank account links. You interact directly with smart contracts using MetaMask, WalletConnect, or Ledger. The platform has been live since 2020 with no major exploits on its core contracts. Audits from firms like CertiK and OpenZeppelin confirm its security.

That said, you’re still responsible for your keys. If you lose access to your wallet, Curve can’t help you. No customer support. No password reset. Just you and your seed phrase.

CRV Token: Governance, Not Just a Currency

The CRV token isn’t meant to be traded like Bitcoin. It’s a governance token. Holding CRV lets you vote on:

- Which new stablecoin pools get created

- How much of the trading fees go to liquidity providers

- Changes to fee structures

- Integration with new blockchains

But you can’t vote with just any CRV. You have to lock it up as veCRV - voting-escrowed CRV. Locking for four years gives you maximum voting power. Locking for one year? Less. This system discourages short-term speculation and rewards long-term commitment.

By 2025, over 80% of CRV supply was locked. That’s how serious users are about shaping the platform’s future.

What’s Missing - And What’s Next

Curve doesn’t offer:

- Spot trading for Bitcoin or Ethereum

- Margin trading or leverage

- Staking for proof-of-stake chains

- A mobile app

It’s not trying to be everything. It’s trying to be the best at one thing: swapping stable assets with minimal cost and maximum efficiency. And it’s succeeding.

Looking ahead, Curve is pushing into cross-chain yield optimization, automated liquidity rebalancing, and deeper integration with lending protocols. The crvUSD rollout is just the beginning. If institutional DeFi adoption grows - and it is - Curve will be at the center of it.

Final Thoughts

Curve Finance isn’t flashy. It doesn’t have NFTs or meme coins. But it’s one of the most important pieces of infrastructure in DeFi. If you’re serious about stablecoin trading, yield farming, or just moving money between protocols without losing value, Curve is unmatched. The learning curve is steep, the interface feels technical, and the fees are hidden in complexity - but once you get it, you’ll wonder how you ever traded anywhere else.

It’s not for everyone. But for those who need precision, efficiency, and control - Curve is the gold standard.

Is Curve Finance the same as Celo?

No, Curve Finance and Celo are completely separate platforms. Curve is a decentralized exchange focused on stablecoin trading on blockchains like Ethereum, Arbitrum, and Polygon. Celo is a mobile-first blockchain that uses phone numbers as wallet addresses and has its own native stablecoins (CUSD, CEUR) and token (CELO). They serve different purposes and have no technical integration.

Can I trade Bitcoin or Ethereum on Curve?

Not directly. Curve specializes in stablecoins and low-volatility assets like sETH (synthetic Ethereum) and sBTC. You can’t swap BTC for ETH on Curve. For that, you’d use Uniswap, SushiSwap, or a centralized exchange.

How do I start using Curve Finance?

First, connect a wallet like MetaMask or WalletConnect. Then, go to curve.fi and choose a chain (Ethereum, Arbitrum, etc.). Deposit stablecoins like USDC or DAI into a liquidity pool. You can earn trading fees, or swap between stablecoins with minimal slippage. To earn more, lock CRV tokens as veCRV to vote on governance and boost rewards.

Is Curve safe to use?

Yes, if you understand the risks. Curve’s core contracts have been audited and live since 2020 without major exploits. But it’s non-custodial - you control your funds. If you send funds to the wrong address or lose your seed phrase, there’s no recovery. Always double-check contracts before interacting.

Do I need to hold CRV to use Curve?

No, you can swap stablecoins without holding CRV. But if you want to earn the highest yields or influence how the platform evolves, you’ll need CRV. Locking CRV as veCRV gives you voting power and boosts your rewards from liquidity pools.

What are the fees on Curve?

Swap fees are typically 0.04%. Deposit and withdrawal fees are 0.02% - only if a pool becomes unbalanced. Most of the time, trades are free. You still pay network gas fees (Ethereum, Arbitrum, etc.), but those vary by chain. On Polygon, gas is under $0.01 per transaction.

Can I use Curve on my phone?

There’s no official Curve app, but you can access it through mobile wallets like MetaMask, Trust Wallet, or WalletConnect. The website works fine on mobile browsers. Just be careful - small screens make it easy to miss contract details or approve the wrong transaction.