Dsdaq Crypto Exchange Review: Crypto Collateral Trading Explained

Jan, 14 2026

Jan, 14 2026

Most crypto exchanges let you buy Bitcoin, trade Ethereum, or maybe dip into futures. But Dsdaq does something different: it lets you use your crypto as collateral to trade stocks, forex, and commodities - without selling a single coin. If you’ve ever wanted to turn your Bitcoin into a leveraged position on the S&P 500 or gold, Dsdaq is one of the few platforms that actually makes this possible.

What Is Dsdaq, Really?

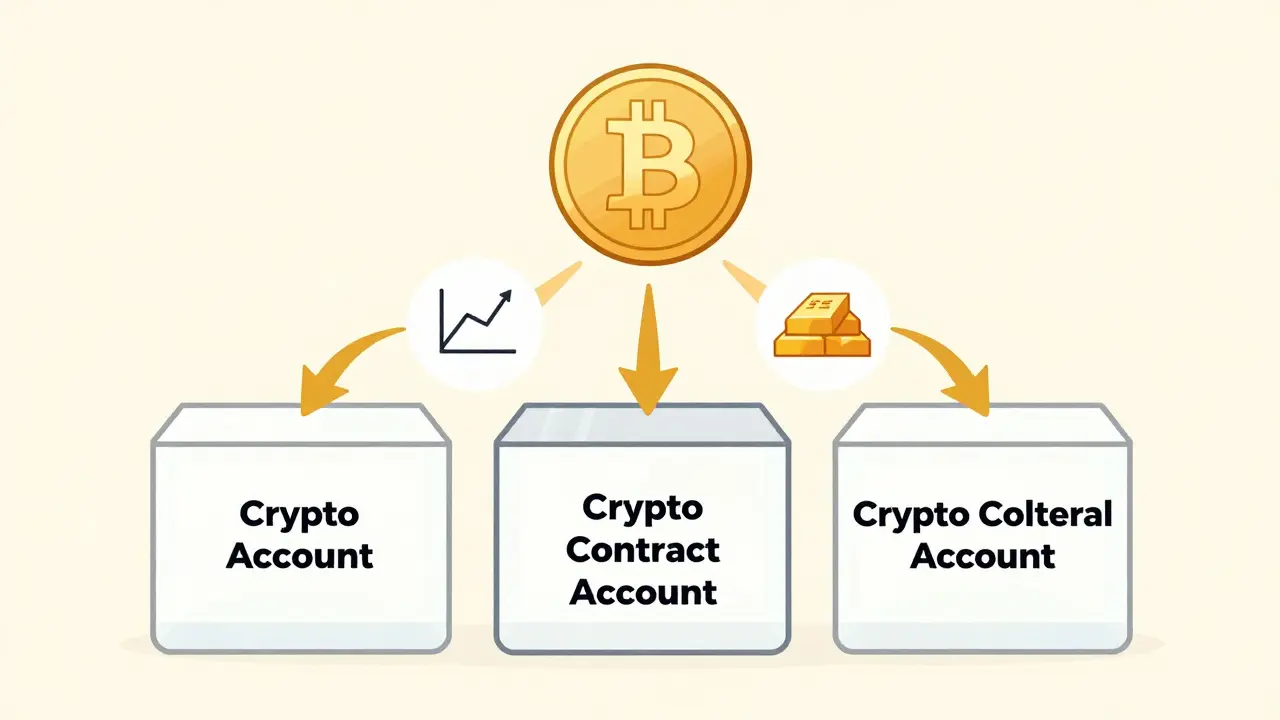

Dsdaq isn’t another copycat exchange. It launched in December 2019 with a clear goal: bridge crypto and traditional finance. Based in Hong Kong and legally registered in the Cayman Islands, it’s not trying to be the biggest. It’s trying to be the most flexible for traders who want to move between asset classes without cashing out. The platform doesn’t just support 46 cryptocurrencies - it lets you use them as collateral to access over 300 traditional financial instruments. That includes US stocks like Apple and Tesla, major indices like the NASDAQ, commodities like crude oil, and even forex pairs like EUR/USD. You’re not trading crypto against crypto. You’re trading crypto against the global market.The Three-Account System: How It Actually Works

This is where Dsdaq gets tricky - and powerful. You don’t just have one wallet. You have three:- Crypto Account: Where you deposit and withdraw your Bitcoin, Ethereum, and other coins.

- Crypto Contract Account: Used for pure crypto derivatives trading - think BTC/USD perpetual swaps with up to 100x leverage.

- Crypto Collateral Account (CCA): The magic piece. This is where your crypto gets locked as collateral to trade non-crypto assets.

Fees: Where Dsdaq Actually Saves You Money

Fees are where Dsdaq shines - especially if you trade traditional assets. Here’s the breakdown:- Traditional assets (stocks, forex, commodities): Zero commission. That’s right - no fee to buy Apple stock using your Ethereum as collateral.

- Crypto spot trading: Flat 0.1% per trade. Standard, but not the lowest.

- Crypto derivatives (futures): Maker fee 0.02%, taker fee 0.05%. Competitive with BitMEX and Bybit.

- Overnight financing: Just 0.015% per day. Much lower than most brokers.

- Bitcoin withdrawal: 0.0005 BTC. Typical for the industry.

Who Can Use Dsdaq? (Spoiler: Not Americans)

Dsdaq doesn’t serve users in the United States. That’s a big limitation. If you’re in the U.S., you can’t sign up - even if you have a VPN. The platform avoids U.S. regulation by design. It’s registered in the Cayman Islands and operates from offices in Hong Kong, Singapore, Bangkok, Vienna, Barcelona, Buenos Aires, and Nigeria. That means:- No access for U.S. residents.

- No SEC oversight.

- No FDIC insurance on funds.

- No protection under U.S. consumer laws.

Mobile-First, But Not Desktop-Friendly

Dsdaq’s app is clean, fast, and built for trading on the go. The interface is trading-oriented - charts are clear, order types are easy to find, and account balances update in real time. It’s designed for people who want to react quickly to market moves. But here’s the catch: there’s no full-featured web platform. You can’t do advanced charting, set complex limit orders, or use trading bots on desktop. The platform is mobile-only. That’s fine for casual traders. It’s a problem for professionals who need multi-monitor setups, backtesting tools, or algorithmic trading. If you’re used to TradingView or MetaTrader, you’ll feel limited. But if you’re someone who checks markets between meetings or while commuting, the app works well.How Does It Compare to the Big Players?

Let’s put Dsdaq next to the giants:| Feature | Dsdaq | Binance | BitMEX | Robinhood |

|---|---|---|---|---|

| Supports crypto as collateral for stocks/forex | Yes | No | No | No |

| Zero commission on traditional assets | Yes | No | No | Yes (but only for buying stocks, not using crypto) |

| Max leverage on crypto derivatives | 100x | 125x | 100x | N/A |

| Supported cryptos | 46 | 350+ | 30+ | 7 |

| Available in the U.S.? | No | No (Binance.US only) | No | Yes |

| Platform | Mobile-only | Web + Mobile | Web + Mobile | Mobile + Web |

Is Dsdaq Safe?

Safety is the biggest question. Dsdaq isn’t regulated by the SEC, FCA, or ASIC. It’s registered in the Cayman Islands - a common jurisdiction for crypto exchanges seeking flexibility. That means:- No government-backed insurance on your funds.

- No mandatory audits published publicly.

- No legal recourse if something goes wrong.

Who Should Use Dsdaq?

This platform isn’t for everyone. Here’s who it’s built for:- You hold crypto and want to trade stocks, forex, or commodities without selling your coins.

- You’re tired of paying fees to convert crypto to USD, then pay more fees to buy Apple stock on a traditional broker.

- You’re outside the U.S. and want a fast, mobile-friendly way to access global markets.

- You’re comfortable with offshore platforms and understand the risks of unregulated exchanges.

- U.S. residents.

- People who need desktop trading tools.

- Those who want government-backed security or insurance.

- Beginners who don’t understand leverage or derivatives.

The Bottom Line

Dsdaq isn’t the biggest exchange. It’s not the safest. It’s not even the easiest to find. But if you’re a crypto holder who wants to trade global markets without cashing out - and you’re outside the U.S. - it’s one of the only platforms that lets you do that with zero commissions. Its three-account system is complex at first, but once you get it, it’s powerful. The mobile app is smooth. The fees are competitive. The concept is innovative. The risks? You’re trusting an offshore platform with no U.S. oversight. Your funds aren’t insured. And if the platform shuts down tomorrow, you might lose access. But for the right user - someone who understands crypto, knows how leverage works, and wants to bypass traditional finance - Dsdaq is a rare tool. It’s not a replacement for Coinbase or Kraken. It’s a supplement. A bridge. A way to turn your digital assets into a passport to the rest of the financial world.Can I use Dsdaq if I live in the United States?

No, Dsdaq does not allow users from the United States to trade on its platform. It avoids U.S. regulatory oversight by restricting access to users outside the country. Even with a VPN, signing up from a U.S. IP address will be blocked. If you’re in the U.S., you’ll need to use platforms like Binance.US, Coinbase, or Robinhood - but none of them let you use crypto as collateral to trade stocks or forex.

How does crypto collateral trading work on Dsdaq?

You deposit crypto into your Crypto Account, then transfer it to your Crypto Collateral Account (CCA). Once there, your crypto acts as security for trades in traditional assets like stocks or gold. If your trade profits, you gain in USD. If it loses, your crypto collateral is used to cover the loss. You never sell your crypto - you just use it as a guarantee. This lets you stay exposed to crypto price movements while trading other markets.

Is Dsdaq’s 100x leverage dangerous?

Yes - extremely. 100x leverage means a 1% move against your position wipes out your entire collateral. This isn’t trading. It’s gambling with crypto as your stake. Dsdaq allows this for derivatives, but it’s only suitable for experienced traders who understand liquidation risk. Most users should stick to 5x-10x leverage, if any. Never trade with more than you can afford to lose.

Are there hidden fees on Dsdaq?

No hidden fees on traditional asset trades - that’s the whole point. But you’ll pay withdrawal fees for crypto (like 0.0005 BTC for Bitcoin), and you’ll pay daily financing fees if you hold leveraged positions overnight (0.015% per day). There are no deposit fees, no inactivity fees, and no account maintenance charges. The fee structure is transparent - just read the details before trading.

Does Dsdaq offer a demo account?

No, Dsdaq does not offer a demo or practice account. You must deposit real crypto to start trading. This is a common limitation among smaller, offshore exchanges. If you’re new to crypto collateral trading, start with small amounts - under $100 worth of crypto - to learn the system before risking more.

Can I withdraw my crypto anytime?

Yes - but only if it’s not being used as collateral. If your crypto is locked in the Crypto Collateral Account because you have open positions, you can’t withdraw it until those positions are closed. You can transfer crypto between your accounts at any time, but if you move funds out of the CCA, you may trigger a margin call if your positions become undercollateralized. Always check your collateral ratio before withdrawing.