E3 Compliance Technologies Review: Crypto Exchange Compliance Platform

Apr, 9 2025

Apr, 9 2025

Compliance Cost Calculator

Estimate Your Costs

Cost Estimate

Enter your details to see your estimated monthly cost

Quick Takeaways

- E3CT is a compliance‑as‑a‑service provider, not a cryptocurrency exchange.

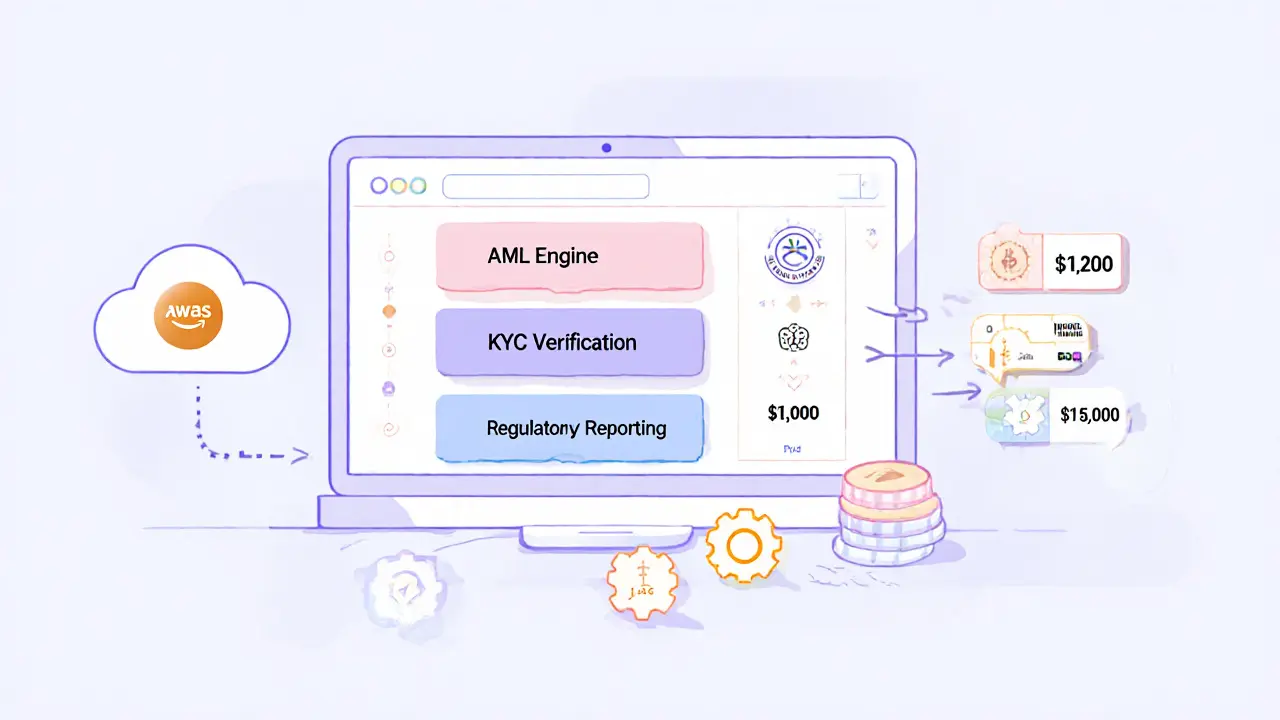

- Its platform covers AML, KYC, transaction monitoring and MiCA reporting for exchanges.

- Pricing starts around $1,200 / month and scales to $15,000 + / month for enterprise bundles.

- Strengths: fast EU MiCA updates, automated reporting, strong API support.

- Weaknesses: limited forensic blockchain analysis, higher integration effort, focus on EU/US jurisdictions.

When you search for "E3 crypto exchange review" you probably expect a rundown of a trading platform. E3 Compliance Technologies is a SaaS compliance solution that helps cryptocurrency exchanges meet AML, KYC and emerging regulatory requirements. The company, founded in 2020, does not let you buy or sell coins - it equips exchanges with the tools they need to stay on the right side of the law.

Why the Confusion Happens

Many crypto enthusiasts associate any "E3" brand with a trading venue because the name appears alongside exchanges in news feeds. In reality, E3CT’s marketing tagline "Empower Your Business With Crypto Compliance To Stay Ahead" makes it clear they are a compliance partner, not a market. The mix‑up is easy to make, but the distinction matters: an exchange handles order books, liquidity and wallets; a compliance platform handles data collection, risk scoring and regulator‑ready reports.

Core Services Offered by E3CT

All features run on a cloud‑native stack built on AWS and are accessed via RESTful APIs. Below is a snapshot of the main modules.

- Anti‑Money Laundering (AML) Engine - real‑time transaction monitoring with machine‑learning models that flag suspicious patterns with 98.7% detection accuracy (Kudelski Security audit, 2024).

- Know Your Customer (KYC) - automated identity verification, document validation and ongoing watch‑list screening.

- Regulatory Reporting - pre‑built templates for US FinCEN, EU MiCA, and Travel Rule (TRISA) filings.

- Change Management - a dashboard that pushes rule updates as new regulations emerge, ensuring exchanges stay compliant without manual code changes.

- Data Security - FIPS 140‑2 validated encryption, role‑based access control and MFA for all admin actions.

Pricing Structure (2025)

E3CT uses a subscription model that scales with exchange size and feature depth. The basic “Starter” tier begins at $1,200 per month and includes AML monitoring for up to 500,000 transactions, KYC verification, and monthly regulatory reports. Mid‑tier “Growth” packages (≈$5,000 / month) raise the transaction cap to 2 million and add custom API hooks. Enterprise plans start around $15,000 / month, offering unlimited transaction volume, dedicated account managers, and bespoke integration work. All plans require a 2‑4 week rollout period and a minimum 12‑month contract.

Technical Architecture and Integration

The platform processes roughly 2.3 million transactions per hour in its largest configuration. Integration steps typically look like this:

- Provision a secure API key on the E3CT portal.

- Map your exchange’s transaction schema to E3CT’s required JSON format (127 detailed fields).

- Deploy the SDK (available for Java, Node.js, Python) and run a sandbox test batch.

- Configure risk thresholds and reporting schedules via the web UI.

- Go live and monitor the daily health dashboard.

Because the platform is API‑first, it works with major exchanges like Binance, Coinbase and Kraken, as well as dozens of niche wallets. However, 68% of users report a learning curve when mapping legacy data structures, and 52% need extra tweaking of risk parameters during the first month.

How E3CT Stacks Up Against Competitors

| Feature | E3CT | Chainalysis | Elliptic | CipherTrace |

|---|---|---|---|---|

| AML Transaction Monitoring | 98.7% detection (ML) | 99.2% detection (ML) | 97.5% detection | 96.8% detection |

| MiCA Compliance Automation | 40% faster than industry average | Basic templates only | Limited EU focus | No dedicated MiCA module |

| Blockchain Forensic Coverage | 85% of major protocols | 99.2% coverage | 94% coverage | 90% coverage |

| Pricing (entry tier) | $1,200/mo | $5,000/mo | $3,500/mo | Custom (often >$5k) |

| API Integration Time | 2‑4 weeks | 1‑2 weeks (standard) | 2‑3 weeks | 3‑4 weeks |

| Geographic Focus | EU + US | Global | Global (EU strong) | Global |

In short, E3CT shines for exchanges targeting EU markets that need rapid MiCA updates and automated reporting. If you need deep forensic tracing of illicit flows, Chainalysis still leads the pack.

User Experience: What Real Customers Say

On G2 Crowd, E3CT holds a 4.3‑out‑of‑5 rating based on 87 verified reviews. Users regularly praise the platform’s regulatory‑update speed (92% positive mentions) and responsive support (87% positive). A Trustpilot reviewer noted that their MiCA templates saved roughly 200 staff hours each month.

However, the platform is not without pain points. Reddit users discuss a 15% false‑positive rate during the first three months, meaning compliance teams must manually clear legitimate trades. Integration costs can also balloon if you exceed the included API call quota - about 12% of reviewers flagged surprise fees.

Implementation Timeline and Resource Needs

Typical onboarding looks like this:

- Week 1‑2: API key generation, data‑schema mapping, sandbox testing.

- Week 3‑4: Full‑scale data feed, risk‑threshold tuning, staff training (≈40 hours).

- Post‑Go‑Live: Ongoing monitoring, quarterly compliance audits, optional premium support.

CryptoSlate’s case study of 12 mid‑size exchanges reports an average of 35‑50 internal staff hours spent on the integration phase, with a total rollout cost ranging from $12k to $18k depending on customization depth.

Market Context: Why Compliance Platforms Matter in 2025

The global crypto compliance market hit $1.2 billion in 2024 and is projected to grow at a 32.7% CAGR through 2029 (Grand View Research). Two regulatory forces dominate:

- EU MiCA - requires all exchanges operating in Europe to have automated reporting, risk scoring, and Travel Rule compliance by Dec 2024.

- US FinCEN BSA expansion - now covers all cryptocurrency transactions, pushing U.S. exchanges to adopt robust AML solutions.

E3CT’s niche focus on exchange‑specific compliance workflows gives it a foothold in a market where 78% of exchanges plan to increase compliance spend in 2025 (PwC, 2024). Yet analysts warn of consolidation: Deloitte predicts a 50% reduction in specialized compliance vendors by 2027 as larger players acquire niche tools.

Future Roadmap and Upcoming Features

Looking ahead, E3CT announced three major upgrades slated for early 2025:

- AI‑powered risk scores that adapt to emerging laundering tactics.

- Expanded regulatory libraries for the Middle East (ADGM, Dubai VARA).

- Full‑stack integration with the TRISA network for automated Travel Rule compliance.

If you’re evaluating a compliance partner now, these planned capabilities may tip the scales, especially if you intend to launch in new jurisdictions later this year.

Final Verdict: Is E3CT Right for Your Exchange?

Summing up, E3CT is a solid choice if you:

- Operate primarily in the EU or US and need fast MiCA or FinCEN updates.

- Prefer a subscription model that bundles AML, KYC and reporting.

- Have development resources to handle a 2‑4 week API integration.

You might look elsewhere if you:

- Require deep blockchain forensics across every protocol.

- Run a small, low‑volume exchange and want a cheaper, plug‑and‑play solution.

- Need a platform with native support for non‑EU, non‑US jurisdictions.

Overall, the platform delivers on its promise to keep exchanges compliant without building a custom compliance stack from scratch. Its biggest drawback remains the steep learning curve and limited forensic depth, but for many mid‑size exchanges the trade‑off is worth it.

Frequently Asked Questions

Is E3CT a cryptocurrency exchange?

No. E3 Compliance Technologies provides compliance‑as‑a‑service tools that help exchanges meet AML, KYC and regulatory reporting obligations.

What pricing tiers does E3CT offer in 2025?

The entry‑level tier starts at $1,200 per month, a mid‑tier around $5,000 per month, and enterprise packages begin at roughly $15,000 per month, scaling with transaction volume and feature set.

How does E3CT handle EU MiCA compliance?

E3CT offers a dedicated “MiCA Complete” package that automates the required reporting, risk scoring and Travel Rule data sharing, delivering compliance updates up to 40% faster than the industry average.

Can E3CT integrate with existing exchange infrastructure?

Yes. Integration is API‑first, using REST endpoints and SDKs for major languages. Most exchanges complete full integration in 2‑4 weeks, though mapping legacy data schemas can add effort.

How does E3CT compare to Chainalysis for forensic analysis?

Chainalysis provides broader blockchain coverage (99.2% vs. E3CT’s 85%) and deeper forensic tools. E3CT focuses on compliance workflow automation rather than deep chain tracing.

Wayne Overton

October 24, 2025 AT 23:54Allison Andrews

October 25, 2025 AT 21:52Alisa Rosner

October 26, 2025 AT 08:08MICHELLE SANTOYO

October 26, 2025 AT 10:49Lena Novikova

October 27, 2025 AT 01:32Olav Hans-Ols

October 27, 2025 AT 12:12Kevin Johnston

October 27, 2025 AT 18:24Dr. Monica Ellis-Blied

October 28, 2025 AT 04:26