Fastex Crypto Exchange Review 2025 - Fees, Features & Competitors

Apr, 10 2025

Apr, 10 2025

Fastex Trading Fee Calculator

Trading Fee Calculator

Fee Results

Fastex Trading Fees (0.14-0.15% per side)

Enter a trade amount to see fee calculations

Looking for a solid spot‑trading platform that isn’t swallowed by the hype of high‑leverage exchanges? This review breaks down the Fastex crypto exchange - from its fee structure to its Web3 ecosystem - so you can decide if it fits your trading style.

What is Fastex?

Fastex is a Dubai‑based cryptocurrency exchange founded in 2017 by Vigen Badalyan and powered by SoftConstruct, a seasoned software development firm. The platform positions itself as a unified hub for spot trading, fiat‑to‑crypto payments, and a growing Web3 ecosystem that includes its native FTN token, the ftNFT marketplace, and the upcoming YoWallet wallet.

Spot Trading Features

Fastex focuses exclusively on spot trading across 49 cryptocurrency pairs. Every pair is displayed through an integrated TradingView chart, giving users professional‑grade technical analysis tools without needing a separate account. Order types cover the basics - market, limit, stop‑limit, stop‑market - and the more advanced trailing stop and trailing stop‑limit options. The minimum order size is 0.1 USDT, making it accessible for newcomers while still satisfying modest‑size traders.

Fee Structure & Deposit Limits

Fees are straightforward: spot‑trading commissions range from 0.14 % to 0.15 % per side, with no hidden charges. Deposit fees sit between 0.09 % and 0.15 % depending on the currency and payment method. Users can fund accounts via Visa, Mastercard, or direct crypto transfers. Withdrawal fees follow the network‑standard rates, and there are no extra fees for moving funds between Fastex’s internal wallet, the ftNFT marketplace, or YoWallet.

Security, KYC & Support

Security follows industry norms - two‑factor authentication, cold‑storage for the majority of funds, and regular audits performed by third‑party firms. KYC verification is required for higher withdrawal limits; the process typically takes under an hour with a set of ID documents. Customer support is multilingual, reachable through live chat, email, and a ticketing system, with response times ranging from four to twenty‑four hours.

The Fastex Ecosystem: FTN Token, NFTs & Wallets

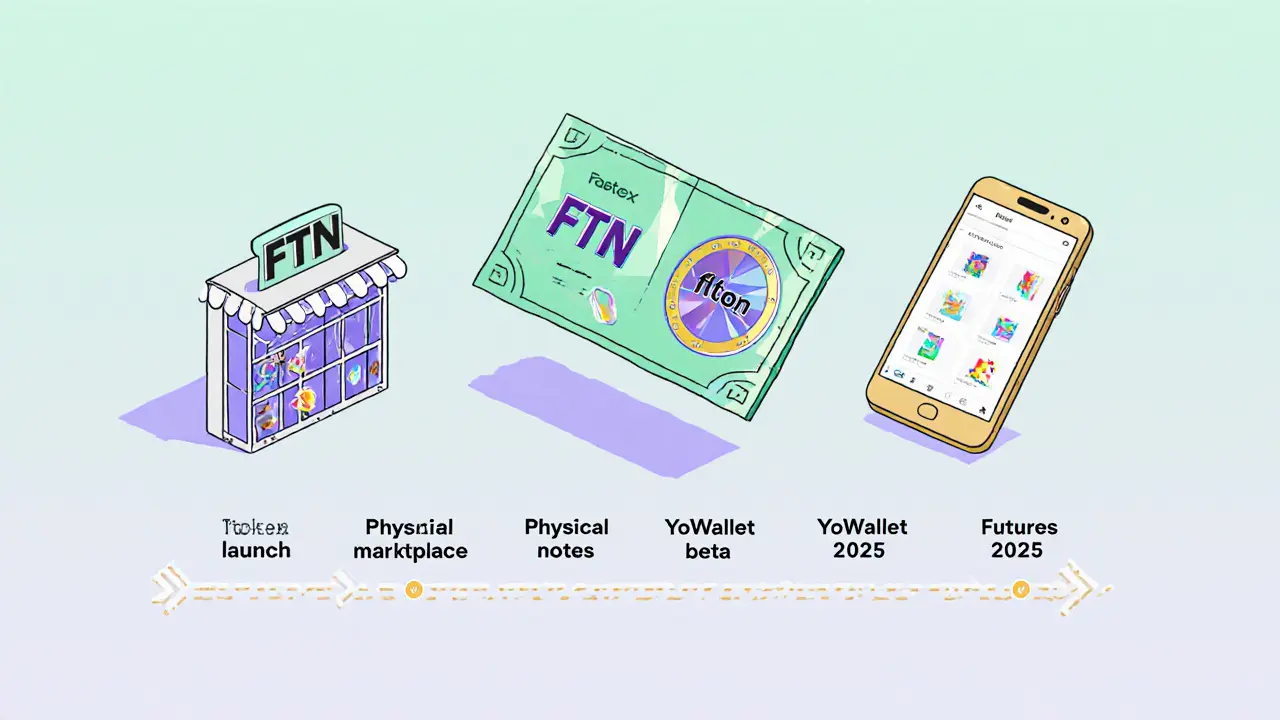

The native FTN token powers the exchange’s fee discounts and gives access to exclusive contests. In July 2025, Fastex made headlines by issuing collectible physical notes backed 1:1 by FTN, each paired with a unique NFT. The notes feature advanced anti‑counterfeit elements and can be redeemed for the full token value on the platform.

The ftNFT marketplace lets users buy, sell, and showcase NFTs using the same unified wallet that handles spot trading. This reduces friction compared with moving assets across multiple platforms. The upcoming YoWallet aims to extend that convenience to a standalone mobile wallet, supporting fiat cards, crypto transfers, and NFT storage in one app.

How Fastex Stacks Up Against the Big Kids

| Feature | Fastex | Binance | Coinbase |

|---|---|---|---|

| Spot Pairs | 49 | ~350+ | ~250+ |

| Leverage / Futures | No (planned) | Up to 125× | No |

| Trading Fees (taker) | 0.14‑0.15 % | 0.04‑0.1 % | 0.5‑1.5 % |

| FIAT Deposit Options | Visa, Mastercard, crypto | Bank, card, crypto | Bank, card, crypto |

| Web3 Integration | FTN token, ftNFT, YoWallet | Limited | Limited |

| Regulatory Base | Dubai (crypto‑friendly) | Malta/UK/Global | USA |

Fastex’s fee rates sit in the middle of the pack - higher than Binance’s tiered discounts but lower than Coinbase’s flat schedule. The biggest gap is asset variety; with only 49 pairs you’ll miss many niche altcoins that Binance or KuCoin list. On the upside, Fastex offers a clean, ad‑free UI and a truly integrated Web3 suite, which the larger exchanges only flirt with.

Pros and Cons

- Pros

- Transparent fee structure with no hidden costs.

- TradingView‑powered charts for professional analysis.

- Unified wallet that links spot trading, NFTs, and upcoming YoWallet.

- Physical FTN notes create a novel bridge between crypto and collectibles.

- Regulatory base in Dubai offers flexibility for future product launches.

- Cons

- Limited to 49 spot pairs - a smaller selection than major competitors.

- No leverage or futures today, which may deter active traders.

- Mobile app occasional connectivity glitches during peak volume.

- Customer‑service response times can vary widely.

User Feedback Snapshot

Reddit threads from the past six months show a generally positive sentiment. Traders praise the intuitive UI and the speed of order execution. A recurring theme is appreciation for the fiat‑to‑crypto card payments, which make first‑time purchases frictionless. Criticisms focus on the limited coin list - users frequently request support for popular DeFi tokens like AAVE or Uniswap (UNI). Android users report occasional “connection timed out” messages when market volatility spikes, while iOS users report smoother performance.

Future Roadmap

Fastex has announced plans to roll out futures trading and leveraged tokens by late 2025. If those features materialize, the exchange could jump from a niche spot‑trader to a more comprehensive platform, directly competing with Binance’s derivatives suite. The recent launch of a Los Angeles office signals a push into the U.S. market, potentially easing regulatory concerns for American users.

Final Verdict

If you’re a beginner or intermediate trader looking for a clean spot‑trading experience, transparent fees, and a cohesive Web3 ecosystem, Fastex is a solid pick. Power users who need deep liquidity, hundreds of altcoins, or margin trading will likely stay with larger exchanges until Fastex’s roadmap delivers those capabilities. In short, treat Fastex as a reliable “entry‑level” exchange that could evolve into a more robust player if its upcoming features arrive on schedule.

Is Fastex safe for storing large amounts of crypto?

Yes. Fastex uses two‑factor authentication, cold‑storage for the majority of assets, and regular third‑party security audits. However, as with any exchange, it’s wise to keep only what you need for trading and store the rest in a personal hardware wallet.

Can I trade using the FTN token for fee discounts?

Holding FTN grants up to a 20 % reduction on trading fees. The discount applies automatically when the token balance meets the required threshold.

What fiat currencies are supported for deposits?

Fastex accepts USD, EUR, BRL, GEL, AMD, as well as Visa and Mastercard card payments.

Will Fastex offer margin trading soon?

The roadmap mentions futures and leveraged tokens slated for late 2025, which would effectively introduce margin‑style trading.

How does the physical FTN note work?

Each note is backed 1:1 by an FTN token and comes with a unique NFT that proves ownership. You can redeem the note at any time for its full token value on the Fastex platform.

Brian Collett

October 25, 2025 AT 17:55Fastex’s UI is actually clean AF compared to Binance’s chaos. I’ve been using it for 3 months now and the TradingView integration is the real MVP-no more switching tabs just to check a chart.

Also, the FTN fee discount works like magic. I hold like 500 FTN and my taker fee dropped to 0.11%. That’s not nothing.

Herbert Ruiz

October 26, 2025 AT 14:4649 pairs. No leverage. Mobile glitches. That’s it. That’s the whole review.

Saurav Deshpande

October 26, 2025 AT 17:04They say 'Dubai-based'... but who really owns SoftConstruct? I’ve seen that name before-linked to a shell company in the Caymans that vanished after a crypto rug pull in 2021.

And those 'physical FTN notes'? Sounds like a pyramid scheme with QR codes. You think they’re backed 1:1? Try redeeming one after a market crash. They’ll disappear faster than TerraUSD.

Also, why is YoWallet coming 'soon'? That’s the same timeline as the moon landings in 2018. They’re not building-they’re selling dreams.

Paul Lyman

October 26, 2025 AT 22:03Yo, I started with Coinbase and switched to Fastex last year and honestly? Best move I ever made.

Yeah, the coin list is small-but I don’t need 300 altcoins I’ve never heard of. I want to buy BTC, ETH, and a few solid ones without getting lost in a jungle of spam tokens.

And the fiat card deposit? Instant. No waiting 3 days like on Binance. Plus, the ftNFT marketplace is dope-I bought a digital art piece and sold it for 2x in a week. It’s all connected. That’s the future.

Stop comparing it to Binance. It’s not supposed to be. It’s for people who want simplicity with substance. And yeah, the app glitches sometimes-but I’ve had worse on Coinbase.

Give it a shot if you’re tired of the hype. It’s not perfect-but it’s honest.

Frech Patz

October 27, 2025 AT 02:56Can anyone confirm the exact percentage reduction for FTN holders? The article states 'up to 20%' but does not specify the threshold. Is it 100 FTN? 1,000? Without this detail, the fee discount claim remains unsubstantiated.

Additionally, the comparison table lists Binance’s fees as 0.04–0.1%. Is this including maker-taker rebates, or just standard taker fees? Clarification would be appreciated.

Derajanique Mckinney

October 27, 2025 AT 19:36ok but the physical notes?? like… literally paper with qr codes?? 😂 i mean… cool? but also… why??

also the app still crashes when i try to trade during a memecoin pump. 1/10 would not recommend unless u like waiting 5 mins for a reload

Rosanna Gulisano

October 28, 2025 AT 09:15TradingView charts don’t make you a trader. You still lose money if you don’t know what you’re doing.

And those 'Web3 ecosystem' buzzwords? Just marketing. You’re still trusting a company with your crypto.

Sheetal Tolambe

October 28, 2025 AT 09:20I’ve been using Fastex for my first crypto purchases and honestly, it’s been a breath of fresh air. I’m not tech-savvy, and I was terrified of messing up-but the interface is so intuitive.

The fact that I can buy crypto with my debit card and then immediately see it in the ftNFT marketplace? That’s magic. I bought a digital collectible and it felt real.

Yeah, the coin list is small, but I’m not trying to trade every new token that pops up. I just want to learn. And Fastex lets me do that without overwhelm.

Also, the support team helped me fix my 2FA issue in under an hour. That’s more than I can say for other platforms.

Keep going, Fastex. You’re doing something right.

gurmukh bhambra

October 28, 2025 AT 14:48Wait… Dubai? So this is just another crypto shell company trying to avoid US regulation?

And those 'physical FTN notes'? That’s a scam tactic. They’re just printing paper with a QR code and calling it 'collectible'.

And YoWallet? They’ve been saying that for 2 years. I’ve seen this movie before.

Also, why are they opening an office in LA? To trick Americans into thinking they’re legal? They’re not registered with the SEC.

Don’t fall for it. This is a Ponzi with a pretty UI.

Sunny Kashyap

October 29, 2025 AT 10:49Only 49 coins? That’s nothing. In India we have 1000+ coins on local exchanges. Fastex is for kids.

And Dubai? Why not just open in Russia? At least there they don’t ask questions.

Also, no futures? Then why even talk about it? Just sell your tea.

james mason

October 29, 2025 AT 17:02How quaint. A 'clean UI' and 'transparent fees'-as if those are achievements in 2025.

I’ve traded on Kraken since 2016, and I’ve seen every 'innovation' this industry churns out. This is just a rebranded OTC desk with a Shopify theme.

The FTN token? A utility token with zero real demand. And the physical notes? A gimmick for influencers to post unboxing videos.

Unless you’re a beginner who doesn’t know what liquidity means, this platform is a glorified ATM with a side of crypto cosplay.

Anna Mitchell

October 30, 2025 AT 13:11I love how this exchange feels like it was built by people who actually use crypto-not by a team of VCs trying to copy Binance.

I’ve had zero issues with deposits, and the ftNFT marketplace is so easy to use. I gave my mom a digital art NFT as a gift and she actually understood how to hold it. That’s rare.

Yeah, the app glitches sometimes, but I’m patient. I’d rather have a focused platform than a bloated monster with 500 coins I don’t care about.

Keep it simple, Fastex. You’re doing great.

Pranav Shimpi

October 31, 2025 AT 12:08For those asking about FTN discount thresholds: you need 1000 FTN to get the full 20% off. Below that, it’s linear-500 FTN = 10% discount, 250 = 5%.

Also, the mobile app issues? They’re mostly on Android 12 and below. Update your OS or use the PWA version-it’s way more stable.

And yes, they’re planning futures by Q4 2025. I’ve seen the internal roadmap-this isn’t vaporware. The team’s been quiet but they’re delivering.

Don’t dismiss them because they’re not Binance. They’re building something different-and honestly, that’s more valuable right now.