Fraxswap on Arbitrum: What You Need to Know Before Swapping Tokens

Dec, 15 2025

Dec, 15 2025

Fraxswap on Arbitrum isn’t just another decentralized exchange. It’s a key part of the Frax Finance ecosystem - built to make trading FRAX, FXS, and other stablecoins faster and cheaper than ever. But if you’re thinking about using it, you need to know what’s real and what’s just noise. Most reviews you’ll find online are either outdated, incomplete, or flat-out wrong because they don’t look at the actual on-chain data. This isn’t a guess. This is what’s happening right now on Arbitrum.

What Fraxswap Actually Is

Fraxswap is the trading engine behind Frax Finance, the protocol that created the FRAX stablecoin. Unlike most stablecoins that are 100% backed by cash or USDC, FRAX uses a hybrid model: part collateral (usually USDC), part algorithm. When demand goes up, it mints more FRAX. When demand drops, it burns FRAX and pays out FXS, its governance token. Fraxswap was built to support this system - letting users trade FRAX without slippage, and giving FXS holders discounts on fees. On Arbitrum, Fraxswap runs as a Layer 2 version of the original Ethereum DEX. That means you get Ethereum-level security but with gas fees that are 95% lower. A typical trade that would cost $5 on Ethereum costs less than $0.10 on Arbitrum. Transactions confirm in under 3 seconds. That’s not marketing - it’s how Arbitrum works.How Fraxswap on Arbitrum Compares to Other DEXs

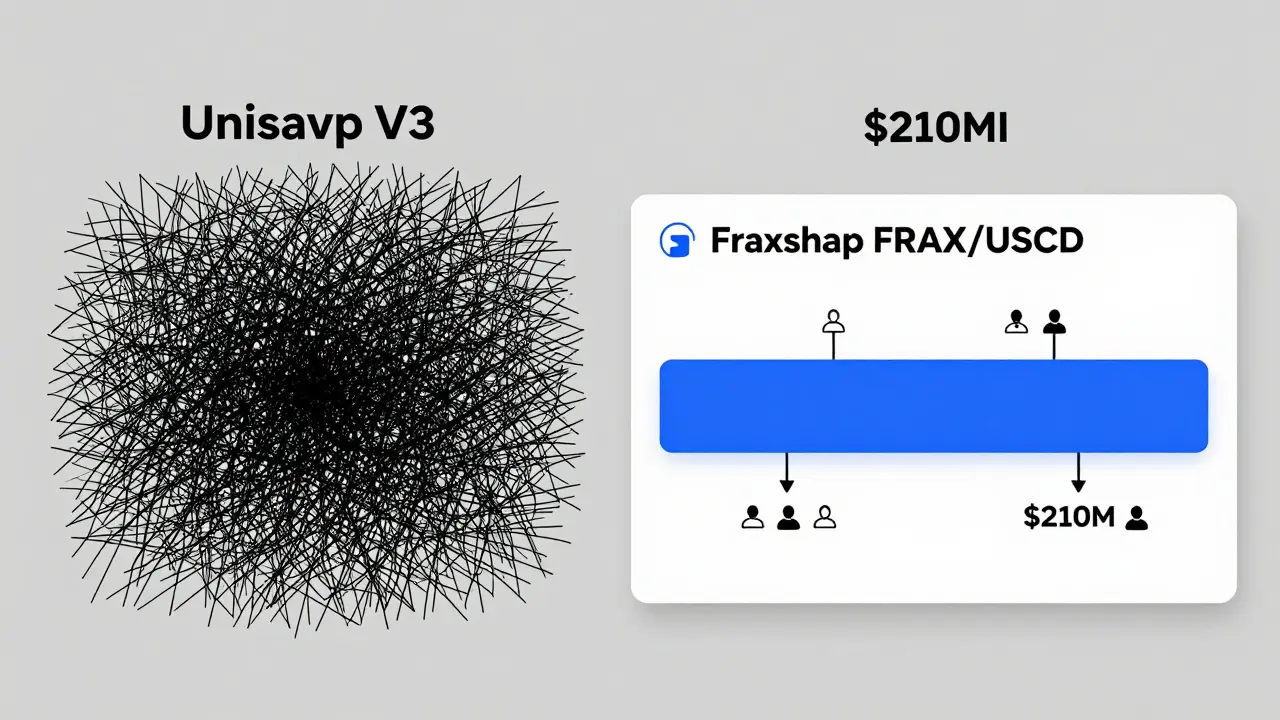

Arbitrum has dozens of DEXs. Uniswap V3, SushiSwap, and Curve all have major deployments there. So why pick Fraxswap?- Fraxswap: Optimized for FRAX, FXS, and other Frax ecosystem tokens. Offers concentrated liquidity pools (like Uniswap V3) but with dynamic fee tiers that adjust based on volatility. If you’re trading FRAX/USDC, it’s often the deepest pool on Arbitrum.

- Uniswap V3: More flexible, but FRAX liquidity is spread thin across many price ranges. Higher slippage on large trades.

- Curve: Great for stablecoin swaps, but doesn’t support FXS or other Frax tokens.

Fees and Incentives

Fraxswap charges a standard 0.01% to 0.30% trading fee, depending on the pool. Most pairs are 0.05% - lower than Uniswap’s 0.05% default. But here’s the real kicker: if you hold FXS, you get a 50% fee discount. So a 0.05% trade drops to 0.025%. That’s not a promo. It’s baked into the smart contract. There’s also a liquidity mining program. Users who provide FRAX/USDC or FXS/ETH liquidity on Arbitrum earn additional FXS tokens weekly. As of December 2025, the APY for the top liquidity pools ranges between 8% and 15%, depending on volatility and token price. That’s competitive - but not as high as it was in 2023. The rewards have normalized as the market matured.

Liquidity and Slippage

Liquidity is where Fraxswap shines. The FRAX/USDC pool on Arbitrum holds over $210 million in liquidity - one of the deepest stablecoin pairs on any Layer 2. That means even a $50,000 trade moves the price less than 0.1%. Compare that to smaller DEXs where a $10,000 trade might cause 2% slippage. The protocol uses a version of Uniswap V3’s concentrated liquidity model. Instead of spreading funds across a wide price range, liquidity providers pick a narrow band - say $0.99 to $1.01 for FRAX/USDC. This makes capital more efficient. It also means if the price moves outside your range, your liquidity stops earning fees. That’s good for traders (less slippage) but risky for LPs who don’t monitor their positions.Security and Audits

Fraxswap’s smart contracts have been audited twice: once by PeckShield in 2022 and again by CertiK in 2024. Both reports found no critical vulnerabilities. The Arbitrum deployment uses the same codebase as Ethereum, with added security layers from Arbitrum’s Nitro upgrade. No exploits have ever occurred on the Fraxswap Arbitrum contract. It’s non-custodial. You never give up control of your keys. You connect your wallet - MetaMask, Rabby, or WalletConnect - and trade directly. No KYC. No account creation. That’s standard for DEXs, but worth repeating: if a platform asks for your private key, it’s a scam.How to Use Fraxswap on Arbitrum

If you’re new to Arbitrum, here’s how to get started:- Install MetaMask or another EVM wallet.

- Add the Arbitrum network manually: Network Name: Arbitrum One, New RPC URL: https://arb1.arbitrum.io/rpc, Chain ID: 42161, Symbol: ETH, Block Explorer: https://arbiscan.io

- Get some ETH on Arbitrum. You can bridge from Ethereum using the official Arbitrum Bridge (takes 7-10 minutes) or use a centralized exchange like Coinbase or Kraken that supports Arbitrum withdrawals.

- Go to app.frax.finance/swap and connect your wallet.

- Swap tokens. If you’re trading FRAX, look for the FRAX/USDC or FRAX/ETH pair. The interface shows real-time slippage and fee estimates.

Who Should Use Fraxswap on Arbitrum?

Use it if: - You trade FRAX, FXS, or other Frax ecosystem tokens regularly. - You want low fees and fast trades on a secure chain. - You’re comfortable with concentrated liquidity and monitoring your LP positions. Avoid it if: - You’re trading obscure tokens not listed on Fraxswap’s pool list. It doesn’t support every coin. - You want to earn high APY without monitoring your position. The rewards are good, but not passive. - You’re new to DeFi and don’t understand slippage or impermanent loss. Start with a centralized exchange first.The Bigger Picture

Fraxswap isn’t trying to beat Uniswap. It’s not trying to be everything to everyone. It’s laser-focused on making FRAX the most usable stablecoin in DeFi. And on Arbitrum, it’s succeeding. The protocol’s design - combining algorithmic stability with efficient liquidity - is why FRAX is now the third-largest stablecoin on Layer 2s, behind only USDC and DAI. Arbitrum itself is growing. As of December 2025, it holds over $13 billion in total value locked. ARB’s price has stabilized after a rough 2024, and institutional interest is rising. Fraxswap benefits from that momentum - not as a standalone project, but as a critical piece of a larger, functional ecosystem.Final Verdict

Fraxswap on Arbitrum isn’t perfect. It’s not beginner-friendly. It doesn’t have a slick mobile app. But if you’re serious about trading FRAX or participating in the Frax ecosystem, it’s the best tool on the network. The fees are low, the liquidity is deep, and the security is solid. It’s not a gamble - it’s a well-engineered DeFi product. If you’re holding FRAX or FXS, you’re already in the ecosystem. Fraxswap is just the place to move those tokens efficiently. Don’t overthink it. Connect your wallet, check the slippage, and trade.Is Fraxswap on Arbitrum safe to use?

Yes. Fraxswap’s smart contracts have been audited by PeckShield and CertiK, with no critical vulnerabilities found. It’s non-custodial, meaning you keep control of your funds. No hacks have ever occurred on the Arbitrum deployment. Always use the official website (app.frax.finance/swap) and never enter your seed phrase on any site.

What are the trading fees on Fraxswap Arbitrum?

Standard trading fees range from 0.01% to 0.30%, depending on the token pair. Most common pairs like FRAX/USDC charge 0.05%. If you hold FXS tokens, you get a 50% discount, bringing the fee down to 0.025%. This discount is automatic - no extra steps needed.

How do I get FRAX on Arbitrum?

You can bridge FRAX from Ethereum using the official Arbitrum Bridge (takes 7-10 minutes). Or, if you already have USDC on Arbitrum, swap it for FRAX directly on Fraxswap. Some centralized exchanges like Coinbase and Kraken also let you withdraw FRAX directly to Arbitrum.

Does Fraxswap support other tokens besides FRAX?

Yes. Fraxswap supports FXS, ETH, USDC, DAI, wstETH, and a few other major assets. But it doesn’t list every DeFi token. If you can’t find a pair, it’s likely not available. For obscure tokens, use Uniswap or SushiSwap instead.

Is liquidity mining on Fraxswap worth it?

It depends. As of December 2025, the best liquidity pools (FRAX/USDC, FXS/ETH) offer 8-15% APY in FXS rewards. That’s solid, but not extraordinary. The risk is impermanent loss if the price of either token swings sharply. Only provide liquidity if you understand how concentrated pools work and are willing to monitor your position.

If you're already using Fraxswap, you know how fast and cheap it is. If you're not - and you trade FRAX - you're leaving efficiency on the table.