How Blockchains Reach Agreement: A Guide to Consensus Mechanisms

Feb, 6 2026

Feb, 6 2026

The Core Problem: Decentralized Agreement

Imagine a group of strangers needing to agree on a single version of truth without a leader. That’s exactly what blockchains do every day. But how? It’s all about consensus mechanisms - the hidden rules that keep decentralized networks working. Without them, double-spending or fraud would be easy. Think of it like this: if you and five friends shared a digital notebook, how would you all agree on the latest entry? Blockchains solve this problem using specific protocols that ensure every node in the network sees the same data. No central authority needed. Just math, incentives, and smart rules.

Proof of Work: Bitcoin’s Energy-Intensive Solution

Bitcoin’s original consensus method, Proof of Work (PoW), is like a digital puzzle race. Miners compete to solve cryptographic problems. The first to solve it gets to add a new block of transactions to the chain. This process is called mining. It’s secure because solving these puzzles requires massive computing power. But it’s also energy-heavy. As of Q1 2023, Bitcoin’s PoW network used about 143.26 terawatt-hours annually - more than some countries. Each transaction consumes 707 kWh of electricity. That’s like running a hairdryer for over 10 hours per transaction.

Why do miners bother? They earn Bitcoin rewards. But there’s a catch: PoW is vulnerable to 51% attacks. If someone controls over half the network’s computing power, they could manipulate transactions. Bitcoin itself has faced 15 such attacks on smaller forks. Despite this, PoW remains trusted for Bitcoin because of its simplicity and proven track record since 2009.

Proof of Stake: Ethereum’s Energy-Efficient Revolution

Ethereum switched to Proof of Stake (PoS) in September 2022 during "The Merge." Instead of mining, validators stake their own cryptocurrency as collateral. The more you stake, the higher your chance to validate blocks. This cuts energy use dramatically. PoS uses 0.0037 kWh per transaction - 99.95% less than PoW. Ethereum now processes 15-45 transactions per second with 12-second block times, far faster than Bitcoin’s 7 TPS.

Validators face penalties for bad behavior. If they try to cheat, their staked coins get slashed. For example, Ethereum’s system can destroy up to 100% of a validator’s stake for malicious actions. This creates strong economic disincentives. However, there’s a barrier: solo staking requires $1,800 worth of ETH as of February 2026. Many users join staking pools to lower the entry cost. Reddit users report consistent 3.8-4.2% annual rewards with near-zero downtime since the switch.

Other Consensus Mechanisms: PBFT, Ripple, and Stellar

Not all blockchains use PoW or PoS. Hyperledger Fabric uses Practical Byzantine Fault Tolerance (PBFT). It works in three phases: Pre-prepare (a leader proposes a value), Prepare (nodes confirm), and Commit (final approval). PBFT achieves finality in 3-5 seconds but struggles with scale. It only handles up to 100 nodes smoothly due to O(n²) communication complexity. Enterprises love it for supply chain tracking, but global deployments need sharding to scale.

Ripple’s consensus algorithm relies on Unique Node Lists (UNLs). Each node has a list of trusted validators. Consensus happens when 80% of the UNL agrees on a transaction. Ripple requires a 40% overlap between UNLs across the network. This speeds up payments but is less decentralized - the network is permissioned, meaning only approved nodes participate.

Stellar uses Federated Byzantine Agreement. It breaks the network into "quorum slices" - subsets of nodes that can convince others of agreement. Consensus happens through voting, acceptance, and confirmation steps. Stellar processes 1,500 transactions per second with near-zero fees, making it ideal for cross-border payments.

Comparing Consensus Mechanisms: Performance, Security, and Trade-offs

| Mechanism | Transactions Per Second | Energy per Transaction | Security Trade-offs | Best For |

|---|---|---|---|---|

| Proof of Work (PoW) | 7 | 707 kWh | 51% attack risk | Store-of-value (Bitcoin) |

| Proof of Stake (PoS) | 15-45 | 0.0037 kWh | Nothing-at-stake concerns | Smart contracts (Ethereum) |

| PBFT | 100-500 | Low (permissioned) | Poor scalability beyond 100 nodes | Enterprise supply chains (Hyperledger) |

| Ripple | 1,500 | Very low | Centralized validator lists | Cross-border payments |

| Stellar | 1,500 | Very low | Quorum slice dependency | Microtransactions, remittances |

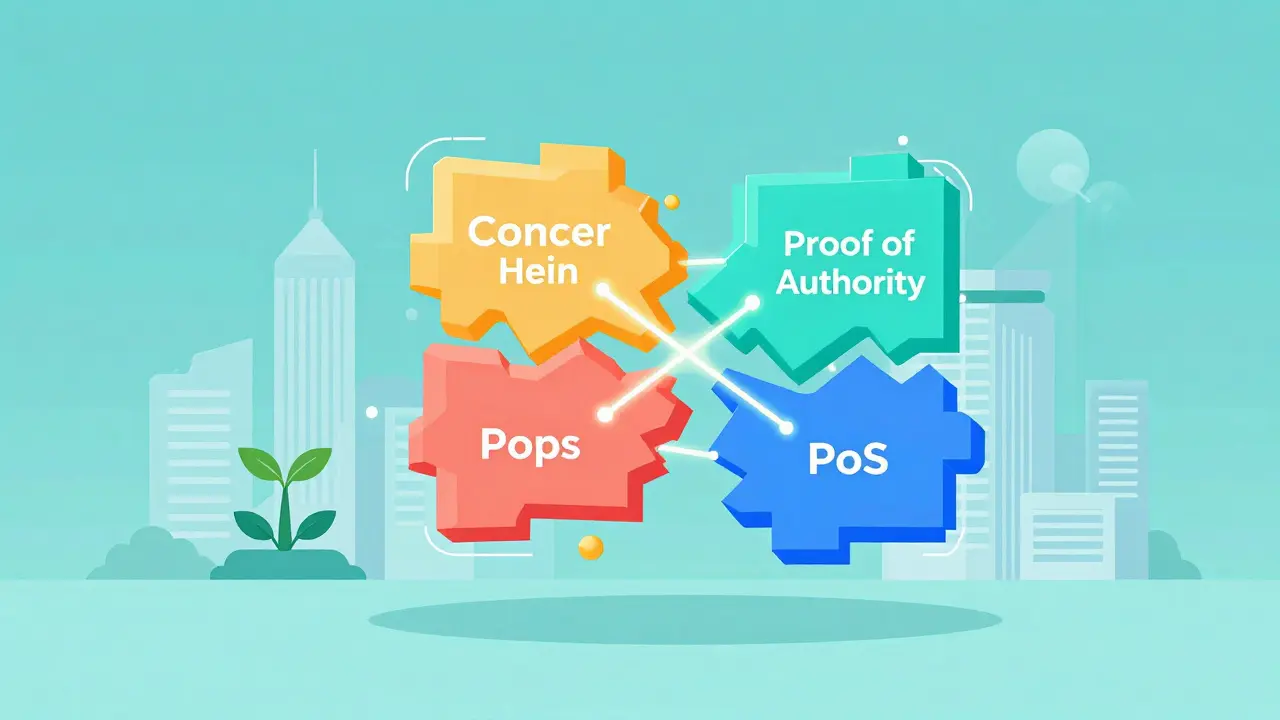

The Future of Consensus: Trends and Innovations

Consensus mechanisms are evolving fast. Ethereum’s Deneb-ProtoDanksharding upgrade (Q2 2026) aims to hit 100,000 TPS by splitting data into chunks. Bitcoin’s Layer 2 Stacks network is testing "Proof of Transfer," which uses Bitcoin’s security for other blockchains. Meanwhile, hybrid models are rising. VeChain combines Proof of Authority with PoS for enterprise supply chains, handling 2,300+ clients. G2 reviews praise its ease of integration but note "limited decentralization" as a downside.

Regulations are shaping the landscape too. The EU’s MiCA rules (effective 2025) label PoW as "environmentally unsustainable," pushing adoption toward PoS and hybrids. The US SEC’s 2025 framework ties "investment contract" status to consensus mechanisms - if a system creates profit expectations from others’ efforts, it’s regulated. This is why 89% of new Layer 1 blockchains launched in 2025 used PoS variants. By 2030, experts predict PoS will power 95% of transaction volume, though staking pools controlling 63.2% of Ethereum’s validators remain a concern.

Frequently Asked Questions

What’s the main difference between Proof of Work and Proof of Stake?

Proof of Work (PoW) relies on miners solving puzzles with computational power, which is energy-intensive. Proof of Stake (PoS) uses validators who stake cryptocurrency as collateral to validate transactions. PoS cuts energy use by 99.95% compared to PoW and speeds up transaction processing. Bitcoin uses PoW; Ethereum uses PoS after "The Merge" in 2022.

Is Proof of Stake more secure than Proof of Work?

It depends. PoW security comes from high mining costs - attacking requires 51% of the network’s power, which is expensive. PoS security uses financial penalties: validators risk losing their staked coins for bad behavior. Ethereum’s slashing mechanism can destroy up to 100% of a validator’s stake. However, PoS has "nothing-at-stake" risks where validators might support multiple blockchain versions. Both have trade-offs, but PoS is generally considered more secure for large networks due to economic disincentives.

Why does Bitcoin still use Proof of Work?

Bitcoin’s PoW is simple, battle-tested, and highly secure. Since 2009, it’s never been hacked. Miners argue it’s necessary for decentralization - anyone with hardware can join. Critics point to energy use: Bitcoin consumes 143.26 TWh annually. But supporters say the security trade-off is worth it. Bitcoin’s design prioritizes security over efficiency, making it a reliable store of value.

What are the limitations of PBFT in enterprise blockchains?

PBFT works great for small networks but hits a wall at scale. It requires O(n²) communication - meaning each node talks to every other node. This slows down as the network grows. Hyperledger Fabric, which uses PBFT, maxes out at around 100 nodes smoothly. For global deployments, enterprises must implement sharding, which adds complexity. G2 reviews note 63% of enterprise users cite "limited decentralization" as a top criticism for PBFT-based systems.

How do Ripple and Stellar’s consensus mechanisms differ from PoW and PoS?

Ripple and Stellar don’t rely on mining or staking. Ripple uses Unique Node Lists (UNLs), where trusted validators agree on transactions. It’s permissioned - only approved nodes participate. Stellar uses Federated Byzantine Agreement with quorum slices: subsets of nodes that convince others of agreement. Both are faster (1,500 TPS) and energy-efficient but less decentralized than PoW or PoS. Ripple is ideal for cross-border payments; Stellar handles microtransactions and remittances with near-zero fees.