How P2P Networks Power Cryptocurrency Systems

Nov, 5 2025

Nov, 5 2025

Bitcoin Node Cost Calculator

Calculate the real-world costs of running a Bitcoin full node based on your local rates.

Node Requirements

Based on Bitcoin's current specifications: 500GB initial size + 144MB/day growth

Estimated Monthly Costs

These are rough estimates. Actual costs may vary based on your service provider, location, and network efficiency. The Bitcoin blockchain grows by approximately 144MB daily.

Running a node requires at least 500GB of storage, 24/7 internet connectivity, and minimal electricity consumption (typically 10-50W).

Think about how money moves in the world. Banks, payment processors, clearinghouses - they all sit between you and the person you’re sending money to. Now imagine removing all of them. No middlemen. No central server. No single point of failure. That’s what P2P networks do for cryptocurrency. They’re not just a technical detail - they’re the reason Bitcoin and other digital currencies can exist without banks.

What Exactly Is a P2P Network?

A peer-to-peer (P2P) network is a flat, decentralized system where every device - or “node” - connects directly to others. There’s no boss server calling the shots. Each node is both a client and a server. It asks for data, and it gives data. In Bitcoin’s case, every node holds a full copy of the blockchain. That means every transaction ever made is stored on thousands of computers around the world.When you send 0.5 BTC to a friend, that transaction doesn’t go to a bank. It goes straight into the P2P network. Nodes pick it up, check if it’s valid (did you really own that money? Is it being spent twice?), and then pass it along. Within seconds, it reaches most of the network. No approval needed from a company. No waiting for a batch settlement. Just pure, direct exchange.

How Bitcoin’s P2P Network Works

Bitcoin’s network runs on TCP port 8333 using a custom protocol built for one thing: trustless verification. Here’s how it actually works on the ground:- Every full node downloads and verifies the entire blockchain - currently over 500GB and growing by about 144MB per day.

- Nodes validate transactions against strict rules: correct signatures, no double-spending, proper fees.

- When a miner finds a new block, they broadcast it to their peers. Other nodes check the block’s proof-of-work and the transactions inside it. If everything checks out, they accept it and add it to their copy of the chain.

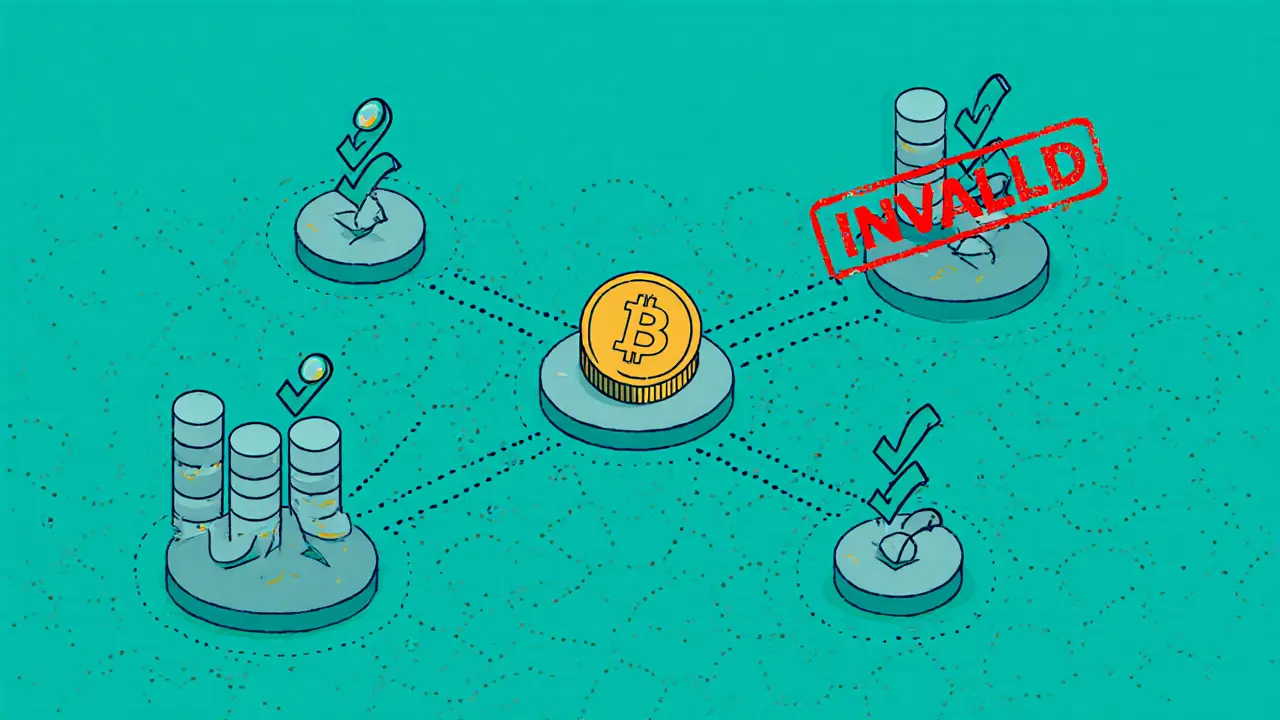

- If a node tries to cheat - say, by accepting an invalid transaction - the rest of the network ignores it. That node gets left behind.

As of October 2023, there were around 14,000 publicly reachable Bitcoin full nodes. That’s not a lot compared to the number of users, but it’s enough. These nodes are the backbone. They don’t get paid. They don’t get rewards. They do it because they believe in the system. Some run them on old laptops. Others use dedicated servers with 2TB SSDs and 1Gbps internet. One Reddit user, u/NodeRunner89, spent 72 hours syncing his node - and said it was worth it. “Now I feel part of the network’s security backbone,” he wrote.

Why P2P Beats Centralized Systems

Compare this to Visa. Visa processes about 65,000 transactions per second. Bitcoin? Four to seven. So why even bother?Because speed isn’t everything. Centralized systems are fast - but they’re fragile. In 2020, when Twitter’s API went down, major crypto exchanges like Coinbase and Binance froze withdrawals. Users couldn’t access their funds. Meanwhile, the Bitcoin P2P network kept running. Transactions still propagated. Nodes still synced. People could still send and receive Bitcoin directly - no third party in the middle.

P2P networks are also censorship-resistant. In countries with capital controls - like Argentina, Nigeria, or Venezuela - people use Bitcoin to move money across borders without asking permission. The World Bank estimated $640 billion in global remittances in 2022, with average fees of 6.15%. With P2P crypto, you can send $100 to family overseas for under $1 - and it arrives in minutes, not days.

The Downsides: Speed, Cost, and Complexity

There’s no free lunch. P2P networks pay for their resilience with trade-offs.First, scalability. Bitcoin’s design limits it to 7 transactions per second. Ethereum manages 15-30. That’s nowhere near what Visa or PayPal can do. That’s why solutions like the Lightning Network exist - a second-layer P2P payment channel network that handles $1.2 billion in monthly volume across 18,000 nodes. It’s still peer-to-peer, but it moves transactions off-chain to avoid congestion.

Second, cost to run a node. You need storage, bandwidth, and electricity. Many people don’t run full nodes because it’s too much work. In 2020, the number of public Bitcoin nodes dropped to 5,000. It’s back up to 14,000 now, but that’s still a tiny fraction of the 48 million Americans who own crypto. Most people use wallets connected to centralized services - which defeats part of the point.

Third, technical complexity. A Trustpilot review from September 2023 said: “I needed three YouTube tutorials just to verify my node was working correctly.” Setting up a Bitcoin node isn’t plug-and-play. You need to understand firewalls, port forwarding, UPnP, and basic Linux commands. That’s a barrier for everyday users.

What Experts Say

Andreas Antonopoulos calls the P2P network Bitcoin’s “immune system.” If one node gets sick - say, it’s hacked or misbehaving - the rest of the network ignores it. No central authority needed to kick it out. That’s the beauty of decentralization.But not everyone is impressed. Nouriel Roubini, the economist known for predicting the 2008 crash, called Bitcoin’s P2P model “inefficient by design.” He points to energy use: Bitcoin consumes about 121 terawatt-hours per year - more than some countries. That’s because proof-of-work requires massive computing power to secure the network.

That changed with Ethereum’s switch to proof-of-stake in September 2022. Ethereum’s energy use dropped by 99.95%. Now, instead of miners solving math puzzles, validators are chosen based on how much ETH they “stake.” The P2P network still exists - nodes still talk directly - but the consensus mechanism is far more efficient.

Enterprise Use and the Future

Big companies aren’t ignoring P2P networks. Ripple’s 2022 case study showed Santander and Westpac using a P2P-style blockchain for cross-border payments with 99.98% uptime over 18 months. They didn’t use Bitcoin - they built their own private network - but the core idea was the same: direct, trustless, decentralized communication.Regulators are catching up too. The EU’s MiCA framework, effective December 2024, officially recognizes P2P network participants as “distributed ledger technology service providers.” That means even if you’re just running a node, you might need to register with authorities.

Future upgrades are focused on making P2P networks lighter and faster. Bitcoin’s proposed Erlay protocol could cut bandwidth usage by 80%. Ethereum’s PeerDAS project aims to let nodes verify data without downloading everything. And the IETF is working on a standard P2P transport protocol for blockchains - something that could make interoperability between different networks much easier.

Is It Sustainable?

A 2023 University of Cambridge study looked at 217 blockchain projects and found an 82% probability that P2P-based cryptocurrencies will survive past 2030. That’s high - but not guaranteed. Quantum computing could break the cryptographic signatures that secure these networks by 2035, according to NIST. Researchers are already working on post-quantum cryptography to fix that.Right now, P2P networks power a $1.17 trillion industry. Bitcoin and Ethereum alone make up over half of that. And despite the complexity, the cost, and the speed limits, millions still choose to run nodes, send transactions directly, and reject intermediaries. Why? Because they value control. They value resilience. They value freedom.

It’s not perfect. But it works. And it’s growing.

How does a P2P network make cryptocurrency secure?

Each node in a P2P network holds a full copy of the blockchain and independently verifies every transaction. If one node tries to accept a fake transaction, the rest of the network rejects it. There’s no single point of failure - you can’t hack the system by taking down one server. Security comes from distributed consensus and cryptographic proof, not from a central authority.

Do I need to run a full node to use cryptocurrency?

No. Most people use wallets connected to centralized services like Coinbase or MetaMask, which connect to nodes on your behalf. But if you want true independence - no third-party control, full transparency, and direct participation in network security - running a full node is the only way. It’s not required, but it’s the most secure option.

Why are there so few Bitcoin full nodes compared to users?

Running a full node requires technical knowledge, storage space (over 500GB), constant internet, and electricity. Most users don’t want to deal with that. They prefer convenience. But fewer nodes mean less decentralization. That’s why projects like Lightning Network and pruning modes are being developed - to let people participate with fewer resources.

Can P2P networks be hacked or shut down?

You can’t shut down a P2P network by attacking one server - there isn’t one. But you can try to isolate nodes using “eclipse attacks,” where malicious nodes trick a target into connecting only to them. Ethereum has seen this happen with as few as 11 fake nodes. Bitcoin is more resistant due to its larger node count and connection randomization, but no system is 100% immune. The best defense is a large, diverse, globally distributed network.

What’s the difference between Bitcoin’s P2P network and Ethereum’s?

Both use P2P for transaction propagation, but Ethereum’s network is optimized for smart contracts and uses proof-of-stake instead of proof-of-work. This means fewer nodes are needed for security, and energy use is drastically lower. Bitcoin’s network is simpler - focused only on secure value transfer - while Ethereum’s is more complex, handling code execution and decentralized apps alongside payments.

Will P2P networks become mainstream for everyday payments?

For direct peer-to-peer transfers, yes - especially in places with unstable banks or high fees. For everyday retail? Not yet. Speed and cost are still barriers. But with second-layer solutions like Lightning Network, P2P payments could become common for small, frequent transactions - think buying coffee with Bitcoin in 5 seconds, with no fees. The infrastructure is being built. Adoption will follow.

What’s Next for P2P Cryptocurrency Networks?

The future isn’t about replacing banks. It’s about giving people alternatives. P2P networks let you send money without asking permission. They let you store value without trusting a corporation. They let you participate in a global system that doesn’t answer to any government or CEO.Right now, the biggest challenge isn’t technology - it’s usability. If running a node becomes as easy as installing a phone app, adoption will explode. That’s the next frontier: making decentralization simple.

For now, the P2P network is still the heart of cryptocurrency. It’s quiet. It’s messy. It’s slow at times. But it’s alive - and it’s working.