How Russian Banks Block Crypto-to-Fiat Withdrawals in 2026

Jan, 13 2026

Jan, 13 2026

When you try to turn crypto into cash in Russia, your bank doesn’t just sit back and wait. It blocks you. Not because you did something illegal, but because the system is built to assume you’re trying to cheat it. Since September 2025, Russian banks have been given legal power to freeze your cash withdrawals the moment you move crypto into your account - and they do it without warning, without explanation, and without mercy.

What triggers the block?

It’s not about how much you withdraw. It’s about how you do it. Russian banks monitor 12 specific patterns that signal a crypto-to-fiat conversion. If your transaction matches even one, your daily cash limit drops to 50,000 rubles - around $600 - for 48 hours. That’s not a suggestion. That’s a hard stop.- You withdraw cash between 11 PM and 5 AM

- You use an ATM more than 50 kilometers from your registered address

- You pay with a QR code or virtual card instead of a physical one

- You get a large transfer (over 200,000 rubles) via Russia’s Faster Payments System and withdraw cash within 24 hours

- Your phone suddenly receives three messages from unknown numbers in six hours

- You withdraw an amount that’s not divisible by 1,000 rubles - like 65,000 instead of 64,000 or 66,000

- Your device shows signs of malware or a rooted phone

These aren’t guesses. They’re coded rules built into every major bank’s system. Sberbank, Tinkoff, VTB - they all use the same flags. The Central Bank of Russia made sure of that. By September 1, 2025, 98% of Russia’s 347 licensed banks had the software live. No exceptions.

Why does this exist?

The official reason? Fraud. In the second quarter of 2025, Russian banks recorded 273,100 scams totaling 6.3 billion rubles. The Central Bank says 89% of those involved crypto in some way - whether it was fake exchanges, phishing wallets, or P2P cash deals gone bad. But there’s another story. Crypto is the only way many Russians can move money out of the country. Sanctions cut off access to Western banks. Visa and Mastercard stopped working. So people turned to crypto. They bought Bitcoin on Binance, sent it to a wallet, then sold it on LocalBitcoins or Paxful for cash. That’s how they paid for medicine, imported parts, or sent money to family abroad. Now, that flow is being choked. Finance Minister Anton Siluanov admitted in October 2025 that crypto accounts now handle 37.2% of all cross-border payments. That’s not just fraud. That’s economic survival. And the government doesn’t like it.What happens when you get flagged?

You get an SMS. Then a push notification. Then a call from your bank’s fraud team. But the damage is already done. Your card is locked for cash withdrawals. You can still pay online. You can still receive salary. But you can’t walk into a store and buy groceries with cash. To get your limit back, you have to go to the branch. In person. With documents. Proof of where your crypto came from. Screenshots of your wallet. Transaction IDs. Sometimes even notarized records from the exchange - even if it’s a decentralized platform like Uniswap that doesn’t keep user logs. User 'CryptoTrader89' on the Russian forum BitBoom said he got frozen after withdrawing 65,000 rubles from a Paxful sale. He spent three days at his Sberbank branch, showing screenshots, wallet addresses, and even the chat history with the buyer. They let him go - but only after he signed a statement promising not to do it again.

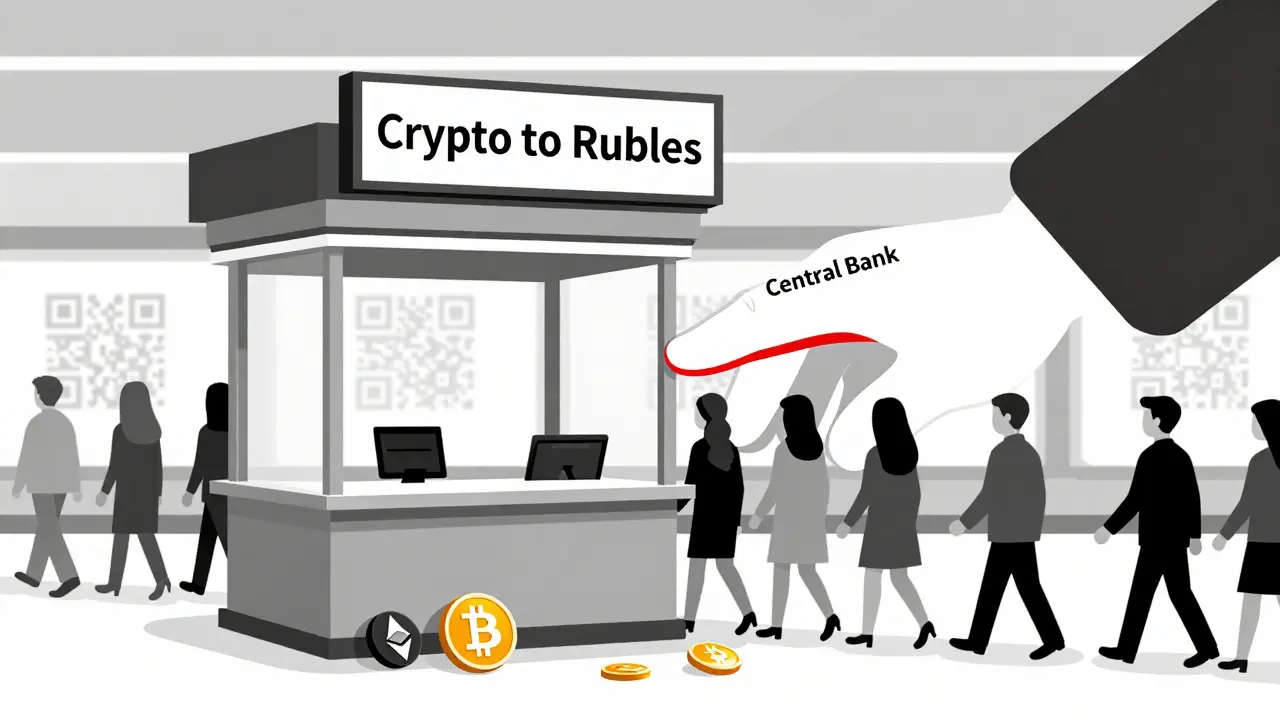

What about small exchange shops?

They’re dying. In Russia, hundreds of small cash-for-crypto kiosks used to operate in metro stations, markets, and shopping centers. They’d buy Bitcoin from you and hand you rubles. Simple. Fast. No questions. Now? Those shops are being targeted. The Central Bank’s internal guidelines explicitly label peer-to-peer transactions over 100,000 rubles as high-risk. Banks are instructed to flag anyone who deposits cash from those shops. So the shops can’t take large amounts anymore. And customers won’t risk it. Ainvest reported that 63% of these operators lost 40-60% of their revenue in the first two weeks after the rules kicked in. Many have shut down. Others moved underground - now operating in basements, apartments, or through encrypted messaging apps. That’s not safer. It’s more dangerous.Can you work around it?

Yes. But it’s not easy. And it’s risky. The most common workaround? Use multiple bank accounts. Active crypto traders in Russia now average 3.7 different accounts. They stagger withdrawals - one bank every 72 hours. They use different ATMs. They avoid the same time slots. They keep small, regular transactions on each card - groceries, coffee, subscriptions - to make their activity look “natural.” According to legal expert Alexey Likhunov, transactions with verified contacts (people you’ve traded with before) are 73% less likely to trigger a block. So some traders build long-term relationships with the same buyers. They don’t use random P2P matches. They trade with friends, coworkers, or trusted forum members. But here’s the catch: using multiple accounts can trigger another algorithm. Banks now monitor cross-institutional patterns. If you’re withdrawing from Sberbank, Tinkoff, and VTB within 48 hours, the system flags you as a “high-risk network user.” That’s worse than a single block. That’s a full account review.