KYC Data Security: How to Protect Customer Info & Ensure Compliance

Oct, 17 2025

Oct, 17 2025

Financial firms today juggle two opposing forces: the need to verify every customer’s identity and the pressure to keep that personal data locked down. Miss the mark on either side and you risk hefty fines, lost trust, or a full‑blown data breach. This guide walks you through the core pieces of a solid KYC data security framework, shows where legacy banks fall short, and points out the tech that’s reshaping identity checks - from AI‑driven verification to blockchain‑based privacy shields.

KYC (Know Your Customer) is a regulatory process that requires financial institutions to collect and verify identity information of their clients to prevent money laundering, fraud, and terrorist financing. It originated from the U.S. Bank Secrecy Act of 1970 and expanded dramatically after the USA PATRIOT Act of 2001.Why KYC Security Matters in 2025

Data‑driven fraud has become more sophisticated, yet regulators have tightened the screws. GDPR, CCPA, and the EU’s 6th AML Directive impose fines up to 4% of global turnover or €20 million, whichever is higher. The Financial Action Task Force (FATF) now lists KYC as a pillar in 189 jurisdictions, meaning any lapse can trigger cross‑border enforcement. In 2023, KYC‑related breaches accounted for 43% of the $2.7 billion in global AML fines.

Core Technical Controls

Building a secure KYC pipeline starts with three layers: data at rest, data in transit, and identity verification logic.

- Encryption at Rest: Use AES‑256 for every database, file store, or backup that holds personally identifiable information (PII). This aligns with PCI DSS v4.0 and ISO 27001 requirements.

- Transport Security: Enforce TLS 1.2 or higher for all API calls, especially when pulling documents from third‑party vendors.

- Verification Algorithms: Deploy biometric matching (face, fingerprint) that meets NIST’s 98.5% accuracy threshold, and supplement with document‑auth checks that follow ISO 32002:2019.

When you add a privacy‑preserving layer like zero‑knowledge proofs (ZKP), you can confirm that a user’s data matches a trusted source without actually exposing the raw data. MIT’s 2024 study showed ZKPs can cut data exposure by 89% while maintaining verification integrity, though the compute cost still requires $500 k+ infrastructure budgets for large banks.

RegTech vs. Legacy: A Comparison Table

| Aspect | Legacy Banking | RegTech (e.g., Onfido, Trulioo) |

|---|---|---|

| Onboarding Time | 2‑4 weeks (manual review) | Under 5 minutes (automated) |

| Document Accuracy | 75‑80% forged‑doc detection | 99.8% detection (deep‑learning) |

| Abandonment Rate | 30‑40% | ~5% |

| Infrastructure Needs | 10‑12 GB RAM, 2‑core CPUs | 16 GB RAM, 4‑core CPUs, 500 GB storage |

| Compliance Coverage | Static AML checks | Risk‑based authentication, dynamic AML rules |

Choosing the Right Vendor

Not every KYC provider fits every business. Use these decision criteria:

- Regulatory Alignment: Verify that the vendor’s solution maps to GDPR, CCPA, and local AML directives.

- Data Residency: Some jurisdictions require PII to stay within national borders; pick a vendor with regional data centers.

- Security Audits: Look for SOC 2 Type II reports, ISO 27001 certification, and regular penetration tests.

- Integration Ease: APIs should speak the same language as your CRM or core banking system (REST/JSON, OpenID‑Connect).

- Scalability: Evaluate concurrent verification limits. For a mid‑size bank processing 10,000 + verifications monthly, a platform should sustain at least 150 TPS.

Industry leaders like LexisNexis Risk Solutions hold 22% market share, while agile startups such as Sumsub are gaining ground in crypto exchanges, where 92% of the top 100 platforms now use blockchain‑based KYC.

Risk Management & Incident Response

A breach in the KYC pipeline can be catastrophic. Build a response plan that covers:

- Detection: Real‑time monitoring for abnormal API traffic or unexpected decryption attempts.

- Containment: Immediate revocation of compromised API keys and isolation of affected databases.

- Notification: Follow GDPR’s 72‑hour breach‑reporting rule and any local regulator’s timelines.

- Post‑mortem: Root‑cause analysis, update of security controls, and documentation for auditors.

According to the Electronic Frontier Foundation’s 2023 analysis, 68% of financial firms experienced a KYC‑related breach in the past two years, making proactive monitoring a non‑negotiable.

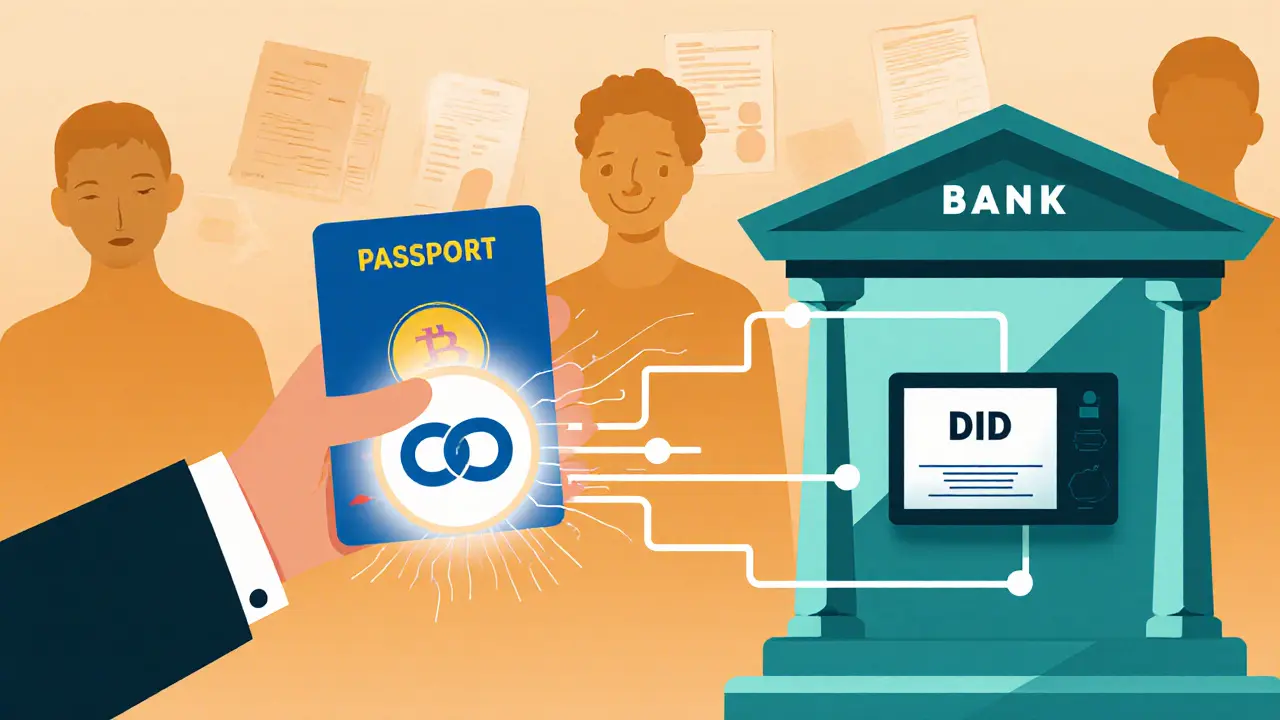

Future‑Proofing with Blockchain and Self‑Sovereign Identity

Blockchain isn’t just for crypto. Decentralized identifiers (DIDs) let customers own their identity data and share verifiable credentials only when needed. The European Central Bank plans a digital euro identity framework for 2025, which will standardize KYC across the Eurozone. Early pilots show a 30% reduction in onboarding friction when users present a blockchain‑anchored credential instead of uploading PDFs.

However, challenges remain: 195 jurisdictions have varying KYC requirements, and interoperability between DID methods (e.g., W3C DID‑core vs. Sovrin) is still evolving. Until standards converge, a hybrid approach-using traditional KYC for high‑risk cases and SSI for low‑risk, recurring customers-offers the best risk‑to‑efficiency balance.

Checklist: Secure KYC Implementation (TL;DR)

- Encrypt all PII with AES‑256 at rest and TLS 1.2+ in transit.

- Adopt biometric verification that meets NIST ≥98.5% accuracy.

- Validate vendors with SOC 2, ISO 27001, and regular pen‑tests.

- Implement risk‑based authentication (multi‑factor for high‑risk transactions).

- Document a breach‑response workflow that satisfies GDPR/CCPA timelines.

- Explore zero‑knowledge proofs or DIDs for privacy‑preserving verification.

What are the minimum encryption standards for KYC data?

KYC data must be encrypted with AES‑256 at rest and transmitted over TLS 1.2 or higher. These standards meet PCI DSS v4.0, GDPR, and most AML regulations worldwide.

How does zero‑knowledge proof improve KYC privacy?

A ZKP lets a verifier confirm that a user’s data matches a trusted source without exposing the raw data. In practice, this means you can prove “the customer is over 18 and lives in the UK” without storing the full passport image, cutting exposure risk by up to 89%.

Which RegTech platforms offer the fastest onboarding?

Onfido and Trulioo consistently report sub‑5‑minute completion times for automated verification, with success rates above 95% for customers in regions with reliable internet connectivity.

What should a KYC breach response include?

Detect the breach, contain it by revoking keys, notify regulators and affected customers within the mandated window (72 hours for GDPR), and conduct a root‑cause analysis to patch gaps.

Can blockchain replace traditional KYC databases?

Blockchain can store verifiable credentials and enable self‑sovereign identity, reducing the need for centralized PII stores. However, full replacement still faces regulatory and interoperability hurdles, so a hybrid model is recommended today.

Sunny Kashyap

October 25, 2025 AT 23:30Why do we even need all this? In India, people just show Aadhaar and move on. This whole crypto-blockchain-encryption thing is overkill for regular folks.

james mason

October 26, 2025 AT 01:05Oh sweet mercy, another whitepaper disguised as a blog post. AES-256? TLS 1.2? Darling, if your KYC system can’t handle zero-knowledge proofs like it’s breathing, you’re already five years behind. I mean, really. The fact that you’re still talking about ‘document verification’ instead of decentralized identity is almost cute.

Let me guess-you also think GDPR is a suggestion, not a mandate? And you didn’t mention FIDO2? No? Of course not. The sheer audacity of overlooking WebAuthn in 2025 is almost poetic.

Also, ‘$500k+ infrastructure’? Honey, if you need that much hardware to run a ZKP, you’re doing it wrong. Cloud-native, serverless ZK-verifiers cost less than your quarterly coffee budget. But hey, keep your legacy stack. It’s charmingly archaic.

And please, for the love of all that’s holy, stop calling blockchain ‘not just for crypto.’ It’s not a metaphor. It’s a protocol. And if your ‘hybrid model’ still stores PII in a SQL database, you’re not future-proofing-you’re just delaying the inevitable.

I’ve seen startups do this with Raspberry Pis and a Python script. You? You’re still using Excel spreadsheets to track compliance. I’m not judging. I’m just… grieving.

Anna Mitchell

October 26, 2025 AT 15:13I love how this article breaks down complex stuff so clearly! It’s refreshing to see real solutions instead of just fear-mongering about breaches. Zero-knowledge proofs sound like magic, but it’s actually genius-protecting privacy while still keeping things secure. Can’t wait to see more banks adopt this!

Pranav Shimpi

October 27, 2025 AT 13:56u can't just use aes-256 and call it a day. u need key rotation every 90 days or else its useless. and tls 1.2 is outdated now, its 1.3 or bust. also, most regtech vendors lie about their soc2 certs-check the actual audit report, not the marketing page. and dont forget: if your biometric system uses 1:1 matching instead of 1:N, u r vulnerable to spoofing. i seen this happen in hyd last year. also, zkp is good but needs gpu clusters, not just cloud vm's. also, why no mention of homomorphic encryption? its better for analytics. and dont get me started on how trulioo fails in rural india because of bad lighting in selfies. lol.

jummy santh

October 28, 2025 AT 10:14As a compliance officer in Lagos, I find this article both timely and deeply resonant. In Nigeria, where digital identity infrastructure is still evolving, the tension between regulatory compliance and technological accessibility is palpable. We must not romanticize Western solutions as universally applicable. While AES-256 and ZKPs are impressive, they require bandwidth, electricity, and legal certainty that many of our citizens still lack. A hybrid approach-where basic biometrics are paired with community-verified attestations-is often more sustainable than blockchain-first models. Let us not export our technological arrogance under the banner of ‘innovation.’

RegTech vendors must localize-not just translate-their interfaces. A 5-minute onboarding means nothing if the user must navigate a UI in British English with no offline fallback. We need empathy, not just encryption.

Kirsten McCallum

October 28, 2025 AT 18:05Encryption is a placebo. The real problem is trust.

You don’t secure data by encrypting it. You secure it by not collecting it in the first place.

Every KYC system is a surveillance architecture dressed in compliance pajamas.

And no, blockchain won’t fix that.

Henry Gómez Lascarro

October 29, 2025 AT 17:04Let’s be real-this whole article is just RegTech shilling wrapped in jargon. You mention ‘blockchain-based KYC’ like it’s the second coming, but you ignore the fact that 97% of blockchain identity projects are vaporware. The European Central Bank’s digital euro? A centralized ledger with a fancy name. And ZKPs? Sure, they’re mathematically elegant, but they require a PhD and a $2 million AWS bill to implement. Meanwhile, the average bank still uses fax machines to verify documents in 12 states. You’re not ‘future-proofing’-you’re just selling overpriced SaaS to banks who can’t code.

And let’s talk about ‘self-sovereign identity.’ What a cult term. Who exactly is sovereign here? The customer? Or the vendor who controls the DID registry? You think I’m going to trust a startup in San Francisco with my identity when your entire business model depends on me giving you more data? Please. The only thing more arrogant than a Silicon Valley founder is a compliance officer who thinks they can outsmart human nature with algorithms.

And don’t even get me started on ‘risk-based authentication.’ That’s just a fancy way of saying ‘we’ll only ask for ID if you’re rich enough to be suspicious.’ Poor people get flagged as ‘high risk’ because they use prepaid cards. Rich people? They get VIP onboarding. That’s not security. That’s classism with a firewall.

Also, why is every vendor you mention American? What about India’s UPI-based identity stack? Or Estonia’s e-Residency? Or Kenya’s M-Pesa? You act like KYC innovation only happens in Silicon Valley. Newsflash: the future is decentralized, not American.

And one last thing: if your ‘breach response’ plan is just ‘notify regulators in 72 hours,’ you’re already dead. The damage is done the moment you collect the data. Stop pretending you can ‘secure’ identity. You can’t. You can only delay the inevitable. And then blame the customer when they get scammed.

Will Barnwell

October 29, 2025 AT 19:01Everyone’s acting like AES-256 is some magic shield. Nah. If your database is exposed, encryption just means the hackers have to spend 3 more hours cracking it. Meanwhile, your users are getting phished because your login page looks like a 2008 MySpace profile.

And ‘biometric verification’? My cousin in Kerala got locked out of his bank account because the app thought his beard was a ‘foreign object.’

Also, why is no one talking about how RegTech vendors sell your data to advertisers under ‘anonymized analytics’? That’s not privacy. That’s monetized surveillance.

Lawrence rajini

October 30, 2025 AT 17:39This is 🔥! Zero-knowledge proofs are next level 🤯 and blockchain KYC? YES PLEASE! Imagine not having to upload your passport again every time you open a new account. The future is here and it’s decentralized 💪 Let’s goooo!

Matt Zara

October 31, 2025 AT 03:25Really appreciate the breakdown-especially the part about hybrid models. Not every user needs the same level of verification. For low-risk transactions, SSI makes sense. For high-risk ones, traditional checks still matter. It’s about matching the tool to the risk, not forcing one-size-fits-all tech on everyone.

Also, props for mentioning data residency. Too many companies assume ‘global cloud’ means ‘global compliance.’ It doesn’t. And it’s not just legal-it’s ethical.

Jean Manel

October 31, 2025 AT 09:23Let’s be honest-this entire framework is just a fancy way to keep the poor out of the financial system. If you can’t afford a smartphone with a good camera, or live in a region where internet is spotty, you’re automatically ‘high risk.’

And who pays for all this? The customer. Through fees. Through delays. Through denied accounts.

Encryption doesn’t fix inequality. It just makes it look professional.

William P. Barrett

November 1, 2025 AT 08:15The real question isn’t how to secure KYC data-it’s whether we should be collecting it at all. Identity is not a dataset to be encrypted. It’s a social contract. When we treat a person’s name, face, and documents as ‘data points,’ we’ve already lost the humanity of the system.

Technology can optimize. But it cannot replace moral responsibility.

Cory Munoz

November 1, 2025 AT 10:35This is actually really well put. I’ve worked in compliance for 12 years and I’ve seen how these systems break down-not because of tech, but because people are rushed, tired, or overwhelmed.

Maybe the real innovation isn’t in ZKPs or blockchain, but in designing systems that don’t make users feel like criminals just for wanting a bank account.

Thank you for writing this with care.

Jasmine Neo

November 2, 2025 AT 02:01Let’s cut the fluff. AES-256? TLS 1.2? Please. If you’re not using post-quantum cryptography (CRYSTALS-Kyber), you’re already compromised. And ‘NIST 98.5% accuracy’? That’s lab conditions. In the real world, lighting, masks, and deepfakes drop that to 70%. You’re giving false confidence.

And ‘blockchain-based KYC’? You mean centralized nodes with a blockchain UI? Classic. The only thing decentralized here is the delusion.

Also, why is no one mentioning the fact that 90% of these RegTech vendors are VC-funded and will sell your data to the highest bidder? Compliance is just their marketing spin.

And ‘hybrid model’? Translation: ‘We’re still storing your data, but now we’re charging you extra to pretend we’re not.’

This isn’t innovation. It’s rebranding exploitation.

Ron Murphy

November 2, 2025 AT 06:34Interesting read. The table comparing legacy vs. RegTech is spot-on-especially the abandonment rate. I’ve seen clients drop off after 3 steps. No wonder fintechs are winning.

But I’d add one thing: compliance isn’t just about tech. It’s about culture. If your staff still prints documents and files them in physical cabinets, no amount of AES-256 will save you.

Prateek Kumar Mondal

November 2, 2025 AT 23:36Good overview but missing one thing-what about offline verification? In rural India, many people don’t have internet. We need solutions that work with SMS and USSD. Not just apps and APIs.

Nick Cooney

November 3, 2025 AT 18:55Typo in the checklist: ‘pen-tests’ should be ‘penetration tests.’ Just sayin’. Also, ‘TLS 1.2+’ is outdated-TLS 1.3 is the baseline now. And ‘SOC 2 Type II’? Most vendors fake the audit. Always check the auditor’s name. If it’s not one of the Big 4, it’s probably a shell company.

Also, why no mention of homomorphic encryption for analytics? You’re leaving money on the table.

Clarice Coelho Marlière Arruda

November 4, 2025 AT 05:55Wait so if i use a blockchain wallet now i dont need to upload my passport again? 😱 that sounds like magic. where do i sign up??

Brian Collett

November 4, 2025 AT 08:52Has anyone tested these ZKP systems against adversarial machine learning attacks? Like, what if someone generates a synthetic face that passes biometric checks but isn’t real? Has that been studied?

Pranav Shimpi

November 4, 2025 AT 19:48u right about adversarial attacks. i seen a paper from iit delhi last year-fake face with infrared patterns fooled 12% of biometric systems. most regtech vendors dont even test for that. also, if ur zkp uses snarks, it can be replayed if ur nonce is weak. fix it before go live.