Mining Crypto in Iran: Law and Restrictions in 2025

Dec, 4 2025

Dec, 4 2025

Iran Crypto Mining Profitability Calculator

Calculate potential mining profitability in Iran based on electricity costs, mining hardware, and Bitcoin prices. The tool accounts for Iran's strict regulations, electricity pricing tiers, and government controls.

Important Considerations

- Regulatory changes without warning

- Power outages and grid instability

- Government monitoring of all transactions

- Political favoritism toward IRGC-linked operations

Iran is one of the few countries in the world where cryptocurrency mining is legal-but only if you follow a growing list of rules that change every few months. It’s not about whether you can mine. It’s about whether you’ll still be allowed to when the next power outage hits.

Legal Mining? Yes, But Only With a License

As of early 2025, you can legally mine Bitcoin or other cryptocurrencies in Iran-but you need a license from the Central Bank of Iran (CBI). That’s the big shift since January 2025, when President Masoud Pezeshkian gave the CBI full control over all crypto activity. Before that, mining existed in a gray zone: tolerated, but not officially regulated. Now, every miner-individual or company-must register, prove they’re using approved hardware, and track every watt of electricity they use. The Ministry of Industry, Mine and Trade also requires proof that your mining rigs meet government standards. You can’t just buy any ASIC miner off the internet. The government has a list of approved models. If you’re caught using something off the list, your equipment can be seized, and you could face fines or even jail time.Electricity: The Real Bottleneck

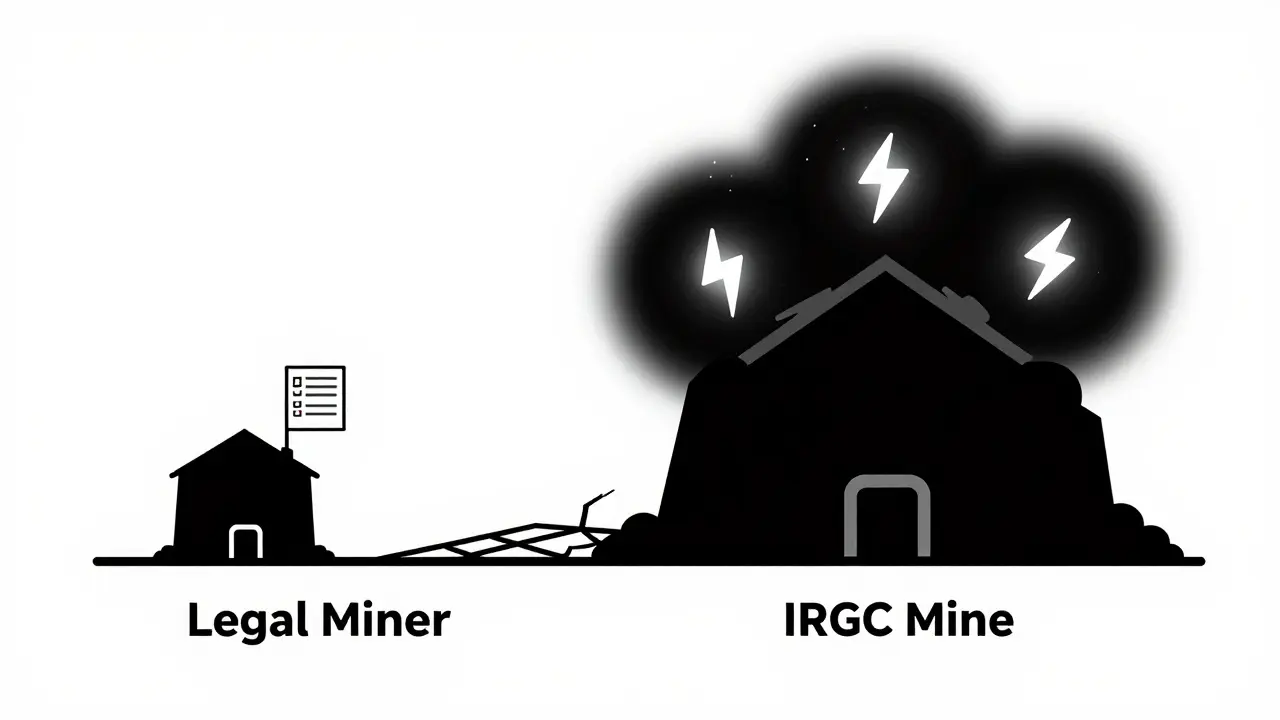

Iran’s biggest advantage in crypto mining has always been cheap power. Industrial electricity costs around $0.004 per kWh-among the lowest in the world. That’s why, in 2021, Iran was responsible for nearly 5% of global Bitcoin mining. But cheap power comes with a price: the grid can’t handle it. In summer 2024, the country suffered massive blackouts. The government blamed illegal miners for stealing up to 2,000 megawatts of electricity-enough to power a small country. In response, they shut down all mining operations for four months. After the ban, they didn’t lift restrictions. They doubled down. Now, even legal miners pay the highest electricity rates in Iran-for mining. Tavanir, the state power company, charges crypto miners more than factories, hospitals, or even government buildings. The idea is to make mining expensive enough that only those with licenses and deep pockets can afford it. But here’s the catch: some of the biggest miners aren’t paying at all.The Two-Tier System: Legal Miners vs. State-Backed Miners

There’s legal mining. And then there’s what’s really happening. The Islamic Revolutionary Guard Corps (IRGC) and other entities tied to Iran’s top leadership have built massive mining farms-like the 175-megawatt operation in Rafsanjan. These facilities don’t pay electricity bills. They run on subsidized power meant for public use. They use government-owned land, protected by political connections. And they’re not alone. Mines hidden inside mosques and religious centers are common. These places get free electricity from the state. Some operators quietly convert them into mining hubs, avoiding the high tariffs entirely. That creates a rigged system. A small business trying to go legal gets slapped with strict rules, expensive power, and constant audits. Meanwhile, state-linked miners operate without oversight, using the same grid that’s already overloaded. The result? Legal miners are squeezed out. Many have shut down. Others are moving operations to special economic zones-where power is more reliable-but even those zones are increasingly controlled by IRGC-affiliated companies.

What Happens When the Power Goes Out?

Iran’s energy grid is fragile. Summer heat, aging infrastructure, and sanctions that limit spare parts make blackouts predictable. And every time the lights go out, the government blames crypto miners. The cycle is brutal: power crisis → mining ban → economic damage → license revival → more mining → more strain → next ban. It’s not a policy. It’s a reaction. In January 2025, the CBI blocked all cryptocurrency-to-rial transactions on domestic exchanges for 23 days. An estimated one million Iranians couldn’t buy crypto to pay for essentials like medicine, food, or even internet access. People turned to peer-to-peer platforms like LocalBitcoins. P2P volume jumped 78% in a month. The government responded by unblocking exchanges-but only after forcing them to connect directly to a government API. Now, every transaction is monitored. Every user’s ID, IP address, and transaction history is logged. It’s not about financial stability. It’s about control.The Advertising Ban and the Death of Public Trust

In February 2025, Iran banned all cryptocurrency advertising-online, on billboards, even in TV commercials. The goal? To reduce public interest. To make crypto seem risky and unreliable. The effect was immediate. Trustpilot ratings for Iranian crypto exchanges dropped from 4.1 stars to 2.4 stars in just two months. User acquisition costs for exchanges tripled. People stopped trusting platforms they once used to buy Bitcoin for daily purchases. This isn’t just about mining. It’s about the government trying to kill the entire crypto ecosystem. They want people to stop using crypto. Not because it’s illegal. But because they can’t control it.

Is There a Future for Crypto Mining in Iran?

The government’s long-term plan isn’t to support crypto. It’s to replace it. They’re developing their own digital currency: the “Rial Currency,” a state-controlled digital token that can’t be mined and is fully regulated by the Central Bank. Unlike Bitcoin, it has no decentralization. No anonymity. No freedom. Just a digital version of the rial-with a tracker. International analysts agree: crypto won’t help Iran bypass U.S. sanctions. TRM Labs found a 11% drop in crypto inflows in the first half of 2025. The money isn’t flowing in. The people are being pushed away. For foreign investors, the risks are extreme. You can get a license. You can buy hardware. But if the power grid fails again, your operation could be shut down overnight-with no compensation. And if you’re not connected to the right political circles, you’re just another target.What Miners Need to Know Right Now

If you’re still considering mining in Iran in 2025, here’s what you need to do:- Apply for a license from both the Central Bank of Iran and the Ministry of Industry, Mine and Trade

- Use only government-approved mining hardware

- Sign up for a Tavanir-approved electricity contract-expect high rates

- Install real-time energy monitoring systems to prove compliance

- Monitor official announcements daily-rules change without notice

- Avoid any operation near religious sites or IRGC-linked facilities

- Prepare for sudden shutdowns. Have backup plans. Keep cash on hand

Why This Matters Beyond Iran

Iran’s crypto mining story isn’t just about electricity bills or Bitcoin. It’s a warning. It shows how a government can legalize something, then use regulation, power control, and political favoritism to quietly kill it. It shows how economic desperation can lead to innovation-and how authoritarian control can crush it. For the rest of the world, Iran is a case study in what happens when crypto runs into a state that values control over freedom. The miners aren’t the problem. The system is.Is crypto mining legal in Iran in 2025?

Yes, but only if you have a license from the Central Bank of Iran and the Ministry of Industry, Mine and Trade. All mining must use government-approved hardware and pay the highest electricity rates set by Tavanir. Unlicensed mining is illegal and can lead to equipment seizure or criminal charges.

Why does Iran allow crypto mining if it causes power shortages?

Iran allows legal mining because it generates foreign currency and tax revenue. The government initially hoped crypto could help bypass sanctions. But the real reason it persists is that the state itself benefits-through IRGC-linked mining operations that use subsidized power without paying bills. Legal mining exists mostly as a controlled outlet, while the real profits flow to politically connected entities.

Can foreigners mine crypto in Iran?

Yes, the Iranian government has officially invited foreign investors to apply for mining licenses. But in practice, it’s extremely risky. Foreigners face the same unpredictable shutdowns, political favoritism toward IRGC-linked operations, and lack of legal recourse. Most foreign miners either partner with local entities or operate through shell companies-both of which increase exposure to government interference.

What happened to crypto payments in Iran in early 2025?

In December 2024, the Central Bank blocked all domestic cryptocurrency-to-rial transactions. For 23 days, one million Iranians couldn’t use crypto to pay for goods or services. Exchanges were offline. People turned to peer-to-peer platforms. In January 2025, the government partially reversed the ban-but only after forcing exchanges to connect to a government-controlled API, giving authorities full access to user data.

Are there any safe places to mine crypto in Iran?

There are no truly safe places. Even special economic zones with dedicated power feeds are increasingly dominated by IRGC-affiliated operations. Miners who avoid political connections face higher risks of shutdowns, audits, or equipment confiscation. The only relatively safer option is to operate under strict compliance with CBI rules and maintain full documentation-but even then, you’re at the mercy of power grid failures and sudden policy changes.

Is Iran’s digital currency replacing Bitcoin?

Yes. The Central Bank of Iran is rolling out its own digital currency, called the "Rial Currency," which is not mineable and fully controlled by the state. Unlike Bitcoin, it offers no decentralization or privacy. The government sees this as the future-replacing public crypto with a state-monitored digital rial. This move signals that Iran’s goal isn’t to embrace crypto, but to eliminate its uncontrolled forms.