Regulatory Framework Comparison by Country: How Blockchain Markets Are Shaped by Global Rules

Jan, 5 2026

Jan, 5 2026

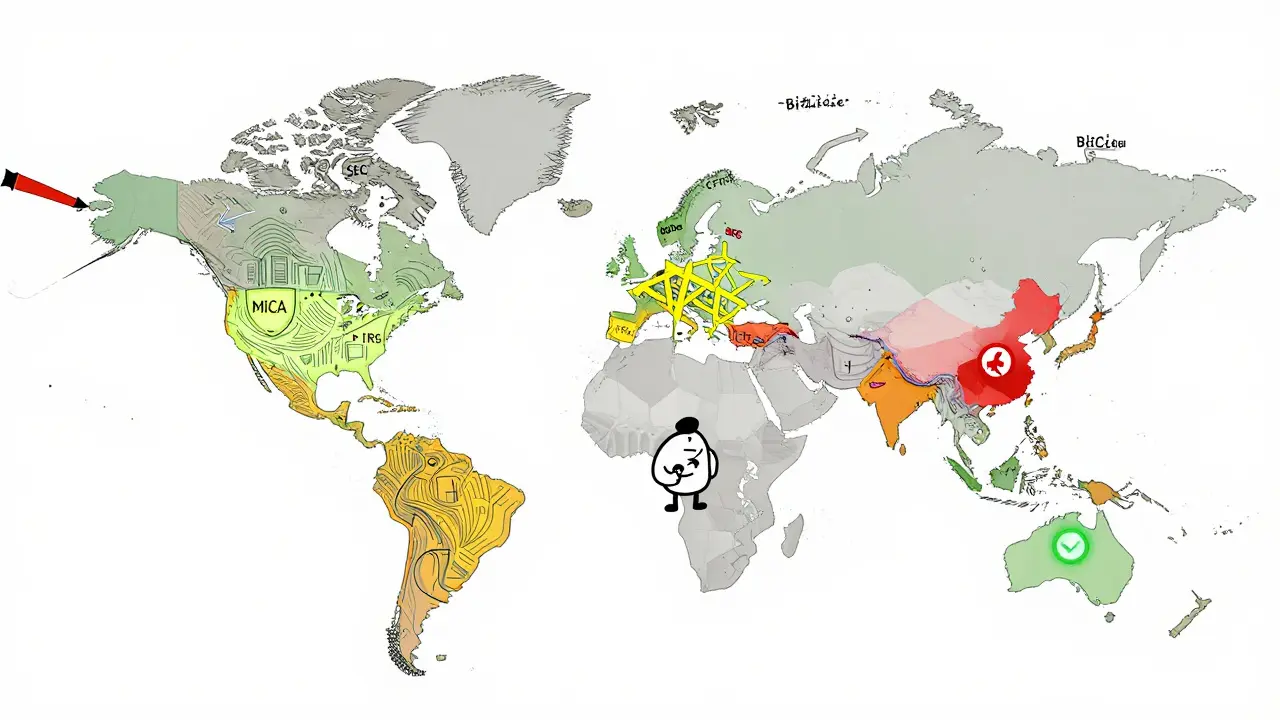

Why Blockchain Regulation Varies Wildly Across Countries

One company can launch a crypto exchange in Estonia and face fines in New York for the same service. Why? Because there’s no global rulebook for blockchain. Each country builds its own system-some strict, some loose, some nonexistent. The result? A patchwork of rules that makes it harder for businesses to scale and for users to know what’s legal. If you’re operating in crypto today, you’re not just fighting market volatility-you’re navigating a maze of conflicting laws.

How the EU Built the World’s Strictest Crypto Framework

The European Union’s Markets in Crypto-Assets Regulation (MiCA), effective January 2024, is the most comprehensive crypto rulebook ever created. It covers everything from stablecoins to decentralized exchanges, requiring full transparency, reserve audits, and licensing for all issuers. Under MiCA, stablecoins like USDT or USDC must hold 1:1 backing in liquid assets and disclose their reserves monthly. Exchanges must be licensed by national authorities and follow strict anti-money laundering rules. The EU also banned anonymous crypto wallets above €1,000, forcing users to verify identities even for small transfers. This isn’t just about safety-it’s about control. The EU’s goal is to prevent financial instability and protect consumers, even if it slows innovation. Companies like Binance and Kraken spent over €50 million each to comply, hiring teams of lawyers and auditors across 27 countries.

The U.S. Approach: A Mess of Overlapping Rules

In the United States, there’s no single crypto regulator. The SEC treats most tokens as securities, the CFTC calls some commodities, the IRS taxes them as property, and state agencies like New York’s BitLicense add another layer. This creates chaos. A startup in California might be cleared by the CFTC but shut down by the SEC for selling an unregistered token. One user reported spending 220 hours a year just tracking sales tax rules across seven states for crypto transactions. The lack of federal clarity means companies often move operations offshore. Coinbase moved its European headquarters to Ireland in 2022 to avoid U.S. regulatory uncertainty. The result? U.S. crypto innovation is stifled, while Europe and Asia gain ground. Experts estimate U.S. firms spend 40% more on compliance than their EU counterparts due to jurisdictional overlap.

Asia: Where Regulation Is Either Extreme or Absent

Asia tells two very different stories. Japan is a model of clarity: it licensed 26 crypto exchanges in 2023, required cold storage for 95% of assets, and mandated quarterly audits. Crypto gains are taxed at up to 55%, but businesses know exactly what’s expected. Meanwhile, China has banned all crypto trading and mining since 2021. Even holding Bitcoin is legally risky. India took a middle path: it taxed crypto at 30% in 2022 and added a 1% TDS on every transaction, making small trades expensive but not illegal. Singapore, on the other hand, welcomes innovation-offering fast-track licenses to blockchain firms that meet strict AML standards. By 2025, Singapore expects to have over 200 licensed digital asset firms. The difference? Japan and Singapore built rules that balance risk and growth. China chose control. India chose revenue.

Latin America and Africa: Crypto as a Workaround for Weak Systems

In countries like Argentina, Nigeria, and Venezuela, crypto isn’t regulated-it’s adopted out of necessity. When inflation hits 200% and banks freeze accounts, people turn to Bitcoin and USDT to save money. Governments react with confusion. Argentina has no formal crypto laws but taxes crypto income at 15-35%. Nigeria banned banks from processing crypto payments in 2021, then reversed it in 2023 after protests. In El Salvador, Bitcoin became legal tender in 2021, but only 30% of citizens use it regularly because infrastructure is lacking. The real story here isn’t regulation-it’s survival. Crypto fills gaps left by broken financial systems. But without clear rules, users have no legal recourse if exchanges collapse or funds are stolen.

Why Compliance Costs Differ by a Factor of 10

Compliance isn’t just paperwork-it’s money. In the EU, a mid-sized crypto firm spends $800,000-$1.2 million annually on legal, audit, and reporting systems under MiCA. In the U.S., the same firm might spend $1.5 million just to navigate SEC, CFTC, and state-level requirements. In contrast, a startup in Georgia or Portugal can operate with under $200,000 in compliance costs because their rules are simpler and centralized. The OECD found that businesses operating in three or more jurisdictions face 22% higher compliance costs and 18% slower market entry. For small teams, that’s the difference between survival and shutdown. RegTech tools-software that auto-updates compliance rules-are growing fast, but they only help if the rules are clear. In places like Brazil or South Korea, where regulations change every six months, even the best software can’t keep up.

What Happens When Rules Don’t Match

Imagine a U.S.-based NFT marketplace that lets users from France and Brazil buy digital art. Under MiCA, French users must be verified with ID and proof of address. Under Brazil’s 2023 crypto law, the platform must report all transactions over R$10,000 to tax authorities. But the U.S. has no such reporting requirement. Now the platform has to build three different systems. That’s not efficiency-it’s redundancy. This is why big players like Coinbase and Circle now run separate legal entities in each region. Smaller firms either avoid certain markets or risk fines. In 2023, the UK fined a crypto firm £1.7 million for failing to verify users from the EU under post-Brexit rules. The lesson? If your rules don’t align with where your users live, you’re not just out of compliance-you’re exposed.

The Future: Will Global Standards Ever Emerge?

There are signs of change. The OECD recently launched a project to create shared metrics for crypto regulation across 38 member countries. The Financial Stability Board is pushing for global anti-money laundering standards for crypto. But true alignment? Unlikely. The EU wants to lead with strict, horizontal rules. The U.S. prefers sector-by-sector control. China wants to ban what it can’t control. The truth is, regulation reflects culture. Europe prioritizes safety. The U.S. values innovation-even if it’s messy. Asia balances control with pragmatism. Until there’s a global treaty-which would require unprecedented cooperation-businesses will keep adapting to local rules. The winners won’t be the biggest tech teams. They’ll be the ones who understand local laws better than their competitors.

What You Need to Do Now

If you’re building or using crypto services, here’s what matters:

- Know where your users are. Don’t assume one rule fits all. If 30% of your users are in the EU, you need MiCA compliance.

- Track changes monthly. Singapore changed its licensing rules in November 2023. Brazil updated its tax rules in March 2024. Set up alerts.

- Use RegTech tools. Platforms like ComplyAdvantage or Chainalysis can auto-update compliance checks based on jurisdiction.

- Don’t ignore small markets. A country like Portugal or Malta might have fewer users, but their clear rules make them safer than chaotic ones.

- Document everything. In the U.S., the SEC has sued companies for “lack of documentation” even when they followed state rules.

There’s no shortcut. But there is a path: understand the rules where you operate, and build for them-not for what you wish they were.

Which country has the strictest crypto regulations?

The European Union has the strictest and most comprehensive crypto regulations through MiCA (Markets in Crypto-Assets Regulation), which came into force in 2024. It requires licensing for all crypto service providers, mandatory reserve audits for stablecoins, identity verification for all wallet users, and strict transparency rules. No other region has such a unified, detailed framework covering all aspects of crypto activity.

Is crypto legal in the United States?

Yes, crypto is legal in the U.S., but it’s heavily regulated-and not uniformly. The SEC treats many tokens as securities, the CFTC regulates derivatives, the IRS taxes crypto as property, and individual states like New York impose their own licensing (BitLicense). This patchwork creates confusion. While you can buy, sell, and hold crypto legally, offering services like exchanges or lending platforms requires navigating multiple agencies and state laws.

Why do crypto compliance costs vary so much between countries?

Costs vary because of regulatory complexity and fragmentation. The EU’s MiCA requires one unified set of rules across 27 countries, making compliance predictable. The U.S. has overlapping federal and state rules, forcing companies to build separate systems. In countries with unclear or changing laws, like Brazil or Nigeria, firms spend more on legal consultants to guess what’s next. The OECD found businesses operating in three or more jurisdictions pay 22% more in compliance costs than those in single-regime countries.

Can I use a crypto exchange based in another country?

Technically, yes-but it’s risky. Many exchanges block users from countries with strict rules (like the U.S. or South Korea) to avoid legal trouble. If you use an offshore exchange, you may lose legal protections. In the EU, only licensed platforms are allowed. In the U.S., unlicensed exchanges can be shut down by the SEC, and your funds may be frozen. Always check if the exchange is registered in your country or has a local entity.

What’s the easiest country to start a crypto business?

Portugal and Georgia are among the easiest. Portugal has no capital gains tax on crypto for individuals and no business license requirement for crypto services. Georgia offers fast, online business registration, low fees, and no VAT on crypto transactions. Singapore is also favorable but requires a full license and AML compliance. For startups, simplicity and clarity matter more than market size. Avoid countries with unclear or frequently changing rules.

How do I stay updated on crypto regulations?

Subscribe to official government portals like the EU’s ESMA updates, the U.S. SEC’s crypto enforcement page, and Singapore’s MAS announcements. Use RegTech platforms like Chainalysis or ComplyAdvantage that track regulatory changes in real time. Join industry groups like the Blockchain Association or Coin Center. And never rely on news sites alone-regulations are often buried in legal documents, not headlines.