Resfinex Crypto Exchange Review: In‑Depth Look at ERC20 Trading, Fees, and RES Token

Mar, 10 2025

Mar, 10 2025

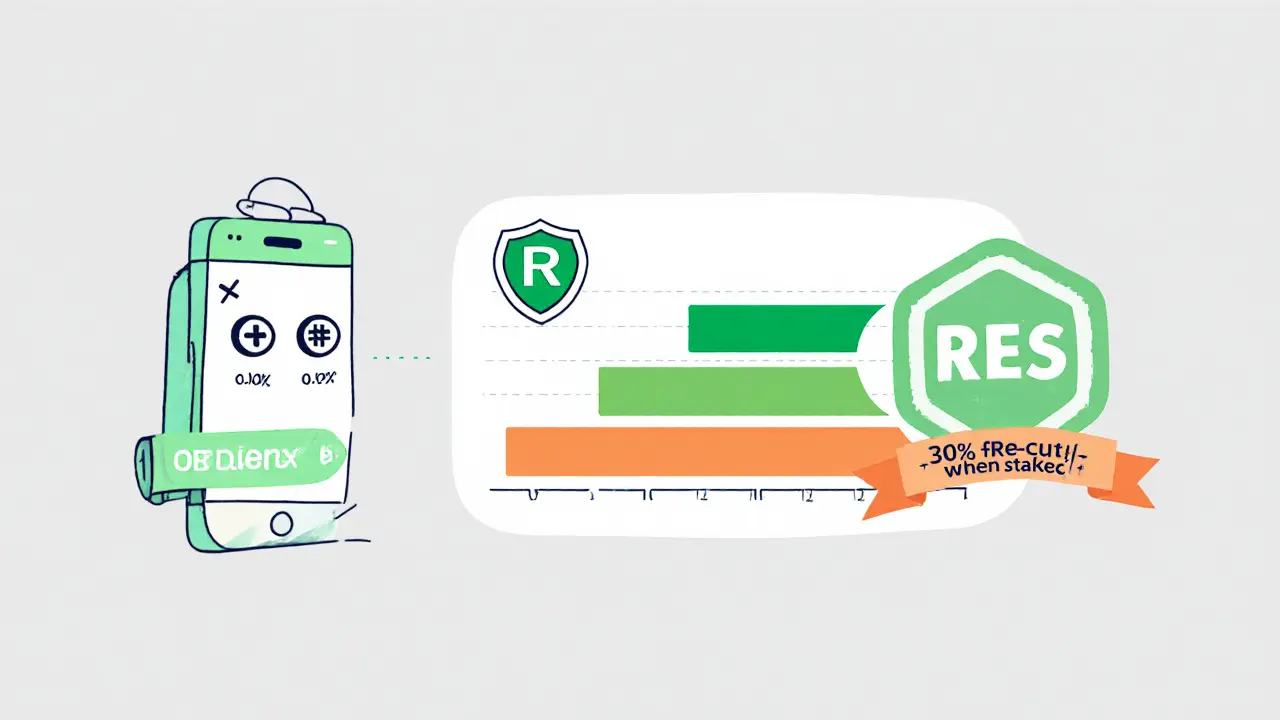

Resfinex Trading Fee Calculator

Calculate Your Resfinex Trading Fees

This calculator shows the expected fees based on Resfinex's tiered fee structure for ERC20 token trading.

Estimated Fee

Example: Based on a $10,000 trade at your current volume tier

If you’ve been hunting for a niche platform that focuses almost exclusively on Ethereum‑based assets, you’ve probably stumbled across Resfinex review. Launched in 2019, Resfinex positions itself as the go‑to hub for ERC20 traders, promising deep liquidity, a lean fee structure, and an API that suits both hobbyists and algorithmic strategists. In this article we’ll break down the exchange’s core features, weigh its strengths against its shortcomings, and help you decide whether it fits your crypto workflow.

Platform Overview

Resfinex is a Resfinex a centralized digital‑asset exchange that concentrates on ERC20 token trading within the Ethereum ecosystem. The company is incorporated in the British Virgin Islands a jurisdiction known for flexible crypto regulations and operates with a fully remote team.

Key stats (as of October 2025): daily trading volume exceeds $109 million, weekly volume tops $390 million, and monthly volume sits around $470 million. Those numbers place Resfinex in the mid‑tier of crypto exchanges-far below Binance’s multi‑billion‑dollar daily flow but respectable for a platform that only supports ERC20 assets.

Security Model & Regulatory Outlook

Security claims are high‑level: cold storage for the majority of assets, two‑factor authentication, and IP‑based login alerts. The public documentation, however, does not spell out specific certifications (e.g., ISO 27001) or third‑party audit reports. Because the exchange is based in the British Virgin Islands, it is not subject to the same licensing scrutiny as exchanges operating under EU or US regulators. Traders from stricter jurisdictions should treat this as a factor in their risk assessment.

Know‑Your‑Customer (KYC) procedures exist, but details on document requirements, verification timelines, and data‑retention policies are scarce. In practice, users report a relatively smooth onboarding experience, but the lack of transparent compliance documentation can be a red flag for institutions that need audit trails.

Fee Structure & Liquidity

Resfinex employs a tiered maker‑taker model that rewards higher volume. Maker fees start at 0.10 % and drop to 0.02 % for traders moving over $10 million daily. Taker fees are slightly higher, ranging from 0.15 % to 0.05 % at the top tier. The dynamic pricing aligns with the exchange’s goal of attracting market‑making activity and keeping spreads tight.

Liquidity is concentrated on popular ERC20 tokens-USDC, LINK, UNI, and AAVE regularly sit in the top‑10 depth. Niche projects with lower market caps can experience slippage, especially during volatile DeFi events. Compared with broad‑scope exchanges like Binance, the depth is thinner, but for pure Ethereum token traders the order‑book is often more competitive because the platform aggregates ERC20‑focused order flow.

Native Utility Token - RES

The exchange issues its own utility token, the RES token a native ERC20 token used for fee discounts, staking, and community governance. Launched at $0.01, the token currently trades around $0.0169 (per Crypto.com) with a maximum supply of roughly 995 million. Market‑cap hovers near $1.6 million, indicating modest trading activity-its 24‑hour volume is often under $30.

Holders can lock RES to receive up to a 30 % reduction on maker fees, a feature that incentivizes token adoption but also ties liquidity to the token’s price stability. Because RES is not listed on major exchanges like Coinbase or Binance, moving large amounts may require using smaller DEXs, adding an extra step for users who wish to leverage the discount.

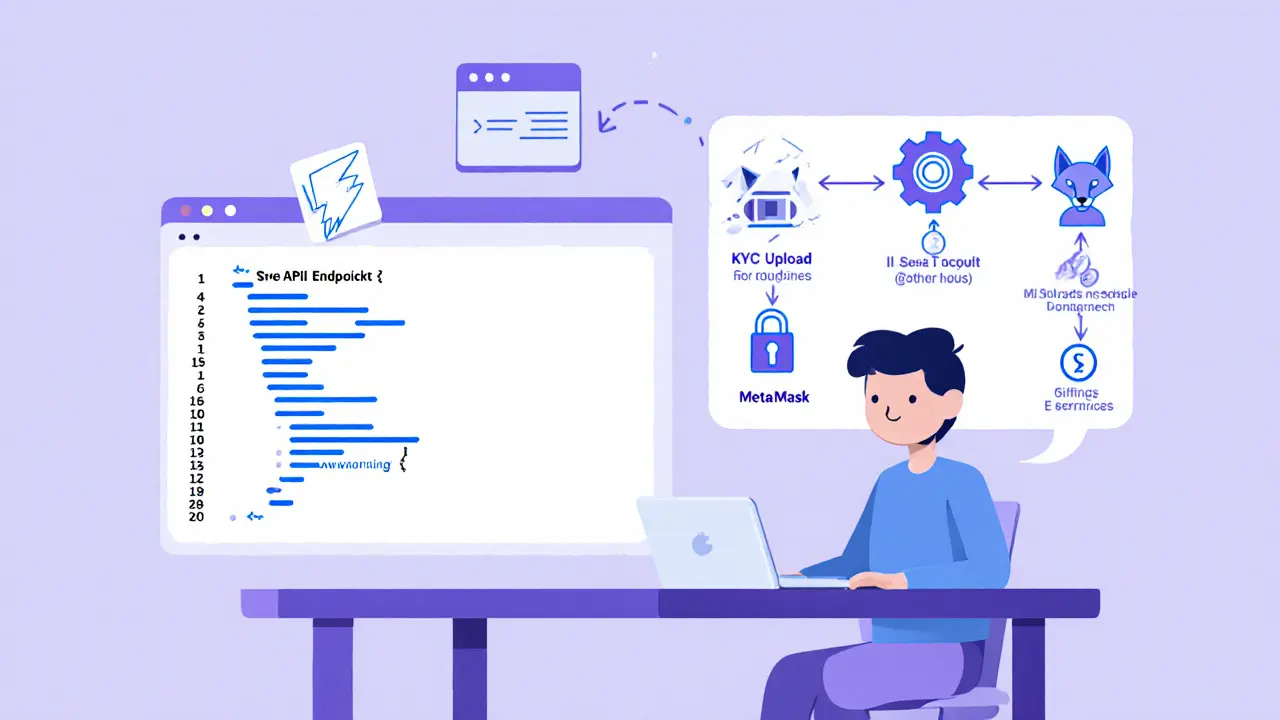

Trading Tools, API & Bot Support

Resfinex shines when it comes to developer‑friendly features. The platform provides a WebSocket feed (WebSocket real‑time push protocol delivering market data with sub‑millisecond latency) for live ticker, order‑book, and trade streams. REST endpoints cover account balances, order placement, and withdrawal management.

The API authentication uses HMAC‑SHA256 signatures, a standard approach that integrates smoothly with popular bot frameworks (e.g., Hummingbot, Gekko). Documentation is relatively concise but thorough, offering code snippets in Python, JavaScript, and Go. For institutional clients needing high‑frequency execution, the low‑latency WebSocket combined with tiered fees makes the platform a viable alternative to larger exchanges, provided the asset list fits their strategy.

Pros & Cons Snapshot

- Pros

- Specialized focus on ERC20 tokens yields deeper order‑book depth for Ethereum assets.

- Competitive, volume‑based fee schedule with additional discounts via RES staking.

- Robust API & WebSocket support ideal for algorithmic traders.

- Remote‑first team that emphasizes quick communication on Telegram and Reddit.

- Cons

- Limited asset coverage-no Bitcoin, BNB, or non‑ERC20 tokens.

- Regulatory opacity due to BVI incorporation; may not satisfy institutional compliance teams.

- Low liquidity for obscure ERC20 projects, leading to occasional slippage.

- RES token has minimal market depth, making fee‑discount unlocking a bit cumbersome.

How to Get Started

- Visit the official Resfinex website and click “Register”.

- Enter your email, create a strong password, and enable 2FA.

- Complete KYC by uploading a government ID and proof of address; verification typically takes 1‑2 business days.

- Connect an external Ethereum wallet (e.g., MetaMask) or generate a custodial address on the platform.

- Deposit ERC20 tokens, review the fee tier in the “Account” section, and start trading.

- If you hold RES, stake it in the “Token” tab to unlock fee discounts.

For developers, navigate to the “API Docs” page, generate an API key, and follow the sample Python script to fetch the live order‑book via WebSocket.

Frequently Asked Questions

Is Resfinex safe for large deposits?

The exchange stores the majority of assets in cold wallets and offers two‑factor authentication. However, because it lacks publicly audited security certifications, users should limit exposure to amounts they are comfortable risking and consider diversifying across multiple platforms.

Can I trade non‑ERC20 tokens on Resfinex?

No. Resfinex exclusively supports ERC20 tokens, so assets like Bitcoin, Solana, or Polygon’s native token are unavailable.

How does the RES token discount work?

Stake RES in the platform’s token‑lock module. For every 10 % of the total RES supply you lock, you receive a 3 % reduction on maker fees, up to a maximum of 30 %.

What are the KYC requirements?

A government‑issued ID, a selfie for facial verification, and a utility bill or bank statement for address proof. Verification is typically completed within 24‑48 hours.

Is there a mobile app?

Resfinex currently offers a web‑only interface. The responsive design works well on mobile browsers, but there is no native iOS/Android app as of October 2025.

Matt Zara

October 26, 2025 AT 00:01Resfinex is actually pretty solid if you’re all-in on ERC20s. I’ve been trading UNI and LINK there for months and the slippage is way better than on Binance for those tokens. The API is a dream too - I run a simple arbitrage bot and it’s been rock solid. Only downside? Having to swap ETH for RES on a DEX just to get the fee discount feels like a hassle, but hey, free money is free money.

Also, props to the team for responding fast on Telegram. Most exchanges ghost you, but they actually reply.

Jean Manel

October 26, 2025 AT 20:11Let’s be real - this is a sketchy BVI shell with a fancy API. No ISO certs, no transparency, and a $1.6M market cap token that’s basically a glorified loyalty card? You’re telling me this isn’t a rug pull waiting to happen? I’ve seen this script before: low-volume niche exchange, fake liquidity, then poof - the devs disappear with the RES token reserves.

And don’t even get me started on KYC being ‘smooth’ - that’s just code for ‘we don’t verify anything until we’ve sucked in your deposits.’

William P. Barrett

October 27, 2025 AT 08:21There’s something poetic about a platform that narrows itself down to one ecosystem - Ethereum’s ERC20s - and doubles down. In a world where exchanges chase everything, Resfinex chooses focus. It’s like a boutique coffee shop in a sea of Starbucks.

But that focus is a double-edged sword. You get depth where it matters, but you’re locked in. No Bitcoin? Fine. But what if Ethereum shifts? What if DeFi moves to Solana or a new L2? Are you betting on the token or the tech?

The RES token feels less like a utility and more like a community ritual - a way to say, ‘I believe in this.’ Whether that belief holds up is another question. Still, I respect the intention.

And yes, the API is genuinely good. If you’re coding, this might be the only place you need.

But trust? Trust needs audits. Not testimonials.

Cory Munoz

October 27, 2025 AT 23:26Just wanted to say I’ve been using Resfinex for my small DeFi trades and it’s been fine. No drama, no delays, and the fee discounts add up over time.

Yeah, it’s not Binance, but I don’t need Binance for what I do. If you’re just trading a few tokens and don’t care about 500 others, this works.

Also, the team seems chill on Reddit. Not pushy, not shady. Just… there. That’s rare these days.

And for the love of god, please don’t deposit your life savings. But for small amounts? It’s okay.

Jasmine Neo

October 28, 2025 AT 09:21Ugh, another ‘niche’ exchange pretending it’s ‘special.’ You’re telling me a platform that can’t even list BTC is worth your time? In 2025? This is why American crypto gets a bad name - small-time operators hiding behind ‘ERC20 focus’ while avoiding real regulation. And RES token? A $30 24h volume token is a joke. You’re basically paying to support a meme.

And don’t give me that ‘API is good’ crap - if your entire business model is built on algorithmic traders who leave as soon as the fee structure changes, you’re not a platform, you’re a temp job for bots.

Stay away. Use Coinbase or Binance. Or better yet - use a self-custody wallet and DEXs. At least then you’re not handing your keys to some BVI LLC with zero accountability.