State-by-State Crypto Regulations in the United States: What’s Legal Where in 2025

Dec, 7 2025

Dec, 7 2025

If you're running a crypto business, trading digital assets, or just holding Bitcoin in your wallet, you need to know this: crypto regulations in the U.S. aren't set by Washington alone. They're decided one state at a time - and the rules change drastically depending on where you live.

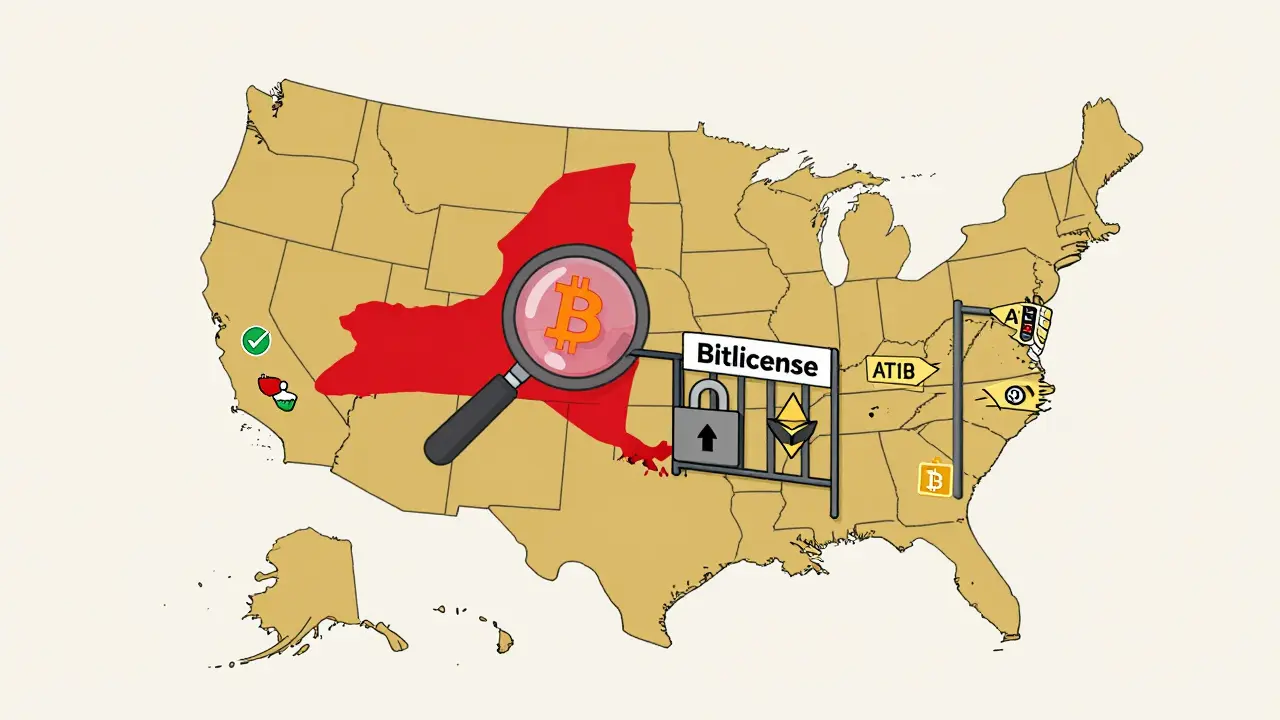

New York: The Strictest State for Crypto

New York doesn't just regulate crypto - it controls it. Since 2015, any business handling virtual currency in New York must get a BitLicense from the Department of Financial Services (NYDFS). That means exchanges, wallets, ATMs, even peer-to-peer platforms that connect buyers and sellers need approval. The BitLicense isn't just paperwork. It requires detailed audits, anti-money laundering systems, capital reserves, and ongoing reporting. Many crypto startups have walked away from New York because the cost and complexity are too high. In 2025, the NYDFS tightened the rules again - now companies must self-certify every new coin they list. If you're not on their approved list, you can't offer it to New York residents. And it's not just the state agency. The New York Attorney General’s office has filed over 40 enforcement actions against crypto firms since 2020. Some were for misleading investors. Others were for operating without a license. The message is clear: if you're doing crypto in New York, you're under a microscope.California: Innovation with Oversight

California does the opposite of New York. It wants crypto companies to stay - but under clear rules. The Department of Financial Protection and Innovation (DFPI) doesn't require a BitLicense-style permit. Instead, it uses existing money transmitter laws in a narrow way. If your business doesn't hold customer funds, you might not even need a license. In 2025, California passed the Digital Financial Assets Law, which created a licensing framework for crypto custodians, exchanges, and stablecoin issuers. But unlike New York, the rules are designed to be scalable. Small firms can start with basic compliance. Larger ones follow stricter standards. The state even created a sandbox program where startups can test new products under supervision without full licensing. This approach works. Over 60% of U.S. crypto startups are headquartered in California. Coinbase, Kraken, and BlockFi all have major offices in San Francisco. The state doesn't stop innovation - it just makes sure it's safe.Texas and Florida: The Pro-Crypto States

Texas and Florida have taken bold steps to attract crypto businesses. In 2025, Texas passed Senate Bill 179, which explicitly bans state agencies from discriminating against crypto companies. That means no state contracts, no tax penalties, no regulatory barriers just because a business uses blockchain. Florida went further. Governor Ron DeSantis signed Executive Order 25-08, which directs all state agencies to treat cryptocurrency as legal tender for state services. You can now pay property taxes in Bitcoin in Miami-Dade County. The state also created a Crypto Innovation Task Force to help businesses navigate regulations - and to recruit blockchain firms from New York and California. Both states have zero state-level crypto licensing requirements. They rely on federal rules and let businesses operate freely unless they break existing financial laws. That’s why crypto ATMs are everywhere in Houston and Orlando - and why more than 120 crypto firms moved there in 2024.

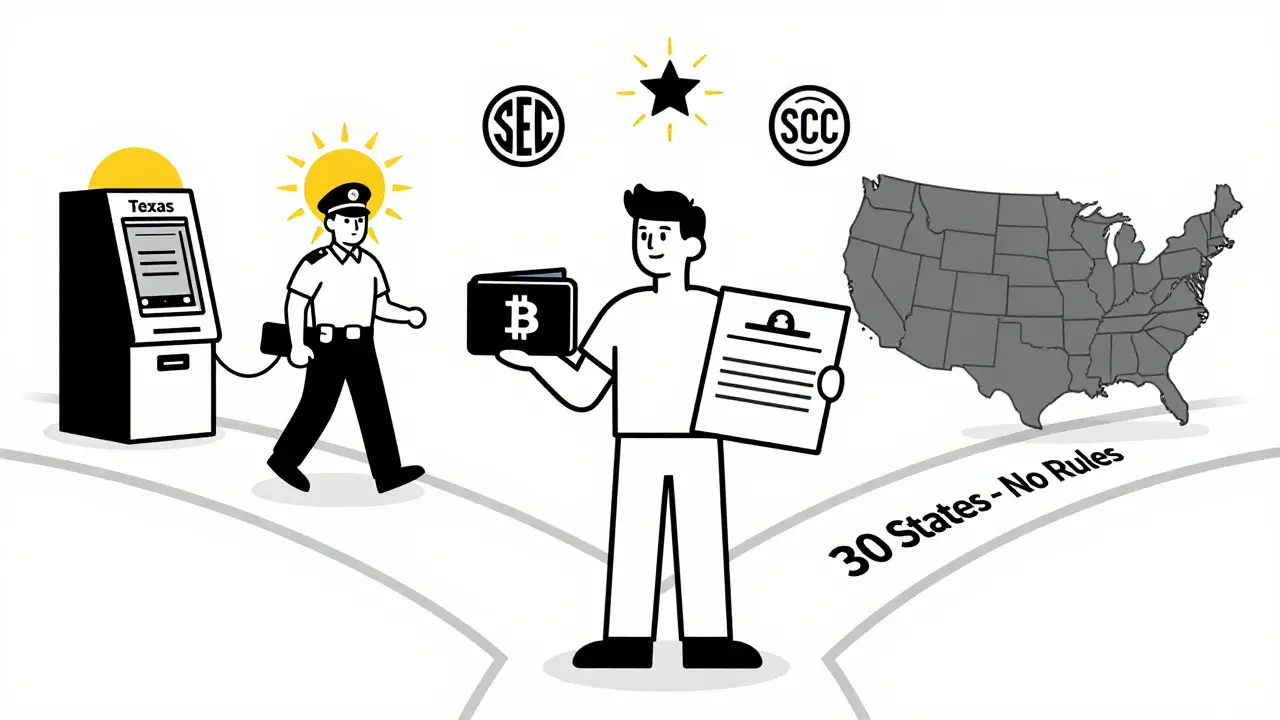

States with No Clear Rules

Most states - about 30 of them - have no specific crypto laws at all. That doesn’t mean crypto is illegal. It means regulators are using old laws to handle new tech. In states like Ohio, Georgia, and Illinois, crypto businesses are treated like money transmitters under the Uniform Money Services Act. That means they need a license, but the process is simpler than New York’s. The state doesn’t care if you’re mining Bitcoin or selling NFTs - if you’re moving money, you need a permit. Some states, like Alabama and Mississippi, haven’t updated their laws since 2018. Crypto businesses there operate in legal gray zones. They follow federal guidelines from the SEC and CFTC, but there’s no state guidance. That’s risky. One wrong move - like failing to report a transaction - could trigger an audit or fine.The Federal Shift: What Changed in 2025

The federal government didn’t sit still in 2025. The GENIUS Act became law in March, setting the first national rules for stablecoins. Now, any company issuing a stablecoin must back it 1:1 with cash or short-term U.S. Treasuries. They must also publish monthly audits. No more algorithmic stablecoins like TerraUSD. In September, the SEC and CFTC issued a joint statement that changed everything. For the first time, they agreed: registered exchanges can list spot crypto assets - even those with leverage or margin trading. That means Coinbase and Binance.US can now offer Bitcoin futures without fear of being sued by the SEC. The Office of the Comptroller of the Currency (OCC) also removed barriers for banks. National banks can now custody crypto, hold stablecoins, and run independent blockchain nodes without needing prior approval. That’s a huge shift from 2021, when banks were told to get permission before touching crypto. These changes mean federal rules are finally catching up. But they don’t override state laws. So if you're in New York, you still need a BitLicense - even if your exchange is SEC-registered.

What This Means for You

If you're a trader: You can buy and hold crypto anywhere in the U.S. No state bans ownership. But if you’re trading on a platform, check where it’s licensed. A platform that works in Texas might be blocked in New York. If you're a business owner: Don’t assume one license covers you. If you want to operate nationwide, you need to comply with each state’s rules. New York? BitLicense. California? DFPI registration. Texas? Nothing beyond federal rules. It’s a nightmare - but it’s the reality. If you're an investor: Look for platforms that are licensed in multiple states. They’re safer. Avoid unlicensed apps, even if they promise higher returns. The SEC and state attorneys general are cracking down hard on unregistered offerings.What’s Next?

The CLARITY Act is still in the Senate. If it passes, it will give the CFTC full control over crypto markets - and could eventually make state licenses redundant. But that’s not guaranteed. Some states, like New York and California, are fighting to keep their authority. The CBDC Anti-Surveillance State Act could block the Federal Reserve from launching a digital dollar without Congress’s approval. That’s a win for privacy advocates - and a warning to anyone thinking the government will replace crypto with a central bank coin. The bottom line: Crypto regulation in the U.S. is no longer a mess of confusion. It’s a patchwork - but a predictable one. Know your state. Know your federal obligations. And don’t assume one rule applies everywhere.Is it legal to own cryptocurrency in every U.S. state?

Yes. No U.S. state bans individuals from owning, buying, or holding cryptocurrency. Even in New York, you can hold Bitcoin in your wallet - you just can't run a crypto exchange without a BitLicense. Ownership is legal everywhere.

Do I need a license to trade crypto as an individual?

No. Individuals trading crypto for personal investment don’t need any license. The rules apply only to businesses - exchanges, wallets, custodians, and platforms that handle other people’s money. If you’re buying Bitcoin on Coinbase or selling Ethereum for cash, you’re fine.

Can I use a crypto exchange that’s not licensed in my state?

Technically, yes - but it’s risky. Some exchanges block users in restricted states like New York. Others don’t. If you use an unlicensed platform in a state with strict rules, you could face issues if the platform gets shut down or fined. Your funds might be frozen. Stick to exchanges that are licensed in your state for maximum safety.

What’s the difference between a BitLicense and a money transmitter license?

A BitLicense is specific to New York and covers virtual currency activities like custody, trading, and issuance. It’s much stricter than a standard money transmitter license, which most other states use. A money transmitter license is simpler, cheaper, and applies to any business moving money - including crypto. New York’s version adds extra layers like audits, capital reserves, and coin listing approvals.

Are stablecoins legal in all states now?

Yes - but only if they’re fully backed. The federal GENIUS Act requires stablecoins to be backed 1:1 by cash or U.S. Treasuries. Unbacked or algorithmic stablecoins are banned nationwide. States can’t allow them, even if they want to. So if you’re using USDC or USDT, make sure the issuer is compliant with federal rules.

Can banks hold my crypto now?

Yes. Since March 2025, national banks and federal savings associations can custody crypto, hold stablecoins, and participate in blockchain networks without needing prior approval from regulators. This was a major shift from the Biden-era restrictions. If your bank offers crypto services, it’s now legally allowed to do so.

Which states are the easiest for starting a crypto business?

Texas, Florida, and Wyoming are the easiest. Texas and Florida have no state licensing for crypto businesses - just federal rules. Wyoming has its own crypto-friendly laws, including special charters for crypto banks. California is also friendly, but requires registration under its Digital Financial Assets Law. New York is the hardest - avoid it unless you have deep pockets and legal teams.