Tapbit Crypto Exchange Review 2025: Fees, Liquidity, and Safety

Apr, 17 2025

Apr, 17 2025

Looking for a fresh crypto platform in a market flooded with big names? Tapbit review dives into the exchange’s promises, pricing, liquidity, and safety so you can decide whether it deserves a spot in your trading toolbox.

What is Tapbit?

Tapbit is a cryptocurrency exchange and forex brokerage that claims to serve more than 190 countries, offering over 700 crypto assets and 500+ trading pairs. Founded amid the crypto boom - sources disagree on whether 2018 or 2021 - the platform markets itself as an all‑in‑one solution for retail and institutional traders. Its headquarters are listed in the United States, though it operates without a clear regulator’s license.

Fee Structure - How Cheap Is It Really?

Tapbit’s headline numbers look attractive: a flat 0.1% fee on spot trades (both maker and taker) and 0.02% maker / 0.06% taker on futures. Unlike tier‑based models on Binance or Kraken, those rates stay static regardless of volume.

- Spot trading: 0.10% per transaction

- Futures (USDT‑margined): 0.02% maker, 0.06% taker

- Leverage up to 150× on selected perpetual contracts

- No fee discounts for high‑volume traders

When you compare these rates side‑by‑side with other major exchanges, Tapbit lands in the middle of the pack.

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Tapbit | 0.10% | 0.10% |

| Binance | 0.02%‑0.04% | 0.04%‑0.07% |

| Coinbase | 0.00% (VIP) | 0.50%‑0.60% |

| Kraken | 0.00%‑0.16% | 0.10%‑0.26% |

Bottom line: Tapbit’s flat fee is simple but not a bargain for high‑frequency traders who could reap tier discounts elsewhere.

Liquidity and Market Depth

Liquidity is the lifeblood of any exchange. Tapbit advertises 500+ active markets, but real‑world data tells a different story. According to CoinGecko data, the platform lists roughly 412 tokens across 425 pairs, with trading volume heavily concentrated in two pairs:

- ETH/USDT - ~45% of total volume

- BTC/USDT - ~17% of total volume

That leaves the remaining 80+ pairs sharing the last 38% of activity, which translates into thin order books and noticeable slippage for anything beyond a few hundred dollars.

Liquidity reserves further raise eyebrows. DeFiLlama tracking shows only $184,000 locked in Ethereum‑based wallets and $60,000 on Bitcoin‑based wallets that carry the Tapbit tag. For a centralized exchange claiming billions in 24‑hour volume, those numbers feel insufficient.

Traders looking for deep markets should treat Tapbit as a niche venue for popular pairs and avoid relying on it for large‑scale executions.

Security, Insurance, and Regulation

Tapbit touts a multi‑layered security stack: encryption, mandatory two‑factor authentication (2FA), and a split between hot and cold wallets. The platform also claims a $40 million Insurance fund to protect users against hacks or operational failures. However, independent verification of that fund’s existence is scarce, leaving the claim unsubstantiated.

Regulatory compliance is where Tapbit stumbles. It does not hold a license from any major financial authority - no FCA, SEC, or MAS coverage. The Forex.WikiBit rating gives the exchange a trustworthiness score of 4/10, reflecting the regulatory gray‑area risk.

For risk‑averse users, the lack of a recognized regulator means you might have limited legal recourse if the exchange were to freeze assets or go offline.

Trading Features - Spot, Futures, Copy Trading, and Earn

Tapbit offers a fairly broad product suite:

- Spot trading - standard buy/sell of over 700 assets.

- Derivatives - USDT‑margined perpetual contracts with up to 150× leverage.

- Copy trading - follow top traders’ strategies; the feature is simple but lacks depth in performance metrics.

- Tapbit Earn - passive yield products ranging from staking‑like rewards to lock‑up savings accounts.

The interface mirrors the look of Binance, which eases the learning curve for users familiar with the industry leader. However, several Binance‑style widgets (e.g., open‑interest charts) are missing, and some copied controls are non‑functional.

Demo trading for futures is available, giving newbies a sandbox to practice leverage without risking capital.

User Experience, Support, and Geographic Limits

Account creation follows a standard KYC flow: upload ID, selfie, and proof of address. Verification can take a few minutes to a couple of days, depending on document quality.

Customer support operates via email and live chat 24/7. The lack of phone support is a recurring complaint, especially for urgent withdrawal issues. Response times vary; many users report average reply windows of 1‑3 hours.

Geographically, Tapbit blocks residents of China, Cuba, Hong Kong, and Japan. Payments can be funded via crypto transfers or credit/debit cards, with minimum deposits set per asset (often $10‑$100 equivalent).

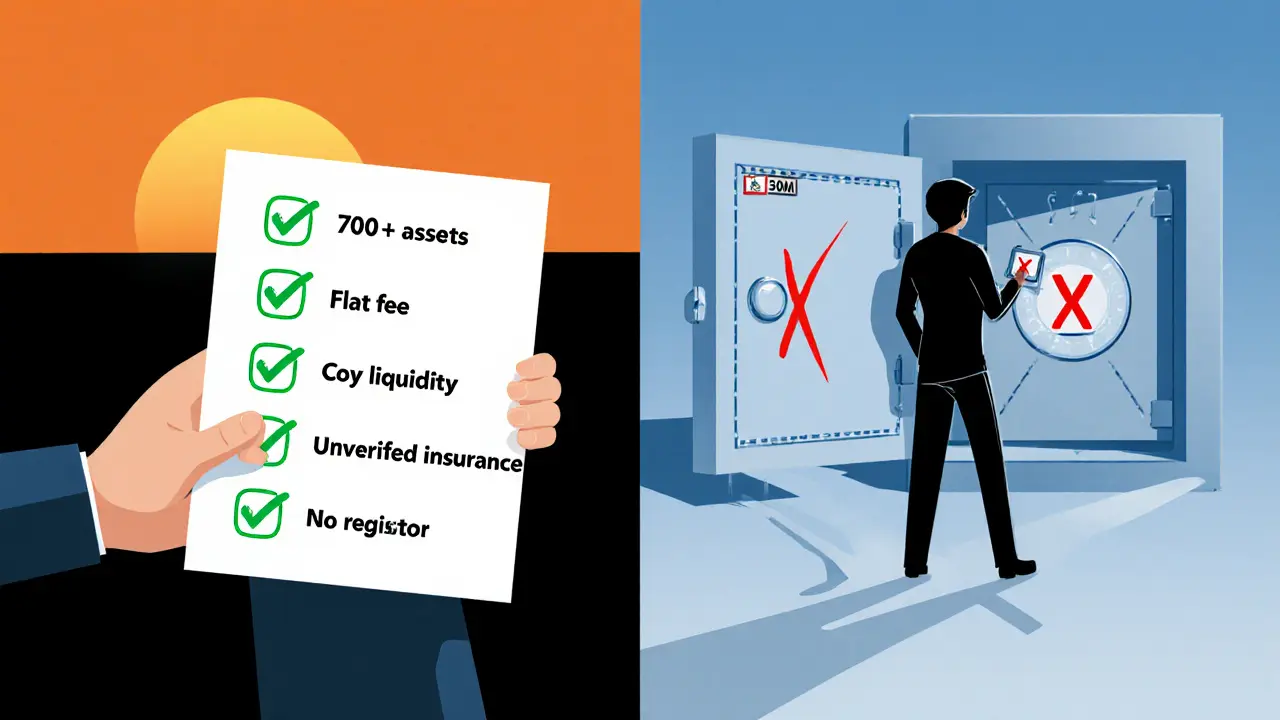

Pros & Cons - Quick Checklist

| Pros | Cons |

|---|---|

| - Flat, relatively low spot fee (0.1%) | - No tiered fee discounts for high volume |

| - Over 700 crypto listings | - Thin liquidity outside ETH/USDT & BTC/USDT |

| - Copy trading and earn products for passive income | - Unverified $40 M insurance fund claim |

| - Binance‑style UI, easy for seasoned traders | - No major regulator licensing (trustworthiness 4/10) |

| - 150× leverage on select futures | - Limited customer support channels (no phone) |

Final Verdict - Should You Trade on Tapbit?

If you value a wide array of altcoins, flat fees, and enjoy copy‑trading, Tapbit can serve as a secondary gateway. However, the thin liquidity on most pairs, questionable insurance transparency, and lack of regulatory oversight make it unsuitable as a primary exchange for large or risk‑averse traders.

Consider using Tapbit for small‑scale experiments or to test copy‑trading strategies, but keep the bulk of your capital on a well‑regulated, high‑liquidity platform like Coinbase or Kraken.

Frequently Asked Questions

Is Tapbit regulated?

No. Tapbit does not hold a licence from any major financial authority, which raises legal and safety concerns for users.

What are the deposit and withdrawal fees?

Crypto‑to‑crypto transfers are free, while credit/debit‑card deposits incur a 1.5% fee. Withdrawal fees depend on the blockchain network and are displayed before confirming the transaction.

Can I use Tapbit’s copy‑trading feature as a beginner?

Yes, but you should start with a small allocation and review the trader’s historical performance, risk level, and drawdown before scaling up.

What is the claimed $40 million insurance fund?

Tapbit states the fund protects users against hacks and system failures, but independent audits or third‑party verification of the fund have not been published.

How does Tapbit’s liquidity compare to top exchanges?

Liquidity is heavily skewed to ETH/USDT and BTC/USDT. For most alt‑pairs, order‑book depth is far lower than on Binance, Coinbase, or Kraken, leading to higher slippage.

Rosanna Gulisano

October 25, 2025 AT 17:19Sheetal Tolambe

October 26, 2025 AT 14:22gurmukh bhambra

October 26, 2025 AT 22:50Sunny Kashyap

October 27, 2025 AT 18:41james mason

October 28, 2025 AT 00:36Anna Mitchell

October 28, 2025 AT 21:41Pranav Shimpi

October 29, 2025 AT 14:36jummy santh

October 29, 2025 AT 18:22Kirsten McCallum

October 30, 2025 AT 16:40Henry Gómez Lascarro

October 31, 2025 AT 02:55Will Barnwell

October 31, 2025 AT 12:41Lawrence rajini

November 1, 2025 AT 07:43Matt Zara

November 1, 2025 AT 19:35Jean Manel

November 2, 2025 AT 03:57William P. Barrett

November 2, 2025 AT 04:42Cory Munoz

November 2, 2025 AT 12:43Jasmine Neo

November 2, 2025 AT 15:10Ron Murphy

November 2, 2025 AT 20:49Prateek Kumar Mondal

November 3, 2025 AT 09:09