TokenSets Review: Free DeFi Strategy Platform vs Crypto Exchanges (2025)

Oct, 3 2025

Oct, 3 2025

TokenSets Fee Comparison Calculator

How much would you pay for crypto trading? Compare your annual costs between TokenSets and traditional exchanges based on your trading volume and frequency.

Your Trading Details

Platform Comparison

TokenSets

0% trading fees, 0.0021 ETH withdrawal fee ($4.50 @ $2,100 ETH)

Traditional Exchange

0.5%-0.8% trading fees, withdrawal fees vary

Trading Bot (e.g., 3Commas)

$4-$59 monthly subscription

Annual Cost Comparison

| Platform | Annual Trading Fees | Annual Withdrawal Fees | Total Annual Cost |

|---|---|---|---|

| TokenSets | |||

| Traditional Exchange | |||

| Trading Bot |

When you type "TokenSets" into a search bar, the first thing you’ll see is a sleek dashboard that looks more like a robo‑advisor than a traditional crypto exchange. TokenSets is a decentralized finance platform that lets users create or buy automated trading “sets” to manage crypto portfolios without fees. In plain English: you pick a strategy, deposit a little ETH for gas, and the platform runs the trades for you 24/7. No order books, no KYC, no monthly subscription - just code‑driven investing.

What makes TokenSets different from a regular exchange?

Most exchanges - think Coinbase, Binance, Kraken - are built around an order‑book model. You place a limit or market order, the exchange matches you with another trader, and the trade settles on‑chain. TokenSets skips the matching step entirely. Instead, it sits on top of decentralized exchanges (DEXes) and executes a pre‑written set of rules every time the price hits a trigger.

That distinction matters for three reasons:

- Automation: Your strategy runs without you watching the screen.

- Zero trading fees: TokenSets charges no maker or taker fees - you only pay the gas needed to move ETH.

- Non‑custodial: Your assets never sit in a hot wallet controlled by the platform; they stay in your MetaMask or other Web3 wallet.

How to get started in under 10 minutes

- Install a Web3 wallet (MetaMask is the most common).

- Connect the wallet to the TokenSets web app.

- Deposit a small amount of ETH - enough to cover gas and the 0.0021 ETH withdrawal fee.

- Browse the marketplace and pick a pre‑built set (BTC20, ETH‑Stable, etc.) or click "Create" to design your own.

- Confirm the transaction; the set is now live and will rebalance automatically.

The whole flow usually takes 2‑3 hours for first‑time users, according to usability tests from CoinCodeCap (2024). If you’re comfortable with DeFi basics, it’s closer to 15 minutes.

Supported blockchains and integrations

TokenSets currently runs on three major networks - Ethereum, Polygon, and Arbitrum - though the exact list isn’t printed on the UI. The platform recently added Chainlink price feeds (Sept 2025) to improve trigger accuracy, and a mobile app (Aug 2025) for on‑the‑go monitoring.

Fee structure - the good, the bad, and the hidden

Every major exchange charges a maker/taker spread. TokenSets advertises a 0 % fee on trades, which is true - you won’t see a 0.1 % fee levied on each rebalancing. The only cost you’ll encounter is the withdrawal fee of 0.0021 ETH (about $4.50 at current gas prices). That fee is higher than some niche bots (e.g., FameEX’s 0.0004 ETH) but it’s still predictable.

Remember: you also pay gas for every on‑chain transaction. The upcoming L2 support (target Q1 2026) aims to cut those gas costs by up to 80 %.

How TokenSets stacks up against competitors

| Feature | TokenSets | Coinbase (exchange) | 3Commas (trading bot) |

|---|---|---|---|

| Fee on trades | 0 % | 0.5 % - 0.8 % | $4‑$59 / month subscription |

| Withdrawal fee | 0.0021 ETH | $0‑$2 based on method | Varies, usually $0‑$5 |

| KYC required | No | Yes | Depends on exchange linked |

| Supported assets | ~200 tokens via DEX pools | 180+ pairs | Depends on API‑connected exchange |

| Automation | Built‑in, no code needed | Manual order placement | Custom scripts, higher learning curve |

The table shows why many hands‑off investors gravitate toward TokenSets - you get fee‑free automation without a monthly bill. If you need margin, futures, or deep order‑book control, a traditional exchange is still your only option.

Strengths and weaknesses - a quick cheat sheet

- Pros:

- Zero maker/taker fees.

- Non‑custodial, no KYC.

- Pre‑built sets are ready‑to‑go.

- Community‑driven strategy library on GitHub.

- Cons:

- No direct trading pairs; you rely on DEX liquidity.

- Documentation is “intermediate” - beginners may stumble.

- Customer support limited to Discord and email (48‑72 h response).

- Higher ETH withdrawal fee compared to some niche bots.

Real‑world user experiences

Reddit’s r/DeFi thread (Jan 2025) highlighted a user who earned 23 % on the BTC20 set while sleeping - a classic “set‑and‑forget” win. Another commenter complained that custom strategy docs were “terrible” and gave up after a few hours. Trustpilot’s 3.7/5 rating mirrors that split: most praise the fee‑free model, while criticism targets limited support and a steep learning curve for newcomers.

In short, if you pick a proven set from the marketplace, odds are you’ll enjoy smooth growth. If you try to build a custom algorithm, be ready to dig into the GitHub repo and the occasional community‑run tutorial.

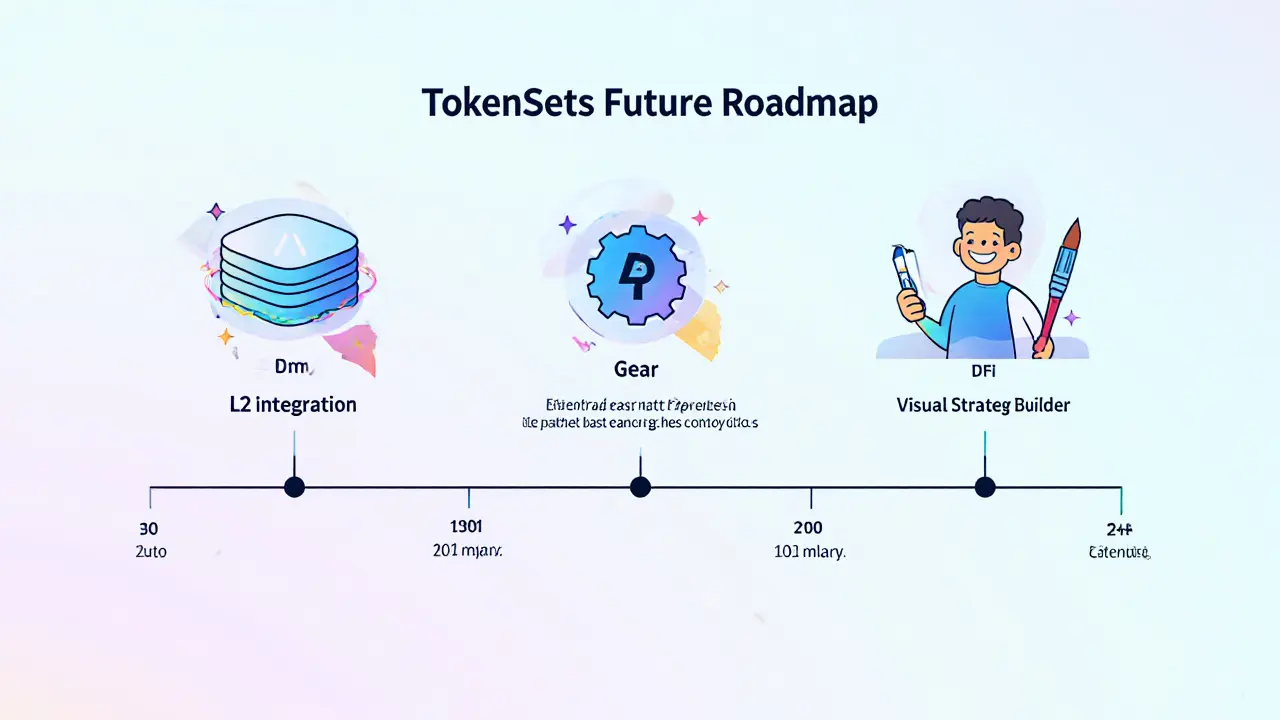

Future roadmap - where is TokenSets headed?

The public dev tracker (Oct 2025) lists three major milestones:

- Ethereum L2 integration (Q1 2026) - expect gas fees to drop dramatically.

- Expansion to two more DeFi protocols (Q2 2026) - more exotic strategies like leveraged yield farming.

- Enhanced UI for strategy customization (mid‑2026) - a visual builder aimed at non‑technical users.

Analysts at Messari expect the whole automated‑strategy sector to grow 15‑20 % annually through 2027, so TokenSets is likely to stay relevant as long as it keeps adding features without re‑introducing fees.

Bottom line - should you add TokenSets to your crypto toolbox?

If you’re looking for a hands‑free way to gain exposure to a diversified basket of tokens, and you’re comfortable handling a little ETH for gas, TokenSets is a solid, fee‑free choice. It won’t replace Binance for active day‑trading, but it does fill a niche that many investors overlook: automated, index‑style portfolios that run on‑chain.

For a first run, grab a pre‑built set like BTC20 or ETH‑Yield, monitor the performance for a week, and then decide whether you want to experiment with a custom strategy. The platform’s non‑custodial nature means you always stay in control of your assets - a big win in today’s regulatory climate.

Is TokenSets a regulated exchange?

No. TokenSets is a non‑custodial DeFi platform, so it doesn’t hold user funds and isn’t subject to the same licensing rules as centralized exchanges.

Can I use TokenSets if I live in the US?

Yes. Because there’s no KYC, US residents can connect a wallet and start using the platform. However, you should stay aware of any future SEC guidance on automated trading.

What’s the typical gas cost for a set rebalance?

On Ethereum mainnet a rebalance usually costs between $5‑$12 in gas. The upcoming L2 support aims to bring that down to under $1.

How do I withdraw my funds?

Open the “Withdraw” tab, specify the amount, and confirm the transaction in your wallet. You’ll pay the 0.0021 ETH withdrawal fee plus the normal gas for the ETH transfer.

Is there any customer support?

Support is limited to the community Discord, a GitHub issues page, and email. Expect 48‑72 hour response times.

Clarice Coelho Marlière Arruda

October 25, 2025 AT 18:28so i tried tokensets last week just to see what it was like… used the eth-stable set and honestly? it just worked. no stress, no watching charts, no panic selling when btc dipped. gas was a bit spicy but whatever, i’m not day trading.

Brian Collett

October 25, 2025 AT 23:53wait so you’re telling me i don’t need to pay 0.5% every time i rebalance? that’s insane. i’ve been using 3commas for months and i’m literally paying for the privilege of watching my portfolio get eaten by fees. this feels like a scam… but in a good way.

Allison Andrews

October 26, 2025 AT 01:30the non-custodial nature of tokensets is philosophically significant. it represents a shift away from centralized trust models toward autonomous, code-enforced financial sovereignty. the withdrawal fee of 0.0021 eth is not a flaw-it’s a boundary condition that enforces rational behavior in an otherwise infinite game.

Wayne Overton

October 26, 2025 AT 10:46gas is still too high. why not just use binance?

Alisa Rosner

October 26, 2025 AT 20:41hi newbie! 🌟 just want to say you’re doing GREAT! if you’re scared of gas fees, start with polygon-it’s like 10 cents per transaction. and yes, the eth-stable set is perfect for beginners. i’ve been using it since march and my portfolio’s up 18% with zero effort. you got this!! 💪✨

MICHELLE SANTOYO

October 27, 2025 AT 03:15tokensets is just another wall street bot dressed up as crypto. they’ll get regulated next year and then you’ll be stuck with kyc and fees again. remember coinbase? remember when they said ‘no fees’? yeah. this is the same script. you’re being played.

Lena Novikova

October 28, 2025 AT 02:02if you think this is easy you’ve never coded a smart contract. the docs are trash and if you try to make your own set you’ll cry by hour 2. this isn’t for you. stick to binance where you can at least call support

Olav Hans-Ols

October 28, 2025 AT 06:51really cool to see how far this has come. i remember when you had to manually script everything in python and run it on a raspberry pi. now you just click a button and it runs on-chain. love the vibe. keep building!

Kevin Johnston

October 28, 2025 AT 21:48just set up btc20 and already up 5% in 3 days 🚀 no stress, no stress, no stress. this is the future. everyone should try it!!

Dr. Monica Ellis-Blied

October 29, 2025 AT 19:46While the platform presents a compelling case for automated, non-custodial portfolio management, it is imperative to recognize the systemic risks associated with unregulated DeFi protocols. The absence of KYC, while appealing, introduces significant compliance exposure for users in jurisdictions with evolving regulatory frameworks. Furthermore, the reliance on third-party DEX liquidity pools introduces impermanent loss exposure that is neither disclosed nor mitigated in the interface. One must proceed with extreme caution.

Herbert Ruiz

October 30, 2025 AT 18:34why does this even exist? just buy btc and hold

Saurav Deshpande

October 31, 2025 AT 12:42they’re using chainlink feeds to manipulate prices. you think your set is rebalancing on real data? it’s a puppet show. the fed owns the contracts. watch the eth withdrawal fee rise after q1 2026. they’re baiting you into l2 so they can charge you more later

Paul Lyman

November 1, 2025 AT 12:02yo i tried this yesterday and got confused but then found a youtube video from a guy named jay and he walked me through it. seriously if you’re new just search ‘tokensets for dummies’ and you’ll be good. the eth-stable set is magic. i’m sleeping better now lol

Frech Patz

November 2, 2025 AT 05:02Could you please provide a link to the GitHub repository where the community-driven strategy library is hosted? Additionally, is there an API available for programmatic interaction with the platform’s sets?

Derajanique Mckinney

November 2, 2025 AT 12:56so i made a set called ‘moonboy’ and it went to the moon 🌕💸 but then it crashed and now i’m sad. why does crypto always do this??

Clarice Coelho Marlière Arruda

November 3, 2025 AT 06:46lol @788 same. i lost 12% on my ‘crypto chill’ set last week. but then it recovered in 3 days. that’s the thing-automated sets don’t panic. you gotta let ‘em ride.