Understanding NFT Digital Art Collectibles: A Complete Guide

Oct, 21 2025

Oct, 21 2025

NFT Minting Cost Calculator

Estimate Your Minting Cost

Calculate your current Ethereum gas fee and total minting cost in USD

Current ETH price: Loading... | Gas Price: Loading...

Note: Ethereum gas fees fluctuate rapidly. Costs shown are approximate based on current network conditions.

Ever wondered what makes a digital picture worth millions or why collectors treat a JPEG like a rare baseball card? The answer lies in NFT digital art - a technology that turns ordinary files into unique, verifiable assets on a blockchain. Below you’ll learn exactly what NFT digital art collectibles are, how they’re created, why they matter, and what risks to watch out for.

Key Takeaways

- NFT digital art collectibles are non-fungible tokens that certify ownership of a specific digital file.

- The minting process embeds a file’s hash on a blockchain, often using Ethereum and IPFS.

- Three main categories dominate the market: art, gaming items, and assorted digital media.

- Market value hinges on scarcity, creator reputation, and community demand, but volatility is high.

- Future growth may shift from speculation toward real‑world applications like virtual worlds and asset authentication.

What is an NFT Digital Art Collectible?

NFT Digital Art Collectible is a non-fungible token that represents a unique piece of digital artwork or collectible item stored on a blockchain, providing cryptographic proof of ownership and authenticity. Unlike Bitcoin or other cryptocurrencies, each token has a distinct identity that cannot be interchanged. In plain language, think of it as a digital certificate of authenticity that lives forever on a public ledger.

How Do NFTs Work?

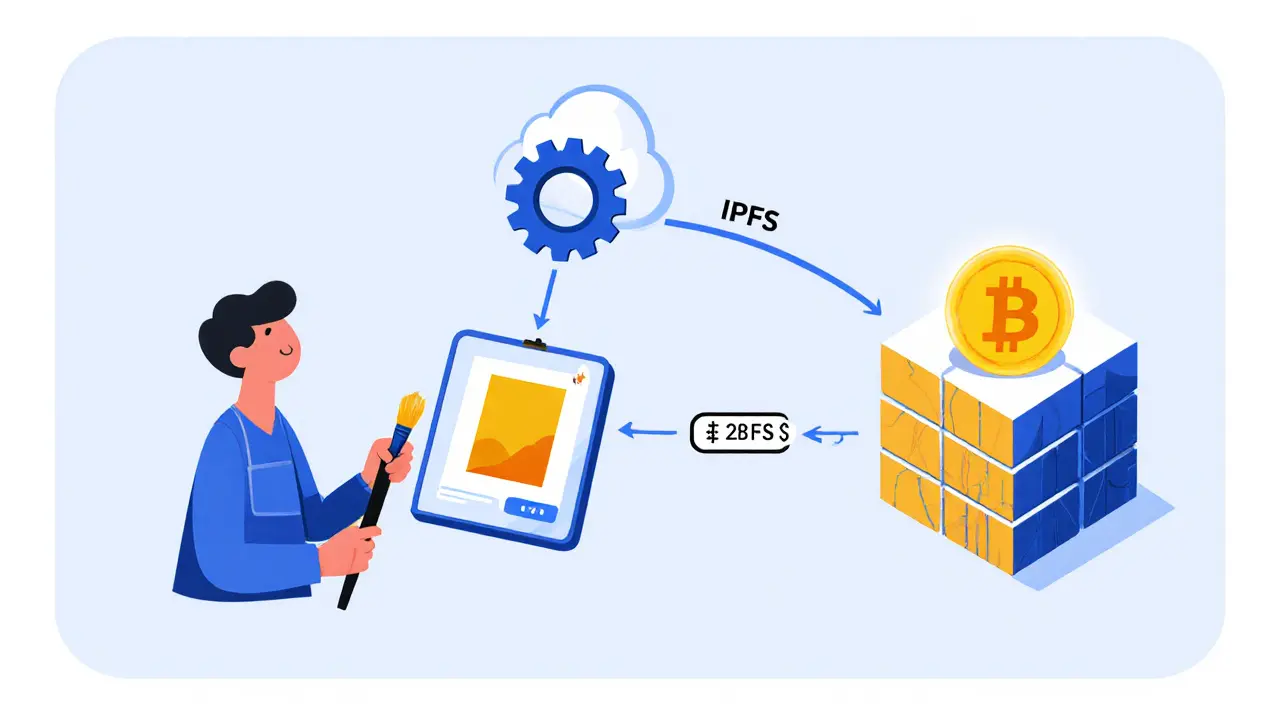

At the core of any NFT is a Blockchain - a distributed database that records every transaction in an immutable chain. When an artist uploads a file, a Smart contract defined on the blockchain creates a token, assigns it a name, symbol, and most importantly a unique hash that points to the file’s location.

The file itself is usually stored off‑chain on IPFS (InterPlanetary File System), a decentralized storage network. The hash stored on the blockchain acts like a fingerprint - any change to the file would generate a different hash, instantly breaking the link and flagging tampering.

Minting: Turning Art into an NFT

Minting is the process of creating the token. Here’s a quick rundown:

- Choose a marketplace (OpenSea, Rarible, or a niche platform like Panini's Blockchain Marketplace) and connect a crypto wallet.

- Upload the artwork - a JPEG, GIF, 3D model, or even an audio clip.

- The platform generates a cryptographic hash of the file and stores it on IPFS.

- A Smart contract writes the token’s metadata (name, description, creator address, royalty percentage) to the blockchain.

- The token is now live. The creator can set a fixed price, start an auction, or hold it in a personal collection.

Once minted, the token is indivisible - you can’t break it into smaller pieces like you can with Bitcoin. That indivisibility reinforces its “collectible” nature.

Market Categories: What Types of NFT Digital Art Collectibles Exist?

The NFT world isn’t just about pricey paintings. It splits into three broad buckets that you’ll see on most marketplaces:

| Category | Typical Content | Key Platforms | Collector Motivation |

|---|---|---|---|

| Art Collectibles | Digital paintings, generative artwork, animated GIFs | OpenSea, SuperRare, Foundation | Prestige, supporting creators, speculative upside |

| Game Collectibles | Skins, weapons, virtual land, avatar accessories | Axie Infinity, Decentraland, The Sandbox | Gameplay advantage, status, earn‑to‑play models |

| Other Digital Media | Sports cards, memes, music tracks, virtual real‑estate | NBA Top Shot, Royal.io, Panini's Blockchain Marketplace | Fan loyalty, unique moments, future utility |

Each segment shares the same underlying tech but serves different communities. For example, the Beeple sale in 2021 catapulted the art segment into mainstream headlines, while games like Axie Infinity demonstrated how NFTs can power whole economies.

Market Dynamics and Valuation

Like any collectible market, prices are driven by supply and demand. Scarcity (often enforced by limited edition drops), creator reputation, and community hype create price spikes. The $69.3 million Beeple auction remains the benchmark for “what’s possible,” but most sales hover in the low‑to‑mid four‑figure range.

Platforms provide multiple trading mechanisms - outright buy, fixed‑price listings, timed auctions, and “reserve price” bids. All transactions are recorded on the blockchain, giving anyone a transparent view of ownership history and past sale prices. This transparency is a double‑edged sword: while it helps verify legitimacy, it also exposes volatility. Prices can swing dramatically in a single day, and many projects fade after initial hype.

Benefits and Criticisms

Why do collectors care? The biggest win is verifiable digital scarcity. In a world where copying media is trivial, an NFT provides a provable scarcity that mirrors physical collectibles. It also gives creators a new revenue stream - every resale can trigger a royalty automatically coded into the smart contract.

But the space isn’t without criticism. Critics argue that owning an NFT doesn’t necessarily confer copyright or reproduction rights; you own a token pointing to a file, not the file itself. There are also environmental concerns: proof‑of‑work blockchains like Ethereum (until its transition to proof‑of‑stake) consume significant energy. Scam risk is real - counterfeit listings, rug pulls, and price manipulation have plagued the market.

Another practical hurdle is complexity. New users must set up a crypto wallet, acquire Ether (or another blockchain's native token), and pay gas fees for each transaction. For many, that learning curve feels steep compared to buying a physical print.

Future Outlook

Where do NFT digital art collectibles go from here? Two trends are shaping the next wave:

- Utility beyond speculation: Games are integrating NFTs as playable assets, and virtual worlds are using them for land ownership. This could anchor value in actual use cases.

- Integration with traditional collectibles: Companies like Panini are bridging physical trading cards with digital twins, offering fans a hybrid experience.

Regulatory clarity will also matter. As governments draft rules around digital assets, clearer legal frameworks could boost institutional confidence while weeding out fraudulent projects.

In short, NFT digital art collectibles have moved from a niche curiosity to a recognizable asset class. Whether you’re a creator looking to monetize, a collector chasing the next big piece, or a skeptic watching the market, understanding the technology, economics, and risks is essential.

Frequently Asked Questions

What exactly does an NFT prove?

An NFT proves that a specific token on a blockchain is linked to a particular digital file. It serves as a tamper‑proof certificate of ownership and transaction history, but it does not automatically grant copyright.

Do I need a special wallet to buy NFTs?

Yes. Most NFT platforms require a crypto wallet (e.g., MetaMask, Trust Wallet) that can store the blockchain’s native token, such as Ether for Ethereum‑based NFTs.

Can I sell an NFT that I don’t own the copyright to?

Technically you can mint any file, but selling it without the creator’s permission can violate copyright law. Many marketplaces enforce rules that require you to be the original creator or have a license.

What are the main costs involved in minting?

The biggest expense is the blockchain’s gas fee, which pays miners or validators to record the transaction. Fees vary widely; on Ethereum they can range from a few dollars to over $100 during network congestion.

How do royalties work for creators?

When a creator sets a royalty percentage in the smart contract, every time the NFT is resold, that percentage of the sale price is automatically transferred to the creator’s wallet.