Understanding Provenance in NFT Collections: How Blockchain Verifies Digital Ownership

Feb, 3 2026

Feb, 3 2026

When you buy an NFT, you’re not just buying a JPEG or a clip of music. You’re buying a provenance - a digital birth certificate that traces every step of its life, from the moment it was created to the hand it’s in today. This isn’t just marketing jargon. It’s the core reason NFTs have value. Without provenance, an NFT is just a file anyone can copy. With it, you own something verifiable, unique, and untampered with.

What Exactly Is Provenance in NFTs?

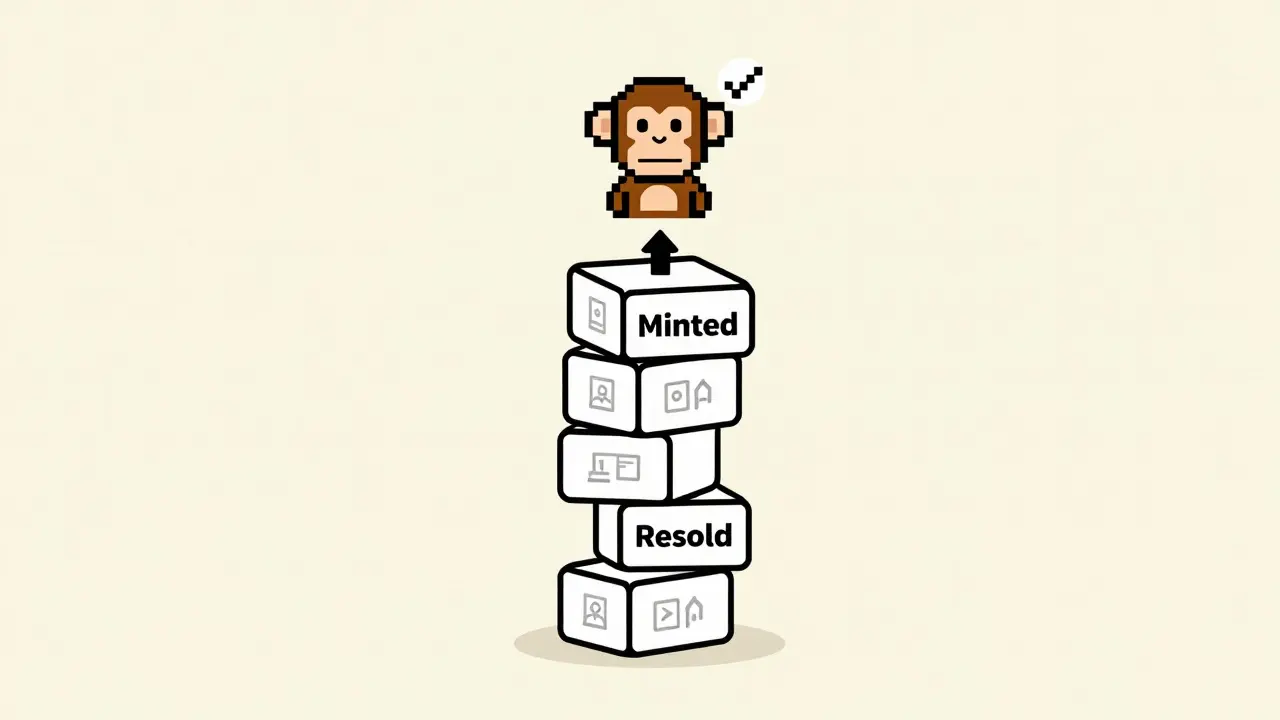

Provenance is the complete, unchangeable record of who created an NFT and who has owned it since. Think of it like a car’s title history, but for digital art. In the physical art world, provenance might mean a signed certificate from the artist, a gallery receipt, or an old auction catalog. Those can be lost, forged, or disputed. With NFTs, every transfer is recorded on a blockchain - a public, decentralized ledger that can’t be altered.When an artist mints an NFT, the blockchain locks in three key facts: who made it, when it was made, and what it represents (like a digital painting or a song). After that, every time it’s sold, gifted, or traded, that new transaction gets added to the chain. No middleman. No paper trail. Just a permanent, public log that anyone can check.

How Is Provenance Built? The Minting Process

Provenance starts at minting. That’s when a digital file - say, a 1000x1000 pixel image - gets turned into a unique token on the blockchain. You don’t upload the full image to the chain (that would be too expensive). Instead, you upload a small digital fingerprint called a hash, which acts like a unique barcode for that file. The actual image is stored elsewhere, usually on decentralized storage like IPFS.The minting process uses smart contracts - self-executing code on the blockchain - to assign ownership. On Ethereum, most NFTs use the ERC-721 standard. On Solana, it’s SPL. These standards make sure every NFT has a unique ID, metadata (like title, description, creator), and a record of its first owner. Once minted, that NFT’s identity is set in stone. Even if someone copies the image, the original token on the blockchain remains the only one with verified provenance.

Smart contracts also handle royalties. If the original artist set a 10% royalty, every time the NFT is resold, 10% automatically goes to them. That’s not a promise. It’s enforced by code. No negotiation. No paperwork. Just blockchain doing its job.

Why Provenance Matters More Than You Think

In 2021, researchers mapped over 6.1 million NFT transactions across major platforms. That’s not just hype - it’s proof that people are using provenance as a real tool. Why? Because it solves real problems.Before NFTs, digital art had no way to prove scarcity. Anyone could download and claim they owned the original. Now, collectors can check a token’s history in seconds. Did this piece come from the artist’s first drop? Has it been owned by a well-known collector? Was it part of a limited edition? That history adds value.

Artists benefit too. Provenance gives them control. They can prove they made the work, even years later. They can earn from resales. They can build trust with collectors who know they’re not buying a fake.

And it’s not just art. Provenance is being used for concert tickets, virtual real estate, and even deeds to physical land. In New Zealand, pilot projects are testing NFTs for land titles. The idea? A tamper-proof record that can’t be lost, stolen, or altered. That’s the power of blockchain-backed provenance.

Blockchains That Power Provenance

Not all blockchains are the same. The network you choose affects cost, speed, and how long your provenance lasts.Ethereum is still the most common. It’s secure, has the most tools, and supports ERC-721 and ERC-1155. But gas fees can be high, and transactions are slow during peak times.

Solana offers faster, cheaper transactions. Its SPL standard is popular for high-volume collections. Many newer NFT projects use it because of efficiency.

Polygon and Base are Ethereum sidechains. They inherit Ethereum’s security but cut costs by handling transactions off the main chain. Good for artists who want to reach more buyers without charging them $50 in fees just to mint.

Each network has its own marketplace ecosystem. OpenSea works across chains. Magic Eden is big on Solana. LooksRare leans on Ethereum. Where you buy and sell matters - because provenance is tied to the chain. You can’t move an NFT from Solana to Ethereum without a bridge, and bridges can break.

What Provenance Can’t Do

Provenance isn’t magic. It doesn’t guarantee quality. It doesn’t stop someone from copying your NFT’s image. It doesn’t mean the artist is legit - only that the token’s history is real.Scammers still exist. Fake collections with copied art and forged creator signatures are common. Provenance tells you who owned what, but not if the original was stolen or if the artist is who they claim to be. You still need to do your homework. Check the artist’s socials. Look at their past work. See if they’ve verified their profile on the marketplace.

Also, if the off-chain storage (like IPFS) goes down, the image might disappear. The token remains - but the art doesn’t. Some projects now use decentralized storage with redundancy to prevent this. Always check how the media is stored before buying.

How to Check an NFT’s Provenance

You don’t need to be a coder to verify ownership. Here’s how:- Go to the NFT’s page on OpenSea, Magic Eden, or another marketplace.

- Click “View on blockchain” or “View on Etherscan” (for Ethereum).

- You’ll see a list of all transactions: who minted it, who bought it, when, and for how much.

- Check the original creator’s wallet address. Is it the same as their verified social profile?

- Look for unusual activity - like 50 sales in 2 hours. That could be a wash trading scheme.

Tools like NFTGo and Rarity.tools also show ownership history and floor price trends. Use them to spot patterns. If an NFT’s price jumped from $200 to $20,000 in a week with no real buyers, it’s probably inflated.

The Bigger Picture: Provenance Beyond Art

NFT provenance is becoming a template for how we track ownership in the digital age. Companies are using it for supply chains - tracking coffee beans from farm to cup. Universities are issuing diplomas as NFTs so employers can verify them instantly. Even insurance policies are being tokenized, with claims history permanently recorded.What’s clear is this: if something has value, and it’s digital, provenance will matter. The blockchain doesn’t care if you’re buying a pixel art monkey or a deed to a house. It just records who owns what. And that’s enough to change how we think about ownership forever.

Can NFT provenance be faked?

The blockchain record itself can’t be faked - it’s immutable. But scammers can create fake NFTs that look real. Always check the creator’s verified wallet address and compare it to their official social media. A fake NFT has a real history - it’s just not the history you think it is.

Does provenance affect NFT value?

Absolutely. An NFT owned by the original artist, then by a well-known collector, then by a museum has more value than one that changed hands 10 times between random wallets. Provenance adds story, credibility, and scarcity - all factors collectors pay for.

What happens if the blockchain shuts down?

Blockchains like Ethereum and Solana are designed to last decades. They’re maintained by thousands of nodes worldwide. Even if one platform disappears, the data lives on. The NFT token and its history are stored across the network - not on a single server. It’s far more resilient than any company-run database.

Can I transfer an NFT’s provenance to another blockchain?

Not directly. Provenance is tied to the chain it was created on. You can use bridges to move the NFT to another network, but that creates a new token on the new chain. The original history stays on the old chain. Some projects are working on cross-chain provenance, but it’s still early.

Why do some NFTs have no provenance history?

They shouldn’t. Every NFT on a blockchain has a history. If you see one with no transactions, it likely hasn’t been sold yet - or it’s a scam. Double-check the contract address. If it’s not on a major marketplace or has zero activity, avoid it.