UPXIDE Crypto Exchange Review: Features, Security, Fees & Verdict

Dec, 3 2024

Dec, 3 2024

When you see a new name like UPXIDE a cryptocurrency exchange (status currently unclear) pop up in a Google search, the first question is - can you trust it?

UPXIDE crypto exchange has very little public information, which makes a thorough review tricky. This article walks you through the key checkpoints you should verify for any exchange, highlights what we could find about UPXIDE, and compares it against well‑known platforms such as Binance, Coinbase and KuCoin.

Why a Review Matters

Crypto trading involves real money, irreversible transactions, and exposure to hacking attempts. Before you deposit any funds, you need to know:

- Is the exchange regulated?

- What security measures protect user assets?

- How transparent are the fee structures?

- Does the platform offer the coins you want to trade?

- How responsive is customer support?

Missing any of these pieces can turn a promising opportunity into a costly mistake.

What We Could (and Could Not) Find About UPXIDE

Our research turned up almost no verifiable sources that describe UPXIDE as an operating exchange. The name appears in a handful of discussions that may actually refer to unrelated projects such as Upside OS (a digital‑securities platform) or Upexi (a Solana‑focused treasury firm). This lack of data could mean one of three things:

- The platform is brand‑new and hasn’t been indexed yet.

- It operates under a different legal name, making public records hard to trace.

- It is a regional or niche service with limited marketing reach.

Because we can’t confirm licensing, security audits, or user volume, we’ll treat UPXIDE as a “black box” and focus on the due‑diligence steps you must take yourself.

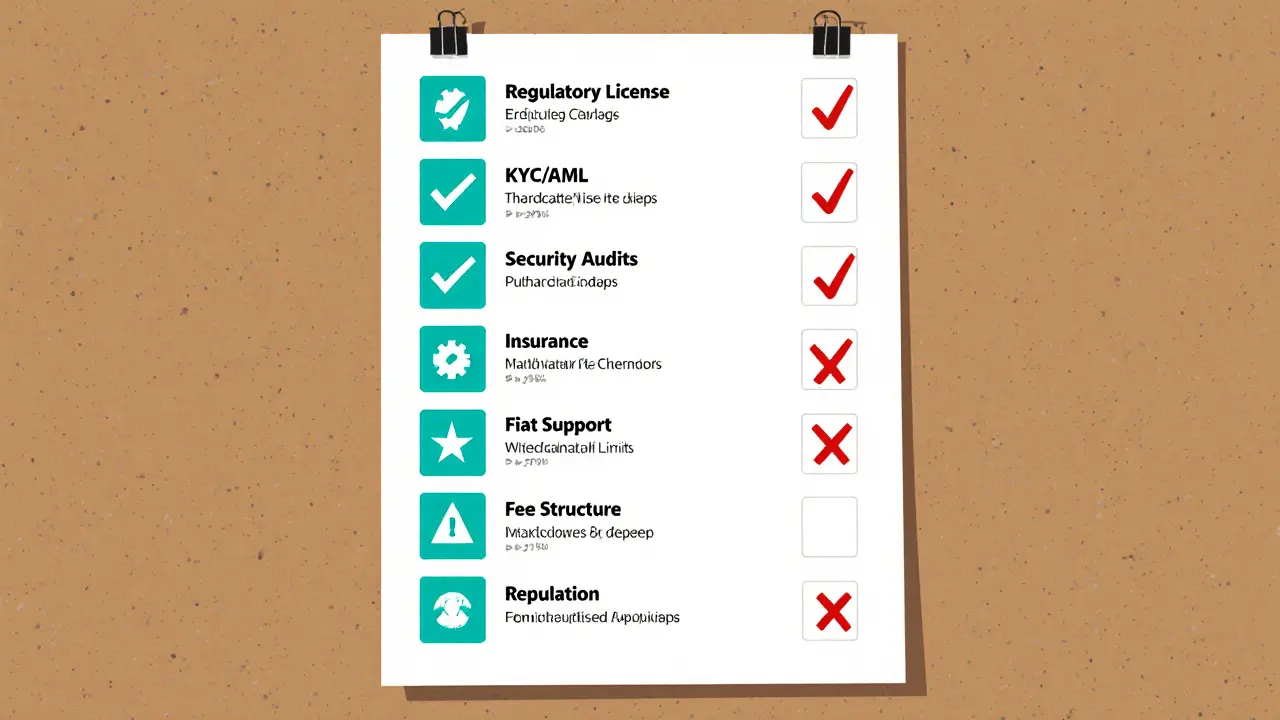

Key Evaluation Checklist for Any Exchange

Use the checklist below before signing up for UPXIDE or any other platform. Mark each item as you verify it.

- Regulatory Licensing: Is the exchange registered with a financial authority (e.g., the SEC, FCA, or a local securities commission)?

- KYC/AML Procedures: Does it require identity verification and run anti‑money‑laundering checks?

- Security Audits: Has a reputable firm (e.g., CertiK, PeckShield) audited the code and infrastructure?

- Insurance Coverage: Does the exchange hold an insurance policy for custodial assets?

- Supported Fiat Currencies: Which national currencies can you deposit/withdraw (USD, EUR, NZD, etc.)?

- Trading Pairs & Liquidity: Are the markets you need listed, and is depth sufficient to avoid slippage?

- Fee Structure: What are maker, taker, withdrawal, and deposit fees? Are they transparent?

- Withdrawal Limits: Daily/weekly caps that could lock your funds.

- Customer Support: Availability of live chat, email, and phone; response time.

- Reputation & Reviews: User feedback on forums like Reddit, Trustpilot, or crypto‑specific sites.

Comparative Snapshot: UPXIDE vs. Established Exchanges

| Exchange | Year Launched | Supported Fiat | Typical Fees (maker/taker) | Security Highlights |

|---|---|---|---|---|

| Binance | 2017 | USD, EUR, GBP, JPY, NZD, ... | 0.10% / 0.10% | SAFU fund, 2FA, hardware‑wallet whitelisting |

| Coinbase | 2012 | USD, EUR, GBP, CAD, AUD, ... | 0.50% / 0.50% | US regulated, insurance on hot wallets |

| KuCoin | 2017 | USD, EUR, CNY, KRW, ... | 0.10% / 0.10% | Multi‑sig wallets, KYC optional for low tier |

| UPXIDE | Unknown | Not disclosed | Not disclosed | Not disclosed - no public audit found |

The table shows that, unlike the three giants, UPXIDE does not currently publish any of the core data points that traders rely on. That omission alone should raise a red flag.

Deep Dive Into Security Concepts You’ll Encounter

Even if an exchange claims strong security, it’s worth knowing the technical terms:

- Cold Storage: Assets kept offline, typically in hardware wallets, reducing hack risk.

- Multi‑Signature (Multi‑sig): Transactions require multiple private keys, preventing a single point of failure.

- Two‑Factor Authentication (2FA): Adds a second login step, usually via an authenticator app.

- Security Audits: Independent code reviews that check for vulnerabilities. Look for reports from firms like CertiK or Quantstamp.

If UPXIDE cannot provide a recent audit report, you should treat that as a missing security layer.

Regulatory Landscape - What to Look For

Regulators such as the U.S. Securities and Exchange Commission (SEC), the UK’s Financial Conduct Authority (FCA), or New Zealand’s Financial Markets Authority (FMA) maintain public registers of licensed crypto service providers. A quick search on those sites can confirm whether a platform holds a valid licence.

UPXIDE does not appear on any of the major regulator lists as of October 2025, which could indicate it operates without a formal license or simply under a different corporate name. Both scenarios carry risk, especially for users in jurisdictions that require licensed providers.

Fees - How to Unpack the Fine Print

Fee structures often hide costs in “spreads,” “withdrawal minimums,” or “inactive‑account charges.” When evaluating UPXIDE, ask for a clear breakdown:

- Deposit fees - are fiat deposits free, or is there a markup?

- Trading fees - maker vs. taker rates, any tiered discounts.

- Withdrawal fees - fixed network fee vs. percentage of amount.

- Hidden fees - account inactivity, API usage, or premium‑feature charges.

Known exchanges publish this data on their “Fees” page; the absence of a similar page on UPXIDE is another warning sign.

Customer Support - The Unsung Deal‑Breaker

When a withdrawal stalls or a login issue occurs, the speed and quality of support can save you from losing funds. Test the channels before you trust the platform:

- Send a test email and note the response time.

- Try the live‑chat widget (if available) and ask a simple question.

- Check community forums for user‑reported support experiences.

UPXIDE’s website currently offers only a generic contact form with no indication of response SLA, which is below industry best practice.

Bottom Line - Should You Trade on UPXIDE?

If you value transparency, regulatory compliance, and proven security, the safest move is to stick with established exchanges that meet all checklist items. Until UPXIDE releases verifiable licensing information, a third‑party security audit, and a full fee schedule, it remains a high‑risk choice.

That doesn’t mean you must avoid it forever-monitor the platform for updates, and if they start publishing the missing data, reevaluate using the same checklist. Crypto markets evolve quickly, and today’s mystery could become tomorrow’s reputable service-only if they earn the trust of the community.

Is UPXIDE a regulated crypto exchange?

No public regulator list (SEC, FCA, FMA, etc.) includes UPXIDE as of October 2025, so its licensing status is unclear.

How can I verify an exchange’s security?

Look for third‑party audit reports, cold‑storage percentages, multi‑sig wallets, and two‑factor authentication enforcement.

What are the typical fees on major exchanges?

Maker and taker fees usually range from 0.10% to 0.50%, with additional withdrawal fees that depend on the blockchain used.

Can I trade on a platform without KYC?

Some decentralized services permit limited trading without KYC, but most reputable centralized exchanges require it for compliance and security.

What should I do if I suspect an exchange is a scam?

Stop all deposits, withdraw any available funds, and report the platform to your local financial regulator.