US Yield Farming Tax Implications: How to Report DeFi Income in 2025

Sep, 19 2025

Sep, 19 2025

When you lock crypto into a DeFi protocol hoping for extra tokens, the IRS treats many of those payouts as taxable events. Understanding the yield farming tax rules can save you from surprise bills and penalties.

What Is Yield Farming?

Yield Farming is a DeFi strategy where investors provide liquidity or stake assets in smart contracts to earn interest, fees, or newly minted tokens. It grew rapidly after 2020, with platforms like Aave, Compound, Uniswap, SushiSwap, and PancakeSwap offering lucrative reward programs.

While the concept sounds like traditional finance, the tax treatment follows cryptocurrency rules because the assets involved are still digital tokens.

How Yield Farming Triggers Taxable Events

Each reward type you receive creates a separate tax transaction. Below are the most common events:

- Interest‑style payments (e.g., a percentage of loaned assets). Treated as ordinary income at the fair market value (FMV) on the day you receive them.

- Governance or reward tokens (e.g., COMP, SUSHI). Also counted as ordinary income based on FMV at receipt.

- Liquidity Provider (LP) tokens that represent your share of a pool. The moment you receive these tokens, their FMV is taxable as income.

- Staking rewards earned inside a farming strategy. The same ordinary‑income rule applies.

After you later sell, swap, or remove liquidity, the same tokens become subject to capital‑gain calculations using the FMV recorded at receipt as the cost basis.

Ordinary Income vs. Capital Gains

The IRS does not have a separate DeFi section, so you must map each event onto existing tax categories.

| Reward Type | Tax Category at Receipt | Later Sale Treatment |

|---|---|---|

| Interest payments (e.g., Aave lending fees) | Ordinary income | Capital gain/loss on disposal |

| Governance tokens (COMP, SUSHI, CAKE) | Ordinary income | Capital gain/loss on disposal |

| LP tokens (Uniswap, PancakeSwap) | Ordinary income (FMV of token at receipt) | Capital gain/loss on removal or swap |

| Staking rewards inside a farm | Ordinary income | Capital gain/loss on disposal |

For the 2024 tax year (used as a reference for 2025 filings), ordinary income rates range from 10% to 37% depending on your total taxable income. Short‑term capital gains (assets held < 1 year) are taxed at the same rates, while long‑term gains enjoy 0%, 15%, or 20% rates.

Record‑Keeping You Can’t Skip

Accurate reporting starts with a solid log. Here’s a step‑by‑step workflow many professionals recommend:

- Export transaction data directly from each protocol’s dashboard (most DeFi interfaces provide CSV downloads).

- Timestamp every reward receipt and note the USD FMV using a reputable price source (CoinGecko, CoinMarketCap, or an exchange where the token trades).

- Enter each event into a crypto‑tax calculator. Two of the most trusted tools are CoinTracking and Koinly.

- Review the generated Form 8949 entries and transfer totals to Schedule D and the appropriate income lines on Form 1040.

- Make quarterly estimated tax payments if you expect to owe $1,000 or more for the year.

Most active farmers spend about 2‑5 hours each week maintaining these records. Skipping even a single small reward can create a compliance gap because the IRS now requires full disclosure of crypto‑related income.

Common Pitfalls and Pro Tips

Pitfall #1: Assuming LP tokens are only taxed when you withdraw liquidity. In reality, the moment the LP token lands in your wallet, its FMV counts as ordinary income.

Pro tip: Use the “USD value at receipt” field in your tax software to lock in that basis automatically.

Pitfall #2: Waiting for a token to list on an exchange before valuing it. The IRS expects you to apply a reasonable market price even if the token trades on a smaller DEX.

Pro tip: Take the average price from the three most liquid pools on the day of receipt.

Pitfall #3: Forgetting that fee‑share rewards (e.g., a slice of swap fees) are also taxable.

Pro tip: Treat fee earnings the same as interest-record the USD amount each time the protocol distributes them.

What the IRS Is Looking At in 2025

Recent guidance shows the agency is tightening its grip on DeFi. The 2025 filing season introduces:

- Mandatory reporting of crypto income on Form 1040 line 8b for the first time.

- New Schedule 13‑H‑D (DeFi) for high‑volume yield farmers (over $100,000 in annual rewards).

- Quarterly estimated‑tax deadlines: April 15, June 17, September 15, and January 15 of the following year.

While a formal “Yield Farming” rulebook is still in the works, the trend indicates future forms will require even more granular disclosures, such as the exact smart‑contract address that generated each reward.

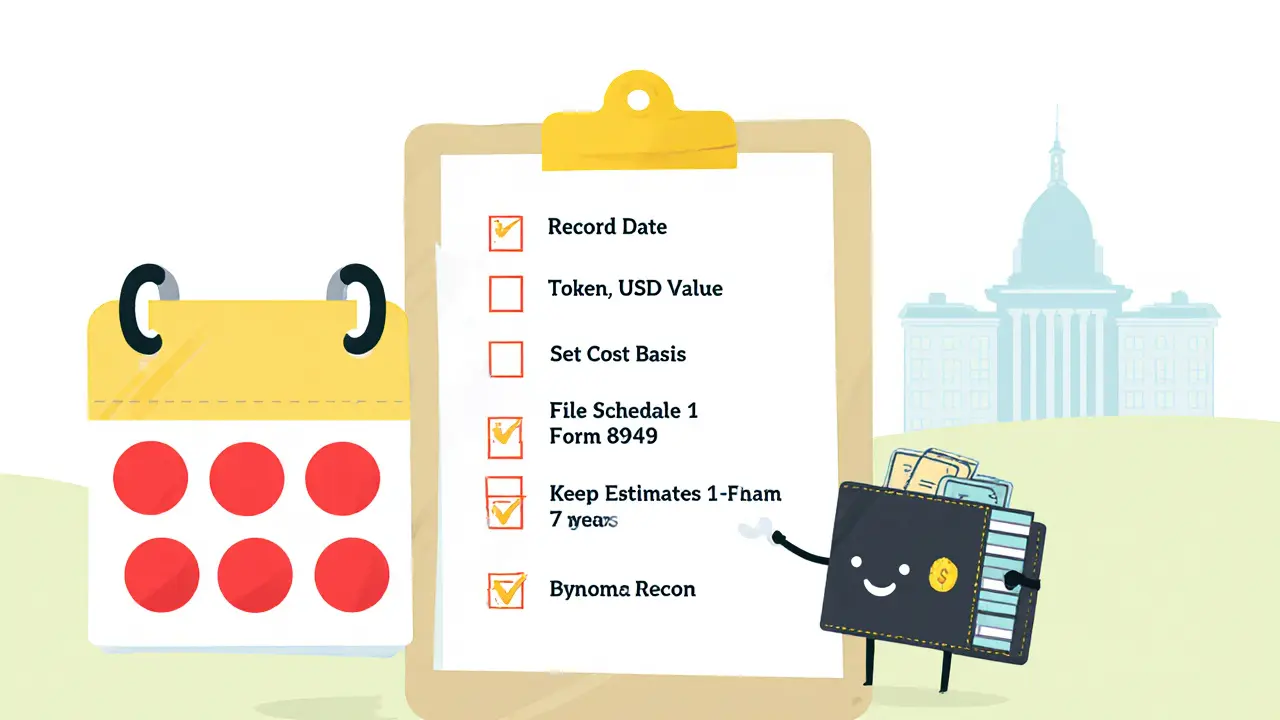

Quick Compliance Checklist

- Record the date, token name, amount, and USD FMV for every reward receipt.

- Set the FMV as the cost basis for future capital‑gain calculations.

- File ordinary‑income amounts on Schedule 1 (Additional Income) of Form 1040.

- Report disposals on Form 8949 and summarize on Schedule D.

- Pay estimated taxes if your projected liability exceeds $1,000.

- Keep backup logs (CSV files, screenshots, wallet addresses) for at least seven years.

Do I need to pay tax on a token I received but never sold?

Yes. The moment you receive a token as a farming reward, its fair market value counts as ordinary income, even if you hold it for years before selling.

Can I treat farming rewards as capital gains instead of income?

Generally no. The IRS classifies most reward tokens as ordinary income at receipt. Only the later sale can generate a capital gain or loss.

Which crypto‑tax software works best for DeFi?

Both CoinTracking and Koinly support DeFi integrations, automatic price pulls, and generate the necessary IRS forms.

What if a token has no market price when I receive it?

Use the average price from the most liquid pool where the token trades, or apply a reasonable approximation based on similar assets. Document your methodology.

Do I need to file Form 1040‑NR if I’m a non‑resident earning yield‑farm income?

Yes, any U.S.‑sourced crypto income triggers filing obligations. Consult a cross‑border tax specialist for the correct form.

Saurav Deshpande

October 25, 2025 AT 08:08they're telling you to report every tiny reward like it's your job... but what if the IRS is just using this to build a crypto surveillance database? i mean, they already know your wallet address, your IP, your coffee order. why not just track your entire digital life through DeFi? they call it 'tax compliance' but it's just phase 2 of the digital ID project. next they'll tax you for breathing in air that's been near a blockchain node.

Paul Lyman

October 25, 2025 AT 17:39yo y'all don't stress 😊 i've been farming since 2021 and i just use koinly + a google sheet. yeah it's a pain but you got this! even if you miss one reward, just file an amended return later - the IRS ain't gonna come knockin' for $12 in SUSHI. just keep it simple, track your dates, and remember: crypto tax is just grown-up math with extra steps. you got this, fam 💪

Frech Patz

October 25, 2025 AT 21:42While the article provides a generally accurate overview of IRS treatment of yield farming rewards, there is a notable omission regarding the application of Section 988 to foreign currency conversions involving stablecoins. If a user receives a reward in a non-USD-denominated stablecoin (e.g., DAI or USDC) and subsequently converts it to USD, the exchange rate differential at the time of conversion may trigger additional taxable events under IRC §988. This is not addressed in the current guidance, and practitioners should consider this nuance when calculating cost basis. Furthermore, the IRS has not yet clarified whether LP token receipt constitutes a constructive sale under §1001, which could impact the timing of recognition. Until further clarification, conservative reporting is advisable.

Derajanique Mckinney

October 26, 2025 AT 10:18ok but why tf do i have to pay tax on tokens i never cashed out?? 🤡 i just wanna chill and earn free coins not do my taxes like a corporate robot. also who even uses cointracking anymore?? i just screenshot my wallet and pray 🙏

Rosanna Gulisano

October 27, 2025 AT 00:33you're all missing the point. if you're earning income from DeFi you're already breaking the spirit of crypto. decentralization isn't about getting rich off interest. it's about freedom. and if you're filing forms and tracking FMV you're not a pioneer you're just another banker with a wallet

Sheetal Tolambe

October 27, 2025 AT 12:03thank you for this clear guide 🙏 i'm just starting out and was so confused about LP tokens. now i know to record the value when they land in my wallet - even if i don't touch them for months. i'm using koinly too and it's been a lifesaver. if anyone needs help organizing their logs i'm happy to share my template! we're all learning together 💛