What is Argo Finance (ARGO) crypto coin? The truth about liquid staking on Cronos

Jan, 16 2026

Jan, 16 2026

Argo Finance (ARGO) isn’t a coin you buy to get rich. It’s not even a coin most people trade. It’s a liquid staking protocol built on the Cronos blockchain - and its story is a cautionary tale about how good ideas can fail without real adoption.

What Argo Finance actually does

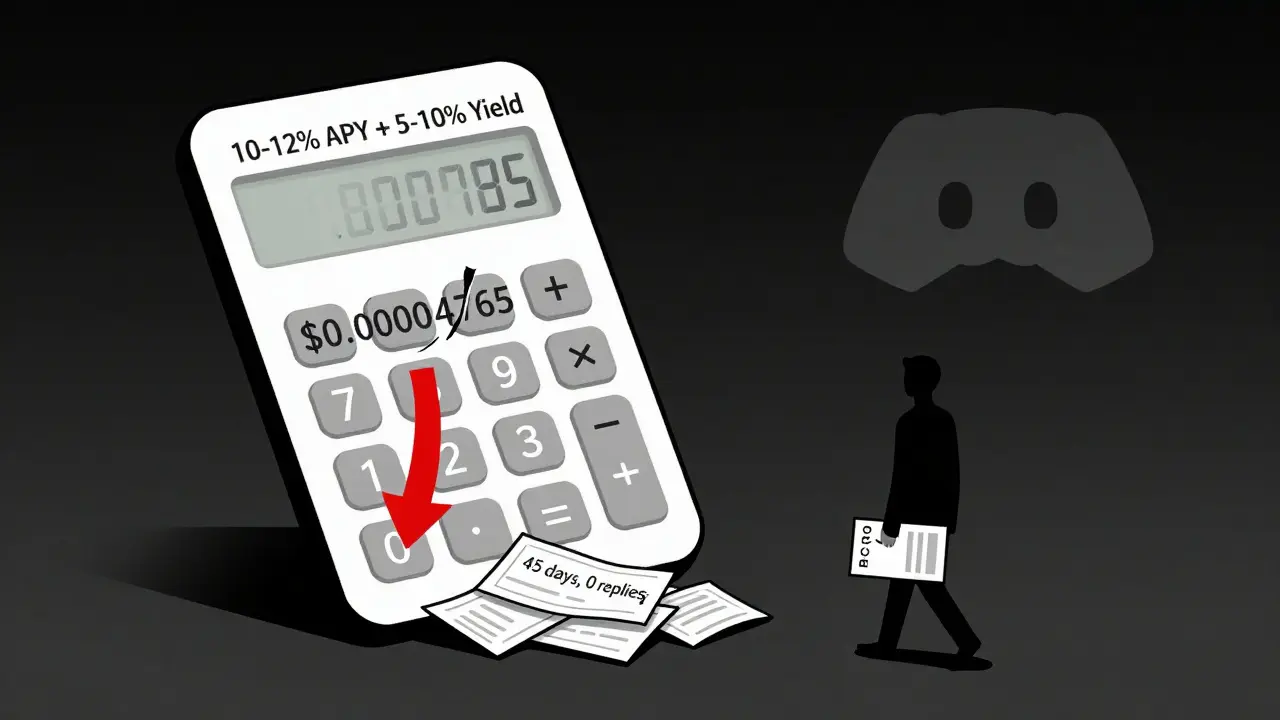

Argo Finance lets you stake your CRO (Crypto.com Coin) and get something called bCRO in return. Think of bCRO like a receipt. You lock up your CRO, and instead of waiting 28 days to get it back - which is the standard unstaking period on Crypto.com - you get bCRO instantly. And bCRO? You can use it like money. You can trade it on Cronos-based DeFi apps, lend it out, or put it into yield farms to earn even more crypto on top of your original staking rewards.The math sounds simple: earn 10-12% APY from staking CRO, then earn another 5-10% by using bCRO elsewhere. That’s called ‘double-dipping.’ And yes, it works - if you can actually use the bCRO without losing half your money to slippage or waiting days to trade it.

But here’s the catch: ARGO isn’t bCRO

This is where most people get confused. ARGO is the governance token of Argo Finance. It’s not used for staking. It’s not used for yield. It doesn’t represent your staked CRO. It’s meant to let holders vote on protocol changes. But here’s the reality: ARGO has no value.As of January 2026, ARGO trades at $0.00004765. That’s a 99.72% drop from its all-time high of $0.0340. The fully diluted market cap? Just $61,223. That’s less than the cost of a decent used laptop. And according to Coinbase, the circulating supply of ARGO is listed as zero. That means no one is trading it. No one wants it. It’s essentially dead.

Meanwhile, bCRO - the real utility token - is what people actually use. But even bCRO has problems. Liquidity is so thin that swapping $100 worth of bCRO back to CRO can cost you 15% in slippage. One user on Trustpilot lost $87 trying to exit their position. Another said it took three days to complete a simple swap because there were no buyers.

Why is Argo Finance still alive?

It’s not because people love it. It’s because it still works - barely.The protocol’s smart contracts are still running. People still stake CRO. The TVL (Total Value Locked) is $571,100 - all of it on Cronos. That’s tiny. For comparison, Lido on Ethereum holds $17.4 billion. Argo’s entire ecosystem is smaller than a single small DeFi pool on a major chain.

Why do people still use it? Because if you’re already holding CRO and you’re not planning to sell it, Argo gives you a way to earn more. It’s a niche tool for long-term CRO holders who don’t mind the friction. But even that’s fading. In mid-2025, Crypto.com introduced partial unstaking: you can now get 25% of your staked CRO back in just 7 days. That cuts the main reason people used Argo in the first place.

Who’s using it - and who’s not

The users left are a small group: long-term CRO holders, mostly from Crypto.com’s app, who don’t care about ARGO token value and just want to squeeze out extra yield. They’re not traders. They’re not speculators. They’re people who believe in Crypto.com’s ecosystem and want to maximize their returns without selling.Everyone else has left. The Argo Finance Discord has 1,247 members - down from 4,500 in 2024. Daily active users? Around 17. Their Telegram group has 1,842 people, but support responses take 18 hours - if they come at all. One user reported submitting three support tickets over 45 days and getting zero replies.

On Reddit, some users praise the one-click staking interface and the yield calculator. But the overwhelming majority of comments are about failed transactions, high gas fees, and confusing documentation. The UX isn’t broken - it’s just poorly designed. Staking CRO should take 2 minutes. On Argo, it takes 30 minutes because of unnecessary steps and unclear prompts.

Is Argo Finance safe?

The smart contracts have been audited - but no one knows by whom. No public audit reports are available. That’s a red flag. In DeFi, transparency isn’t optional. It’s the baseline.There’s no team behind the project. No LinkedIn profiles. No Twitter bios with real names. No GitHub commits from identifiable developers since late 2024. The entire project feels like a ghost town with a working engine.

And then there’s the regulatory risk. The SEC’s 2025 guidance on staking derivatives could classify bCRO as a security. If that happens, Argo Finance could be forced to shut down overnight - and users might lose access to their bCRO. No one knows if Crypto.com would step in to protect users. They haven’t said anything.

What’s the future of Argo Finance?

The most likely outcome? Crypto.com buys it - not to make ARGO valuable, but to fold the liquid staking tech into their own app. That’s happened before. It’s how most niche DeFi protocols die: quietly absorbed by bigger players who never announce the acquisition.That would mean ARGO becomes worthless. bCRO might be replaced by a new Crypto.com-native token. The whole thing gets rebranded. The Argo website disappears. The community vanishes.

The second possibility? It keeps limping along with a handful of users, slowly bleeding out until no one remembers it existed. That’s what happens to most crypto projects that don’t have real demand, strong governance, or a team willing to fight for their users.

Should you use Argo Finance?

Only if all these things are true:- You already hold CRO and plan to hold it for years

- You don’t need quick access to your staked coins

- You understand DeFi risks and can handle gas fees and slippage

- You’re okay with zero support and no transparency

- You’re not investing in ARGO - you’re just using bCRO to earn yield

If any of those are false - walk away. Don’t buy ARGO. Don’t stake CRO through Argo unless you’re prepared to lock it up for 90+ days just to break even on trading costs.

Argo Finance isn’t a crypto coin. It’s a fading utility tool for a shrinking ecosystem. Its value isn’t in the token. It’s in the function - and even that function is being replaced by the platform it was built to serve.

Is ARGO coin a good investment?

No. ARGO has no market value, no trading volume, and no utility beyond governance - which no one uses. Its price is effectively zero. Buying ARGO is like buying shares in a company that stopped operating. There’s no upside, only risk.

What’s the difference between ARGO and bCRO?

ARGO is the governance token - it lets you vote on protocol changes, but it has no real value. bCRO is the liquid staking token you receive when you stake CRO. You can trade, lend, or farm with bCRO to earn extra yield. Only bCRO has utility. ARGO is dead weight.

Can I unstake my CRO quickly using Argo Finance?

Not really. While Argo lets you get bCRO instantly, converting bCRO back to CRO is slow and expensive due to low liquidity. You might wait days and lose 10-15% in slippage. Crypto.com’s own partial unstaking feature (7 days for 25%) is now faster and cheaper for most users.

Is Argo Finance secure?

The smart contracts appear to work, but there’s no public audit report. No team is identified. No support responds to tickets. Security in DeFi isn’t just about code - it’s about transparency and accountability. Argo lacks both.

Why is the TVL so low if people are staking CRO?

Because most CRO stakers still use Crypto.com’s native staking. Argo only serves a small fraction - those who want to maximize yield and accept the friction. The $571K TVL is real, but it’s a drop in the ocean compared to the billions locked in Ethereum or Solana staking protocols.

Will ARGO ever recover?

Almost certainly not. The token is functionally dead. Even if Crypto.com integrates Argo’s tech, they’ll likely replace ARGO with their own token. Recovery would require a complete rebuild, new team, massive marketing, and ecosystem adoption - none of which are happening.