Zerogoki REI Token Airdrop Details - What You Need to Know (2025)

Dec, 5 2024

Dec, 5 2024

Zerogoki REI Airdrop Risk Calculator

Airdrop Risk Assessment Tool

Calculate potential costs, risks, and legitimacy of a Zerogoki REI token airdrop based on current Ethereum network conditions.

Airdrop Risk Assessment Results

Cost Analysis

Total Cost: ETH

Equivalent in USD (at $2,500/ETH):

Gas Fee (GWEI):

Risk Assessment

High Risk

Safety Checklist

Critical Warning

The Zerogoki REI token currently shows zero supply across all exchanges (CoinMarketCap, Binance, CoinGecko). Any claim of REI tokens is either theoretical or a scam. Never share private keys or send ETH to unknown addresses.

Every time a new crypto project whispers about an airdrop, you start wondering if it’s real or just hype. The buzz around the Zerogoki REI airdrop has been no different. Below is a plain‑talk walkthrough of what Zerogoki actually is, why its REI token still shows zero supply, and what (if anything) you can realistically expect from an airdrop.

What is Zerogoki and the REI token?

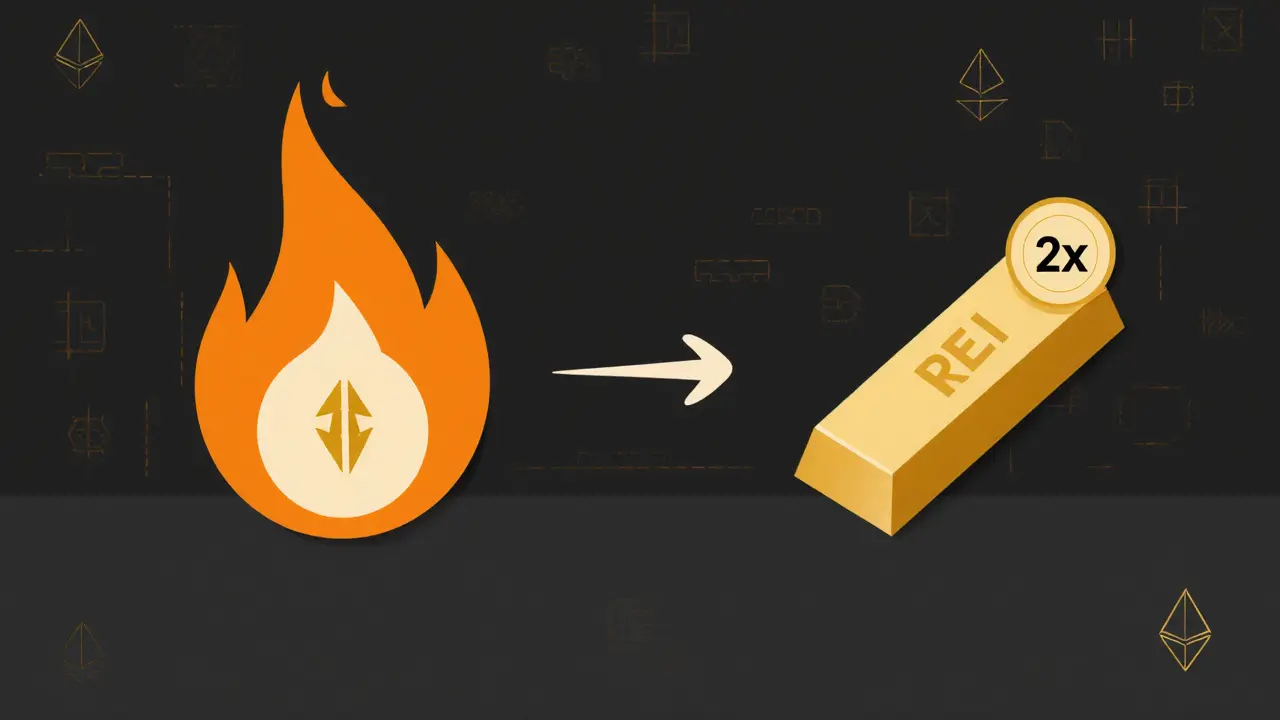

Zerogoki is an experimental protocol built on Ethereum that draws its name from the Japanese phrase “零号機” (zero‑model unit). The platform’s sole public token is the REI token - a nod to the Japanese pronunciation of the word “zero”. In Zerogoki’s design, REI acts as the fuel for mint‑and‑burn operations that generate synthetic leveraged assets.

Unlike many launch‑and‑run projects, Zerogoki positions itself as a stress‑test for its parent system, the Duet Protocol. The idea is to push Ethereum’s expensive gas fees and slow block times to the limit and see if the underlying algorithm can still keep a peg.

Current status - why the token shows zero supply

Data from major aggregators (CoinMarketCap, Binance, CoinGecko) all report a price of $0, a 24‑hour volume of $0, and a total and circulating supply of 0 REI. Those numbers tell a clear story: the token has never been minted for public trading.

There are three plausible reasons for this:

- Pre‑launch phase: The team may still be fine‑tuning the mint‑burn logic before any distribution.

- Paused development: Funding or technical hurdles could have halted progress, leaving the project in limbo.

- Alternative distribution model: Some experimental protocols keep the token entirely off‑chain until a certain test milestone is reached.

Because no REI tokens have ever entered circulation, any airdrop claim would have to start from a snapshot of a non‑existent balance - which is, frankly, impossible under the current conditions.

How the REI token works: technical architecture

The core mechanic revolves around an algorithmic peg that lets users destroy REI to mint synthetic assets, most of which are high‑volatility leveraged tokens. Here’s a quick rundown:

- Burn REI: Users send REI to a smart contract that locks (burns) the tokens.

- Mint synthetic asset: The contract mints a corresponding amount of a synthetic token, such as a leveraged version of gold or a foreign‑exchange pair.

- Leverage module: The synthetic token is tied to a leverage multiplier (e.g., 2x, 3x) that amplifies price movements.

The protocol also offers a native synthetic stablecoin called zUSD. Users can swap zUSD for leveraged assets without destroying REI, but the REI‑burn path remains the primary method for creating high‑risk test cases.

Because the whole system lives on Ethereum’s mainnet, each burn‑mint cycle costs a considerable amount in gas fees. That cost is intentional - it forces the developers to optimize the algorithm under real‑world pressure.

Airdrop rumors - what the data actually shows

Search results from October 2025 contain zero concrete details about an REI airdrop. No official announcement, no snapshot date, no eligibility criteria. The only “airdrop” mentions appear in speculative blog posts that simply copy‑paste the word “airdrop” to attract clicks.

Here’s what you can verify right now:

- No token balance on any wallet explorer - all address balances for REI read “0”.

- No pending transactions on Etherscan related to airdrop contracts.

- No community posts on Reddit, Telegram, or Discord that detail a claim process.

In short, the airdrop is either a future plan that hasn’t been announced, or it’s a myth spun to generate noise.

Risks and red flags for potential participants

If you’re tempted to chase a possible REI airdrop, keep these warnings in mind:

- Zero liquidity: A token with no market cannot be sold or swapped, meaning any airdropped tokens would be essentially worthless until a market is created.

- High gas costs: Claiming an airdrop on Ethereum can cost $30‑$80 in gas alone, which could exceed the value of any future tokens.

- Scam potential: Fake “claim” websites often ask for private keys or require you to send ETH to a “verification” address. Never share your seed phrase.

- Project abandonment: The fact that REI shows zero supply after two years suggests the team may have shifted focus or halted development.

How to verify a legitimate airdrop and protect yourself

When an authentic airdrop does happen, the process usually follows a predictable pattern. Use this checklist before you click anything:

- Official source: Check the project’s verified Twitter, GitHub, or blog for an announcement. Look for a link that ends in the platform’s official domain.

- Snapshot details: A real airdrop will publish a snapshot block number and the eligibility criteria (e.g., holding a certain token amount on a specific date).

- Claim contract address: The announcement should provide a read‑only contract address on Etherscan. Verify the contract’s source code and see if it has been audited.

- No private keys: Never be asked to input a private key, seed phrase, or to sign a transaction that transfers funds out of your wallet.

- Gas estimation: Use a gas estimator (e.g., ethgasstation.info) to see if the claim cost is reasonable compared to the token’s market price.

If any of these steps raise doubts, walk away.

Bottom line - should you wait for a Zerogoki REI airdrop?

Based on the current data, the odds are slim. The token hasn’t been minted, no official airdrop roadmap exists, and the project’s public footprint is minimal. If you’re a crypto enthusiast looking for experimental tech, you might subscribe to Zerogoki’s developer channel for future updates. But if you’re chasing free tokens, there are far better opportunities with projects that already have active communities and transparent airdrop schedules.

In short, treat the Zerogoki REI airdrop as a rumor until a verifiable announcement lands on an official channel. Until then, keep your funds in wallets you control and avoid any site that asks for private keys.

Quick comparison with similar tokens

| Feature | REI (Zerogoki) | REI Network | Typical Airdrop Token |

|---|---|---|---|

| Launch status (Oct 2025) | Pre‑launch, zero supply | Live, circulating supply 10 M+ | Live, circulating supply varies |

| Primary chain | Ethereum | Binance Smart Chain | Ethereum, BSC, Solana, etc. |

| Airdrop history | No confirmed airdrop | Multiple airdrops since 2022 | Often a single launch‑phase airdrop |

| Use case | Stress‑test leveraged synthetic assets | Staking rewards, fast TPS | Community incentives, marketing |

| Risk level | Very high (inactive, experimental) | Medium (established ecosystem) | Variable (depends on project) |

Frequently Asked Questions

Is there an official REI token airdrop scheduled for 2025?

No. As of October 2025, Zerogoki has not published any official airdrop announcement, snapshot date, or claim procedure.

Why does the REI token show a $0 price on exchanges?

Because there is no circulating supply. Without any minted tokens, exchanges cannot list a price.

Can I claim REI tokens by sending ETH to a contract?

No legitimate claim method exists. Any site requesting ETH to “unlock” REI is a scam.

What is the relationship between Zerogoki and Duet Protocol?

Zerogoki is a stripped‑down testbed that uses only the Lite‑minting module of Duet Protocol to evaluate how leveraged token minting behaves under high gas fees.

Should I keep an eye on Zerogoki for future opportunities?

If you enjoy experimental DeFi research, monitoring Zerogoki’s developer updates could be interesting. For most investors seeking real returns, focus elsewhere until a verifiable airdrop is announced.

Derajanique Mckinney

October 25, 2025 AT 18:31Sheetal Tolambe

October 26, 2025 AT 13:58Pranav Shimpi

October 27, 2025 AT 13:44Will Barnwell

October 27, 2025 AT 22:37Henry Gómez Lascarro

October 28, 2025 AT 19:39Herbert Ruiz

October 29, 2025 AT 05:00james mason

October 30, 2025 AT 02:05gurmukh bhambra

October 30, 2025 AT 23:47Saurav Deshpande

October 31, 2025 AT 22:06Kirsten McCallum

November 1, 2025 AT 16:53Paul Lyman

November 1, 2025 AT 23:37Anna Mitchell

November 2, 2025 AT 21:57jummy santh

November 3, 2025 AT 13:14Rosanna Gulisano

November 4, 2025 AT 07:00Sunny Kashyap

November 4, 2025 AT 20:36Wayne Overton

November 4, 2025 AT 22:40