1% TDS on Crypto Transactions in India: What You Need to Know in 2025

Dec, 5 2025

Dec, 5 2025

Crypto TDS Calculator

Calculate Your TDS

TDS Deduction

Transaction Value: INR 0.00

TDS Rate: 1%

TDS Amount: INR 0.00

Threshold Status:

When you buy, sell, or trade crypto in India, a 1% tax is automatically taken out before you even see your money. It’s not a capital gains tax. It’s not a fee. It’s TDS - Tax Deducted at Source. And if you’re trading crypto in India, this rule affects you directly, whether you like it or not.

What exactly is 1% TDS on crypto?

The 1% TDS rule came into effect on July 1, 2022, under Section 194S of the Income Tax Act. It means that every time you transfer a cryptocurrency - whether you’re selling Bitcoin for INR, swapping Ethereum for Solana, or even spending Dogecoin to buy something - 1% of the transaction value is withheld by the exchange or platform and sent to the government as tax.

This isn’t the final tax you owe. It’s a prepayment. Think of it like when your employer withholds income tax from your salary. You get credit for it later when you file your return. But unlike salary, there’s no refund if you didn’t make a profit. Even if you lost money on the trade, the 1% is still taken.

Who pays it, and when?

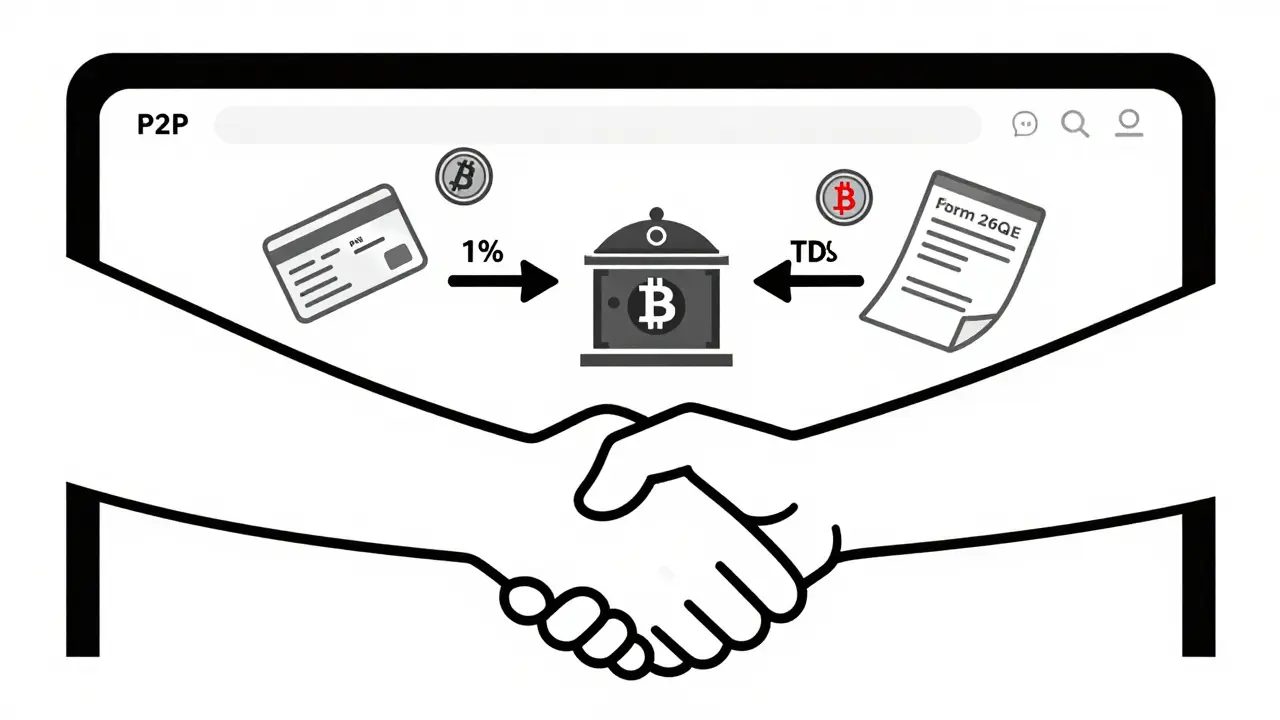

If you trade on Indian exchanges like CoinDCX, WazirX, or ZebPay, you don’t have to do anything. The platform automatically deducts the 1% at the time of the transaction. But if you’re using a peer-to-peer (P2P) platform or an international exchange like Binance, the responsibility shifts to you.

In P2P trades, the buyer must deduct 1% from the payment and deposit it with the government. They also need the seller’s PAN number and must file Form 26QE every month. That’s a lot of paperwork for someone just trying to buy a little Bitcoin.

And here’s the catch: if you’re trading crypto for crypto - say, BTC for ETH - both sides pay 1% TDS. So on a ₹50,000 trade, ₹500 is taken from the buyer, ₹500 from the seller. That’s ₹1,000 gone before either party even sees their new coins.

Thresholds: ₹10,000 vs ₹50,000

Not everyone is hit the same way. There are two different thresholds based on your tax status.

- If you’re a regular individual or HUF (Hindu Undivided Family) who doesn’t need to get audited every year, TDS only applies if your total crypto transactions in a financial year exceed ₹50,000.

- If you’re a business, company, or someone who’s already under tax audit, the threshold drops to just ₹10,000.

That means a salaried person trading casually might not hit the limit. But if you’re active - even just buying ₹10,000 worth of crypto every month - you’ll hit the ₹10,000 threshold in your first month. And that’s when TDS kicks in.

What counts as a transaction?

Not everything is taxed. Transferring crypto from your wallet to another wallet you own - say, from Coinbase to Trust Wallet - doesn’t trigger TDS. It’s not a transfer of ownership, just a move.

But if you sell, swap, spend, or gift it? That’s a transfer. And TDS applies. Even buying NFTs with crypto counts. So does using crypto to pay for a service. The rule is broad by design: the government wants to track every movement.

What about crypto-to-crypto trades?

This is where things get messy. In most countries, swapping one crypto for another is a taxable event, but not always tracked at the point of trade. In India, it’s tracked - and taxed - right then and there.

And because both parties pay 1%, a single swap ends up costing 2% of the total value. A ₹1 lakh trade means ₹2,000 disappears in TDS. That’s not just tax - it’s a liquidity drain. Day traders doing 50 swaps a month could lose ₹50,000 a year just in TDS, even if they break even overall.

What’s the bigger tax picture?

TDS is just one part of India’s crypto tax system. On top of it, you pay 30% on any profit you make, plus a 4% health and education cess. And losses? You can’t offset them against other income. So if you lose ₹2 lakh on Bitcoin but make ₹1.5 lakh on altcoins, you still pay 30% on the ₹1.5 lakh. No relief.

And starting July 1, 2025, Indian exchanges now also charge 18% GST on their service fees. So if you trade ₹2.5 lakh worth of crypto and pay a ₹1,000 fee, you’re hit with:

- ₹2,500 TDS (1% of ₹2.5 lakh)

- ₹180 GST (18% of ₹1,000 fee)

That’s ₹2,680 gone before you even see your coins. And you still owe 30% tax on any profit later.

Real-world impact: Who’s being hurt?

According to a 2025 survey by ClearTax, 63% of salaried Indians stopped trading crypto after TDS was introduced. Why? They didn’t realize how fast the ₹50,000 limit adds up. One person told me they bought ₹10,000 of Bitcoin every month. By June, they’d already hit the limit - and had TDS deducted on every single transaction since July.

Active traders are finding workarounds. Some split trades into smaller chunks under ₹10,000. Others use foreign exchanges - but that brings legal risk. And many are just quitting.

Industry data shows India’s crypto user base dropped from 15 million in 2022 to 10.2 million in 2023. It’s bounced back to 11.7 million in 2025, but growth has flatlined. Compare that to the U.S. or Singapore, where crypto adoption keeps rising. India’s tax structure is a major reason why.

Compliance headaches

Even when people try to follow the rules, it’s hard.

Form 26AS - the official tax statement that shows your TDS deductions - often lags by 30 to 90 days. People file returns thinking they’ve paid enough, only to find the TDS hasn’t reflected yet. That triggers notices from the tax department.

Some exchanges made mistakes too. CoinSwitch Kuber had a glitch in late 2023 that applied double TDS to over 15,000 transactions. Users had to wait months for refunds.

And if you didn’t file your income tax return for two years in a row and had over ₹50,000 in TDS deducted? The penalty kicks in: your TDS rate jumps from 1% to 5%.

What’s next?

The government is watching. The Central Board of Direct Taxes (CBDT) has signaled it may raise the individual threshold from ₹50,000 to ₹1,00,000 in the 2025-26 budget. That’s a direct response to pressure from traders and industry groups.

There’s also talk of a new Digital Asset Bill in 2026 that could replace TDS with a centralized registry - like a blockchain ledger tied to Aadhaar. That would make tracking easier for the government, but even more invasive for users.

Meanwhile, the Reserve Bank of India has noticed a 37% rise in P2P trades under the ₹50,000 limit. People are moving off exchanges to avoid TDS. That’s exactly what the rule was meant to stop.

What should you do?

If you trade on Indian platforms: you’re already covered. Just check your Form 26AS every quarter. Make sure the TDS amounts match your trades.

If you use P2P or foreign exchanges: you’re on your own. Keep detailed records - timestamps, wallet addresses, PAN numbers, transaction IDs. File Form 26QE every month. Don’t wait until March.

If you’re thinking of starting: understand the cost. Every trade costs you 1% upfront. Add in GST on fees. Add in 30% on profits. You’re not just buying crypto - you’re paying a tax bill before you even hold it.

There’s no way around TDS if you’re trading in India. But you can manage it. Track everything. Know your threshold. Don’t assume the exchange has it right. And don’t ignore Form 26AS - it’s your proof you paid.

Common mistakes

- Thinking the ₹50,000 limit is per transaction - it’s annual.

- Believing TDS is your final tax - it’s not. You still owe 30% on gains.

- Ignoring crypto-to-crypto swaps - they trigger TDS on both sides.

- Not saving PAN details from P2P sellers - without it, you can’t file Form 26QE.

- Waiting for Form 26AS to update before filing returns - it often takes months.

Is 1% TDS the same as capital gains tax on crypto in India?

No. TDS is a 1% deduction taken at the time of every crypto transfer, regardless of profit or loss. Capital gains tax is a separate 30% tax you pay on any profit you make from selling or trading crypto. You pay both - TDS upfront, and capital gains later when you file your return.

Do I pay TDS if I transfer crypto between my own wallets?

No. Transferring crypto from one wallet you own to another - like from CoinDCX to Trust Wallet - is not considered a transfer of ownership. TDS only applies when you sell, swap, spend, or gift crypto to someone else.

What happens if I don’t pay TDS on a P2P trade?

If you’re the buyer in a P2P trade and you don’t deduct and deposit the 1% TDS, you’re liable for the unpaid tax, plus penalties and interest. The tax department can trace transactions through blockchain records. You may also face a 5% TDS rate in the future if you’ve failed to file returns in the past two years.

Can I claim a refund if I lost money on crypto trades?

You can’t get the TDS amount back as a refund. But when you file your income tax return, you can claim credit for the TDS already paid. If your total tax liability is less than the TDS amount, you may get a refund of the difference. But remember: you can’t offset crypto losses against other income, so your overall tax bill might still be high.

Why is TDS applied to crypto-to-crypto trades?

India treats every crypto swap as a taxable event. Unlike some countries that only tax crypto-to-fiat conversions, India’s rule applies to any change in ownership - even if you’re just swapping one coin for another. This ensures the government tracks all activity, not just cash-outs.

What if I trade on Binance or Coinbase?

Foreign exchanges don’t deduct Indian TDS. But if you’re an Indian resident, you’re still legally required to self-report and pay TDS on your trades. You’ll need to calculate 1% of each transaction, file Form 26QE, and pay it manually. Failure to do so can lead to penalties and notices from the tax department.

Does GST apply to crypto transactions too?

Yes. Since July 1, 2025, Indian crypto exchanges charge 18% GST on their service fees - like trading fees, withdrawal fees, or conversion charges. This is separate from TDS. So if you pay a ₹1,000 fee to trade, you pay ₹180 in GST on top of the 1% TDS on the trade value.

Will the TDS threshold change in 2025?

There are strong indications the government will raise the individual threshold from ₹50,000 to ₹1,00,000 in the 2025-26 budget. This follows pressure from traders and industry groups. But until it’s officially announced, the current ₹50,000 limit still applies.

Final thoughts

The 1% TDS rule wasn’t designed to punish traders. It was designed to track them. And it’s working - the government collected ₹1,852 crore in TDS during FY 2023-24, far above projections. But the cost isn’t just financial. It’s psychological. It’s slowing adoption. It’s pushing people underground. And it’s making India look less like a crypto hub and more like a tax trap.

If you’re still trading, you’re not alone. But you need to be smarter than ever. Track every transaction. Know your limits. Understand the rules. And don’t assume the platform has your back.