China Crypto Mining Laws & Restrictions 2025

Sep, 22 2025

Sep, 22 2025

Global Mining Hash Rate Distribution Calculator

China Crypto Mining Ban Impact Calculator

Visualize how the 2025 Chinese crypto mining ban reshaped global Bitcoin hash rate distribution.

The 2025 ban caused a dramatic shift in global mining power. China went from controlling over 65% of hash rate to just 5-7% within months.

When the Chinese government rolled out its China crypto mining law in May 2025, the world felt the tremor: Bitcoin slid over $6,000 in hours, and dozens of mining farms vanished overnight. If you’re wondering how the ban works, why it matters, and what it means for miners everywhere, keep reading. This guide walks you through the legal timeline, enforcement tactics, the government’s motivations, and the ripple effects that still echo across the global crypto landscape.

Legal Timeline: From Caution to Criminalization

China’s stance on digital assets didn’t start with a ban. The evolution looks like a series of tightening screws:

- 2013: Banks prohibited from handling Bitcoin transactions - the first financial choke point.

- 2017: Initial Coin Offerings (ICOs public token sales that raise funds without a traditional intermediary) were outlawed and domestic exchanges shut down.

- 2019: Crackdowns on large mining farms began, forcing many operators overseas.

- 2021: The People's Bank of China China's central bank and chief financial regulator declared all crypto transactions illegal and banned mining nationwide.

- 2022‑2023: Legal interpretations denied civil claims related to crypto, while blockchain projects were allowed only under strict government oversight.

- 2024: Systematic arrests and asset seizures intensified, signaling a shift from administrative penalties to criminal enforcement.

- May 31, 2025: A comprehensive ban made mining, trading, and ownership a criminal offense - the final piece of the puzzle.

This progression shows a clear policy trajectory: from limiting financial exposure to eradicating any decentralized competition to the state‑backed digital yuan.

Current Legal Status (October 2025)

As of today, Cryptocurrency mining in China the extraction of digital assets using computational power, now prohibited by law is a criminal act. The 2025 framework criminalizes:

- Any form of crypto mining, regardless of scale.

- Trading, selling, or purchasing digital assets.

- Holding or transferring cryptocurrencies for personal use.

Violators face penalties ranging from hefty fines to up to three years in prison, depending on the scale and intent of the offense.

Why the Ban? Four Pillars Behind the Policy

Chinese officials cite four overlapping reasons:

- Energy consumption: Bitcoin mining alone can consume more electricity than entire provinces, clashing with China’s pledge to achieve carbon neutrality by 2060.

- Financial control: Decentralized currencies sidestep the central bank’s monetary policy, creating systemic risk and potential capital flight.

- Illicit activity: Cryptocurrencies have been linked to money laundering, fraud, and sanctions evasion, prompting a security crackdown.

- Digital yuan promotion: The state‑backed digital yuan also known as e‑CNY, China’s sovereign digital currency needs a clear, competition‑free environment to gain user trust.

Enforcement Mechanisms: How Authorities Shut Down Mining

Multiple agencies work in concert to detect and dismantle illicit operations:

- People's Bank of China: Monitors banking channels, freezes accounts linked to crypto transactions.

- State Administration of Foreign Exchange: Tracks cross‑border crypto flows and flags suspicious currency conversions.

- Cyberspace Administration: Scans internet traffic for mining software signatures and suspicious wallet activity.

- Ministry of Industry: Oversees hardware imports, ensuring ASIC miners can’t enter the supply chain unnoticed.

- Electricity grid monitoring: Sudden spikes in power usage trigger investigations; many farms were caught via regional utility data.

These layers create a net that catches everything from large industrial farms to tiny covert setups hidden in basements.

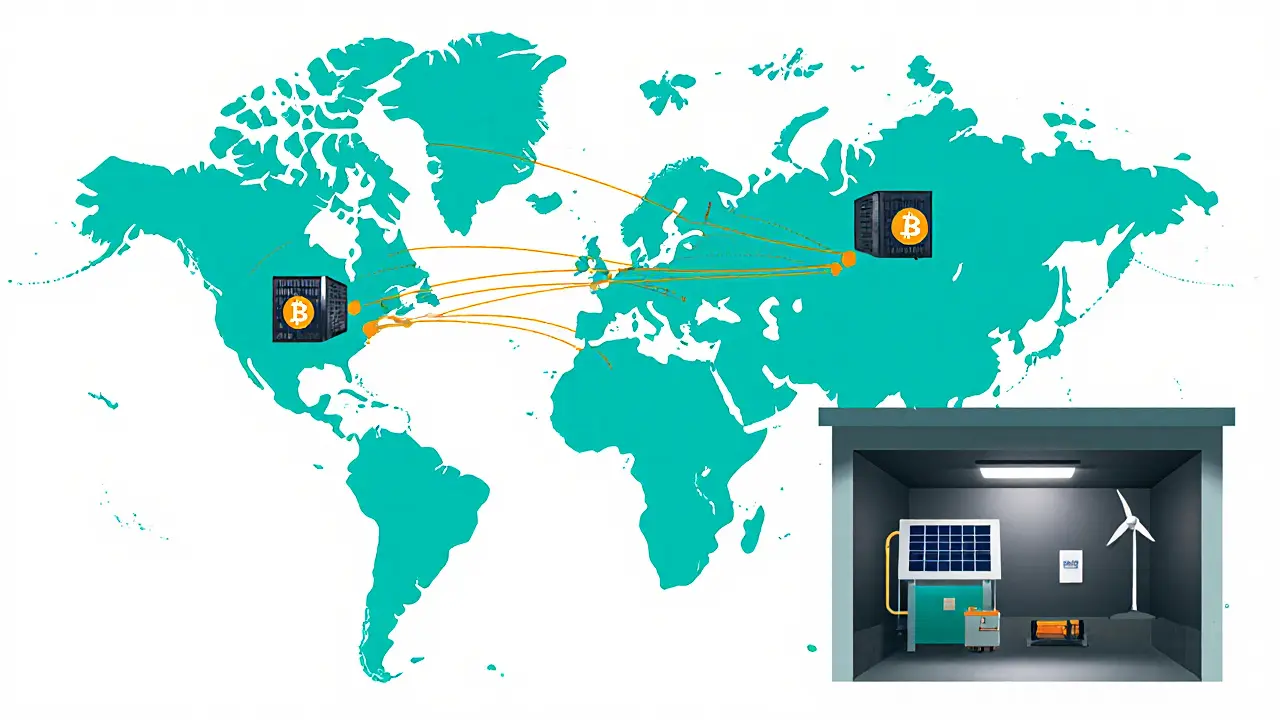

Global Ripple Effects

China once accounted for over 60% of the world’s Bitcoin hashrate. After the 2025 ban, the hash power reshuffled to:

- United States (especially Texas and Wyoming)

- Canada’s Quebec and Alberta provinces

- Kazakhstan’s cheap coal‑powered farms

- Norway and Iceland, leveraging renewable energy

The immediate market impact was stark: Bitcoin slipped from $111,000 to $104,500, Ethereum fell roughly 8%, and the total crypto market cap dropped over 10% in a single day. Longer‑term, the redistribution led to:

- Increased decentralization of hash power, improving network resilience.

- Higher hardware efficiency drives, as miners seek lower electricity costs.

- New regional clusters of mining jobs, especially in North America and Central Asia.

Underground Mining: The Shadow Market

Despite the crackdown, some operators keep a low‑profile presence. These setups typically:

- Hide in residential or industrial spaces with fragmented power draws.

- Use off‑grid renewable sources, like rooftop solar paired with battery storage.

- Employ VPNs and encrypted communications to evade cyberspace monitoring.

Studies from early 2025 estimate that China still contributes roughly 5‑7% of global hashrate via these covert farms. However, the risk profile is high: arrests have risen by 40% YoY, and penalties now include asset seizure of mining equipment.

Future Outlook: No Light at the End of the Tunnel

All signs point to a continued hard‑line approach. The digital yuan roadmap is advancing, with pilot programs in Shenzhen and Chengdu slated for wide rollout in 2026. As the state tightens its grip, we can expect:

- More sophisticated AI‑driven detection of abnormal electricity consumption.

- Higher fines and longer prison terms for repeat offenders.

- Collaborative enforcement with neighboring jurisdictions to curb cross‑border hardware smuggling.

For miners outside China, the lesson is clear: regulatory risk can wipe out entire operations overnight. Diversifying locations, using renewable energy, and staying compliant with local law are now survival tactics.

Quick Reference Checklist

- Mining in China = illegal (criminal offense).

- Key enforcing bodies: People's Bank of China, State Administration of Foreign Exchange, Cyberspace Administration, Ministry of Industry.

- Primary motivations: energy use, financial control, illicit activity, digital yuan promotion.

- Global hash power shifted to US, Canada, Kazakhstan, Norway, Iceland.

- Underground farms still exist but face steep penalties.

Frequently Asked Questions

Is it still possible to mine Bitcoin in China secretly?

A few small‑scale farms hide in residential basements or use off‑grid solar setups, but they risk arrest, equipment seizure, and prison sentences. The probability of detection has risen sharply due to electricity‑usage analytics.

What penalties do offenders face?

Penalties range from fines up to 5 million RMB to imprisonment for up to three years, depending on the scale and whether the activity involved cross‑border capital flows.

How did the 2025 ban affect Bitcoin’s price?

Within 24 hours of the May 31 announcement, Bitcoin dropped from about $111,000 to $104,500, wiping out roughly $750 million in long positions.

Will the ban ever be lifted?

All indicators - policy statements, ongoing enforcement, and the push for the digital yuan - suggest the ban will remain in place for the foreseeable future.

What’s the best way for miners to protect themselves from sudden regulatory shocks?

Diversify operations across jurisdictions with clear regulatory frameworks, invest in renewable‑energy‑friendly hardware, and maintain legal counsel to monitor policy changes.

Regulatory Timeline Table

| Year | Regulatory Action | Impact on Mining |

|---|---|---|

| 2013 | Banks barred from processing Bitcoin payments. | Early financial isolation of miners. |

| 2017 | ICOs banned; exchanges shut down. | Reduced liquidity, pressure on mining profits. |

| 2019 | Crackdown on large mining farms. | First wave of farm relocations abroad. |

| 2021 | People’s Bank of China declares all crypto transactions illegal; nationwide mining ban. | Majority of hash power forced out of China. |

| 2024 | Systematic arrests; asset seizures. | Underground operations become riskier. |

| 2025 | Comprehensive criminal ban on mining, trading, ownership. | Any mining activity now a criminal offence. |

Understanding the regulatory landscape is crucial for anyone involved in crypto, whether you’re a miner, investor, or policy watcher. The Chinese crackdown reshaped the industry, and its aftershocks will be felt for years to come.

Clarice Coelho Marlière Arruda

October 25, 2025 AT 21:28Brian Collett

October 26, 2025 AT 11:15Allison Andrews

October 26, 2025 AT 14:22Wayne Overton

October 27, 2025 AT 02:55Alisa Rosner

October 27, 2025 AT 08:17MICHELLE SANTOYO

October 27, 2025 AT 18:56Lena Novikova

October 28, 2025 AT 16:33Olav Hans-Ols

October 29, 2025 AT 12:40Kevin Johnston

October 29, 2025 AT 13:13Dr. Monica Ellis-Blied

October 29, 2025 AT 16:22Herbert Ruiz

October 30, 2025 AT 12:01Saurav Deshpande

October 31, 2025 AT 06:51Paul Lyman

October 31, 2025 AT 13:55Frech Patz

November 1, 2025 AT 11:53Derajanique Mckinney

November 2, 2025 AT 10:37Rosanna Gulisano

November 3, 2025 AT 05:31Sheetal Tolambe

November 3, 2025 AT 22:34gurmukh bhambra

November 4, 2025 AT 11:15Sunny Kashyap

November 5, 2025 AT 03:40Brian Collett

November 5, 2025 AT 17:25