Coinavenir Crypto Exchange Review 2025 - In‑Depth Look at Features, Security & Fees

Oct, 25 2025

Oct, 25 2025

Coinavenir Fee Calculator

Calculate Your Trading Fees

Estimate fees for Coinavenir's perpetual futures trading based on industry-standard fee structures. Note: Actual fees may vary depending on market conditions and Coinavenir's current fee schedule.

Enter your trade details to see estimated fees

Coinavenir Fee Comparison

Key Takeaways

- Coinavenir focuses almost exclusively on perpetual futures and derivatives, making it a niche player.

- Liquidity is hard to verify - CoinMarketCap lists the platform as ‘untracked’ and provides no reserve data.

- Security claims rely on automated cold‑storage transfers, but no third‑party audit or insurance details are public.

- KYC is mandatory for every user, which adds friction for privacy‑focused traders.

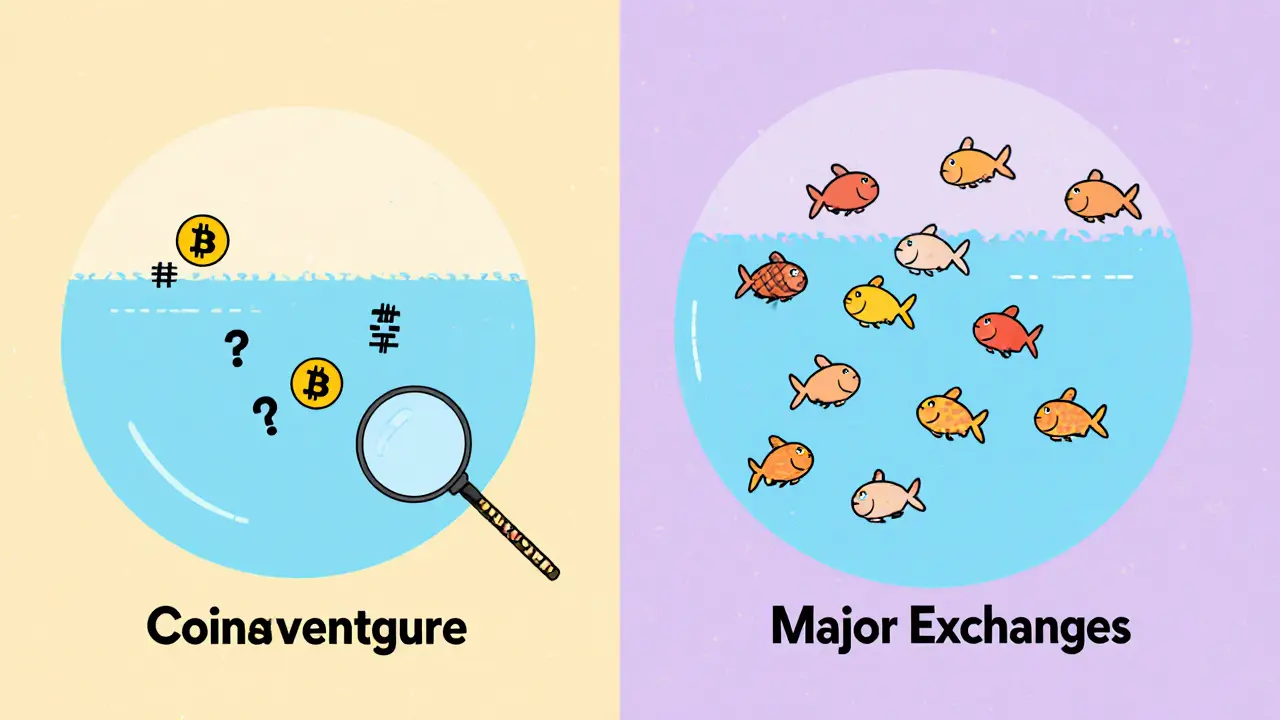

- Compared with major rivals, Coinavenir offers simpler UI for beginners but lacks the depth, liquidity and transparency of larger exchanges.

When you hear the name Coinavenir is a global cryptocurrency exchange launched in September 2023 that markets itself as a beginner‑friendly platform for perpetual futures. The company spreads its headquarters across Vietnam, Taiwan, Indonesia, Saint Vincent and Singapore, a structure aimed at navigating the patchwork of crypto regulations worldwide. Its tagline, "to spread the fire further up to the most calm," hints at a focus on users who aren’t finance experts. In practice, that promise translates into a stripped‑down UI, limited coin selection and a heavy emphasis on derivatives trading.

What is Coinavenir?

Coinavenir’s core product is a derivatives trading engine that lets users trade perpetual contracts on a handful of major cryptocurrencies. Unlike full‑service exchanges that list hundreds of spot pairs, Coinavenir offers only a curated set of futures contracts - currently Bitcoin, Ethereum, Ripple and Litecoin. The platform’s documentation describes these contracts as “not the most technical or most coins,” positioning itself as a simpler alternative to more complex venues like Binance or ByBit.

Platform Features & User Experience

The dashboard is clean, with a dark theme and large chart windows that default to the 1‑hour timeframe. Navigation is limited to three main tabs: Trade, Balance and Support. This minimalism can be a blessing for newcomers but may frustrate experienced traders who expect advanced order types, adjustable leverage sliders or custom UI layouts.

On‑boarding requires a full KYC check before any deposit or withdrawal can be made. The verification process typically takes 15‑30 minutes, during which users upload a government ID, selfie and proof of address. There is no “basic” tier that lets you trade without ID, unlike some competitors that allow low‑volume trades with a minimal verification step.

Security & Custody

Coinavenir claims to move every deposited asset straight into cold storage, with only a small portion shifted to hot wallets for immediate withdrawals. The description on the exchange reads: Cold storage automatically receives all incoming assets, while hot wallets hold just enough funds for short‑term withdrawals. The company does not publish any third‑party audit reports, nor does it disclose insurance coverage for potential hacks. By contrast, Coinbase stores about 98% of user funds in cold wallets and carries up to $400 million in hacking insurance.

Given the 2025 wave of exchange hacks - the ByBit breach that cost $1.5 billion (AIInvest.com, Sept 2025) - the lack of verifiable security audits is a notable red flag.

Fees & Costs

Coinavenir does not publish a detailed fee schedule on its public site. Industry averages for derivatives platforms in Q3 2023 place maker fees between 0.02 % and 0.06 % and taker fees between 0.05 % and 0.1 %. In the absence of official numbers, users should assume fees fall within that range, but the uncertainty adds another layer of risk.

Liquidity & Transparency

The biggest hurdle for prospective traders is the “untracked” status on CoinMarketCap lists Coinavenir without verifiable trading volume or reserve data. Without on‑chain proof‑of‑reserves, users cannot independently confirm that the exchange holds enough assets to meet withdrawal demands. Competing platforms such as Kraken publishes regular proof‑of‑reserves reports audited by Mazars offer a clearer safety net.

How Does Coinavenir Stack Up?

| Exchange | Founded | Derivatives Offered | Typical Maker Fee | Typical Taker Fee | Cold‑Storage % | KYC Required | Transparency Rating |

|---|---|---|---|---|---|---|---|

| Coinavenir | 2023 | Perpetual futures (BTC, ETH, XRP, LTC) | 0.02‑0.06 % | 0.05‑0.10 % | ~100 % (cold‑only claim) | Mandatory | Low - untracked volume, no reserve data |

| Binance | 2017 | Futures, options, perpetual swaps | 0.02 % | 0.04 % | ~80 % | Optional (basic tier) | High - public volume, regular audits |

| ByBit | 2018 | Futures, perpetual contracts | 0.025 % | 0.075 % | ~90 % | Optional (tiered) | Medium - disclosed volume, no public reserve reports |

| Coinbase | 2012 | Futures (via Coinbase Advanced) | 0.03 % | 0.05 % | 98 % | Mandatory | Very High - audited balances, insurance coverage |

| Kraken | 2011 | Futures, margin trading | 0.02 % | 0.06 % | 95 % | Mandatory (basic tier) | High - proof‑of‑reserves published |

Pros & Cons

Pros

- Very simple UI - ideal for users who only want to trade a few futures contracts.

- All‑in‑cold‑storage claim reduces hot‑wallet exposure.

- Multi‑jurisdiction setup may allow users in restricted regions to find a legal entry point.

Cons

- Liquidity is opaque; no verifiable volume or reserve data.

- Security details, insurance and audit reports are missing.

- Mandatory KYC adds onboarding friction and deters privacy‑focused traders.

- Limited coin selection and lack of advanced order types restricts sophisticated strategies.

Who Should Consider Coinavenir?

If you are brand‑new to crypto derivatives and want a stripped‑down interface without the noise of dozens of order types, Coinavenir could serve as a testing ground. However, if you need deep liquidity, institutional‑grade security, or a wide range of contracts, you’ll likely feel cramped. The platform’s lack of transparency also makes it unsuitable for traders who want to monitor reserve health before committing large capital.

Final Verdict

Coinavenir positions itself as a beginner‑friendly gateway to perpetual futures, but the trade‑off is a substantial opacity around volume, reserves and security audits. In a market still reeling from high‑profile hacks, the absence of third‑party verification is a serious drawback. For hobbyists dabbling with small positions, the clean UI and all‑cold‑storage claim might be enough. For serious traders, established exchanges with proven track records remain the safer bet.

Is Coinavenir safe for storing crypto assets?

Coinavenir says it moves every deposit into cold storage, but it does not publish third‑party audit reports or insurance coverage. Without verifiable proof‑of‑reserves, safety cannot be fully confirmed.

What fees can I expect on Coinavenir?

Official fee tables are missing, but market averages for similar derivatives platforms suggest maker fees around 0.02‑0.06 % and taker fees around 0.05‑0.10 %.

Does Coinavenir offer a mobile app?

Public sources do not list a dedicated iOS or Android app, so trading is only available via the web interface.

Can I trade without completing KYC?

No. Coinavenir requires full KYC verification before any deposit, trade or withdrawal.

How does Coinavenir’s liquidity compare to larger exchanges?

Because CoinMarketCap marks the exchange as ‘untracked,’ there is no public volume data. In practice, liquidity is expected to be far lower than Binance, ByBit or Coinbase.