dApp Security Considerations: What You Must Know Before Using Decentralized Apps

Feb, 18 2026

Feb, 18 2026

When you interact with a dApp - whether swapping tokens on a decentralized exchange, staking ETH, or buying an NFT - you’re not just clicking a button. You’re signing a transaction that moves real value on a public blockchain. And if that dApp isn’t secure, you could lose everything. Unlike traditional apps where a company can reverse a mistake or freeze a hacked account, dApp security is your only line of defense. There’s no customer support hotline. No chargeback option. Once funds leave your wallet, they’re gone for good.

Smart Contracts Are the Core - And They’re Full of Hidden Flaws

Every dApp runs on smart contracts. These are self-executing code snippets stored on the blockchain. They handle everything from token transfers to governance votes. But code is never perfect. And when it’s open-source and immutable, even tiny bugs become catastrophic.Take reentrancy attacks. This is when a malicious contract calls back into your contract before the first transaction finishes. It’s like letting someone withdraw money from your bank account while you’re still counting it. The infamous DAO hack in 2016 drained $60 million because of this exact flaw. Even today, many new dApps skip proper audits or rely on automated tools that miss subtle logic errors.

The OWASP Smart Contract Security Verification Standard (SCSVS), released in draft form in September 2024, is the first unified effort to map out these risks. It lists top vulnerabilities: integer overflows, unchecked external calls, improper access control, and oracle manipulation. If a dApp doesn’t reference this standard or show a full audit report from a reputable firm like CertiK or OpenZeppelin, treat it like a sketchy website asking for your password.

Your Wallet Isn’t Safe Just Because It’s Decentralized

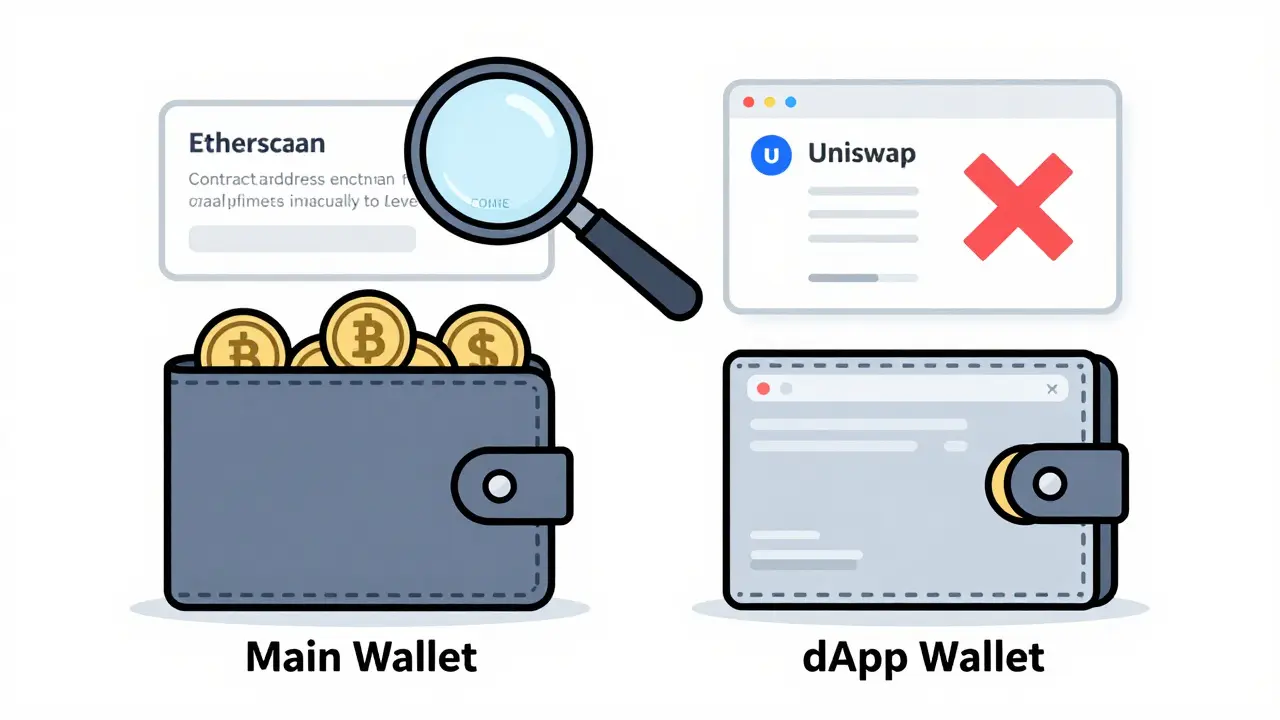

You might think, “I use MetaMask - it’s secure.” But your wallet is only as safe as the dApp you connect to. Many phishing sites look identical to real ones like Uniswap or OpenSea. They trick you into approving a transaction that drains your entire wallet - not just the token you meant to swap.Here’s what you should always check before signing:

- Is the contract address listed on the official website? Copy-paste it into Etherscan or another block explorer. Don’t trust what’s shown in the popup.

- Does the transaction show exact token amounts, decimals, and fees? A fake dApp might show “0.1 ETH” but actually approve a transfer of 100 ETH.

- Are you approving a token allowance? That’s a silent permission that lets the contract spend your tokens forever. Always revoke unused allowances.

Some advanced dApps now use multi-step confirmations. For example, before you mint an NFT, you first approve the contract, then sign the mint transaction. This gives you two chances to catch a scam. If a dApp skips this, it’s a red flag.

Frontend Security Is Often Ignored - But It’s Critical

Most people assume dApp security is all about the blockchain. But the frontend - the website you visit - is just as vulnerable. A hacker can inject malicious JavaScript into a dApp’s UI to steal your signature or redirect your transaction.Here’s how to protect yourself:

- Only use dApps from domains you know. Bookmark them. Don’t click links from Twitter, Discord, or Telegram.

- Check the SSL certificate. If the site says “Not Secure” in your browser, walk away.

- Look for transparency. Reputable dApps show their GitHub repo, audit reports, and team info. If it’s anonymous or has zero code history, assume it’s a rug pull.

Even big names have been compromised. In 2023, a popular NFT marketplace had its frontend hijacked for 72 hours. Thousands of users unknowingly approved malicious transactions. The fix? The team had to freeze all assets and manually refund users. That’s not how it should work.

Decentralization Isn’t Just a Buzzword - It’s a Safety Layer

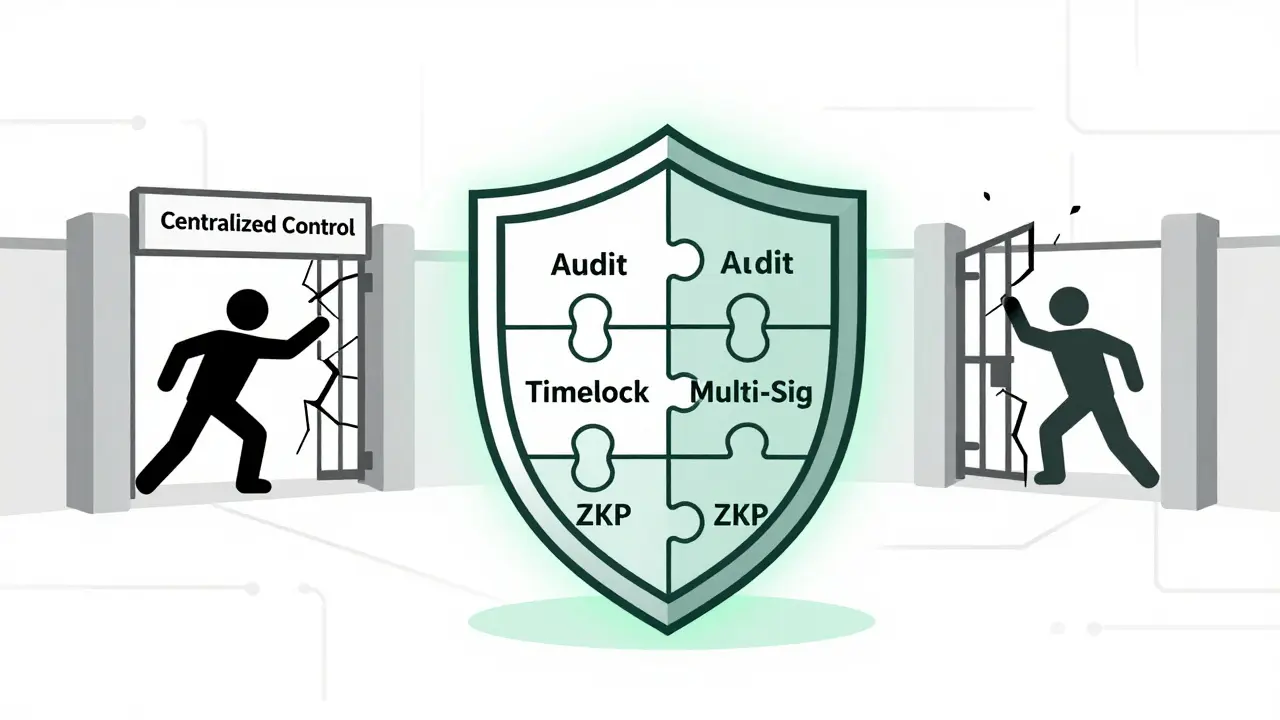

The more centralized a dApp is, the more dangerous it becomes. If one person controls the contract upgrade key, they can change the rules anytime. They can freeze your funds. They can drain the treasury. They can disappear with your money.Look for dApps that use:

- Multi-signature wallets for critical changes - requiring 3 out of 5 team members to approve.

- Timelocks - so even if a change is proposed, it can’t happen for 48 hours, giving users time to react.

- Decentralized governance - where token holders vote on upgrades, not a single developer.

Platforms like the Internet Computer use canister controllers with policy-based access. Tools like Orbit Station help enforce rules like “no changes without community vote.” If a dApp doesn’t explain how upgrades are controlled, it’s not decentralized - it’s just a front for a central server.

Privacy Tools Are Your Secret Weapon

Blockchains are public. Every transaction you make is visible forever. But that doesn’t mean you have to give away everything.Modern dApps are starting to integrate:

- Zero-knowledge proofs (ZKPs) - letting you prove you have enough funds to trade without revealing your balance.

- Decentralized identity (DID) - so you can log in without linking your wallet to your real name.

- Gateway Protocol-style systems - letting you choose exactly what data to share with each dApp.

For example, you might allow a lending dApp to verify your collateral without showing your full transaction history. Or prove you’re over 18 without handing over your ID. These aren’t sci-fi - they’re live on chains like zkSync and Polygon. If a dApp doesn’t offer privacy controls, it’s asking for trouble.

Common Threats You Can’t Afford to Ignore

Here are the three most common ways people lose money to dApps:- Phishing - Fake websites, fake Discord admins, fake airdrop links. Always verify URLs. Use browser extensions like Phantom or Rabby that warn you about suspicious contracts.

- Rug pulls - Developers abandon the project after draining liquidity. Check if the team has done previous projects. Look for locked liquidity and verified contracts.

- Unchecked approvals - You approve a token once, and it never expires. A hacker can steal all your tokens from that contract later. Always check and revoke old allowances using tools like Revoke.cash.

There’s no such thing as a “safe” dApp. But there are dApps that take security seriously. They audit. They disclose. They let you verify. They give you control. If it doesn’t do those things, you’re gambling.

What You Can Do Today

You don’t need to be a coder to protect yourself. Here’s your quick action list:- Always verify contract addresses manually - never trust what’s auto-filled.

- Use a separate wallet for dApps with a small amount of funds - keep your main wallet offline.

- Revoke token allowances monthly - use Revoke.cash.

- Only use dApps with published audits from known firms.

- Enable multi-factor authentication on your wallet (if supported).

- Join the dApp’s official Discord or Telegram - and watch for warnings.

Security isn’t a one-time setup. It’s a habit. Every time you interact with a dApp, ask: “What could go wrong?” If the answer is “I have no idea,” walk away.

Are all dApps on Ethereum secure?

No. Ethereum has the most dApps, which also means it has the most targets. Just because a dApp runs on Ethereum doesn’t mean it’s safe. Many have unpatched bugs, anonymous teams, or no audits. Always check the contract code and audit reports - not the chain it’s on.

Can I get my money back if a dApp gets hacked?

Almost never. Blockchains are immutable. Once funds are sent to a malicious contract, there’s no central authority to reverse it. Some projects have insurance pools or community funds to refund users - but these are rare exceptions. Prevention is your only real protection.

Do I need to use a hardware wallet for dApps?

It’s highly recommended, especially if you hold significant value. Hardware wallets like Ledger or Trezor store your private keys offline, making them immune to remote hacks. While MetaMask is convenient, it’s vulnerable to browser-based attacks. Use a hardware wallet for long-term holdings and reserve your software wallet for small, frequent transactions.

What’s the difference between a smart contract audit and a code review?

A code review is usually done internally by the dev team - it’s basic and often misses deep flaws. A smart contract audit is performed by an independent third party with expertise in blockchain exploits. They simulate attacks, test edge cases, and check for known vulnerabilities like reentrancy. Audits cost thousands and take weeks. If a dApp says “we did a code review,” that’s not enough.

How do I know if a dApp is truly decentralized?

Look for three things: 1) Can the contract be upgraded? If yes, who controls it? 2) Are upgrades governed by token holders? 3) Is there a timelock on changes? If one person or team can change the rules anytime, it’s not decentralized. Tools like LaunchTrail can show you recent changes - if there’s no history, be suspicious.