Global Crypto Adoption Index 2025 - Country Rankings, Methodology & Insights

Apr, 6 2025

Apr, 6 2025

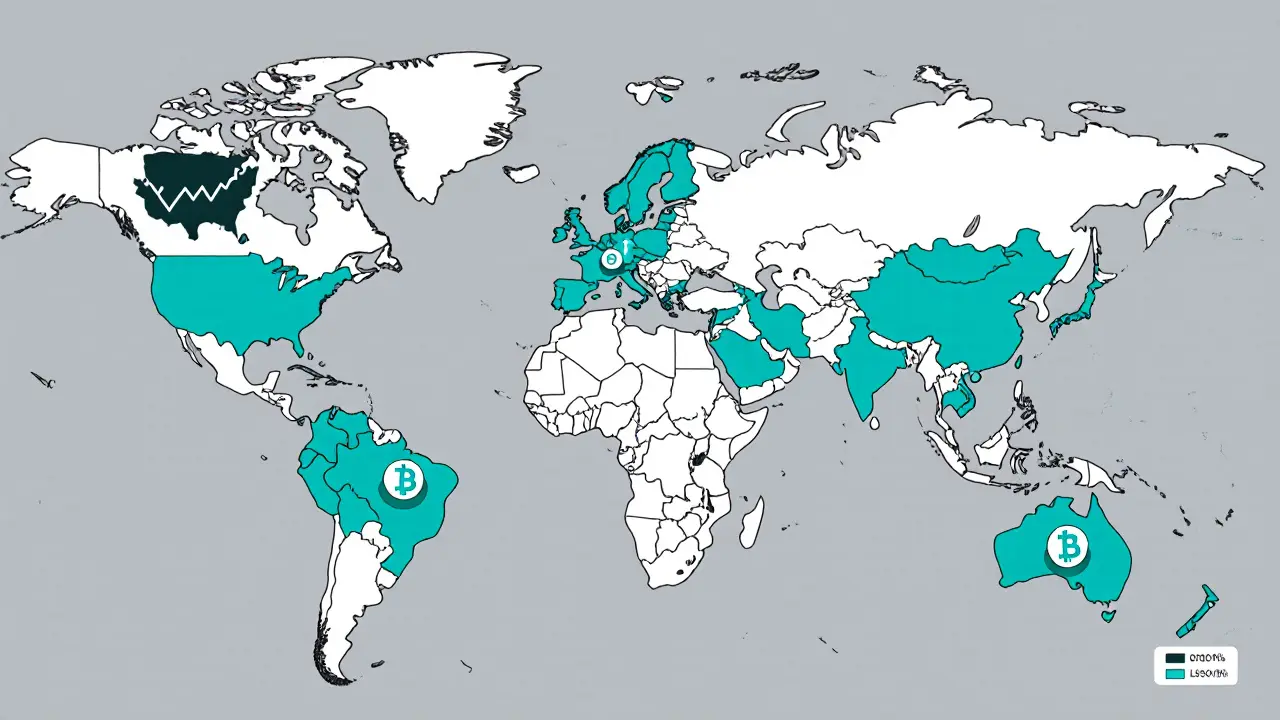

If you’ve been wondering which nations are really embracing digital money in 2025, the answer lies in the latest adoption scores. Multiple firms have crunched on‑chain data, web traffic and institutional flows to rank every country, and the results reveal surprising leaders, fast‑growing regions and the regulatory forces shaping the market.

Key Takeaways

- India holds the top spot in the Chainalysis Global Crypto Adoption Index for a third year running, thanks to more than 100 million users.

- The United States jumps to #2, propelled by spot Bitcoin ETF inflows and clearer rules.

- When you adjust for population, Ukraine tops the per‑capita list, followed by Moldova and Georgia.

- Singapore dominates the ApeX crypto‑obsession score, while the UAE ranks just behind it.

- Regulatory clarity is the single biggest driver of rank improvements across all three major indices.

What the Index Measures

Global Crypto Adoption Index 2025 is a composite ranking that combines on‑chain transaction value, retail activity, DeFi engagement and institutional transfers to gauge how widely crypto is used in each country. The score ranges from 0 to 1, with higher numbers indicating deeper penetration across the four pillars. Population size, purchasing power parity and internet penetration are factored in, so the index tries to balance raw volume with the size of the market.

Methodology Highlights (Chainalysis)

Chainalysis revamped its approach for the 2025 edition. The retail DeFi sub‑index was dropped because it captured only niche activity, and a new institutional activity lens was added to track transfers over $1 million, reflecting the post‑ETF surge in professional participation.

The four sub‑indices are:

- On‑chain value received by centralized services (exchanges, wallets).

- Retail‑sized on‑chain value received by centralized services.

- On‑chain value received by DeFi protocols (still measured, just at a lower weight).

- Institutional‑sized on‑chain value received by centralized services.

Each pillar is weighted by population and purchasing power, then combined using a geometric mean to produce the final normalized score.

Top Countries by Overall Score

The latest rankings show a mix of giants and emerging players:

| Rank | Country | Score | Key Drivers |

|---|---|---|---|

| 1 | India | 0.84 | 100 M+ users, strong retail & DeFi activity |

| 2 | United States | 0.78 | ETF inflows, growing institutional transfers |

| 3 | Pakistan | 0.73 | High retail usage, cheap remittance channels |

| 4 | Vietnam | 0.71 | Consistent DeFi engagement, mobile‑first adoption |

| 5 | Brazil | 0.69 | Inflation hedging, large crypto‑savvy community |

These scores reflect both sheer volume and the diversity of activity. Nigeria slipped to #6 despite regulatory progress, illustrating how enforcement uncertainty can dampen measured adoption.

Per‑Capita Leaders

Adjusting the index for population uncovers a different set of champions. The top five per‑capita adopters are:

- Ukraine - leading institutional inflows relative to its economy.

- Moldova - high retail ownership driven by cross‑border remittances.

- Georgia - robust DeFi usage despite a small user base.

- Jordan - crypto as a hedge against regional currency volatility.

- Hong Kong SAR, China - strong institutional pipelines.

These nations often face economic instability or currency devaluation, prompting citizens and local firms to turn to crypto as a store of value.

Regional Snapshots

Asia‑Pacific surged 69 % YoY in transaction value. India’s sheer user count dominates, while Vietnam’s steady top‑five placement shows a mature market that balances retail and DeFi.

Eastern Europe punches above its weight on a per‑capita basis. Ukraine, Moldova and Georgia benefit from lower banking penetration and a desire for sovereign financial tools.

Latin America remains a hotbed for crypto as inflation hedging. Brazil stays in the global top‑five, and Venezuela, despite sanctions, ranks in the top‑ten per‑capita.

Middle East shows rising adoption, with Jordan and the UAE posting strong ownership rates. The UAE’s 25.3 % ownership places it near the top of the Henley index, reflecting a pro‑crypto regulatory stance.

How Other Indices Compare

Beyond Chainalysis, two other reports offer alternative lenses.

ApeX Protocol publishes a “crypto‑obsession” index that weighs search activity and ownership percentages. Singapore tops that list with a 24.4 % ownership rate and 2,000 searches per 100 k people. The United Arab Emirates follows closely at 25.3 % ownership.

Henley & Partners focuses on crypto‑friendly investment‑migration pathways, using 750+ data points. Their score highlights jurisdictions that blend low taxes, supportive banking and clear legal frameworks - the UAE, Portugal and Malta rank highly.

| Country | Chainalysis Rank | ApeX Score | Henley Rank |

|---|---|---|---|

| Singapore | - | 100 (1st) | 5 |

| United Arab Emirates | - | 99.7 (2nd) | 1 |

| India | 1 | - | 3 |

| Ukraine | - (per‑capita 1st) | - | 4 |

| USA | 2 | - | 2 |

The divergence shows why it matters to look at several metrics before drawing conclusions about a market’s health.

What the Numbers Mean for Investors and Regulators

For investors, high scores in the institutional‑activity pillar flag jurisdictions where large‑scale capital is already moving. Ukraine, Moldova and Estonia, for example, attract fund managers seeking crypto exposure without the overhead of a major exchange.

Regulators can use the per‑capita rankings to spot where citizens are most dependent on crypto for daily transactions. Policies that simply ban coins may push activity underground, skewing future index readings.

Companies looking to launch crypto services should target regions with both strong user bases and regulatory openness. The data suggests Vietnam, the UAE and Singapore are fertile ground for payment solutions, while India offers scale but presents a complex compliance landscape.

Checklist: Using the Index Effectively

- Confirm which sub‑index (retail, DeFi, institutional) aligns with your goal.

- Cross‑reference multiple indices to avoid single‑source bias.

- Adjust for population if you need per‑capita insights.

- Watch for recent regulatory announcements - they can cause rapid rank shifts.

- Combine index scores with on‑the‑ground data like exchange KYC volumes for a fuller picture.

Frequently Asked Questions

What data sources does the Chainalysis index use?

Chainalysis blends on‑chain transaction data (wallet flows, exchange deposits) with off‑chain signals like web traffic, Google Trends and mobile app downloads. Over 13 billion web visits are analyzed to geolocate crypto‑related activity.

Why did the retail DeFi sub‑index disappear in 2025?

Chainalysis found that retail DeFi transactions represent a very niche slice of overall activity and were inflating scores for a few tech‑savvy markets. Removing it improves comparability across countries.

How does per‑capita ranking differ from the overall index?

The overall index favors large economies that move big dollar volumes, while the per‑capita version normalizes the score by population, highlighting countries where a higher share of citizens actively use crypto.

Which country is best for crypto‑focused investment migration?

According to the Henley Crypto Adoption Index, the United Arab Emirates ranks first, thanks to its tax‑friendly regime, strong banking links and clear legal protections for digital assets.

Can I rely solely on the index to pick an exchange?

The index shows where activity is high, but it doesn’t assess exchange security, fee structures or user experience. Pair the index insight with due‑diligence on each platform.

Prateek Kumar Mondal

October 24, 2025 AT 18:36Cory Munoz

October 25, 2025 AT 04:04Jasmine Neo

October 26, 2025 AT 01:13Ron Murphy

October 26, 2025 AT 09:13Nick Cooney

October 27, 2025 AT 03:52Clarice Coelho Marlière Arruda

October 27, 2025 AT 10:28William P. Barrett

October 27, 2025 AT 16:01Brian Collett

October 27, 2025 AT 16:48