How USDT and Bitcoin Are Keeping Afghan Families Alive Despite the Ban

Dec, 6 2025

Dec, 6 2025

Remittance Calculator

Calculate Your Afghan Remittance

See how much value reaches families in Afghanistan through crypto channels after local conversion fees.

Estimated Funds Received

Note: Exchange rates and fees vary by region. This tool uses current average rates based on 2024 data. Actual amounts may differ based on agent networks and market conditions.

On any given day in Kabul, a woman might slip a phone into her burqa, open a messaging app, and send a few hundred dollars in USDT to her brother in Pakistan. He cashes it out at a local shop, hands her family cash in Afghanis, and no one at the bank ever knows. This isn’t smuggling. It’s survival.

The Taliban banned cryptocurrency in 2022. They called it haram-forbidden under Islamic law. They shut down exchanges. They arrested traders. They seized wallets. But the money didn’t stop flowing. It just went underground.

Afghanistan’s formal banking system collapsed after the Taliban took over. International aid froze. Foreign banks cut ties. The Afghan afghani lost more than 40% of its value against the dollar in just two years. For millions of Afghans, especially women and families relying on remittances from abroad, there was no other way to get money in or out. So they turned to Bitcoin and USDT.

Why USDT and Bitcoin? Because the banks are gone

Before 2021, Afghan families depended on hawala networks-informal money transfer systems that have existed for centuries. But hawala couldn’t handle the scale of need after sanctions hit. International wire transfers became nearly impossible. Banks refused to process transactions for anyone who had worked with the former government, NGOs, or women’s organizations.

That’s when crypto stepped in-not because people loved it, but because they had no choice.

USDT, or Tether, became the go-to because it’s pegged to the US dollar. In a country where the local currency is collapsing, holding USDT means your savings don’t vanish overnight. Bitcoin, while more volatile, lets people send money across borders without banks. You don’t need a passport. You don’t need ID. You just need a phone and a connection.

One woman in Herat told a journalist last year: "I used to wait weeks for money from my husband in Dubai. Now, it arrives in 10 minutes. I don’t ask how. I just thank God."

The ban is real. The enforcement isn’t.

The Taliban’s ban on crypto is absolute. Da Afghanistan Bank (DAB), the country’s central bank, declared digital currencies illegal. FinTRACA, the financial intelligence unit, is supposed to track and punish violations. But enforcement is patchy. In some cities, police raid crypto traders. In others, they look the other way.

Why? Because the system has no alternatives. The government can’t print enough cash. It can’t restore trust in the banking system. It can’t bring back international aid. So while the ban stays on paper, people keep using crypto in practice.

Platforms like Pursa and local Telegram groups operate openly, advertising anonymous USDT trades. You send Afghanis to a local agent. They send USDT to your wallet. No KYC. No registration. No questions asked. The transaction completes in seconds. The agent pockets a small fee-usually 1% to 3%-and everyone walks away satisfied.

This isn’t a fringe activity. It’s a national workaround. Estimates from local analysts suggest that over 30% of all remittances into Afghanistan now flow through crypto channels. That’s billions of dollars a year, moving outside the control of any government.

Women are leading the crypto revolution

Nowhere is this more true than with Afghan women.

Under Taliban rule, women are barred from most jobs, universities, and public spaces. They can’t open bank accounts without a male guardian. Many don’t even have official IDs. Traditional finance shuts them out completely.

But crypto doesn’t care who you are. It only cares if you have a phone and a wallet address.

Organizations like the Digital Citizen Fund, led by tech entrepreneur Roya Mahboob, train women in rural areas to use Bitcoin and USDT. They teach them how to receive money from relatives abroad, store it safely, and convert it to cash through trusted local contacts. For many, this isn’t just about money-it’s about autonomy.

"Bitcoin gives us a way to be independent," one trainee said. "I can save money. I can send it to my sister. I don’t need my brother’s permission. That’s power. And they can’t take it from me."

These women aren’t investors. They’re not speculators. They’re using crypto the way people used gold in wartime: as a portable, invisible store of value.

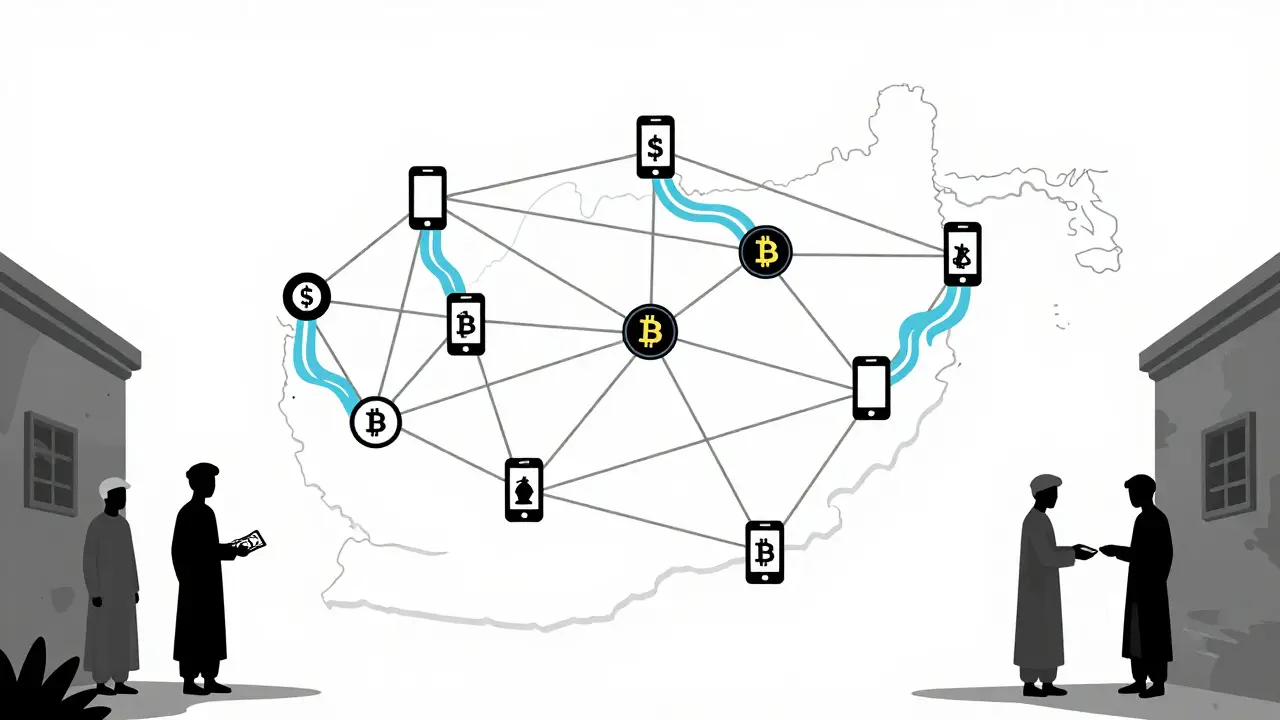

How it actually works: The underground pipeline

Here’s how a typical remittance works today:

- A family member in the UAE, Turkey, or the U.S. buys USDT on a global exchange using their bank account.

- They send the USDT to a trusted Afghan contact-often a friend, cousin, or community leader-with a wallet address.

- The Afghan contact connects with a local peer-to-peer dealer via Telegram or WhatsApp.

- The dealer gives cash in Afghanis to the recipient, usually within hours.

- The dealer then sends the USDT to their own wallet, which they’ll later sell to another buyer or convert to cash.

No banks. No paperwork. No government oversight. Just trust, phones, and a network of people who know each other.

USDT dominates because it’s stable. Bitcoin is used too, but mostly for larger transfers or long-term savings. The volatility makes it risky for daily needs. But if you’re trying to preserve wealth over months or years, Bitcoin’s scarcity becomes an advantage.

Why Afghanistan’s ban is unique-and unsustainable

Most countries that ban crypto still struggle to stop it. But Afghanistan is different. Most nations ban crypto because they fear losing control. Afghanistan bans it because it has no control to begin with.

Neighboring Uzbekistan lets people mine crypto using solar power. Saudi Arabia is testing its own digital currency. Even Iran, under heavy sanctions, allows crypto trading with restrictions.

Afghanistan is the only country where crypto is banned outright, with no alternative financial infrastructure in place. That’s why the ban is failing. It’s not because people are tech-savvy. It’s because they’re desperate.

The Taliban’s stance is ideological. But survival is practical. And when people are starving, laws about digital money don’t matter as much as the next meal.

The human cost of the ban

The real tragedy isn’t the ban itself. It’s what happens when people can’t access money.

Children go hungry. Women sell their jewelry. Families break apart as men leave to find work abroad, and the money they send never arrives. Hospitals can’t buy medicine. Schools shut down because teachers aren’t paid.

Crypto doesn’t fix the political mess. But it keeps people alive.

Every USDT sent is a child’s lunch. Every Bitcoin transfer is a mother’s dignity. Every anonymous transaction is a quiet act of resistance against a system designed to erase them.

There’s no legal path forward. No Central Bank Digital Currency is coming. No banking reforms are planned. The Taliban has no interest in innovation. They only want control.

But control doesn’t work when the people have no other choice.

What happens next?

As of 2025, there’s no sign the Taliban will lift the ban. International pressure hasn’t changed their mind. Humanitarian aid still flows through NGOs, not banks. The economy is stuck in freefall.

So the underground crypto network will grow. More people will learn how to use wallets. More local agents will emerge. More women will find ways to save and send money without asking permission.

The government can shut down a few exchanges. It can arrest a few traders. But it can’t shut down a phone. It can’t block a WhatsApp message. It can’t stop a mother from sending her child’s future through a digital wallet.

USDT and Bitcoin aren’t the solution to Afghanistan’s crisis. But they’re the only thing keeping millions of people from falling completely off the grid. And until the world offers a better alternative, they’ll keep running.