Huckleberry (Clover) Crypto Exchange Review - DEX Features, Security, and Outlook 2025

Nov, 13 2024

Nov, 13 2024

Ever wondered whether a small‑scale DEX can actually hold its own against giants like Uniswap? Let’s break down the Huckleberry review and see if the platform’s cross‑chain tricks and community vibe are enough to earn a spot in your DeFi toolbox.

What is Huckleberry and How It Works

Huckleberry is a decentralized cryptocurrency exchange and lending platform launched in 2022. It operates on both the Moonriver and Clover blockchains, offering a suite of DeFi services such as Swap, Farm, Stake, Lend, Vote, and Bridge. The platform markets itself as a “community DEX” with the tagline “Let the drifters guide you,” emphasizing user‑driven governance and a lightweight onboarding experience.

Unlike centralized exchanges that hold custody of your assets, Huckleberry lets you retain full control of private keys. Trades happen directly between wallets via smart contracts, and the built‑in lending module enables users to earn interest on supported assets without needing a third‑party lender.

Technical Architecture and Cross‑Chain Capabilities

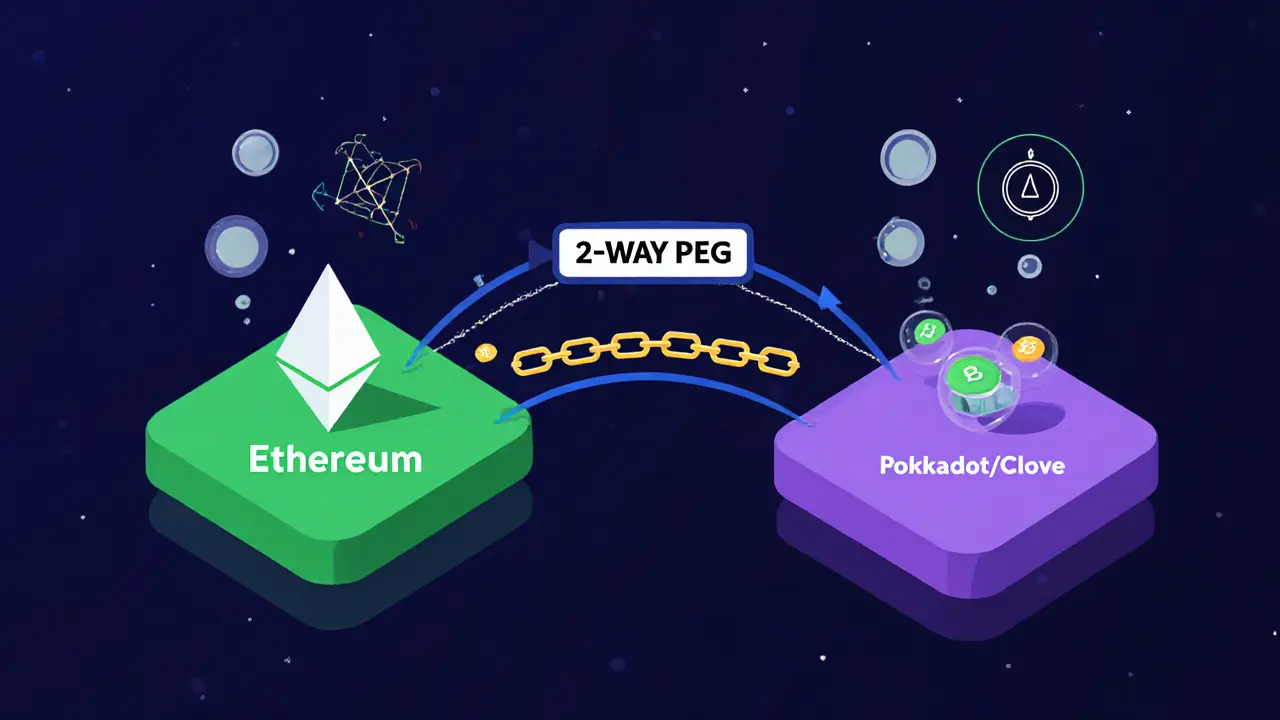

Clover Finance is the Substrate‑based blockchain that powers Huckleberry’s core infrastructure. Clover provides a multi‑layered structure (storage, smart‑contract, DeFi protocol, and eApp layers) that allows seamless interaction between Ethereum‑compatible and Polkadot ecosystems. This architecture powers the platform’s 2‑way peg (2WP) system, a built‑in bridge that moves assets between Ethereum and Polkadot without relying on external escrow services.

The bridge uses Merkle‑based inclusion proofs to verify cross‑chain transactions, a method highlighted by CoinBureau as reducing attack surfaces compared to traditional bridge designs. Because Clover runs an EVM‑compatible environment, developers can deploy Solidity contracts on the network, making the transition from Ethereum to Polkadot almost frictionless.

Gas fees on Clover are “identity‑based” - they are deducted from the transacted asset itself rather than requiring a separate native token for payment. For newcomers, this means you won’t need to hold CLV or ETH solely for gas, simplifying the UX considerably.

Key Features: Swap, Farm, Stake, Lend, Vote, Bridge

- Swap: Instant token swaps across the 16 listed pairs (10 unique coins) with near‑zero slippage on low‑volume routes.

- Farm: Liquidity providers can earn reward tokens by supplying assets to designated pools. Rewards are paid in Huckleberry’s native token (when available) and occasionally in CLV.

- Stake: Users may stake CLV or other supported tokens to secure the network and receive a share of transaction fees.

- Lend: The lending module offers variable‑interest loans, allowing borrowers to use their deposited collateral without selling.

- Vote: Governance proposals are submitted and voted on directly from the UI, with voting power proportional to staked CLV.

- Bridge: One‑click bridging between Ethereum, Polkadot, and Moonriver lets you move assets without leaving the platform.

Token Listings, Trading Pairs, and Liquidity

As of the last CoinGecko snapshot (2023), Huckleberry supports 10 coins and 16 trading pairs. The limited selection keeps the order book thin, which can lead to higher price impact on larger trades. However, the platform’s focus on community‑driven liquidity means that early adopters can earn generous farming incentives.

Compared to Uniswap’s 14,000+ pairs and PancakeSwap’s 1,200+ pairs, Huckleberry’s catalogue feels niche. That niche is intentional: by concentrating on assets that have strong bridges to the Polkadot ecosystem, the DEX can provide lower fees and faster finality on its native networks.

User Experience and On‑boarding

First‑time users need a compatible wallet. The official recommendation is the Clover Extension Wallet, which mirrors MetaMask’s UI but connects directly to the Clover network. After installing the extension, users simply click “Connect Wallet” on Huckleberry’s homepage, approve the connection, and they’re ready to trade.

The UI is clean and split into tabs (Swap, Farm, Stake, etc.). Because transaction fees are auto‑deducted, the “Confirm” screen only shows the amount you’ll receive and a single fee line - no separate ETH‑gas prompt. This reduces confusion for newcomers coming from Ethereum‑only environments.

Documentation is hosted on the site’s “Docs” section, but the depth is modest. Community channels (Telegram, Discord) are active, though the lack of a public Reddit or Trustpilot presence makes it harder to gauge broader sentiment.

Comparison with Major DEXs

| Feature | Huckleberry (Clover) | Uniswap (Ethereum) | PancakeSwap (BNB Chain) |

|---|---|---|---|

| Supported Chains | Moonriver & Clover (Polkadot parachain) | Ethereum Mainnet | BNB Chain (formerly BSC) |

| Token Pairs (approx.) | 16 pairs (10 coins) | 14,000+ pairs | 1,200+ pairs |

| Cross‑chain Bridge | Native 2‑way peg (ETH↔DOT) | External bridges (e.g., Hop) | External bridges (e.g., Binance Bridge) |

| Gas Model | Fee deducted from assets (no separate token) | ETH required for gas | BNB required for gas |

| Governance Token | CLV (via staking/voting) | UNI | CAKE |

| Liquidity Incentives | High‑yield farms for early pools | Standard liquidity mining | Varied farms, often high APY |

| Security Audits | Audited by several firms (details limited) | Multiple audits, widely reviewed | Audited, but bridge incidents recorded |

The table shows that Huckleberry’s main advantage is its integrated cross‑chain bridge and low‑fee model, while its main drawback is a shallow liquidity pool. If you’re chasing niche Polkadot assets or need a cheap bridge, Huckleberry stands out. For pure volume trading, Uniswap still dominates.

Security, Risks, and Community Outlook

Security assessments specific to Huckleberry are scarce, but we can infer risk levels from its underlying infrastructure. Clover Finance’s substrate codebase has undergone multiple audits; its 2‑way peg design eliminates third‑party escrow, theoretically reducing the attack surface. However, any bridge remains a high‑value target, and history shows that even audited bridges can be exploited.

Potential risks include:

- Parachain Lease Expiry: Clover’s original Polkadot lease expired in October 2023. Continuation depends on winning a new auction, which adds uncertainty to long‑term platform stability.

- Liquidity Shortage: Thin order books can cause price slippage and make large trades costly.

- Limited Audits on DEX Smart Contracts: While the network layer is audited, the specific swap and lending contracts have less public scrutiny.

Community sentiment appears modestly positive on Telegram, with users praising the gas‑free model. The lack of broader social proof (Reddit, Trustpilot) means you should approach large positions cautiously.

Pros, Cons, and Bottom Line

- Pros: Native cross‑chain bridge, gas‑free transactions, community‑driven governance, generous early‑adopter farms.

- Cons: Small token selection, thin liquidity, dependence on Clover’s parachain lease, limited public security audits.

If you’re already active in the Polkadot or Moonriver ecosystem and need an easy way to move assets without juggling separate wallets for gas, Huckleberry is a solid addition. For high‑volume traders focused on deep liquidity and mature audit trails, sticking with Uniswap or PancakeSwap remains safer.

Frequently Asked Questions

What wallets can I use with Huckleberry?

Huckleberry works best with the Clover Extension Wallet, which connects directly to the Clover network. It also supports any EVM‑compatible wallet (MetaMask, Trust Wallet) as long as the network is manually added.

Do I need to hold CLV to pay for gas?

No. The platform deducts transaction fees from the assets you’re swapping, lending, or staking, so you won’t need a separate CLV balance for gas.

How secure is the cross‑chain bridge?

The bridge relies on Merkle proofs and Clover’s built‑in 2‑way peg, which removes third‑party escrow. While this design reduces certain risks, bridges are still a common target for attacks, so only move amounts you’re comfortable risking.

Is there a minimum amount for staking CLV?

Staking requires a minimum of 10 CLV, but the exact amount can change with governance updates. Check the latest figures on the platform’s staking page.

What happens when Clover’s parachain lease ends?

If Clover wins a new lease, the network continues as before. If not, the team will either migrate to another parachain slot or shift to a solo chain. Users would need to follow official announcements for migration steps.

Olav Hans-Ols

October 25, 2025 AT 08:04Huckleberry’s gas-free model is honestly a game-changer for newcomers. No more scrambling to buy ETH just to swap a token. I tried it last week with some DOT and it felt like using a normal app, not a blockchain. The UI is clean, no clutter, and the bridge just works. Not gonna lie, I was skeptical at first, but now I keep a small position there just for quick swaps.

Biggest win? No need to juggle multiple wallets for gas. That’s huge for people who just want to use DeFi without becoming accountants.

Kevin Johnston

October 25, 2025 AT 13:26Yessss this is the kind of DEX we need 😍 No gas drama + cross-chain = win win. Already dumped my spare ETH into CLV farms. 18% APY and I didn’t even have to buy gas. 🚀

Dr. Monica Ellis-Blied

October 26, 2025 AT 03:53While the interface may appear user-friendly, the underlying security posture remains dangerously under-audited. The reliance on a parachain lease that expired in October 2023-without public confirmation of renewal-is not merely a risk; it is a structural vulnerability. Users who treat this as a ‘safe’ DeFi option are ignoring the fundamental instability of its backbone. Moreover, the lack of comprehensive smart contract audits for the lending and swap modules is, frankly, irresponsible. You cannot build trust on convenience alone. This platform is a house of cards, and the moment Clover loses its lease-or worse, gets exploited-the entire ecosystem collapses. I urge caution, not enthusiasm.

There is a difference between innovation and recklessness-and this is the latter.

Herbert Ruiz

October 26, 2025 AT 09:3316 trading pairs? That’s not a DEX, that’s a demo. Uniswap has 14,000. You’re not competing-you’re irrelevant.

Saurav Deshpande

October 27, 2025 AT 04:31They say 'community-driven' but who really controls the votes? The same whales who bought CLV before the launch, probably. And that bridge? It’s just a fancy honeypot. I’ve seen this movie before-small chain, big promises, then poof. The devs vanish with the liquidity. Why do people keep falling for this? It’s not innovation, it’s a slow-motion rug pull with a nice UI.

Wait till the next bridge exploit hits. Then you’ll see who’s really 'drifting'.

Paul Lyman

October 27, 2025 AT 05:19Guys, this is actually really cool. I’m not even into Polkadot but I tried Huckleberry because the gas thing sounded too good to pass up. And wow-it just worked. No confusing gas prompts, no wallet switcheroos. I swapped some WBTC to DOT and it took 12 seconds. I didn’t even need to buy CLV. That’s the future right there.

Yeah the pairs are limited but if you’re just moving between chains, this is way smoother than using Hop or Multichain. I’m keeping it on my dashboard. And yes, I know the lease is up-but the team seems active on Telegram. Let’s give them a shot before we trash them.

Frech Patz

October 28, 2025 AT 03:40Can anyone provide a link to the official audit reports for the Huckleberry smart contracts? The post mentions 'several firms' but does not name them or link to the findings. Without transparency in audit documentation, the claim of security remains speculative. Furthermore, the Merkle-based inclusion proof design-while theoretically sound-has not been independently verified in the context of this specific implementation. I request verifiable evidence before considering any allocation.

Derajanique Mckinney

October 28, 2025 AT 08:5718% APY? Sounds sus 😴 also why is the website so… basic? Like, no animations? Feels like 2021. I’m out.

Also, is this even legit? No Trustpilot? No Reddit? 🤔

Rosanna Gulisano

October 28, 2025 AT 19:47If you’re using this you’re already losing. No audits, no liquidity, no future. You’re just funding someone’s side project.

Sheetal Tolambe

October 28, 2025 AT 22:17I’ve been holding CLV since last year and honestly, the community is super chill. People help each other out on Telegram, no drama. I started with just 5 CLV to stake and now I’m earning enough to cover my gas on other chains. It’s small but steady.

Yeah the pairs are limited but I don’t need 14,000 coins. I just want to move my DOT and KSM around without paying $50 in fees. This does it. And the bridge? It’s been working fine for me for months. No issues.

Let’s not be too harsh on the little guys trying something new. Not everything has to be a giant.

gurmukh bhambra

October 28, 2025 AT 23:36They say it's decentralized but the team controls the bridge keys, right? I’ve seen the code-it’s not open source. And that 'community governance'? The votes are all from 3 wallets. This is a front. The whole thing is a pump-and-dump disguised as innovation. Wait till the next moonriver fork. Then you’ll see who’s really in charge.

They’re not building a DEX. They’re building a exit scam with a nice logo.

Sunny Kashyap

October 29, 2025 AT 09:24Why use this when Binance has everything? Indian people should stick to real exchanges. This is for losers who don’t know how to trade.

james mason

October 29, 2025 AT 21:52How quaint. A DEX with 16 trading pairs. I suppose it’s charming in the same way that a hand-cranked washing machine is charming. But let’s be honest-this isn’t DeFi. It’s a hobbyist’s sandbox. The only thing more nostalgic than this platform is the idea that anyone with real capital would choose it over Uniswap V3’s concentrated liquidity.

Unless you’re trying to impress your crypto-enthusiast cousin at Thanksgiving, I’d advise against allocating anything meaningful here. The aesthetics are cute, but the economics are irrelevant.

Olav Hans-Ols

October 29, 2025 AT 21:52Actually, I’ve been using Huckleberry to bridge my DOT to Moonriver for staking, and the fees are literally 1/10th of what I pay on other bridges. I don’t care if it’s ‘small’-it’s efficient. And the fact that I don’t need to hold CLV for gas? That’s the kind of UX that actually grows adoption.

Yeah, the audit docs aren’t perfect-but the chain itself is audited. The DEX is just a UI on top. If the bridge works, and the contracts haven’t been exploited in 2 years, maybe we stop demanding perfection from projects that aren’t trying to be Ethereum.