What is Hacken Token (HAI) crypto coin? Explained with current price, supply, and use cases

Nov, 12 2025

Nov, 12 2025

HAI Token Value Calculator

HAI Token Value Calculator

Calculate the value of HAI tokens based on current market prices and understand token economics

Current Market Data

HAI is a utility token for cybersecurity services in Web3. Value depends on ecosystem adoption and security audit demand.

Token Value

What exactly is Hacken Token (HAI)? It’s not another meme coin or speculative gamble. HAI is a utility token built for one purpose: to power cybersecurity services in the Web3 world. If you’ve ever heard of companies auditing smart contracts or checking for blockchain vulnerabilities, Hacken is one of them-and HAI is the token that makes it all work.

What does Hacken Token actually do?

Hacken Token (HAI) isn’t just a digital asset you buy hoping it goes up. It’s a tool. Think of it like a digital voucher used inside a specific system. In this case, that system is the Hacken ecosystem-a group of teams and tools focused on finding security flaws in blockchain projects before they get hacked. Here’s how it works in practice:- If a DeFi project wants a security audit, they pay in HAI tokens to Hacken’s team.

- Token holders can vote on ecosystem changes through hDAO, the decentralized organization running Hacken.

- Some users stake HAI to earn rewards or gain access to exclusive audit reports.

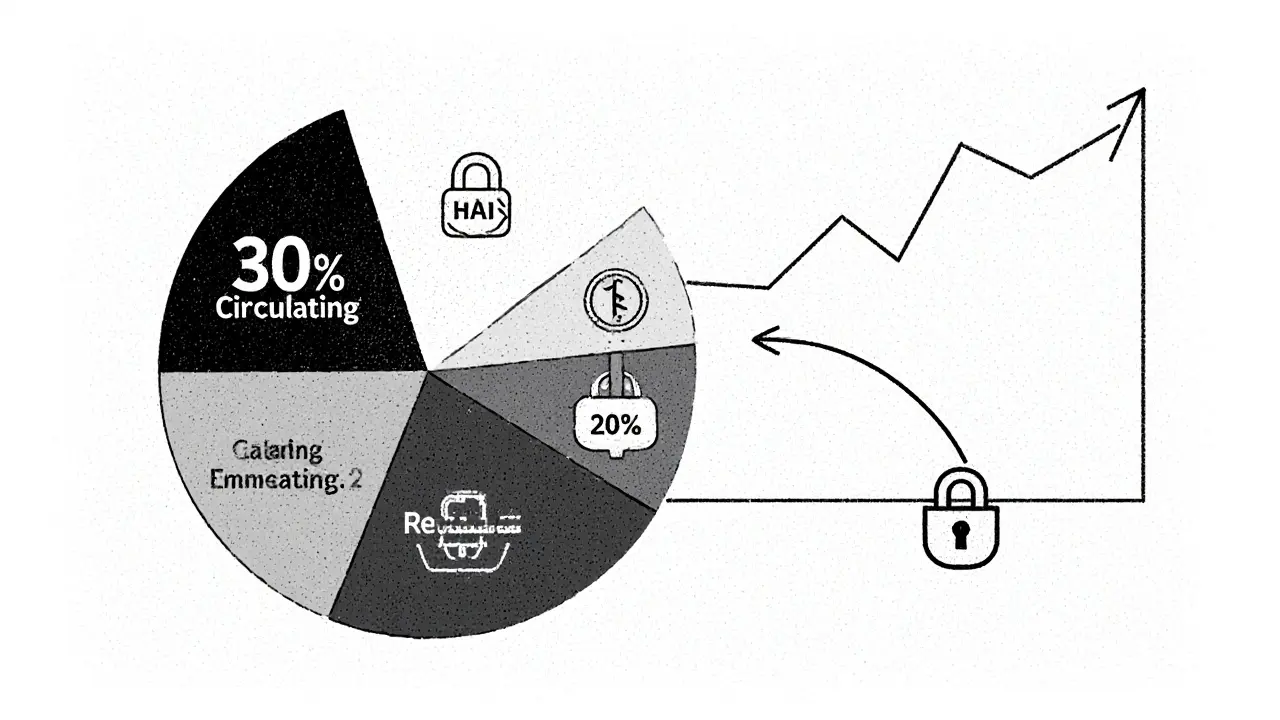

How many HAI tokens are there?

The total supply of HAI is capped at 1 billion tokens. That’s fixed. No mining. No new tokens created out of thin air. Everything is pre-planned. But here’s the catch: not all of them are in circulation yet. Different tracking sites show different numbers:- CoinGecko says about 830 million HAI are circulating.

- CryptoRank says 844.97 million.

- CoinLore shows only 645 million.

What’s the current price of HAI?

As of November 2025, HAI trades between $0.00728 and $0.00797 per token. That’s less than a penny. It sounds cheap, but remember-it’s not about the price per token. It’s about total value. Different exchanges show slightly different prices:- Gate.io: $0.00769

- Uniswap V4 (Base): $0.00754

- WhiteBIT: $0.00728

How has HAI performed historically?

HAI had a wild ride. In April 2021, it hit an all-time high of $0.47. That’s over 60 times higher than where it trades today. Since then, it’s lost more than 98% of its peak value. Some sources list a slightly lower ATH of $0.1156, which still means it’s down over 93% from its best day. The drop wasn’t sudden. It’s been a long, slow decline. Over the past year, HAI has lost over 82% of its value against the US dollar and nearly 90% against Bitcoin. That’s not just market noise-it’s a sign that demand for the token has dried up, or that people lost confidence in the project’s ability to grow.Where can you trade HAI?

You won’t find HAI on Coinbase or Binance. It’s not a big-name coin. But you can trade it on smaller exchanges:- Gate.io

- MXC

- WhiteBIT

- Uniswap V4 (on the Base network)

Why is HAI so cheap now?

It’s not because the tech is broken. Hacken still does security audits. They still work with major Web3 projects. The problem is adoption. Most people buying crypto don’t care about audits. They want to trade, stake, or speculate. HAI doesn’t fit that mold. It’s a B2B tool disguised as a crypto asset. Unless more companies start paying for audits in HAI-and not in USDT or ETH-the demand won’t grow. Also, the token’s supply is huge. With nearly a billion tokens out there and a market cap under $7 million, the price per token has to stay low. It’s math. If you have 800 million coins and a $6 million market cap, each coin is worth less than a cent. That’s not a bug-it’s a feature of the design.Is HAI a good investment?

If you’re looking for a quick flip? Probably not. The price has been falling for years. The volume is low. The liquidity is thin. You could get stuck holding it if you need to sell fast. But if you believe in Web3 security as a growing need? Then HAI has potential. Imagine a future where every DeFi project is required to get audited before launch. If Hacken becomes the go-to provider, and they start requiring HAI for payment, demand could spike. That’s a long-term bet. Right now, HAI is more of a utility token than an investment. It’s like buying a subscription to a security service-but in crypto form. Don’t buy it because you think it’ll hit $1. Buy it because you plan to use it.What’s next for Hacken and HAI?

The future of HAI depends on two things:- More Web3 projects using Hacken’s audit services-and paying in HAI.

- More people staking HAI or voting in hDAO, making the ecosystem more active.

Is Hacken Token (HAI) a good investment in 2025?

HAI is not a typical investment. It’s a utility token with very low liquidity and a history of massive price declines. If you’re looking for short-term gains, it’s not ideal. But if you believe in Web3 security and plan to use Hacken’s audit services, holding HAI makes sense. Its value is tied to real-world usage, not speculation.

Where can I buy Hacken Token (HAI)?

You can buy HAI on exchanges like Gate.io, MXC, WhiteBIT, and Uniswap V4 (Base). The most common trading pair is HAI/USDT. Avoid buying it on major exchanges like Coinbase or Binance-it’s not listed there.

Why is the HAI price so low compared to its all-time high?

HAI peaked at $0.47 in 2021 during a crypto bull run. Since then, demand for the token has declined as Web3 projects shifted focus away from security audits or switched to other payment methods. The large circulating supply-over 800 million tokens-also keeps the price per token low. The market hasn’t yet recognized its utility value.

Can I stake HAI tokens?

Yes, staking HAI is possible through the hDAO governance system. By staking, you can earn rewards and participate in voting on ecosystem upgrades. This helps align token holders with the long-term health of the Hacken platform.

Is Hacken Token safe to use?

The Hacken platform itself has a strong reputation for security audits and has helped prevent major exploits in DeFi. However, like any crypto asset, HAI carries risks: low liquidity, price volatility, and dependence on ecosystem adoption. Only use it if you understand the risks and have a clear reason to hold it.