XMS Airdrop Details: Mars Ecosystem Token Distribution Explained (2025)

Jul, 4 2025

Jul, 4 2025

XMS Airdrop Value Calculator

Calculate the current USD value of XMS tokens you received in the Mars Ecosystem airdrop campaigns. Enter the current XMS price to see your token value.

About the Airdrops

The Mars Ecosystem ran two airdrop campaigns to distribute XMS tokens:

Mars Ecosystem Airdrop

50 XMS tokens per winner (total 50,000 XMS distributed)

CoinMarketCap Learn & Earn

$5 worth of XMS per winner (total $200,000 value distributed)

Estimated Value

Based on current XMS price of $0.00

Ever wondered why the XMS airdrop generated buzz across DeFi forums and social channels? You’re not alone. Below we break down everything you need to know about the token, the two major distribution events, and what the numbers mean for anyone watching the Mars Ecosystem.

What is XMS (Mars Ecosystem Token) and the Mars Ecosystem?

XMS (Mars Ecosystem Token) is the governance token that powers the Mars Ecosystem, a suite of decentralized finance (DeFi) building blocks that includes a stablecoin, a DEX, and a DAO structure. Holders can vote on protocol upgrades, fee allocations, and the future direction of the project.

The broader Mars Ecosystem launched with the ambition to become “the central bank and reserve currency for DeFi”. Its flagship stablecoin, USDM, is meant to offer high stability while keeping capital utilization efficient.

Past XMS Airdrop Campaigns - A Quick Overview

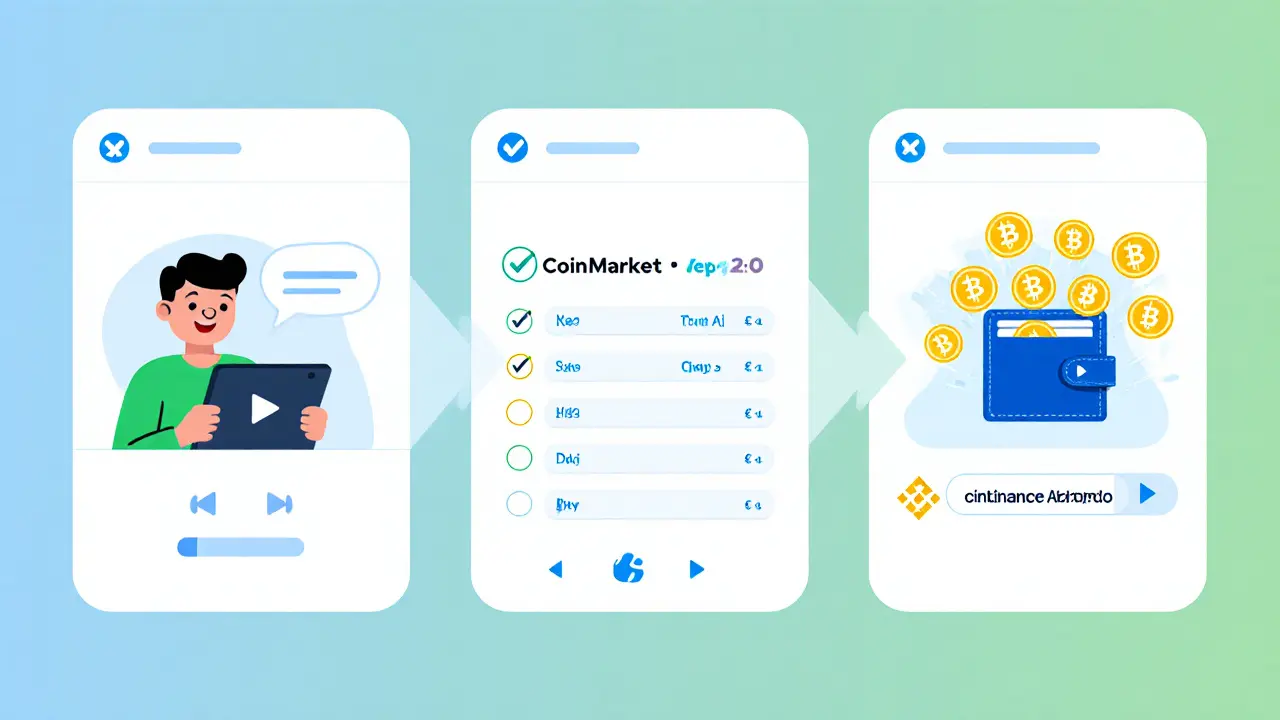

To seed initial distribution, Mars Ecosystem ran two sizable airdrop programs:

- Mars Ecosystem Airdrop: 50 XMS tokens were handed to 1,000 randomly selected participants. This was a one‑off event and closed in early 2024.

- CoinMarketCap Learn & Earn: A partnership with the popular education platform resulted in a $200,000 prize pool split among 40,000 winners. Each qualified participant earned $5 worth of XMS after completing a short video series and passing a quiz with perfect scores.

Both campaigns required a BEP‑20 wallet address, confirming that XMS lives on the Binance Smart Chain (BSC) network.

How the Airdrops Worked - Eligibility, Process, and Distribution

- Account Setup: Participants needed active accounts on both CoinMarketCap and Binance. The dual‑account rule ensured users were already comfortable with a major exchange.

- Education Phase: A series of 3‑5 minute videos explained the Mars ecosystem, the role of USDM, and how governance works. The content was intentionally simple to attract newcomers.

- Quiz Completion: The quiz consisted of 5 questions covering the video material. All answers had to be correct; otherwise the reward was forfeited.

- Wallet Submission: After passing, users submitted a BEP‑20 address. Tokens were sent within three days of the campaign’s end.

- Verification: The team ran an anti‑spam script to filter out duplicate or obviously bot‑generated wallets.

Current Market Snapshot - Price, Volume, and Liquidity

As of 24 Oct 2025, XMS shows stark price discrepancies across trackers:

- Binance lists XMS at $0.000297 USD (up 1.24 % over 24 h).

- CoinMarketCap reports $0.0004989 USD with a 24‑hour volume of about $2,300 USD.

The low trading volume-roughly $2.3 k-signals limited liquidity. Daily price swings can be sharp, which is typical for governance tokens with modest market caps. CoinGecko puts the total market cap at $315 k, ranking XMS around #5,900 in the crypto universe.

Technical Foundations - Architecture, Security, and Scalability

The Mars Ecosystem addresses what it calls the “positive externality” problem of existing stablecoin protocols: costs are borne by the protocol while external parties capture the value. To combat this, the platform focuses on four pillars:

- High Stability: USDM is pegged to the US dollar using algorithmic and collateralized mechanisms.

- Capital Efficiency: Over‑collateralization is minimized, freeing up user assets for other yields.

- Scalability: Built on BSC, the system can process thousands of transactions per second at low fees.

- Decentralization: Governance through XMS ensures that decisions come from the community rather than a single entity.

Security is reinforced by a bug bounty hosted on Immunefi, offering up to $10,000 for critical discoveries. The scope includes wallet interaction attacks, contract address swaps, and sub‑domain takeover vectors.

Strategic Partnerships - Real‑World Use Cases

One of the most tangible integrations is the deal with MugglePay, a crypto‑to‑business payment gateway. MugglePay now leverages MarsSwap for stablecoin conversions and plans to embed USDM into its checkout flow, giving merchants a low‑volatility payment option.

These collaborations signal that the ecosystem is looking beyond speculative trading, aiming for everyday transaction utility.

Risks and Considerations - What to Watch Out For

- Liquidity Constraints: With daily volume under $3 k, large orders can cause noticeable price slippage.

- Price Feed Discrepancies: Conflicting data across Binance, CoinMarketCap, and CoinGecko can mislead traders.

- Community Activity: Social media chatter is modest compared with rivals like MakerDAO or Curve, which may affect governance participation.

- Future Airdrops: Both major campaigns are closed, and no new public distribution has been announced. Relying on airdrop hype for price lifts is risky.

How to Stay Informed - Tools and Resources

For anyone wanting to keep tabs on XMS, consider the following:

- Official Channels: Follow the Mars Ecosystem Twitter and Telegram for governance proposals.

- Analytics: Use BSCScan to monitor token transfers and wallet distribution patterns.

- Community Forums: Reddit’s r/DeFi and the Mars Discord host occasional AMA sessions with the core team.

Quick Takeaways

- XMS is the governance token of the Mars Ecosystem, built on Binance Smart Chain.

- Two airdrop campaigns-one small private drop, one massive CoinMarketCap partnership-have already ended.

- Current price volatility and low liquidity make XMS a high‑risk asset.

- Technical design targets stablecoin inefficiencies, but real‑world adoption remains limited.

- Future value hinges on ecosystem growth, partnership rollout, and community engagement.

Frequently Asked Questions

What is the primary purpose of XMS?

XMS serves as the governance token for the Mars Ecosystem, allowing holders to vote on protocol upgrades, fee structures, and strategic directions.

Can I still earn XMS through an airdrop?

Both major airdrop events have concluded. New users must purchase XMS on the secondary market or earn it via community incentives that the team may launch later.

Which blockchain does XMS use?

XMS is a BEP‑20 token on the Binance Smart Chain, which offers low fees and fast transaction finality.

How does the Mars Stablecoin (USDM) differ from other stablecoins?

USDM aims to combine algorithmic stability with partial collateralization, targeting higher capital efficiency while maintaining a 1:1 US dollar peg.

Is XMS listed on major exchanges?

Currently, XMS is primarily traded on Binance’s BSC DEX aggregator and a handful of smaller BSC‑based platforms. Liquidity remains thin.

Comparison of XMS Airdrop Campaigns

| Feature | Mars Ecosystem Airdrop | CoinMarketCap Learn & Earn |

|---|---|---|

| Participants | 1,000 (random selection) | 40,000 (quiz‑based qualification) |

| Total XMS Distributed | 50 XMS per winner (≈ 50,000 XMS total) | $200,000 worth of XMS (≈ 400,000 XMS) |

| Required Accounts | Binance wallet only | CoinMarketCap + Binance |

| Distribution Timeline | Tokens sent within 3 days of event close | Tokens sent within 3 days of quiz completion |

| Network Used | BEP‑20 (BSC) | BEP‑20 (BSC) |

Both campaigns were designed to attract early adopters and boost community awareness, but the CoinMarketCap partnership offered a far larger reach thanks to its educational hook.

Ron Murphy

October 25, 2025 AT 08:27Been watching XMS since the CoinMarketCap drop. Honestly, the liquidity is a joke - $2.3k daily volume? That’s not a market, that’s a weekend garage sale. You buy 10k tokens and the price collapses like a tent in a hurricane. BSC’s cheap fees help, but without real adoption, it’s just speculative noise.

Still, the USDM design is interesting. Mixing algorithmic and collateralized? That’s the kind of hybrid approach DeFi needs. Most stablecoins are either over-collateralized ghosts or fragile algo trains wrecking themselves on Fed rate hikes.

Prateek Kumar Mondal

October 25, 2025 AT 13:13Two airdrops done no new ones coming so if you missed out you gotta buy now or wait years for another chance

Nick Cooney

October 26, 2025 AT 02:06So let me get this straight - the team runs a $200k airdrop to attract users, then the token trades at 0.000297 on Binance but 0.000498 on CMC... and we’re supposed to trust the data?

Also, CoinGecko says $315k market cap but the volume is less than my coffee budget. Someone’s clearly inflating the numbers for a rug pull vibe. Not saying it’s bad - just saying I’d rather watch paint dry than trade this.

Also, typo: ‘sub-domain takeover’ - should be ‘subdomain’. Just sayin’.

Clarice Coelho Marlière Arruda

October 27, 2025 AT 01:22Wait so if I did the quiz on CoinMarketCap back in 2024 I got like 5 bucks worth of XMS? That’s wild. I still have it in my wallet but I forgot it even existed until now.

Just checked the price - holy crap it’s like 20 cents now? No wait that’s not right… I think my wallet app is glitching. Or maybe I’m just bad at math. Either way, I’m not selling. Too much sentimental value now.

Brian Collett

October 27, 2025 AT 07:12Anyone else notice how the Mars Ecosystem keeps saying ‘central bank for DeFi’ but the whole thing runs on BSC? That’s like calling yourself the Federal Reserve but only accepting cash in one state.

Also, the MugglePay integration is actually legit. I used it last week to pay my landlord in USDM and he didn’t even know it was crypto. That’s the kind of quiet adoption we need - not airdrop hype, just real use.

Allison Andrews

October 28, 2025 AT 02:24It’s fascinating how governance tokens like XMS are designed to empower communities, yet the reality is that 99% of holders are passive. They got a free token, never voted, and now they’re just hoping for a pump.

Who’s really in charge? The core team? The whales who bought post-airdrop? The DAO is a beautiful idea, but if no one shows up to the meeting, it’s just a PowerPoint presentation with a blockchain logo.

And the price discrepancies across trackers? That’s not a market inefficiency - that’s a trust crisis. If we can’t even agree on the price, how can we agree on governance?

Wayne Overton

October 28, 2025 AT 19:34airdrops are dead

buy or get out

Alisa Rosner

October 29, 2025 AT 07:56Okay, let’s break this down like I’m 10 😊

XMS = voting token for a crypto bank on Binance Chain 🏦

They gave away free tokens in 2024 - 1,000 people got 50 each, 40,000 got $5 worth 🎁

Now the price is super low and no one’s trading it much 😕

But they’re working with MugglePay so you can pay for pizza with USDM 🍕

Biggest risk? If no one uses it, it’s just digital confetti.

Biggest hope? If MugglePay gets big, XMS could actually matter!

PS: Don’t buy unless you’re ready to hold for 3+ years. And always double-check your wallet address - I once sent ETH to a USDT address and cried for a week 💔