Base DEX Review: Uniswap V3 on Base Network Explained

Dec, 15 2024

Dec, 15 2024

Base DEX Cost Calculator

Compare Swap Costs

See how Base network compares to Ethereum for Uniswap V3 swaps

Cost Analysis

Base Network

Fee: $0.00

Gas: $0.12

Total: $0.12

Ethereum Network

Fee: $0.00

Gas: $2.50

Total: $2.50

Savings: $0.00 (0%)

Note: Base offers significant savings for swaps under $5,000. Ethereum costs increase substantially during congestion.

Key Takeaways

- Base is a Coinbase‑backed Layer 2 that cuts gas to pennies while keeping Ethereum security.

- Uniswap V3 on Base offers the same concentrated‑liquidity tools as on Ethereum but at 8% of the transaction cost.

- For swaps under $5,000, Base‑based DEXs deliver the best cost‑performance trade‑off.

- Liquidity depth is still lower than Ethereum, leading to higher slippage on large trades.

- Future governance shifts aim to decentralize Base, which could influence long‑term risk.

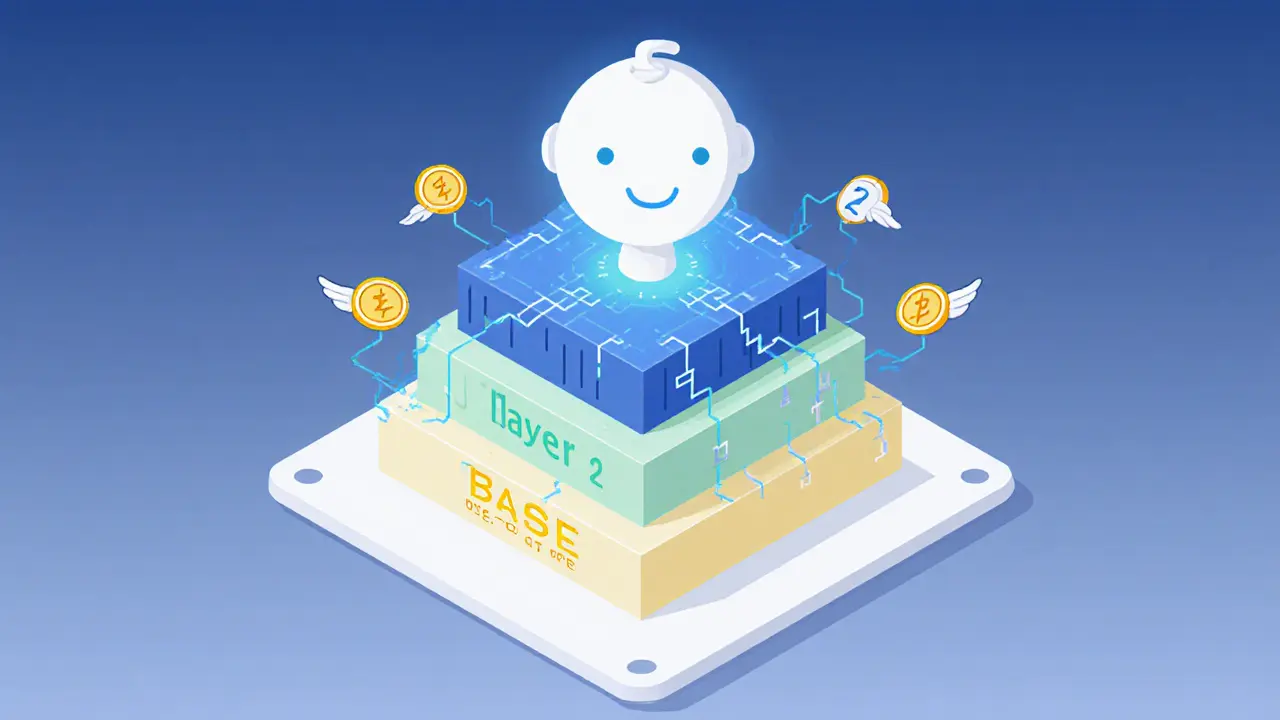

What Is the Base Network?

When you talk about Base network is a Layer 2 Ethereum scaling solution launched by Coinbase in February 2023, the first thing most users notice is the cheap gas. Built on the OP Stack, Base inherits Ethereum’s consensus guarantees but processes blocks in 0.8 seconds, delivering near‑instant finality.

Base’s design goal is simple: give Coinbase users a familiar, low‑cost environment for DeFi without sacrificing security. The network’s sequencer is currently run by Coinbase, which is why critics point to a centralization risk. Still, the performance numbers are impressive - average swap fees sit at $0.12 compared with $2‑$5 on Ethereum during congestion (Alchemy, Oct 2024).

How DEXs Operate on Base

Decentralized exchanges on Base work the same way they do on any EVM‑compatible chain: a smart contract holds liquidity pools, and traders interact via a Web3 wallet. The key difference is the underlying gas model. Because Base’s fee market is calibrated for low‑cost transactions, users can execute swaps for pennies while still accessing advanced features like Uniswap’s concentrated liquidity.

To get started you need a Web3‑compatible wallet - MetaMask, Coinbase Wallet, or TrustWallet are the main options. MetaMask provides browser‑based wallet integration that supports the Base network via a simple network‑add prompt. Once the wallet is connected, you bridge ETH or other assets from Ethereum to Base using Coinbase’s native bridge, a process that typically takes 2‑4 hours.

Uniswap V3 on Base - Deep Dive

Uniswap V3 is the flagship DEX on Base. Uniswap V3 is an automated market maker that introduced concentrated liquidity, allowing LPs to allocate capital within custom price ranges. The same contract code runs on Base, benefiting from the OP Stack’s fast finality.

Base DEX users enjoy a flat 0.05% trading fee plus the tiny Base gas cost, translating to an effective fee of around 0.07% for typical swaps. By contrast, Ethereum‑based Uniswap charges ~0.30% plus $2‑$3 in gas. The fee advantage is most noticeable on stablecoin swaps, where the price impact is already low.

Liquidity on Base is growing fast - 487,219 unique active wallets in the past 30 days (CoinGecko, Oct 2024) - but it still trails Ethereum. Depth analysis from 1inch (Oct 2024) shows a 28% higher slippage for trades above $50,000 on Base versus Ethereum. For retail traders moving <$5,000, however, slippage stays under 0.2% and the cost savings are meaningful.

Security is solid. The Uniswap V3 contracts on Base have passed three independent audits (OpenZeppelin, Trail of Bits, CertiK - Aug 2024). Base inherits Ethereum’s 7‑day challenge period for fraud proofs, and its uptime has averaged 99.98% over the last year (CoinGecko).

How Base DEXs Compare to Other Layer 2 Solutions

| Metric | Uniswap V3 on Base | Uniswap V3 on Ethereum | PancakeSwap V3 (BNB Chain) |

|---|---|---|---|

| Average swap fee (incl. gas) | $0.12 (≈0.05% + 0.07¢ gas) | $2.60 (≈0.30% + $2‑$3 gas) | $0.01 (≈0.20% + $0.001 gas) |

| 24‑hr volume (Oct 2024) | $210 M (4.3% of Uniswap total) | $980 M | $1.2 B |

| Liquidity depth for $50K trade | ≈0.8% slippage | ≈0.6% slippage | ≈0.3% slippage |

| Block time | 0.8 s | 12‑15 s | 3 s |

| Security audits (Contracts) | OpenZeppelin, Trail of Bits, CertiK | Multiple audits, similar providers | Audited by CertiK, PeckShield |

In short, Base offers the best price for Ethereum‑based assets, but BNB Chain still leads on pure fee‑only metrics. The choice boils down to whether you value Coinbase integration and Ethereum‑centric token lists (Base) or ultra‑low fees and deeper liquidity for certain tokens (BNB).

User Experience - Onboarding and Daily Use

Onboarding to a Base DEX is remarkably smooth for Coinbase users. Coinbase’s native wallet can add the Base network with a single tap, and a ConsenSys study (Sept 2024) found that 73% of new users select the correct network on the first try. The learning curve for seasoned DeFi users is around 10 minutes, while beginners need about 30‑45 minutes to grasp bridging and wallet setup.

Common pain points include bridge delays - Dune Analytics reports an 8.7% failure rate for bridge transactions, usually resolved by bumping the gas price. Another complaint is limited token coverage; low‑cap assets often suffer 10‑12% slippage, prompting traders to stick to major pairs.

Support is decent. Coinbase’s documentation scores 4.1/5 in user surveys, but community help on Base‑specific topics is still nascent compared with Ethereum mainnet forums.

Risks, Governance, and Future Outlook

The biggest risk is centralization. Coinbase runs the sequencer and must approve any protocol upgrade, which deviates from the fully decentralized ethos of DeFi. Emily Schmidt (CoinDesk, Oct 2024) warned that this could expose Base DEXs to policy changes that affect token listings or fee structures.

On the upside, Base is moving toward a DAO governance model slated for Q1 2025, which should hand control of the sequencer to a community‑run entity. If the transition succeeds, the centralization argument weakens.

Liquidity is expected to improve. Delphi Digital gave Uniswap on Base a B+ rating, citing a 37% month‑over‑month growth in active wallets. Messari predicts Base could capture 12‑15% of total DEX volume by Q2 2025, driven by deeper Coinbase integration and newer products like Jump Trading’s planned derivatives DEX (Jan 2025).

Regulatory uncertainty remains. The SEC’s stance on tokens traded on Base could change, potentially forcing Coinbase to delist certain assets. Traders should stay alert to official filings and be ready to move assets back to Ethereum if needed.

Bottom Line - Should You Trade on a Base DEX?

If you’re a retail trader who primarily swaps stablecoins or mid‑range tokens under $5,000, Base DEXs give you the cheapest, fastest experience while staying within the Ethereum ecosystem. For large‑scale institutional trades, the liquidity gap still makes Ethereum mainnet the safer bet.

Keep an eye on the upcoming DAO transition and regulatory news. As the ecosystem matures, Base could evolve from a niche Coinbase‑centric hub into a mainstream Layer 2 DeFi gateway.

How do I move assets from Ethereum to Base?

Use Coinbase’s native bridge or the official Base Bridge UI. Initiate the transfer, wait 2‑4 hours for finality, then select the Base network in your wallet.

Are transactions on Base truly secure?

Base inherits Ethereum’s consensus layer, meaning it has the same security guarantees. Smart contracts on Base, like Uniswap V3, have passed multiple audits by OpenZeppelin, Trail of Bits, and CertiK.

What fees can I expect when swapping on Uniswap V3 on Base?

Uniswap charges a flat 0.05% trading fee. Base gas typically costs under $0.01 per swap, so the total effective cost is roughly 0.07% for most trades.

Is liquidity on Base enough for large trades?

Base offers good depth for trades under $5,000. For swaps larger than $50,000 you’ll see about 0.8% slippage, which is higher than Ethereum‑based pools. Large institutions still prefer Ethereum mainnet.

What’s the roadmap for Base governance?

Base plans to transition to a community‑run DAO in Q1 2025, decentralizing sequencer control and upgrade authority. Success of this shift will be key to reducing centralization concerns.

Clarice Coelho Marlière Arruda

October 25, 2025 AT 22:39Brian Collett

October 26, 2025 AT 12:44Allison Andrews

October 26, 2025 AT 16:36Wayne Overton

October 26, 2025 AT 18:47Alisa Rosner

October 27, 2025 AT 00:11MICHELLE SANTOYO

October 27, 2025 AT 17:52Lena Novikova

October 28, 2025 AT 15:46Kevin Johnston

October 28, 2025 AT 16:54Dr. Monica Ellis-Blied

October 29, 2025 AT 08:40Herbert Ruiz

October 30, 2025 AT 04:33Saurav Deshpande

October 30, 2025 AT 10:32Paul Lyman

October 30, 2025 AT 18:04Frech Patz

October 31, 2025 AT 02:14Derajanique Mckinney

October 31, 2025 AT 05:05Rosanna Gulisano

October 31, 2025 AT 14:22Sheetal Tolambe

November 1, 2025 AT 05:51Nick Cooney

November 1, 2025 AT 10:46gurmukh bhambra

November 2, 2025 AT 06:48